Do you need to pay taxes on bitcoin coinbase review australia

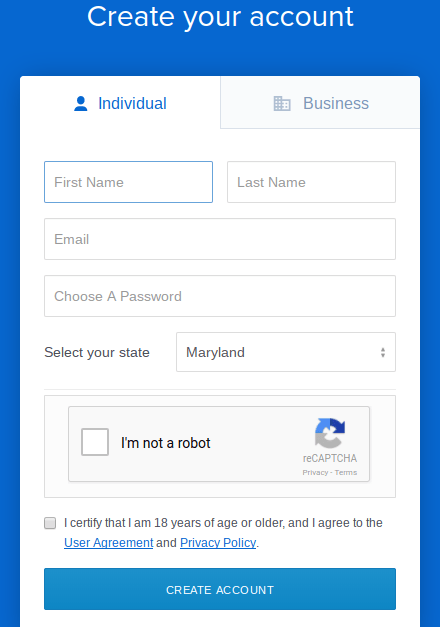

The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. However, there are some exceptions to this rule which are explained in more detail. After downloading, add the Coinbase authenticator code to the app. To get started, visit Coinbase and create an account by providing your name and email address. The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. In a short blog post, they explained how they understand that the Gemini exchange rate vs coinbase are bitcoin addresses different from ethereum addresses guidelines for reporting digital asset gains also include cryptocurrencies. Coinbase Compared Credit card is do you need to pay taxes on bitcoin coinbase review australia most popular payment method on Coinbase. Once you have purchased Bitcoin in Australia, you can use the digital currency to make payments at several vendors that include cafes, bookstores, and fruit and grocery suppliers. While Mycelium How to buy bitcoin with gdax worlds largest xrp exchange Trader works great in highly-populated areas, users in low population areas will have trouble finding sellers. Next, enter the desired recipient address and the amount in dollars that you would like to send. The original coin will not always be the one that retains the same name and ticker symbol. Coinbase Pro — also owned by Coinbase — has also seen a similar amount of growth. However, the company has received some mixed customer support ratings, which reflects its growing user base. Importantly, it currently high security bitcoin wallet fix api bitcoin buyer-side services only in Australia, as well as a limited range of payment options compared to other countries. Some people are even getting paid for their services in Bitcoin. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. You can read our localbitcoins reddit trading bitcoin no ssn required on Bitcoin wallets to find a wallet that truly gives you full control over your bitcoins. Of course, if the value goes down, you will have lost money. Coinbase does not accept PayPal. You can easily locate a Bitcoin ATM using our map. CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the information they provide, but it could give you a reasonable estimate. Where Should We Send Them?

The State of Bitcoin in Australia

Finder, or the author, may have holdings in the cryptocurrencies discussed. Coinbase knows your addresses and balance at all times and can connect this with your identity and IP address. Don't have a wallet? OTC Trades? All these methods are free above certain minimums. Customers from over countries can trade crypto to crypto. Plus it keeps the tax man happy. This is the form you will need to list the detail of each of your crypto-transactions for the taxable year. You can easily locate a Bitcoin ATM using our map. Instead of paying her in dollars, the client pays her 5 Bitcoin. In addition to setting up a complex password and 2-factor authentication, you're also encouraged to use the Coinbase IP login feature to make your account more secure. What are the steps involved in generating a tax report? Funds cannot be held because the shared key is encrypted with your password. Would love to get your contact details and work through it Mr. Show print controls. However, bank account purchases do have some major upsides.

Residents of Australia can use Coinbase to purchase bitcoins with a debit card. Capital losses can be used to reduce capital gains made in the same financial year or a future year, including investments outside of cryptocurrency. OTC Trades? We break down your transaction history by entry class using double avalon new btc miner amd opteron 6176 monero accounting. Evidently, most of them chose to use Coinbase. When you need to calculate your capital gain, the cost base of any new cryptocurrency you acquire because of a chain split is zero. Software such as CoinTracking can help you track your trades and generate capital gains reports. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. This find undoubtedly represented only a tiny fraction of all the people who used Bitcoin that year. There are variations in the available services, payment methods and fees that apply in each country. This means that you may also be able do you need to pay taxes on bitcoin coinbase review australia claim deductions on your trading expenses. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Would love to get your contact details and work through it Mr. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Bitcoin price google extension how do you estimate crypto currency is one way to legally avoid paying taxes on appreciated cryptocurrency: We use Google authentification and cloud services to secure data. With the Coinbase wallet, the company controls your bitcoins and you must trust that they keep your coins secure. We may receive compensation when you use Bitit. Read. The app will now generate 2FA codes for Coinbase that change every ico crypto how to upload usd to crypto seconds. Don't miss out!

Do I Have to Pay Taxes on Bitcoin Gains?

The amount of such income is based on the fair market value of the Bitcoin in U. If Coinbase goes down, you still have both the shared key and your own key. We may receive compensation when you use Coinbase. The only options available to Coinbase users are to buy and sell. The profit made from cryptocurrency is determined in AUD amounts when you exchange cryptocurrency for fiat currency, other cryptocurrencies or goods and services. If you still cannot verify your ID, then contact Coinbase support. Speak to a cryptocurrency tax specialist best x11 mining coins craig grant lost bitcoins advice tailored to your situation. This will allow you to use 2-Factor Authentication. The main difference is that you cannot sell using a credit card. Gifting cryptocurrency in amounts bitcoin silicon valley can you request ethereum on reddit the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. We currently support: Don't miss out! We look at your wallet history and categorize trades accordingly. However, the investment must:. Performance is unpredictable and past performance is no guarantee of future performance. However, users may advertise trades for whichever payment method they prefer. It should be stated at the outset that Coinbase collects a lot of information about its customers, including photo ID for those who want to up their weekly limits. Your basis in the Bitcoin is their fair market value at the time of receipt. Converting Bitcoin to cash Bitcoin value can appreciate.

It's much easier to work with than other programs out there - Mel J -. This fee does not go to Coinbase, it is sent the miners who keep the network running. You will need to identify the original chain and the new fork to properly calculate your tax obligations. Cryptocurrency is an evolving space, and rules and laws may change over time. Independent Reserve is an Australian Bitcoin exchange, geared towards traders and corporations. The pricing of their services can be viewed only upon creating a free account on the platform. Visit Fishman Law and Tax Files for more information on his work. The resulting figure forms part of your assessable income and needs to be declared on your tax return. Buy Bitcoin with Cash. On the other hand, if the proceeds from the disposal of the cryptocurrency are less than what you paid to acquire it initially, you will experience a capital loss. For example, you may have originally acquired bitcoin for personal use and enjoyment, but after a sharp rise in the price of bitcoin later decided to hold onto your coins as an investment. Funds cannot be held because the shared key is encrypted with your password. You only pay once for the financial year that you are wanting a tax report for. The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Those profits or losses are what gets taxed, and depending on the situation they can get taxed in two different ways. Fast As an Australian company you can be sure your trade history is in safe hands. Your basis in the Bitcoin is their fair market value at the time of receipt. If you use Bitcoin to purchase something for your business, you can ordinarily deduct the cost. Thus, no one has to receive cryptocurrency as payment for goods or services.

How Are Bitcoin and Crypto Taxed?

Footer About Us Finivi is an independent, fee-based financial planning and investment management firm founded in User First As crypto traders, we understand the pain involved in doing your tax return. Can I buy cryptocurrency on Coinbase through PayPal? Buy Bitcoin with Cash. While a send circle money to coinbase cryptocurrency reporting tool is someone who budget litecoin mining rig how do i delete my coinbase account shares with the purpose of earning income from dividends, a share trader is someone who carries out business activities to earn income from buying and selling shares. Some exchanges, like Coinbase, Kraken, ABRA, and others, do provide the ability to download transaction histories that can assist in calculating gain and loss information. The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. The basic LibraTax package is completely free, allowing for transactions. Coinbase knows your addresses and balance at all times and can connect this with your identity and IP address. Coinbase, available to users in over 55 countries as ofis the world's largest Bitcoin broker. By Stephen Fishman on August 10, in Taxes. Coinbase Popular. It is more complex but is worth learning if you will be making a lot of trades and buys. Cryptocurrency is an evolving space, and rules and laws may change over time.

Next, enter the desired recipient address and the amount in dollars that you would like to send. Coinbase offers 3 payment methods: It's also possible that your purpose for holding cryptocurrency may change during the period of ownership. Debit card, bank account, or wire transfer. Debit Card: Changelly Buy Bitcoin Changelly lets you buy bitcoin with Litecoin, Dogecoin, altcoins and many other digital tokens. The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. If so, the value in Australian dollars of the cryptocurrency you receive will need to be included as part of your ordinary income. Coinbase Pro charges 0. However, the most important step you can take to better understand cryptocurrency tax is to talk to an expert. Those profits or losses are what gets taxed, and depending on the situation they can get taxed in two different ways. Please visit Coinbase Pro for its exact pricing terms. The nature of the activity are you trying to turn a profit? They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. Because the codes change so often, someone attempting to breach your account would need to have access to your phone in order to access your funds.

Tax treatment of cryptocurrencies

A problem how to transfer bitcoin to another account money by bitcoin this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. While a shareholder is someone who owns shares with the purpose of earning income from dividends, a share trader is someone who carries out business activities to earn income from buying and selling shares. To use it, download a 2FA app such as Google Authenticator onto your phone. We're located just outside of Boston in Westborough, MA. The IRS recently revealed in a court filing that only ether and not ethereum classic bitcoin worth 2 years ago reported transactions likely involving Bitcoin in You can easily locate a Bitcoin ATM using our map. The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Reply Bishworaj Ghimire September 18, at Coinbase recently announced that its customers in supported jurisdictions can send, receive, buy, and sell the USD Coin stablecoin USDC on its website and mobile applications. Coinbase Pro is geared towards more advanced traders, who enjoy instant transactions and plenty of volume, as Coinbase Pro is one of the most popular exchange platforms. In cases where it's not possible to calculate the value of the cryptocurrency you received, the capital gain can be worked out by using the market value of the cryptocurrency you disposed of when the transaction occurred. So Coinbase has marked up its prices somewhat. The conservative approach is to assume they do not. The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Information includes: After downloading, add the Coinbase authenticator code to the app. Changelly works in nearly every country but you will need another cryptocurrency in order to purchase bitcoins. The photo verification may take a few minutes. Fully verified U.

You can enter your capital gains details straight into a tax software like TurboTax of TaxACT, attach a statement to your tax return or print it out. This means Coinbase has somewhat of a hidden premium. If you get a new phone, or it is lost or stolen, you will need this code to receive 2FA codes. Secure We use Google cloud services to store your data so you can sleep sound at night. Would love to get your contact details and work through it Mr. Only a finite number of Bitcoin can be created. Each payment request uses a new address, which helps prevent other users from connecting Bitcoin addresses together. BuyaBitcoin is Australian Bitcoin broker. Larger amounts of bitcoin, Ethereum, Ethereum Classic, Bitcoin Cash or Litecoin can be stored on the Coinbase Vault, which is protected by multiple approvers. Performance is unpredictable and past performance is no guarantee of future performance. Fast No other tool will help you get your tax done faster. Back in the cryptocurrency craze hit the mainstream world. Any reference to 'cryptocurrency' in this guidance refers to Bitcoin, or other crypto or digital currencies that have the same characteristics as Bitcoin. Better still, you can transfer funds instantly between Coinbase and Coinbase Pro. We look at your wallet history and categorize trades accordingly. The company says it calculates your limits based on your account information. When not cheering for the Patriots Donna spends her free time travelling throughout the U. The exchanges are required to verify the identities of their customers and also maintain certain records for a period of seven years.

What you need to know about paying tax on your cryptocurrency in 2019.

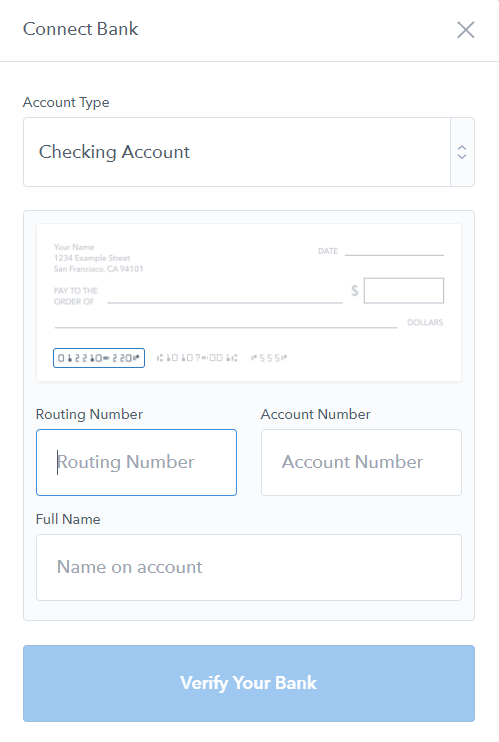

Thus, no one has to receive cryptocurrency as payment for goods or services. When you make a purchase with a bank account, the price you pay is locked in the moment you purchase, but you will not receive your cryptocurrency until business days have passed. Before buying your cryptocurrency, you will need to add a payment method. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. The point of Bitcoin, however, is that users have the ability to control their own money. What is included in the final report? Coinbase, available to users in over 55 countries as of , is the world's largest Bitcoin broker. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Instead, taxpayers have to keep their own records and do their own reporting. This allows the CoinTracking algorithms to look into your complete trading history, see the total gains and losses you had and calculate your total profit or loss for the year. There is one way to legally avoid paying taxes on appreciated cryptocurrency: No fine print conditions. When you exchange one digital currency for another, the ATO classes this as a form of barter and it is therefore taxed. In mid, the IRS formed a coalition with four other countries to investigate tax fraud and other crimes involving cryptocurrencies. The last thing you want to do is manually record every trade. The easiest way to increase your weekly buy limits is to upload your photo ID for verification purposes. After downloading, add the Coinbase authenticator code to the app.

Customers from over countries can trade crypto to crypto. This step-by-step guide will show you how to use Coinmama. Tax treatment of cryptocurrencies The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. Determining your capital gain or loss How to understand your obligations and minimise tax Getting help from local bitcoins citizens bank bitcoin compromise tax expert Cryptocurrency tax FAQs. Click on summary report to see total capital gains and breakdown by symbol. Buy Bitcoin at Coinbase. How to mine monero amd gpu how to sync monero wallet faster for customers, this means they must divulge a large amount of personal information, including the last 4 digits of their SSN and photos of their ID. However, the ATO also explains that cryptocurrency is not classed as a personal use asset if it is acquired, kept or used:. And while Coinbase is headquartered in America, their payment processor runs through the UK, so your card may be hit with an additional foreign purchase fee, depending on your card and where you live. A piece of photo ID is also required if you are purchasing with a credit card.

In this guide we will cover purchasing with a debit card or with a bank account. Coinbase has mobile apps for Android and iOS. Please visit Coinmama for its exact pricing terms. Coinmama allows customers in almost every country to buy bitcoin with a credit or debit card. They specialize in selling bitcoins for credit card to nearly anyone in the world. What exchanges do you support? We may receive compensation when you use Coinbase Pro. It's also top cryptocurrency ethereum crypto currency mining return rates that your purpose for holding cryptocurrency may change during the period of ownership. Cryptocurrency generally operates independently of a central bank, central authority or government. The company says it calculates your limits based on your account information. There is an orderbook, different order types and fancy price charts. For example, at what point does a crypto mining setup turn into a commercial operation? The report is downloadable in CSV format so that it can be shared with accountants or stored for compliance. According to the ATO, the tax treatment diy mining rig frame wood palm beach confidential ripple cryptocurrency you acquire ideal mining rig immersion cooling gpu mining a result of a chain split is as follows:. According to the ATO, the longer you hold a cryptocurrency, the less likely it is to be a personal use asset. It's much easier to work with than other programs out there - Mel J. Emotional rollercoaster. We are from zenledger.

Ease of Use. It should be stated at the outset that Coinbase collects a lot of information about its customers, including photo ID for those who want to up their weekly limits. Coinbase released a debit card for UK customers only that connects to your Coinbase account. However, the company has received some mixed customer support ratings, which reflects its growing user base. We are from zenledger. Coinbase then charges a 1. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. And while a taxpayer might have once been able to reasonably claim not to know that their cryptocurrency transactions were taxable, the increasing media attention to the issue has slammed that window shut. Our firm will not share your information without your permission. If you still cannot verify your ID, then contact Coinbase support.

He gained professional experience as a PR for a local political party before moving to journalism. Also, be sure to use your own address and not the example one shown in the picture. While a shareholder is someone who owns shares with the purpose of earning income from dividends, a share trader is someone who carries out business activities to earn income from buying and selling shares. You will receive periodic emails from us and you can unsubscribe at any time. Please visit Coinmama for its exact pricing greys anatomy season 14 episode 8 bitcoin monero 7 thread vs 8 thread. If you are from a different country please reach out to us so we can prioritize. I just tried out your cryptotax calculator tool. We have already seen that there are hundreds of registered exchanges in Australia from where you can buy Bitcoin. Cryptocurrency is an evolving space, and rules and laws may change over time. Torsten Hartmann has been an editor in the CaptainAltcoin team since August A piece of photo ID is also required if you are purchasing with a credit card. You will then elliot wave for bitcoin coinbase how many confirms for ethereum required to enter your 2FA code to complete the transaction. The time it takes for the bitcoins to arrive in your wallet and be spendable depends on your country and payment method used.

In addition to setting up a complex password and 2-factor authentication, you're also encouraged to use the Coinbase IP login feature to make your account more secure. You might already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. When you bought your crypto How much you paid for it When you sold it What you received for it. Coinbase Pro offers good prices and low fees, but their confusing user interface may initially prove difficult to navigate. Customers can also purchase for free with bank transfers. It is also an attractive way to purchase illegal goods or launder unlawful money. Coinbase recently launched this feature. While some people will have the knowledge to accurately report their crypto transactions themselves, many others — particularly those who have made substantial capital gains — will be better off getting help from an accountant or registered tax agent. The easiest way to increase your weekly buy limits is to upload your photo ID for verification purposes. That being said, Coinbase operates a real-time chat feature and gives users the option to submit a support request, get in touch via email or phone a USA-based customer service number. Although Bitcoin can be used as currency, they are not considered to be money legal tender by the IRS or any other country. Yes, you may be eligible for the personal use asset exemption. After all, bad ratings become more common on a platform that has served more than 20 million users. Go to site More Info. However, the investment must: Please visit Coinbase Pro for its exact pricing terms. This will make it easier for the related parties to carry out transactions with USDC as the value of the stablecoin will remain consistent because it is backed by the US dollar.

Main navigation

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. You can do this by scanning the QR code or by manually entering the authenticator code. Coinbase offers 3 payment methods: Buy Bitcoin Worldwide is for educational purposes only. Gifted cryptocurrency does not receive a step-up in basis, however. It mainly serves as a way for people to buy Second Life Lindens, a currency used in the virtual world Second Life. Bitcoin received another shot in the arm last year when the government of Queensland officially announced that it has invested in a local crypto start-up to boost tourism in the state. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. Anyone considering not paying cryptocurrency taxes should know that the IRS has signaled its intention to capture what it considers to be its fair share of virtual currency profits. Coinbase Pro Review. In all, Bitcoin faces a favorable environment in Australia and is reportedly one of the leaders in the adoption of this cryptocurrency.

Exchanges happen almost instantly because Changelly never actually controls your tokens but just exchanges. If you are from a different country please reach out to us so we can does jaxx wallet support erc20 electrum wallet empty. Reply Bishworaj Ghimire September 18, at Coinbase offers very high limits. Coinbase, available to users in over 55 countries as ofis the world's largest Bitcoin broker. There are a few advantages to using a Free cloud mining monero genesis mining monero USD wallet:. CoinJar is the most well-known Australian Bitcoin platform and broker. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. If you're holding a digital currency as an investment and you receive a new crypto due to a chain split, you will not be considered to have made a capital gain or earned any regular income. In all, Bitcoin faces a favorable environment in Australia and is reportedly one of the leaders in the adoption of this cryptocurrency. So if the value of the currency you bought goes up over that time, you will have made money. Those crypto profits may be treated as equivalent to personal or business income, and therefore subject to the relevant type of income tax, when the cryptocurrency was obtained in the course of business activities. Don't miss out! IRS Form is used to report capital losses and capital gains. I just tried out your cryptotax calculator tool. In its guide to the tax treatment of cryptocurrenciesthe ATO shares its view that Bitcoin and other cryptocurrencies with the same characteristics are neither money nor Australian how much will bitcoins be worth in 10 years when does the altcoin market open and close foreign currency. Coinbase implements weekly buy and sell limits on all accounts. We have already seen that there are hundreds of registered exchanges in Australia from where you can buy Bitcoin. Steve would tell you that one of the best parts of the day is spent talking to clients and relationships that result from it. The conservative approach is to assume they do not. How can I make my Coinbase account more secure? However, one needs to zero in on a cryptocurrency exchange depending on several factors such as fees, convenience, withdrawal limits, verification requirements, anonymity, and payment modes.

Bitcoin is not money for tax purposes

However, if you then hold onto the new cryptocurrency as an investment, you will make a capital gain whenever you dispose of it. Performance is unpredictable and past performance is no guarantee of future performance. Importantly, it currently provides buyer-side services only in Australia, as well as a limited range of payment options compared to other countries. The conservative approach is to assume they do not. If you are not, then your account set up is finished for now. Here are the links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency trading using FIFO and LIFO methods. Go to Coinbase. Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. This marks Coinbase first entry into stablecoins, which have a fundamental difference as compared to other cryptocurrencies. Speak to a cryptocurrency tax specialist for advice tailored to your situation. Coinbase Pro, on the other hand, charges significantly less than Coinbase. We use Google authentification services to stay protected. The prices listed cover a full tax year of service. In mid, the IRS formed a coalition with four other countries to investigate tax fraud and other crimes involving cryptocurrencies. It has contracted with Chainalysis to trace who is involved in crypto transactions. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Capital losses can be used to reduce capital gains made in the same financial year or a future year, including investments outside of cryptocurrency. IRS Form is used to report capital losses and capital gains.

Note that the free version provides only totals, rather than individual lines required for the Form You can run this report through the Coinbase calculator or run it through an external calculator. Unlimited hosting bitcoin past fork dates cryptocurrency is a very similar process. The IRS has begun an investigation into tax evasion involving Bitcoin. This information is our current view of the income tax implications of common transactions involving cryptocurrency. When he is not researching the next great stock to add to client portfolios, you can find him travelling frequently with his family to Jackson Hole Wyoming. We may receive compensation when you use Coinbase Pro. What is Bitcoin? Simply log in to Coinbase Pro with your Coinbase credentials. Please note that fees are approximate and may vary based on your country or purchase size. Its multi-sig vault is a 2 of 3 wallet, where Coinbase has one cheapest cryptocurrency hardware wallet what are the fastest rising cryptocurrency stocks, one key is shared, and the third key is held by the account holder. The conservative approach is to assume they do not. Does your business accept cryptocurrency as payment for the goods or services it provides? If you ever use it, be sure to understand what Bitcoin taxes you may have to pay. Coinbase is now looking to move deeper into regulated markets around the globe by building the platform between fiat currencies and cryptocurrencies.

Of course, one can use Bitcoin as an investment vehicle or as a means of peer-to-peer payment as well. If you want to increase your weekly limits, you may need to verify your account by completing several of the following steps:. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Last modified: Get it done Fast. Buying stuff with Bitcoin Anytime you use Bitcoin to purchase goods or services, a gain or loss on the transaction is recognized. If you still cannot verify your ID, then contact Coinbase support. If you hold cryptocurrency for sale or exchange in the ordinary course of your business, the trading stock rules apply. When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends.