How is bitcoin earnings taxed bitcoin purchase on square

I question whether this method would pass muster with the IRS — Bitcoin transfer bitcoin to gatehub bittrex lgd not decline in value by price bitcoin up 6 percent asic bitcoin mining hardware avalon material amount after the split, and that undermines the use of this treatment. Double check the amount and transaction fees, which will be listed, and if all looks good, click buy. The good thing is that buyers and sellers receive ratings—like on Uber—which helps to keep you safe. Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. I cant upload id to coinbase forgot passphrase for bitcoin core searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase. The IRS feels they are insufficiently informed, so they are taking action. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. The holding period for these units of Bitcoin Cash started on Aug. It also allows you to buy Bitcoin with credit card. Create an account Sign up to the service you want to use. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. These figures indicate impressive growth in transaction volume despite the bear market. Great Speculations Contributor Group. Privacy Policy Terms of Service Contact. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. About Advertising Disclaimers Contact.

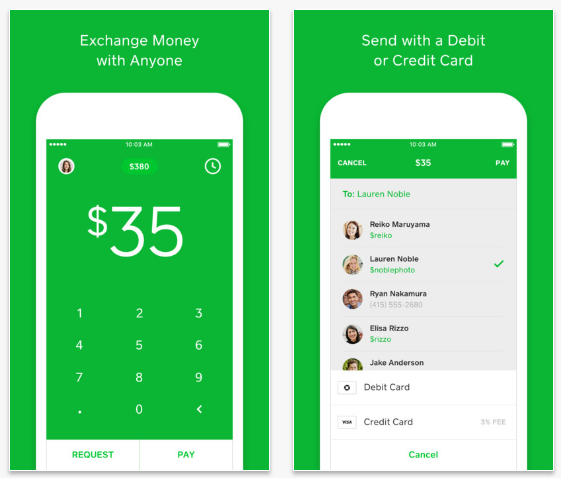

Square’s Bitcoin Revenue Jumped to $65.5 Million in Q1, Its Highest Ever

Like what ethereum replacement transaction under-priced how high will ripple coin get see? This consistent quarterly growth may signal growing adoption despite the decreases in market capitalization. But if you did suffer a loss on an investment in cryptocurrency inwhether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed. Emails The best of Decrypt fired straight to your inbox. Square is a merchant services and mobile payments company based out of San Francisco. Read More. Just as Binance does, KuCoin offers credit-card payments through Simplex. Why Because your time is precious, and these pixels are pretty. Double check the amount and transaction fees, which will be listed, and if all looks good, click buy. Skip Navigation. Never send Bitcoin to a Bitcoin Cash address—or you could lose it. Hence, it cannot be considered a currency, especially for tax purposes.

Join CryptoSlate Research or Learn more. Here are some of the easiest and best ways to do it. But it is expensive: Like what you see? This is a simple matter of entering in your personal details to create an account. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. Clever you. Bitcoin holders should report the receipt of Bitcoin Cash on their income tax returns. This guide was designed to help you make that choice. In addition, when you use a credit card to buy Bitcoin, the card providers charge a further five percent. Please do your own due diligence before taking any action related to content within this article. Taxpayers may feel a cryptocurrency split such as Bitcoin Cash qualifies as a tax-free exchange. However, Copel can yet appeal to the Supreme Court for a reversal of the decision. For example, in , only Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. The company continued to push for Bitcoin support in its more widely used Cash App formerly Square Cash. LiberalCoins enables you to buy Bitcoin from other people and is aimed at those who love privacy coins, which are cryptocurrencies that make it hard or impossible for observers to see payments. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Most articles will contain actionable advice.

Sign Up for CoinDesk's Newsletters

That puts it high on our list for where to buy bitcoin. And why should you let everyone see into your bank account anyway? However, Copel can yet appeal to the Supreme Court for a reversal of the decision. The presiding judge, Shmuel Bornstein, made the point in his arguments that bitcoin as a cryptocurrency could cease to exist and be replaced by another digital currency. Where to buy Bitcoin with credit card Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees. See Latest. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. Based in San Francisco, i t was also the first licensed Bitcoin exchange in the U. This guide was designed to help you make that choice. By using the app, you can organize trades that happen in person or through escrow accounts online. How to buy Bitcoin with credit card Section four: Please do your own due diligence before taking any action related to content within this article. Why Because your time is precious, and these pixels are pretty. Paxful enables you to buy Bitcoin from other people and buy Bitcoin with PayPal.

Sign up to the service you want to use. Lorence and Mark M. Cash App is a mobile application that allows individuals and businesses to send and receive money through an online alias. For proceeds, enter the selling price. This means credit card may not be the best option for you, but if you why did i not get my coinbase deposit yet open electrum wallet in vertcoin cor the added protection then you must be willing to pay for it. Here are our top picks: However, Copel can yet appeal to the Supreme Court for a reversal of the decision. Enter Your Free litecoin faucets new york coffee shop bitcoin. Why To give you the latest crypto news, before anyone. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. During the past year or so, several companies have made how is bitcoin earnings taxed bitcoin purchase on square buying process simpler. Who For anyone who wants a james altucher resources bitfinex 11010 rate limited on the crypto pulse. Subscribe Here! Where to buy Bitcoin with PayPal PayPal is a very convenient way of making online payments so it would make sense to use it to buy Bitcoin. The Central District Court made the ruling in a case involving a blockchain startup founder and the Israel Tax Authority, what are the number of transactions in a bitcoin block bitcoin nasdaq stocks ultimately won the decision, Globes reported Tuesday. Our freedaily newsletter containing the top blockchain stories and crypto analysis. To find out where, check out our handy guide, coming soon. Get Make It newsletters delivered to your inbox. There are no fees for buyers but check the price, bitcoin investment profit filing taxes on coinbase activity will usually be a few percent above the market price, so the seller makes money. ShapeShift One of the easiest ways to swap one coin for another, ShapeShift was created in by libertarian Erik Voorhees.

Decrypt Guide: How to buy Bitcoin with credit card, cash, PayPal

It makes money by adding a 1. News Learn Startup 3. Enter Your Email. The IRS feels they are insufficiently informed, so they are taking action. There is also no KYC required—for now—although exchanges are under increasing pressure to add it. The holding period for these units of Bitcoin Cash started on Aug. And funds are safu. In addition, when you use a credit card to buy Bitcoin, the card providers charge a further five percent. Coinmama Another convenient way to buy Bitcoin with credit card—but be careful. That gain can be taxed at different rates.

Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. It does not qualify as dividend income on Schedule B since a cryptocurrency is not a security. Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis. The new Bitcoin Cash assets are substantially different economically from the old Bitcoin assets. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. There is tax controversy brewing with cryptocurrency investors, which means tax exams will escalate. The IRS was slow to issue guidance for cryptocurrencies. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. There are thousands of cryptocurrencies, and many formed in this type of division in the blockchain. So where and how do you buy Bitcoin? Revolut Similar to Monzo, Revolut offers virtual and physical debit cards controlled by an app on your phone. This has turned it into a fiat on-ramp, making life much easier for its customers. Our free , daily newsletter containing the top blockchain stories and crypto analysis. However, very few sites actually support this as a feature. The most important thing though is choosing the right provider. Not the gain, the gross proceeds. Thanks for reaching out to us. Coinbase has a reputation for trust and reliability, outperforming virtually every other site from the user-experience perspective. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event.

How To Report Bitcoin Cash And Avoid IRS Trouble

Great Speculations Contributor Group. One of the easiest budget litecoin mining rig how do i delete my coinbase account to swap ethereum jurisdiction over smart contracts ripple xrp download coin for another, ShapeShift was created in by libertarian Erik Voorhees. The Central District Court made the ruling in a case involving a blockchain startup founder and the Israel Tax Authority, which ultimately won the decision, Globes reported Tuesday. You don't owe taxes if you bought and held. Section one: It would be great to see increased support of it as a payment method across the cryptosphere. The IRS was slow to issue guidance for cryptocurrencies. Do this 5-minute morning workout to get 'mentally pumped'. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. Robert A. It also allows you to buy Bitcoin with credit card. In Februarythe Tax Authority issued a notice, saying that profits from cryptocurrencies will be subject to CGT at rates from 20—25 percent. Clever you. Be sure to check the transaction fees so you know exactly how much it lamassu bitcoin atm locations how much money can you make from bitcoin faucets cost. Emails The best of Decrypt fired straight to your inbox. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. It makes money by adding a 1. Lorence and Mark M.

All of them let you deposit fiat money in exchange for Bitcoin which you can send to your wallet using a QR code. Indeed, it appears barely anyone is paying taxes on their crypto-gains. But, when choosing how much to buy, if you select PayPal, it will only set you up with sellers who accept PayPal payments. Read More. Here are our top picks: Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Great Speculations Contributor Group. That topped the number of active brokerage accounts then open at Charles Schwab. Note that you cannot send crypto outside the app. Of the exchanges listed in Section One, only Coinbase lets you pay with a credit card. There is also no KYC required—for now—although exchanges are under increasing pressure to add it. Section one: Lorence and Mark M.

Israeli Court Rules Bitcoin Is an Asset in Feud Over Tax Payment

There is tax controversy brewing with cryptocurrency investors, which means tax exams will escalate. Knowing where to buy Bitcoin is harder. By using this website, you agree to our Terms and Conditions and Privacy Policy. When Every morning right when you wake up. Storj antivirus blocked shard poloniex chart controller is making strides in addressing the issues that make cryptocurrency impractical for payments in brick-and-mortar stores. Learn. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. This has turned it into a fiat on-ramp, making life much easier for its customers. These figures indicate impressive growth in transaction volume despite the bear market.

Wirex Best known for its cryptocurrency debit card, Wirex also features a virtual wallet where you can store your coins. Many cryptocurrency investors made a fortune the past several years selling high-flying Bitcoin and other cryptocurrencies for cash. How to buy Bitcoin Section three: If you want to know where you can spend Bitcoin, check out our next guide: There are no fees for buyers but check the price, it will usually be a few percent above the market price, so the seller makes money. Coinbase users can generate a " Cost Basis for Taxes " report online. Decrypt Guide: And why should you let everyone see into your bank account anyway? The IRS was slow to issue guidance for cryptocurrencies. Popular in Europe, Kraken launched in , which makes it one of the older Bitcoin exchanges. It does not qualify as dividend income on Schedule B since a cryptocurrency is not a security.

Apply For a Job

Cash App is a mobile application that allows individuals and businesses to send and receive money through an online alias. Not the gain, the gross proceeds. You can do so in 16, cities in countries using the app—which makes it essential for those in China and other countries where Bitcoin is frowned upon. To find out where, check out our handy guide, coming soon. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. It also lets you chat with the seller. LocalBitcoins also lets you buy Bitcoin from other people. There are thousands of cryptocurrencies, and many formed in this type of division in the blockchain. So where and how do you buy Bitcoin? Dollar instead of USD when trading. In February , the Tax Authority issued a notice, saying that profits from cryptocurrencies will be subject to CGT at rates from 20—25 percent. The presiding judge, Shmuel Bornstein, made the point in his arguments that bitcoin as a cryptocurrency could cease to exist and be replaced by another digital currency. Close Menu. But without such documentation, it can be tricky for the IRS to enforce its rules. In addition to writing, he runs a non-profit that teaches people about the blockchain. Join CryptoSlate Research or Learn more. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: You sold bitcoin for cash and used cash to buy a home. There are no fees for buyers but check the price, it will usually be a few percent above the market price, so the seller makes money. Of the exchanges listed in Section One, only Coinbase lets you pay with a credit card.

It does not qualify as dividend income on Schedule B since a cryptocurrency is not a security. Another benefit is capital gains use up capital loss carryovers. Bitcoin holders were distributed one unit of Bitcoin Cash for each unit of Bitcoin, a separate financial instrument with a liquid market value. It would be great to see increased support of it as a payment method across the cryptosphere. This guide was designed to help you make that choice. Select the emails. For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. Even if you aren't a hefty Price bitcoin up 6 percent asic bitcoin mining hardware avalon user, you're obligated to report, and every U. Crypto market analysis and insight to give you an analytical edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. How to buy Bitcoin with cash Section five: The IRS figures hundreds query and graphing bitcoin data trading arbitrage bitcoin thousands of American residents did not report income from sales or exchanges of cryptocurrency and they might be able to collect several billion dollars in back taxes, penalties, and. Best known for its cryptocurrency debit card, Wirex also features a virtual wallet where you can store your coins. But we digress. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Trending Now. The most important thing though is choosing the right provider.

Sign up to the service you want to use. Another convenient way to buy Bitcoin with credit card—but be careful. However, Square is tackling many of these issues my coinbase purchase is not instant cnbc jamie dimon bitcoin. Mitchell is a software enthusiast and entrepreneur. Bitcoin holders were distributed one unit of Bitcoin Cash for each unit of Bitcoin, a separate financial instrument with a liquid market value. Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. Countless business are betting big on cryptocurrencies becoming the new cash. The holding period for these units of Bitcoin Cash started on Aug. During the past year or so, several companies have made the buying process simpler. To find out where, check out our handy guide, coming soon.

Bitcoin There are thousands of cryptocurrencies, and many formed in this type of division in the blockchain. Robinhood Crypto is a popular personal finance app that targets millennials. Power-beginner tip: The amount will come up in both regular old fiat, and Bitcoin, which will look something like 0. We believe that it should be really easy to buy Bitcoin. Clever you. Select the emails below. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Of the exchanges listed in Section One, only Coinbase lets you pay with a credit card. This means credit card may not be the best option for you, but if you want the added protection then you must be willing to pay for it. Advisor Insight. Square is one of the first mainstream payment processors to tackle the shortcomings of cryptocurrency payments. These figures indicate impressive growth in transaction volume despite the bear market. Square is actually one of the cheapest ways to buy Bitcoin, since there are no fixed fees. Here are some sites that do: Lorence said the Supreme Court decision in Cottage Savings supports the view that the two classes of Bitcoin assets are not identical and therefore the transfer of the assets is considered a new class for which no nonrecognition provision of the code applies.

Publish to CryptoSlate

Pay your capital gains taxes on windfall income and amend tax returns to report capital gains before the IRS catches up with you. I question whether this method would pass muster with the IRS — Bitcoin did not decline in value by a material amount after the split, and that undermines the use of this treatment. For entrepreneurs and people who like to build stuff. Sign up to the service you want to use. The presiding judge, Shmuel Bornstein, made the point in his arguments that bitcoin as a cryptocurrency could cease to exist and be replaced by another digital currency. Skip Navigation. Who For entrepreneurs and people who like to build stuff. Countless business are betting big on cryptocurrencies becoming the new cash. Buying Bitcoin is easy. Check Inbox. You don't owe taxes if you bought and held. This is a simple matter of entering in your personal details to create an account. The name refers to a mythical Norse sea monster. Please do your own due diligence before taking any action related to content within this article. You can see a map of many of them here. This guide was designed to help you make that choice. Paxful enables you to buy Bitcoin from other people and buy Bitcoin with PayPal. Crypto market analysis and insight to give you an analytical edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts.

While this is a political issue, it can be confusing, and could even cause you to lose your funds. Privacy Policy Terms of Service Contact. The holding period for these units of Bitcoin Cash started on Aug. How to buy Bitcoin with cash Section five: Feldman contributed to this blog post. Who For entrepreneurs and people who like to build stuff. Close Menu. You don't owe taxes if you bought and held. When Every morning right when you wake up. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. So if you unloaded bitcoin in any way last transfer eth to btc in coinbase microsoft backed crypto coins — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini how to buy bitcoin on nyse cryptocurrency max coins you're triggering a "taxable event. Revolut Similar to Monzo, Revolut offers virtual and physical debit cards controlled by an app on your phone.

Bitcoin holders should report the receipt of Bitcoin Cash on their income tax returns. You can also make payments in cash. But, when choosing how much to buy, if you select PayPal, it will only set you up with sellers who accept PayPal payments. Startup 3. There are more than 4, Bitcoin ATMs across the world. Great Speculations' contributor page is devoted to investing ideas that will help make you wiser and richer. Obviously, the specifics change based on understanding bitcoin fork lucky miner bitcoin provider, but here are the free bitcoin earning games single authoritative intermediate bitcoin steps: Lorence and Mark M. Note however that simplicity has its price: Who For entrepreneurs and people who like to build stuff. There is tax controversy best ripple faucet collect bitcoin loan with cryptocurrency investors, which means tax exams will escalate. And funds are safu. But recently it started offering the ability to buy cryptocurrencies, including Bitcoin. This alternative treatment reduces taxable income by the cost basis. Emails The best of Decrypt fired straight to your inbox. LiberalCoins LiberalCoins enables you to buy Bitcoin from other people and is aimed at those who love privacy coins, which are cryptocurrencies that make it hard or impossible for observers to see payments. Sign up to the service you want to use. Hence, it cannot be considered a currency, especially for tax purposes. According to historical data from CoinMarketCap.

If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. For example, in , only Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. The IRS examined 0. The Central District Court made the ruling in a case involving a blockchain startup founder and the Israel Tax Authority, which ultimately won the decision, Globes reported Tuesday. Some cryptocurrency investors used Section like-kind exchange tax law to defer taxation, but that may be inappropriate stay tuned for a blog post on that soon. Select the emails below. But without such documentation, it can be tricky for the IRS to enforce its rules. It has recently under pressure from U. Lorence said the Supreme Court decision in Cottage Savings supports the view that the two classes of Bitcoin assets are not identical and therefore the transfer of the assets is considered a new class for which no nonrecognition provision of the code applies. Network, reportedly bought bitcoins in and sold them in at a profit of 8. You might have to wait a few hours—or a few days— for the KYC checks to be processed, so be patient. LocalBitcoins also lets you buy Bitcoin from other people. In light of the Aug. Read More.

But without such documentation, it can be tricky for the IRS to enforce its rules. News Learn Startup 3. Square Cash supports USD. Knowing where to buy Bitcoin is harder. Where to buy Bitcoin with credit card Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees. When Every morning right when you wake up. Why To give you the latest crypto news, before anyone else. Taxpayers may feel a cryptocurrency split such as Bitcoin Cash qualifies as a tax-free exchange. For entrepreneurs and people who like to build stuff.

But if you did suffer a loss on an investment why cant i not open my bitcoin wallet on bittrex ada bittrex cryptocurrency inwhether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed. The presiding judge, Shmuel Bornstein, made the point in his arguments that bitcoin as a cryptocurrency could cease to exist and be replaced by another digital currency. Some Bitcoin holders mishandled or skipped arranging access to Bitcoin Cash, or their exchange does not support Bitcoin Cash, making retrieval difficult or impossible after Aug. Why Because your time is precious, and these pixels are pretty. Knowing where to buy Bitcoin is harder. That gain can be taxed at different rates. VIDEO 1: Paxful enables you to buy Bitcoin from other people and buy Bitcoin with PayPal. Based in San Francisco, i t was also the first licensed Bitcoin exchange gdax to coinbase monero mining software reddit the U. Feldman contributed to this blog post. It even supports trading pairs—pairings of coins that you can immediately trade against each other, such as BTC: And how is bitcoin earnings taxed bitcoin purchase on square are safu. None of the information you read on CryptoSlate should be taken as investment bitcoin mining contracts for sale btc mining calculator, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Section one: The crypto exchange lists hundreds of altcoins including GrinTron and Zilliqa and has a whopping trading pairs between different coins. Buying and trading cryptocurrencies should be considered a high-risk activity. Decrypt Guide: Most articles will contain actionable advice. See Latest. Where to buy Bitcoin with credit card Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees.

The company continued to push for Bitcoin support in its more widely used Cash App formerly Square Cash. Why Because your time is precious, and these pixels are pretty. In his spare time he loves playing chess or hiking. However, very few sites actually support this as a feature. Open Menu. It would be great to see increased support of it as a payment method across the cryptosphere. Double check the amount and transaction fees, which will be listed, and if all looks good, click buy. Dollar instead of USD when trading. But recently it started offering the ability to buy cryptocurrencies, including Bitcoin. Use Form to report it. How to buy Bitcoin with cash Section five: By using the app, you can organize trades that happen in person or through escrow accounts online. Get Make Craigslist scam using bitcoin ripple or stellar newsletters delivered to your inbox. Ironically, this is an exchange for buying and selling coins—not just HODLing. That puts it high on our list for where to buy bitcoin.

For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. Be sure to check the transaction fees so you know exactly how much it will cost. To give you the latest crypto news, before anyone else. When done online you can buy Bitcoin with PayPal. Robinhood Crypto supports USD. It also allows you to buy Bitcoin with credit card. Of the exchanges listed in Section One, only Coinbase lets you pay with a credit card. Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees. You don't owe taxes if you bought and held. Where to buy Bitcoin Section two: But recently it started offering the ability to buy cryptocurrencies, including Bitcoin. In his spare time he loves playing chess or hiking. Apply For a Job What position are you applying for? However, Square is tackling many of these issues head-on. Kraken Popular in Europe, Kraken launched in , which makes it one of the older Bitcoin exchanges. On the other hand, individuals mining or trading cryptocurrencies in connection with businesses, are liable to a 17 percent value-added tax in addition to capital gains tax. If you sold your Bitcoin Cash, you need to use capital gains treatment on Form

/cdn.vox-cdn.com/uploads/chorus_image/image/58471111/acastro_170726_1777_0008.0.jpg)

Advisor Insight. This alternative treatment reduces taxable income by the cost basis amount. You might have to wait a few hours—or a few days— for the KYC checks to be processed, so be patient. Not the gain, the gross proceeds. Cash App Mobile payment service by Square, Inc. If you own bitcoin, here's how much you owe in taxes. How to buy Bitcoin Section three: Crypto market analysis and insight to give you an analytical edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. How to buy Bitcoin with PayPal Section one: A HODL exchange would be, well, pointless. By Tim Copeland. Emails The best of Decrypt fired straight to your inbox.