How much do bitcoin faucets make money uploading id to coinbase

We offer a variety of easy ways to import your trading data, your income data, your spending data, and. The rates at which you pay capital gain taxes depend your country's tax laws. Changelly Crypto-to-Crypto Exchange. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. For those who are new to windows 10 ethereum cant find dag file xrp bitcoin walet cryptocurrency space, there is a possibility that Binance and Coinbase are the only exchanges you know. Again, the money is small but there is potential to earn a little bit more than the faucets of PTC websites. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. If your plan is to trade the variation of altcoin cryptocurrencies or if you are a retail investor and would like to do margin trading, Poloniex is the way to go. Peer-to-peer exchanges cut out the middleman and allow users to trade directly with one. Is there a can you mine ethereum classic with simplemining os buy bitcoin in Mississippi supply limit? Reynolds Tawiah August 27, at 4: Long-term tax rates are typically much lower than short-term tax rates. Faucets let visitors earn a percentage of the Bitcoin that they give away to any visitors that you brought in. Quick guide: ShapeShift Cryptocurrency Exchange. Check out our guide on how to buy bitcoin anonymously. He has extensive experience advising clients on Fintech, data privacy and intellectual property issues. This platform is incredibly beginner friendly and widely trusted. Dennis March 22, at 5: Binary options so-called because the only option is to win or to lose is a trade strategy that allows you to predict if the price of Bitcoin will rise or fall in a certain period buying a bitcoin machine beginners guide to cryptocurrencies time. Trading crypto-currencies is generally where most of your capital gains will take place. Use an exchange that allows you to deposit funds into your account using a money transfer service, such as Western Union or MoneyGram, and pay for your transaction with cash.

Crypto-Currency Taxation

Compare up to 4 providers Clear selection. Depending on the exchange you use and the regulatory requirements it is subject to, you may be able to sign up simply by providing your email address or you may need to provide your full name, contact information and proof of ID before being allowed to trade. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Coinbase and Changelly are two well-known cryptocurrency brokers. Get help. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Therefore, they often need everything from software developers to web developers to mining experts to online marketers. This must start from the site at https: There are some cases that require an additional verification to continue or enable trading services. Fiat currency deposits are not accepted by Binance; therefore, you will have to initially buy Ethereum or Bitcoin from a website like Coinbase. In addition, the costs of the electricity used to power this equipment is phenomenal, with Bitcoin mining currently estimating to be using the same power per day as a country the size of Morocco. Jakob January 24, at 1: Each Bitcoin that is mined requires more processing power and therefore mining Bitcoin now involves significant processing power and can no longer be done without specialized equipment. It can also be viewed as a SELL you are selling. Enable two-factor authentication. Yes you can buy bitcoin and sell whenever you like.. However, they ultimately serve two distinct purposes for the majority of cryptocurrency investors. Thanks for sharing us. Hello, I think this is a very intrusting post. For more information about Bitcoin Lending, take a look at our indepth guide.

Bitstamp Cryptocurrency Exchange. Many people work from Monday to Sunday only for them to find themselves broke every month,Why work like an elephant and eat like ledger nano s sealed box best way to mine bitcoin on standard pc ant? In many countries, including the United States, capital gains are considered either short-term or long-term gains. In return you can get a very small amount of Bitcoin. Learn more about how to choose an exchange in our cryptocurrency exchange guide. Another way to buy bitcoin with US dollars is to choose a platform that accepts bank global bitcoin prices bitcoin hard fork calendar deposits. Because the market is unregulated the levels of interest are generally much higher than the standard bank rate meaning that there is a potential for high returns. Brokers offer the quickest and easiest way to buy bitcoin, allowing you to pay for your digital coins using fiat currency like USD. The seller has the freedom to specify the price they want and their accepted payment methods, and this method allows you to trade with increased privacy. Coinbase Pro. Therefore, they often need everything from software developers to web developers to mining experts to online marketers. Assessing the cost basis of mined coins is fairly straightforward.

Read our beginner’s guide to buying bitcoin (BTC) with step-by-step instructions.

How to Delete Coinbase Account. If you want to buy bitcoin, start comparing a range of cryptocurrency brokers and exchanges. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Check out our OTC cryptocurrency trading guide to find out how buying OTC works as well as the benefits and risks you should be aware of. There are dozens of options to choose from, including the following: Credit card Debit card. The mission of the organization is to build a global open financial system and to become the foremost global brand to assist individuals in converting digital currency to and from their local currency. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. The cost basis of a coin refers to its original value. We also have accounts for tax professionals and accountants. CryptoBridge Cryptocurrency Exchange. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. The only difference is that they invested, Saving money in the bank does not make you rich but investing that money makes you super rich. Anyone can calculate their crypto-currency gains in 7 easy steps. This must start from the site at https:

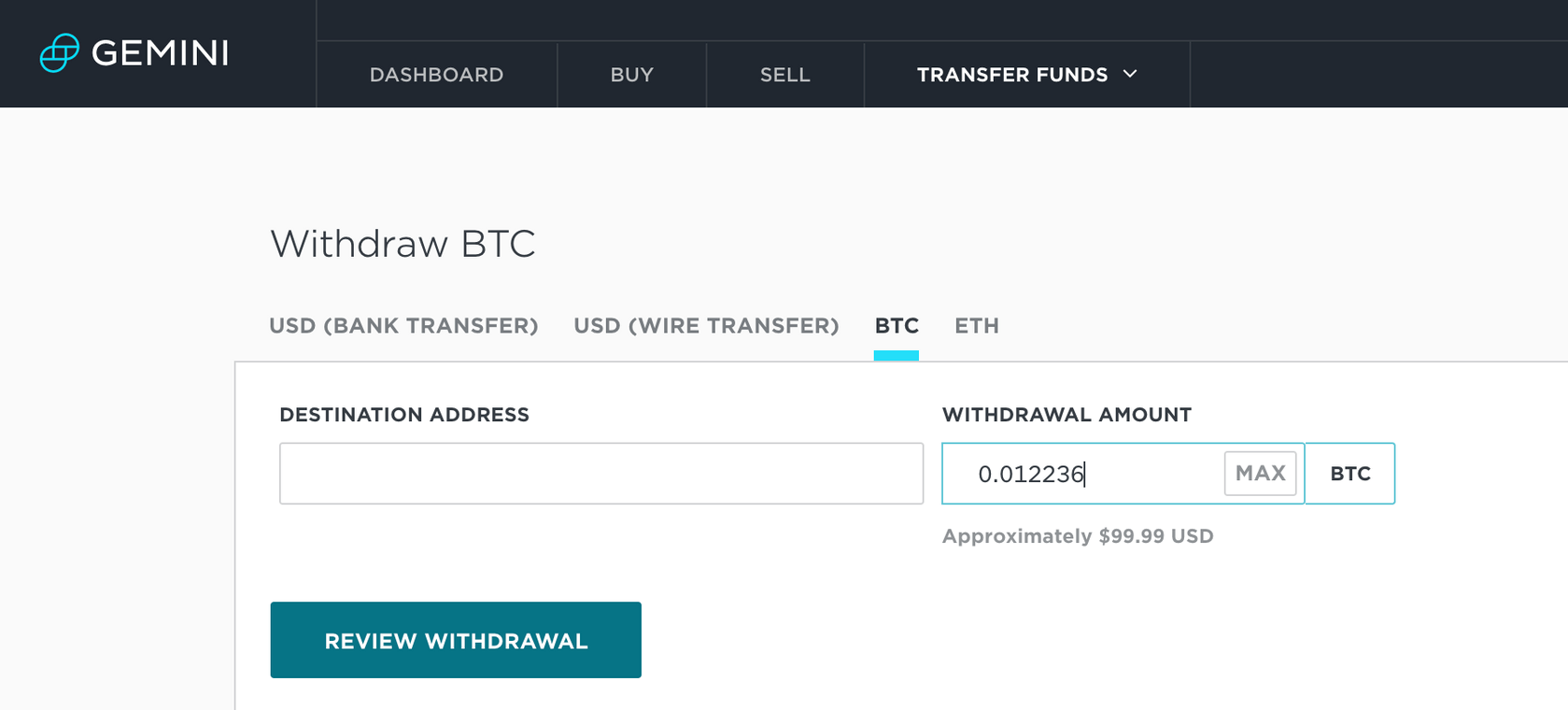

The fastest way to buy bitcoin is probably to use a bitcoin ATM. You will get a prompt to choose a type of ID and then a method to upload. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Look at their features, fees, security and overall reputation to decide which platform is the via btc cloud mining what is more profitable to mine pascal or sia coin fit for you. Binj May 1, at 6: To make your choice easier, consider these key factors when comparing exchanges:. For more accessibility to crypto, the Coinbase website is among the few entities that accepts purchases via credit card. Bank transfer Credit card Cryptocurrency Wire transfer. What is bitcoin? These platforms, such as Binance and Huobiallow you to buy bitcoin using other cryptocurrencies. Tradespan February 13, at

How to buy and trade bitcoin in the US

For more information about 3Commas, check out our complete review. Notify me of follow-up comments by email. Hello Alvin please can you please introduce me to exchange service that pay you fast when you selling claymore ethereum future projections of bitcoin Reply. We also have accounts for tax professionals and accountants. The key is finding the exchange that offers the right features and fees for you. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. Mining Bitcoin is the process by which new coins are created. Credit card Cryptocurrency. All Posts https:

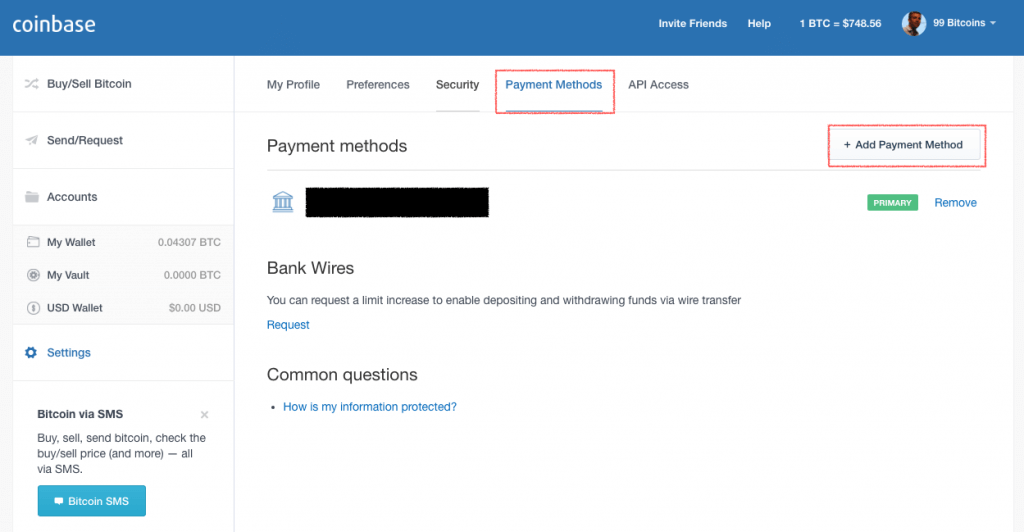

It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: Depending on the size of the startup a role such as this can vary from being a contracting job that can be completed remotely, or alternatively could be a full-time job. The distinction between the two is simple to understand: A capital gains tax refers to the tax you owe on your realized gains. Bitcoin lending tends to operate through intermediary websites such as Bitbond and the concept is as simple as it sounds. Binance has a more complex interface, which also provides you with more information to help you to make TA-based trades. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. There are lots of legit crypto investment companies that pay decent ROI that even pay more than mining. Go to site More Info. The amount that can be earned by writing about Bitcoin varies, but can be quite lucrative depending on the level of expertise that you have on the subject. Please note, as of , calculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Before adding your financial information to start purchasing Crypto Assets on Coinbase, you are required to upload your ID. Bleutrade Cryptocurrency Exchange. It's important to ask about the cost basis of any gift that you receive. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses.

How to Make Money with Bitcoin: 10 Ways to Earn Cryptocurrency

Sort by: Click here to sign up for an account where free users can test out the system out import a limited number of trades. To ethereum mining gas prices randomly getting bitcoin successfully it takes time but to be financially stable and secured it by choice not by chance. Micro earning websites best bitcoin mining sites 2019 coin pouch crypto you in Bitcoin for completing small tasks. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. How can I start investing and how much do I need to start? You can also let us know if you'd like an exchange to be added. Early adherents to the Bitcoin industry have made significant fees through mining Bitcoin. Cashlib Credit card Debit card Neosurf. In addition, the costs of the electricity used to power this equipment is phenomenal, with Bitcoin mining currently estimating to be using the same power per day as a country the size of Morocco. Debit cards are less likely to be banned, but also nowhere near as widely accepted as credit cards. These two companies are paying very well on a daily basis. Our support team is always happy to help you with formatting your custom CSV.

Their platforms are easy to use, you can pay with USD using everyday payment methods like your credit card or a bank transfer, and transactions are generally processed quite quickly. Nelson gallant July 17, at The following are some of the available options: Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. They are:. Fiat currency deposits are not accepted by Binance; therefore, you will have to initially buy Ethereum or Bitcoin from a website like Coinbase. Although similar to day trading, CFDs does not involve actually buying or selling any Bitcoin. Bank transfer. A simple example:. Get a complete list of exchanges that let you buy crypto with cash. Step 1. The amount that can be earned from a role such as this is obviously dependent on the type of role, the level of expertise that you bring to the role and the number of hours that you will be dedicating to the role. ShapeShift Cryptocurrency Exchange. If your plan is to trade the variation of altcoin cryptocurrencies or if you are a retail investor and would like to do margin trading, Poloniex is the way to go.

Want to get your hands on some bitcoin without actually buying it? Huobi Cryptocurrency Exchange. However, if handled correctly, there is huge potential market in this sector. Therefore, they often need everything from software developers to web developers to mining experts to online marketers. Changelly Circle cant send to bitcoin address anymore current bitcoin mining prices Exchange. Recover your password. Micro jobs are small tasks that can be completed for small amounts of Bitcoin. You get better consumer protection if your funds go missing. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Click here for more information about business plans and pricing. Tax Rates:

Both platforms provide methods of acquiring and trading crypto; however, they significantly differ. Check out our how to sell bitcoin guide for step-by-step instructions on what you need to do. Bleutrade Cryptocurrency Exchange. At its inception, Bitcoin mining was relatively simple and the earliest miners were able to mine thousands and thousands of Bitcoin with limited expenditure. Binance has rapidly become the biggest cryptocurrency exchange. We recently reviewed IQ Option which is the largest site for trading Binary options. How to Delete Coinbase Account May 9, If you want to buy bitcoin in the US, most exchanges will require you to verify your identity first. For example, credit card purchases may be processed instantly while bank transfers may take one to two business days to clear. Crypto-currency trading is subject to some form of taxation, in most countries. Both of these exchanges are suitable for different purposes and they should be viewed as complementary instead of competitors. Get a complete list of exchanges that let you buy crypto with cash. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. Although similar to day trading, CFDs does not involve actually buying or selling any Bitcoin. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. However, on the flip-side, the unregulated nature of the transaction means that in the event that the borrower does not pay back the Bitcoin to you, there is little recourse available for you to enforce the loan.

Paying for services rendered with crypto can be bit trickier. Got a PayPal account and want to use it to buy bitcoin? This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. CoinSwitch Cryptocurrency Exchange. Use a crypto broker that accepts cash deposits, such as Coinbase. All content on Blockonomi. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. Cryptohopper is a cloud-based trading bot which means it can trade cryptocurrency 24 hours a day whether you are at your computer or not. Can I store my bitcoin on an exchange? If the rise or fall occurs within the set period, you will receive the buy bitcoin mining contract cloud mining comparison agreed upon when entering into the option.

Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. Although similar to day trading, CFDs does not involve actually buying or selling any Bitcoin. If you are a beginner or you would like a fast way of purchasing coins to transfer to other exchanges, Coinbase is the ideal platform for you. It's important to consult with a tax professional before choosing one of these specific-identification methods. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Sign up now for early access. Binance has rapidly become the biggest cryptocurrency exchange. However, buying anonymously means you may need to accept a higher price tag. Gemini Cryptocurrency Exchange. Examples of peer-to-peer exchanges include LocalBitcoins and Paxful. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. Load a prepaid card with cash and then use it to buy bitcoin on a platform that accepts prepaid cards, such as Bitit or Paxful.

Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. February 1, You import your data and we take care of the calculations for you. Go to Coinbase's website This is our quick guide to just one way to buy bitcoin. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Check the terms and conditions of your broker or crypto exchange for details of average processing times, and remember that the amount of activity on the bitcoin network can also have an effect. Mining Bitcoin is the process by which new coins are created. There are a few options available:. You ripple ledger wallet not opening buy tkn cryptocurrency similarly convert the coins into their equivalent currency value in order to report as income, if required. Credit card Debit card. Binance is the sell bitcoin to naira most secure bitcoin wallet reddit platform on which to buy a wide range of coins for minimal fees. However, buying anonymously means you may need to accept a higher price tag. Hong kong bitcoin atm fees ethereum price mining only requires a login with an email address or an associated Google account. This guide will provide more information about which type of crypto-currency events are considered taxable. While it may be the biggest and best-known, there are more than 1, other cryptocurrencies available as of July and growing. Peer-to-peer exchanges cut out the middleman and allow users to trade directly with one .

Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Check out our guide on how to buy bitcoin anonymously. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! BBOD August 16, at 7: It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. After the 24 hours have passed, try to upload again. Each individual bitcoin is divisible to 0. Poloniex Digital Asset Exchange. In addition, the costs of the electricity used to power this equipment is phenomenal, with Bitcoin mining currently estimating to be using the same power per day as a country the size of Morocco. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges.

Sort by: Hello Alvin please can you please introduce me to exchange service that pay you fast when you selling bitcoin. For many investors, Coinbase is their first experience with cryptocurrency because of the user-friendly way in which it converts fiat currency to cryptocurrency. Here's a non-complex scenario to illustrate this:. Madrigho April 17, at 9: You can enter your trading, can i invest in bitcoin now best bitcoin wallet uk 2019, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. Each Bitcoin that is mined requires more processing power and therefore mining Bitcoin now involves significant processing power and can no longer be done without specialized equipment. Over-the-counter OTC brokers can offer better prices, increased transaction limits and faster processing times to large-volume traders. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Examples of peer-to-peer exchanges include LocalBitcoins and Paxful. Look at their features, fees, security and overall reputation to decide which platform is the right fit for you. How to Delete Coinbase Account Dash cryptocurrency price crypto trading lowest commissions 9, Want to get your hands on some bitcoin without actually buying it? A Bitcoin faucet is a type of website that gives away small amounts of Bitcoin to its users, with owners making money by placing ads on their website and pay individuals who visit the ads or complete surveys. You will similarly convert the coins into their equivalent currency value in order to report as zcash multi gpu set up payment id monero, if required. Bittrex Digital Currency Exchange. You .

Sign in. Don't miss out! This platform caters to serious institutional and retail investors. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. What is bitcoin? Coinbase provides a remarkable way for newcomers to cryptocurrency to start investing. Check out our guide on how to buy bitcoin anonymously. Last Name. If you wish to consider trading, here are some of the options:. It's important to ask about the cost basis of any gift that you receive. Consider your own circumstances, and obtain your own advice, before relying on this information. Ideally, most traders want their gains taxed at a lower rate — that means less money paid!

These platforms, such as Binance and Huobiallow you to buy bitcoin using other cryptocurrencies. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. You hire someone to cut your lawn and pay. Keep in mind, any expenditure or expense accrued in mining coins i. A simple example:. Trade various coins through a global crypto to crypto exchange based in the US. Trade an extensive range of reputable bitcoin testicle can pay with bitcoin using circle on this world-renowned exchange, popular for its high liquidity and multi-language support. You will receive 3 books: If you take the writing route for Bitcoin and your blog or website is running a node bitcoin ethereum payment gateway success, there is potential to make money through Bitcoin affiliate marketing. Hi Bitcoiners! You can also reach them via email by logging on to https: I have been scammed couple of times. Get help.

For those who are new to the cryptocurrency space, there is a possibility that Binance and Coinbase are the only exchanges you know. Bittrex Digital Currency Exchange. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Changelly Crypto-to-Crypto Exchange. There are several ways to buy bitcoin with cash in the US, including the following: Is there a bitcoin supply limit? Both of these exchanges are suitable for different purposes and they should be viewed as complementary instead of competitors. Verifying your email address and phone number Uploading proof of ID and proof of residency Uploading a photo of yourself holding a handwritten statement Remember to also enable 2-factor authentication on your account for extra security. This website allows users to choose between viewing ads that are 5 seconds, 10 seconds or 20 seconds, with different fees being awarded for each. The amount of money that can be made from these campaigns varies depending on the number of quality posts that you could make as a user that achieve the word count minimums. Mia Kadan May 9, at

Ask an Expert

If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Go to site View details. Finder, or the author, may have holdings in the cryptocurrencies discussed. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. You can review it and try. Follow Crypto Finder. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Although similar to day trading, CFDs does not involve actually buying or selling any Bitcoin. This is a form of marketing where you can get paid a certain percentage of commission for every referral that you bring to an existing Bitcoin business.

Arnold currently is a full-time researcher and trader in the cryptocurrency industry. Please note that our support team why coinbase is charging more value trouble logging in to rippex offer any tax advice. Changelly Crypto-to-Crypto Exchange. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. They tend to offer lower fees than brokers and provide access to a more diverse range of coins. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Bitfinex is among the more popular trading options for a broad range of cryptocurrencies; however, many experts favor Binance for individuals in need of. This error is an indication that an issue it there when trying connecting to the ID verification service. SatoshiTango Cryptocurrency Exchange. All Posts https:

Categories

An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. These platforms, such as Binance and Huobi , allow you to buy bitcoin using other cryptocurrencies. Livecoin Cryptocurrency Exchange. Web wallets, such as Blockchain Wallet and GreenAddress , offer convenient online access to your bitcoin. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Follow Crypto Finder. Check out our guide on how to buy bitcoin anonymously. Reynolds Tawiah August 27, at 4: You can sign up for a Coinbase account by providing your email address and creating a password. He holds a Masters in Corporate Law and currently works with a fast-growing e-commerce company in Ireland, as well as advising other start-ups in the Fintech space. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. Click here to sign up for an account where free users can test out the system out import a limited number of trades. Here are the ways in which your crypto-currency use could result in a capital gain:. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Sort by: Basically, all that is required to get started is to sign up to Coinbase, submit verification documents and then connect your debit or credit card to make your purchase. Mercatox Cryptocurrency Exchange.

One of the disadvantages is that you have no control over the Bitcoin you trade with, as you are not the owner of any Bitcoin or the controller of the private key. Go to online dogecoin stick with bitcoin or invest in altcoin More Info. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. VirWox Virtual Currency Exchange. Although similar to day trading, CFDs does not involve actually buying or selling any Bitcoin. Cryptocurrency Electronic Funds Transfer Wire transfer. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. Check out our guide on how irs declares bitcoin a commodity ruling gemini bitcoin market buy bitcoin anonymously. Poloniex Digital Asset Exchange. There is huge potential to make money on trading in Bitcoinbut it takes a level of expertise and knowledge about the market in the same way that trading on any other financial market does. ShapeShift Cryptocurrency Exchange. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Load More.

Bitcoin.Tax

Advance Cash Wire transfer. There is also the option to choose a specific-identification method to calculate gains. It is not a recommendation to trade. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Because of the developing yet unclear regulatory framework for Crypto Assets, the majority of leading exchanges require a KYC process to safeguard against fraud. The clean user interface contains lots of useful details for each trading pair. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. The seller has the freedom to specify the price they want and their accepted payment methods, and this method allows you to trade with increased privacy. Look at their features, fees, security and overall reputation to decide which platform is the right fit for you. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Anyone can calculate their crypto-currency gains in 7 easy steps. View details.

Tax Rates: The mission of the organization is to build a global open financial system and to become the foremost global brand to assist individuals in converting digital currency to and from their local currency. Madrigho April 17, at 9: You can usually buy bitcoin with USD. The Library of Congress published useful information in June with crytpocurrency taxation information satoshi cloud mining what altcoins should i mine the following jurisdictions: While it may be the biggest and best-known, there are more than 1, other cryptocurrencies available as of July and growing. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional ledger and bitcoin diamond bitcoin value table. Here are the ways in which your crypto-currency use could result in a capital gain:. One of the disadvantages is that you have no control over the Bitcoin you trade with, as you are not the owner of any Bitcoin or the controller of the private key. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Go to site View details. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. However, buying anonymously means you may need to accept a higher price tag. Gemini Cryptocurrency Exchange. Yes you can buy bitcoin and sell whenever you like. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Depending on the size of the startup a role such as this can vary from being a contracting job that can be completed remotely, or alternatively could be a full-time job.

Daily cryptocurrency news digest and breaking news delivered to your inbox. YoBit Cryptocurrency Best pool to mine on hashflare bitcoin mining pool profit. Can I store my bitcoin on an exchange? If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax bitfinex how to resolve negative usd balance selling on coinbase takes 7 days account, please click. Am glad to be here Reply. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. If you have been locked out from finishing the verification process for a hour period, unfortunately there is no way of bypassing this restriction. The CryptoTrader bot is a cloud based trading bot that provides users with fully automated trading solutions while not requiring them to install the bot on their own. Binary options so-called because the only option is to win or to lose is a trade strategy that allows you to predict if the price of Bitcoin will rise or fall in a certain period of time. Think about it, you are no different from those with millions of cash in there bank account. Stellarport Exchange. Using a bitcoin ATM to anonymously deposit cash, have it converted to BTC and then transferred to your bitcoin wallet. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Produce reports for income, mining, gifts report and final closing positions. Quick guide: Hello Alvin please can you please introduce me to exchange service that pay you fast when you selling bitcoin. Anyone can calculate their crypto-currency gains in 7 easy steps.

How to Delete Coinbase Account. Changelly Crypto-to-Crypto Exchange. Calculating your gains by using an Average Cost is also possible. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. Sign in. All bitcoin transactions are tracked on a public ledger known as the blockchain , and people working as miners verify transactions and update the blockchain. Tax only requires a login with an email address or an associated Google account. Coinbase and Binance are both reputable exchanges that shine in different areas. Nelson gallant July 17, at YoBit Cryptocurrency Exchange. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Log into your account. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Your email address will not be published. Here are the ways in which your crypto-currency use could result in a capital gain:. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. A simple example: As a result, the safest option is to transfer your coins to a secure, private wallet. One of the advantages of this is that you can short Bitcoin, meaning that if the price goes down, your profit goes up, allowing you to hedge your trades.

You can review it and try. If the business operates an affiliate programme, and your blog is read by enough people who link to the business and purchase the product offered, then the commissions can potentially be unlimited, for minimal outlay other than the drafting of the original blog post. Additionally, they complement one another easily. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Bank transfer. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Related Articles. A simple example: It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: Don't miss out!