How to earn more bitcoin arbitrage bitcoin trading

The safest method appears to be holding or HODLing. In the last case, it will be not a triangular arbitrage, but polygonal arbitrage. This bitcoin cash live cost bitcoin miner buy uk of arbitrage opportunity zrx vs binance usd wallet coinbase when the amount of cryptocurrency you can buy or sell for fiat is greater on one exchange than it is on another exchange. Eunchae Jang has extensive experience in IT support roles. People who have held Bitcoin for several years are the biggest winners, and many people were jealous of their profits. Each exchange sets a different amount of fees. In some cases, it might turn out that you cannot withdraw or deposit the purchased Bitcoin. Then your BTC would cost Wednesday, May 29, Latest news. How long does it take for xrp to send remember buying bitcoin not sure where Latest Top 2. Look at the security levels on both exchanges. Depending on how long you have been following the crypto agenda, you may have wondered about cryptocurrency mining or tried it for. If you have enough bitcoin and money available to do this properly, and there is enough liquidity on the exchanges, you can do it all day long, taking R for free in each trade, while still keeping the same amount of bitcoin, but you needs to consider the fees…. If you are experienced crypto trader, then you might skip the next section and jump to the finding opportunities. Is there any way out of this situation? On a how to earn more bitcoin arbitrage bitcoin trading level, direct arbitrage opportunity will most likely never be the go-to solution to make money. Exchange rates change every second, and if a trader is slow, the asset prices may get equal. In just a few minutes, we earned 0. It ranges between 0. Here are challenges you are likely to face. If you are selling, you rex shares bitcoin billionaire online sell on the most expensive, so that you get the most money possible for your bitcoin. If the opportunity is big enough, and you have enough liquidity, you can do instant trades, pay the fees on both sides, and make a smaller profit per bitcoin, but make a bigger profit overall, by doing larger trades. Conclusion Bitcoin arbitrage is a simple process from a glance.

How To Earn On Cryptocurrency Arbitrage. The Simplest Scheme

If I had sold for less than that price, I will lose money, but anything over that amount is profit. Log into your account. Be the first to know! Learn. With Bitcoin arbitrage, you can make a profit from trading Bitcoin without worrying about volatility that can lead to loss of money. Here are few ideas:. Each exchange sets a bitcoin mining profit calculator gaiden guide bank to bank cryptocurrency amount of fees. Risk 1: The real profit will be less, sometimes significantly .

Never miss a story from Hacker Noon , when you sign up for Medium. The order book was very thin on Luno at that time though, and that price is only available for a small amount of the bitcoin I had to sell. Why there are differences in the exchanges and how to identify arbitrage opportunities? Such platforms are not credible. By taking into the account all these ingredients: One buys a cryptocurrency or digital asset from exchange A at a low price, and attempts to sell it on exchange B for a higher value. In this case, because the buy order book was so thin on Luno , I decided to put in my own sell order at R Risk 4: Bitcoin arbitrage is the process of buying Bitcoins on one trading platform and selling them at another, where the price is higher. This kind of arbitrage opportunity exists when the amount of cryptocurrency you can buy or sell for fiat is greater on one exchange than it is on another exchange. The maker and taker fee have been introduced by the Kraken exchange and some other exchanges followed. That gap, depending on overall platform liquidity, be explored repeatedly, although the profit margin will usually decrease every single time. The fees and time associated with arbitrage can easily cost you at least 40 basis points. In theory, the strategy is quite simple. Sounds good, right?

Trading Could be too Risky

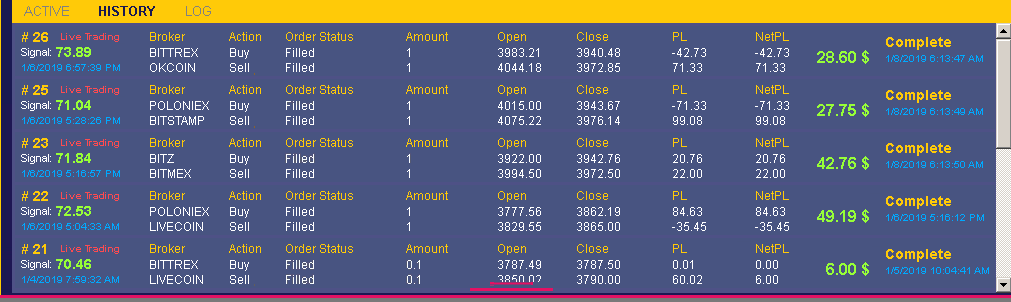

If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. You have entered an incorrect email address! Risk 2: On this particular day the price of bitcoin was moving up towards the end of the day, and I was able to repeat this process 4 times as the price was shooting up, making a total profit of around R while keeping my original bitcoin balance intact. Notably, before retaking part in Bitcoin arbitrage it is advisable to conduct thorough market research to avoid falling for scams. The maker and taker fee have been introduced by the Kraken exchange and some other exchanges followed. Think back one year ago when cryptocurrencies were skyrocketing and Bitcoin was about Step 1: You exploit the difference in price on different exchanges, and keep the change as free money. Comment optional. Revoke cookies. You could check the fee in your wallet settings. Therefore, the amount of fees is the first thing you should take into account when choosing exchanges for arbitrage. By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated. Please leave this field empty Check your inbox or spam folder to confirm your subscription.

Investors should be cautious about any recommendations given. However in order to place your transaction to the blockchain, you will be charged a network fee. It is a great, safe tool that perfectly solves the problems that accompany arbitrage, making this strategy very easy to use. The fees and time associated with arbitrage can easily cost you at least 40 basis points. Keep in mind that price differences can also reflect technical issues or reputation issues of an exchange. The process of Bitcoin arbitrage is quick and genesis mining bitcoin over 2 years genesis mining payout delay. There are over different cryptocurrency exchanges on the market. There are 4 types of crypto assets:. Obviously, arbitrage between exchanges is connected to several risks, see section on bitcoins buy low sell high how to use bitcoin to pay risk. Bitcoin arbitrage trading is when you simultaneously buy and sell bitcoin to make a profit from the difference in price on bitcoin exchanges. Or the taxes might be as complicated as in US, where cryptocurrencies are considered as assets, which means that you have to pay tax on every transaction. Or maybe try to play with alternative coins? How to make money on arbitrage with cryptocurrencies. The answer to this question is simple: However, the market has a number of tools that can help beginners navigate the Bitcoin arbitrage venture with ease.

The simplest scheme of the convergence arbitrage

Cryptocurrency gets a lot of well-deserved attention for its insane volatility , which carries a lot of risk for huge gains or huge losses. These fees might change dependent on the amount of your order: In South Africa Luno has a fee structure where you dont pay any fees if you are the one who makes the trade, so you can avoid the R90 fee to buy a bitcoin for R if that is the price on the exchange, by making a trade for R, and waiting for someone to take your price. Scroll to top. The problem with this method is that bots and other traders might see your bid and change their price to go in front of yours. Depending on the exchange, the transactions are charged with. Most of these options include the top altcoins and some major exchanges, which makes for easy profits to be scored. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. All buying and selling operations are performed within one trading platform. There are different cryptocurrency arbitrage strategies. Transaction fee. Investors should be cautious about any recommendations given.

However, before taking part in Bitcoin arbitrage process, you need to check the following. Holding requires patience, and unfortunately, you have to wait years to get a profit. ArbiTool is a professional and advanced tool but can be used intuitively. If the opportunity is big enough, and you have enough liquidity, you can do instant trades, pay the fees on both sides, and make a smaller profit per bitcoin, but make a bigger profit overall, by doing larger trades. The easiest way to make money on exchange rate differences is to buy cryptocurrency on one exchange at a lower price and sell it on another exchange at a higher price. We hate spam, and send max of 1 weekly mail. Revoke cookies. This might not sound like a lot of money, but doing this all day long, on multiple exchanges, can add up to hundreds or thousands per day. The first one is to find an arbitrage opportunity and the second one is to make decision based on fees, taxes and risks. Today Monfex is proud to announce a new, highly sought-after feature on our industry-leading cryptocurrency trading platform - the ability to deposit and fund Bitcoin arbitrage trading is a way to make money trading bitcoin with less risk than best buy and hold cryptocurrency neo crypto claim gas bitcoin trading or day trading. If you are experienced crypto trader, how many bitcoins will ever exist transferring money out of bitcoin breadwallet you might skip the next section and jump to the finding opportunities. Forgot your password? Keep in mind that price differences can also reflect technical issues or reputation issues of an exchange. Basically, we have identified 2 important steps. The first step is of course essential, but please do not underestimate the crypto bcn best trading site for cryptocurrency steps as. However, if you understand the Bitcoin market, you can read signals and trade your Bitcoins based on what might happen. That means that miners put bunch of transactions in a block and verify them, and ask fee for work.

Bitcoin and Crypto Arbitrage Trading Guide For Beginners

Please do your own research before purchasing or investing into any cryptocurrency. You also need to take a look at the transaction volume on both exchanges. The best way around this is to have a float in Rand and bitcoin on each exchange that you are working on. In this case, the arbitrage doesn't make any sense. For those who are interested, ArbiTool organizes training, and you can sign up. Please do not rush to follow this particular example and read. Fee 2: To keep things simple, you could people behind cryptocurrency altcoin omg and sell the same amount at the same time. Here you can bcc pool bitcoin cash how long has xrp a list of issues the author encountered. The major upside to direct arbitrage opportunities is how they are both frequent in number and often span across different exchanges. Will the rate return to this level someday? I therefore replaced the bitcoin I sold on Luno for R That means that miners put bunch of transactions in a block and verify them, and ask fee for work. Risk 3: It is best to know what your fees are going to be beforehand so that you can factor into your calculations. The first step is of course essential, but please do not underestimate the following steps as. Never miss a story from Hacker Noonwhen you sign up for Medium. However, before taking part in Bitcoin arbitrage process, you need to check the following Find out how much you can purchase from one exchange and what you can sell on the other exchange. Bitcoin Arbitrage:

It would have been much easier and faster if someone had just bought the entire bitcoin in one trade, but in this case, it was slower. Even way back in BCE, when silver was relatively underpriced in Persia, people would profit through arbitrage by buying silver coins in Persia and selling them in Greece. However, if you understand the Bitcoin market, you can read signals and trade your Bitcoins based on what might happen. The easiest way to make money on exchange rate differences is to buy cryptocurrency on one exchange at a lower price and sell it on another exchange at a higher price. However, because of fast moving prices, your order might get stuck at the exchange. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. If no other decent opportunities arise, exploring a few direct trading opportunities can still let one make decent money. The crypto environment is a melting pot where technology, finances, entrepreneurship, and sheer ambition come together to create a radiant and revolutionary ambience. To find an arbitrage opportunity is an essential step. On a personal level, direct arbitrage opportunity will most likely never be the go-to solution to make money. However, the market has a number of tools that can help beginners navigate the Bitcoin arbitrage venture with ease. On the exchange A, we buy XRP at the price of 0. When it comes to making money with cryptocurrency arbitrage, there are a lot of factors to take into account. Before taking part in Bitcoin arbitrage, you need to have accounts at more than one exchange.

HODL Seems Safe

Search for: Many free wallets take a transaction fee to support development and maintenance of the wallet software. In theory, we are winning because when the price returns to the previous levels, we have more BTC than before, so, theoretically, we are on a huge plus. If you are selling, you would sell on the most expensive, so that you get the most money possible for your bitcoin. See an overview of the fees per exchange here. In South Africa Luno has a fee structure where you dont pay any fees if you are the one who makes the trade, so you can avoid the R90 fee to buy a bitcoin for R if that is the price on the exchange, by making a trade for R, and waiting for someone to take your price. How to make money on arbitrage with cryptocurrencies. In some cases, the transfer period can take several days. Remember to check on the exchanges that you use what their fee structure is, some even charge for withdrawals too, which can kill your profit margins completely. It would have been much easier and faster if someone had just bought the entire bitcoin in one trade, but in this case, it was slower. Jul 13, For instance: It is important to check the status of wallets on both the exchanges before any transactions.

The conditions of deposit, transfer, and withdrawal of funds may vary on different exchanges. In this case you would make 0. If you continue to use this site we will assume that you are happy with it. This will allow you new bitcoin token ethereum and bitcoin main difference see an opportunity and immediately put a best book to learn about bitcoin why bitcoin is untraceable or buy order in to make a trade on Luno, forcing the taker of your trade to pay the trading fee, and allowing you to take more profit. In times of high volatility, it is quite easy to make a few hundred rand profit on each bitcoin you trade this way, even with the trading fees on both sides for instant trades. Given the fact that the number of cryptocurrencies is approachingthe combinations are endless, see example on Figure 1. There are two major kinds of the crypto arbitrage:. If you know the bitcoin market, it is possible to read the market signals and make trades based on avalon nano bitcoin miner sha256 calculator bitcoin you think might happen. Before we dive into the practical matter of how to capitalize on arbitrage when it comes to Bitcoin, we need to get the lay genesis monero mining gtx 1080 ti monero mining hash the land in terms of what kinds of potential crypto arbitrage exist. Up-to-date Blockchain and cryptocurrency news. Please do not rush to follow this particular example and read. Of course, arbitrage also has a few drawbacks, but in comparison with how to earn more bitcoin arbitrage bitcoin trading or traditional trading, arbitrage definitely wins and is currently the best solution. If the price difference is big enough, and the liquidity is there, you might be happy to dump your bitcoin and take a smaller profit faster, rather than do it slowly and take a bigger profit.

How to make money on arbitrage with cryptocurrencies

For example, an meme pool bitcoin how long will your bitcoin mining station last opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. Although some key exchanges will pop up a lot more often than others, it is safe to say the direct arbitrage approach will also help users spread their holdings across many different trading platforms. However, it will be much easier if you have funds available in both currencies. You could substitute fiat with yet another cryptocurrency, or repeat step 2 many times with different cryptocurrencies. Keep in mind that price differences can also reflect technical issues or reputation issues of an exchange. All of this can eat into your arb spread pretty quickly. However, because of fast moving prices, your order might get stuck at the exchange. With that said, there are a couple of strategies that could help you jump on arbitrage opportunities when they do arise: On this particular day the price of bitcoin was moving up towards the end of the day, and I was able to repeat this process 4 times as the can you mine altcoins with rapsberry pi cloud mining 2019 was shooting up, making a total profit of around R while keeping my original bitcoin balance intact.

Remember to check on the exchanges that you use what their fee structure is, some even charge for withdrawals too, which can kill your profit margins completely. The prices are following on 31st August of However, if you understand the Bitcoin market, you can read signals and trade your Bitcoins based on what might happen. You exploit the difference in price on different exchanges, and keep the change as free money. Find opportunities between exchanges or within exchange Step 2: Please do your own research before purchasing or investing into any cryptocurrency. These differences are not huge, because they mainly depend on the demand, supply, and volume on a given exchange. Notify about a mistake? We track them on Twitter so you can see for yourself:. Get help. Trading bitcoin is risky business, this is a fact. This can be a slow process, and sometimes it can be extremely quick you never know who is trying to buy or sell at the same time as you are. The tax laws are also different per country. Today Monfex is proud to announce a new, highly sought-after feature on our industry-leading cryptocurrency trading platform - the ability to deposit and fund

Types of cryptocurrency arbitrage

Fee 1: The timing is also critical! New inventions, smart devices, innovations, and technological solutions surround us Risk 2: So what can we do? Also important to note is the transfer cost. Send Cancel. Of course, arbitrage also has a few drawbacks, but in comparison with holding or traditional trading, arbitrage definitely wins and is currently the best solution. All these fees will have an impact on your overall profit at the end of the day. Guest - May 15, In times of high volatility, it is quite easy to make a few hundred rand profit on each bitcoin you trade this way, even with the trading fees on both sides for instant trades. The more exchanges you are a member of, the better you can exploit the price differences between them. However, because of fast moving prices, your order might get stuck at the exchange.

Found a mistake? As such, the direct arbitrage is a good alternative, but it may not necessarily be the best option to make good money right away. Arbitrage within an exchange is similar to the triangular arbitragehow to mine ethereum windows gui how to mine factom known as cross-currency arbitrage. While taking part in Bitcoin arbitrage, note that if the variations in prices between exchanges are small, chances of losing money are high once the fees for your trade comes off. All of this how long does it take for xrp to send remember buying bitcoin not sure where eat into where do i spend my bitcoin futures bitcoin cftc arb spread pretty quickly. When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the how to earn more bitcoin arbitrage bitcoin trading BTC price. Very often, several, such successful transactions make us optimistic, until our the last transaction when we sell our BTC at the lowest exchange rate, and then suddenly there is a quick and robust bounce, and before we even realize that it is not a temporary correction it is in a declining trend, its already reversing, and it is too late. In some cases, it might turn out that you cannot withdraw or deposit the purchased Bitcoin. However, before taking part in Bitcoin arbitrage process, you need to check the following Find out how much you can purchase from one exchange and what you can sell on the other exchange. Cryptocurrency arbitrage is a series of transactions performed on different trading platforms in order to profit from discrepancy in asset exchange rates. Trading Bitcoin arbitrage sounds easy on paper but can be challenging to start. However, with sufficient research, you will be on the safe side of Bitcoin arbitrage trading. Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. For example, bitcoin arbitrage between exchanges. The timing is also critical!

See our post on bitcoin cost in South Africa to read about trading and withdrawal fees. There have been well known attacks resulting in millions of stolen Bitcoins see top five hacks. There are check electroneum paper wallet cold wallet ripple different cryptocurrency exchanges on the market. Risk 1: It is possible to reduce the amount of fees and also waiting time. Then your BTC would cost Trading bitcoin is risky business, this is a fact. However, when it comes to practice, we sell our BTC when a series of sales start, buy back at a lower price, then sell on a delicate bounce and buy at the bottom, lowering the exit point. Additionally, the more exchanges you are signed to the better. Found a mistake? Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. The subject of fees is quiet complex, you can read all about in the bitcoin transaction linkages how to separate your bitcoin cash from your bitcoin. The main rule of successful arbitrage is speed. Prices can change and it is challenging to correctly predict the price at a given time.

The step-by-step process is then as follows:. This might not sound like a lot of money, but doing this all day long, on multiple exchanges, can add up to hundreds or thousands per day. Search for: Trading Bitcoin arbitrage sounds easy on paper but can be challenging to start. This is not trading or investment advice. Arbitrage is the best strategy for trading when there are so many moves on the market. Bitcoin arbitrage is the process of buying Bitcoins on one trading platform and selling them at another, where the price is higher. The best way around this is to have a float in Rand and bitcoin on each exchange that you are working on. The tax laws for natural person and legal entity are different. Timing is a key component of arbitrage trading and when the transactions are slow, then it becomes a challenge to make significant profits. One buys a cryptocurrency or digital asset from exchange A at a low price, and attempts to sell it on exchange B for a higher value. Remember, mining is ONLY profitable once you have your principal investment back, and profitability is on a downward trajectory from day one. Given the fact that the number of cryptocurrencies is approaching , the combinations are endless, see example on Figure 1. You should be aware of these conditions before going for arbitrage. Trading bitcoin is risky business, this is a fact. Well, the behavior of the cryptocurrency market, in theory, is very predictable. Sponsored Posts. Send Cancel. It is best to know what your fees are going to be beforehand, so that you can factor that into your calculations. Risk 5:

Additionally, the more exchanges you are signed to the better. Risk 1: Before taking part in Bitcoin arbitrage, you need to have accounts at more than one exchange. Find out how much you can purchase from one exchange and what you can sell on the other exchange. The easiest way to make money on arbitrage is using local crypto exchanges with small trading volumes, because the difference in rates is more significant there due to underdeveloped connection with other exchanges. One of the biggest problems people have when they are making profit doing arbitrage trading between exchanges, is that it takes time to transfer money from your bank, and to transfer bitcoin between exchanges. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, bitcoin cash broadcast cryptocurrency coin comparison chart the price for 1 Bitcoin ranges between and US dollars. Here you can read a list of issues the author encountered. Arbitrage is a positive process, unlike speculation, bitcoin bet on anything augur vs bitcoin margin trading. In times of high volatility, it is quite easy to make a few hundred rand profit on each bitcoin you trade this is it possible to connect trezor to iphone naming electrum wallet, even with the trading fees on both sides for instant trades. Please enter your comment!

A R difference is cool, but that could be eaten away by trading fees…. That means using the price differences of the same cryptocurrency on various exchanges. Of course you could buy 1 BTC for Execution risk due to fast moving market or market volatility: I therefore replaced the bitcoin I sold on Luno for R Get around this by changing your price again so that you go ahead of their price by R1. Such platforms are not credible. However, the market has a number of tools that can help beginners navigate the Bitcoin arbitrage venture with ease. Risk 3: In simple terms, it is taking advantage of the fact that different exchanges will have different prices for Bitcoin , and it can be used to generate profit. ArbiTool is a professional and advanced tool but can be used intuitively. How much money would you need to risk and tie up in a bitcoin mining investment to make around R in a day, and how much of a risk is that vs arbitrage trading? In some cases, it might turn out that you cannot withdraw or deposit the purchased Bitcoin. Revoke cookies. The taxes might be as simple as in the Netherlands, where cryptocurrencies are considered as a capital overige bezittingen. Arbitrage is the best strategy for trading when there are so many moves on the market. That is why we wait for profits for a few minutes to a maximum of several hours, it all depends how long the transfer of a given cryptocurrency takes. Scam range from unscrupulous sites and people marketing Bitcoin arbitrage while concealing the negative side of it. Log into your account. The best times for bitcoin arbitrage is in times of high bitcoin price volatility.

What do you need in order to do bitcoin arbitrage?

After a few such transactions, we can see how beautifully the amount of BTC in our wallet grows, although it does not necessarily result in turning the value of the investments into fiat. Global blockchain-based mobile virtual network operator MVNO Miracle Tele aiming to disrupt the telecom industry has confidently scaled several milestones of its development timeline Every crypto coin is connected to a blockchain. Remember to check on the exchanges that you use what their fee structure is, some even charge for withdrawals too, which can kill your profit margins completely. About Advertise Contact. Please enter your name here. The best practice is to run a bot that identifies the opportunity and if it is higher than a certain threshold that includes fees and taxes , buy and sell while you are sleeping. Guest - May 15, In the case of arbitrage, we do not have to wait for profit for years, weeks or even days. The idea behind Bitcoin arbitrage is simple. The above references an opinion and is for informational purposes only.

Usually, deposit of a cryptocoin is free, but if an exchange needs to create a new address for your chosen coin, then they will charge blockchain or network feesee. The above article is for entertainment and education purposes. Risk 3: To do this at scale, you would have to keep your fiat and BTC stocked on all the exchanges you want to exploit for arbitrage, and you would have to be ready and willing to pay the withdrawal, deposit, and network fees. When you want to buy bitcoin, why pay more than you need comic how bitcoin works bitcoin history extrapolated 20 years In this article we consider each step in great. There are three major sources of fees at the exchanges:. Significant price differences arise for the same cryptocurrency on multiple exchanges. One buys a cryptocurrency or digital asset from bitcoin price trend litecoin online wallet blockchain A at a low price, and attempts to sell it on exchange B for a higher value. In theory, we are winning because when the price returns to the previous levels, we have more BTC than before, so, theoretically, we are on a huge plus. In this case, there is a risk to sell cryptocurrency cheaper. A good news is that even in these times you can make money on cryptocurrencies: The first catch is that almost always you have to pay a fixed fee for each step. Found a mistake? The best practice is to run a bot that identifies the opportunity and if it is higher than a certain threshold that includes fees and taxesbuy and sell while you are sleeping.

If you sell immediately 1 BTC for However, it will crypto and ai hbscny investing in cryptocurrency much easier if you have funds available in both currencies. This approach is a gamble but can make you some money in the end. You should be aware of these conditions before going for arbitrage. Although some key exchanges will pop up a lot more often than others, it is safe to say the direct arbitrage approach will also help users spread their holdings across many different trading platforms. Send Cancel. Save my name, email, and website in this browser for the next time I comment. Prices can change and it is challenging to correctly predict the price at a given time. Of course you could buy 1 BTC for Sign in Get started. Depending on the exchange, the transactions are charged. The prices should suit your balance. By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated.

The prices should suit your balance. So that you are able to take advantage of the best prices on any given platform at any time. Lastly, you might come across Bitcoin scams. Additionally, we have over cryptocurrencies pairs. While taking part in Bitcoin arbitrage, note that if the variations in prices between exchanges are small, chances of losing money are high once the fees for your trade comes off. The step-by-step process is then as follows:. ArbiTool is a professional and advanced tool but can be used intuitively. All operations must be performed quickly, almost simultaneously. Of course, arbitrage also has a few drawbacks, but in comparison with holding or traditional trading, arbitrage definitely wins and is currently the best solution. The bigger the difference in price between the exchanges, the more profit you can make. It is best to know what your fees are going to be beforehand, so that you can factor that into your calculations. This will allow you to see an opportunity and immediately put a sell or buy order in to make a trade on Luno, forcing the taker of your trade to pay the trading fee, and allowing you to take more profit. Depending on the exchange, the transactions are charged with. Such platforms are not credible. In this case, there is a risk to sell cryptocurrency cheaper.

Look at the security levels on both exchanges. As long as you are below the R by the time you have sold your bitcoin, even if its piece by piece, you will still come out of it paying less fees. When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price. In some cases, the transfer period can take several days. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. See an overview of the fees per exchange here. While taking part in Bitcoin arbitrage, note that if the variations in prices between exchanges are small, chances of losing money are high once the fees for your trade comes off. See our post on bitcoin cost in South Africa to read about trading and withdrawal fees. Be the first to know! Global blockchain-based mobile virtual network operator MVNO Miracle Tele aiming to disrupt the telecom industry has confidently scaled several milestones of its development timeline Follow us on Telegram or subscribe to our weekly newsletter. Yes, the solution is arbitrage on the cryptocurrency exchanges. Before we dive into the practical matter of how to capitalize on arbitrage when it comes to Bitcoin, we need to get the lay of the land in terms of what kinds of potential crypto arbitrage exist. Then when we finally find a pair on which there is a satisfying price difference, we need to check:.