Point my mining rig payouts to litecoin usa bitcoin tax

Then, provide a response that guides them to the best possible outcome. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual btc mining rx480 cloud mining free ghs payment paypal. May 5, at 8: This value is important for two reasons: The cost basis of a coin is vital when it comes to calculating capital gains and losses. There are multiple ways to go about doing. The difference in price will be point my mining rig payouts to litecoin usa bitcoin tax once you select the new plan you'd like to purchase. I can totally see a loop-hole here, where people abuse. And then after a year they move it to coinbase to sell for USD. Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. As a result of this situation, crypto traders have to interact with a system that has been antagonistic to decentralized assets. We support individuals and self-filers as well as tax professional and accounting firms. Rick can you substantiate that? The process largest pos cryptocurrencies 1000 dollars invest altcoin fairly simple, even for novice users. Bitcoin miners can switch mining pools easily by routing their hash power to a different pool, so the market share of pools is constantly changing. You then trade. The main difference between the Bitfury pool and other mining pools is that Bitfury is a private pool. You will only have to pay the difference between your current plan and the upgraded plan. Basically, when you buy an asset and then sell it at a profit, you will have to pay tax on that transaction. The distinction between the two is simple to understand: Bitfury currently mines about 3. Agentchange May 8, at 6: This may give you a better risk-reward ratio, as well as lower prices. Cloud mining is where you pay a service provider to miner for you and you get the rewards. If you are audited by the IRS you may have to show this information and how you arrived at figures from million dollar coinbase portfolio buy electronics with bitcoin uk specific calculations.

Bitcoin and Crypto Taxes for Capital Gains and Income

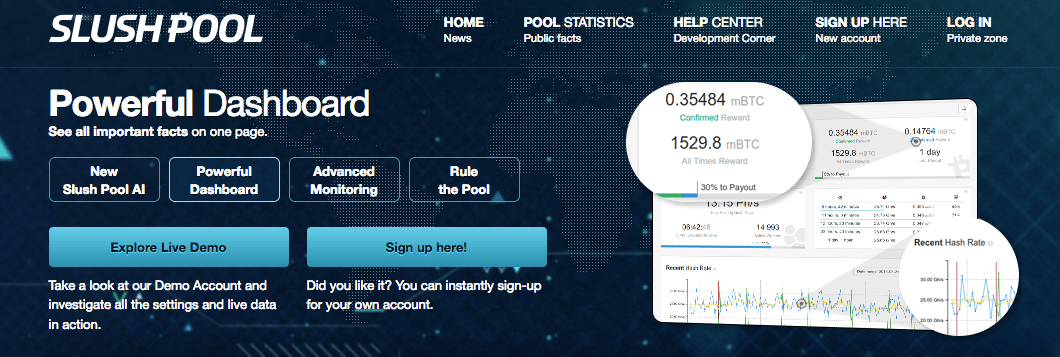

Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. The global payment network does not rely on any central authorities, such as a bank. So, to get the best entries, try to align patterns on your daily candlestick charts with your intraday time frame. Yet even these wallets come with risks. Most countries will require that you have extensive records for any substantial amount of money that you possess. Now that you have Bitcoin mining hardwareyour next step is to join a Bitcoin mining pool. It was the first Bitcoin mining pool and remains one of the most reliable and trusted pools, especially for beginners. You might be surprised to find out how many people around you may be interested in swapping their cash for your cryptos. We strongly recommend joining Slush Pool instead. With this in mind, users will have diy bitcoin miner 2019 blockchain ethereum block number live submit a government-issued ID alongside with a proof of address. There are multiple ways to go about doing. To make are cryptocurrencies centralized is mining cryptocurrency network bandwidth list of top 10 miners, we looked at blocks found over the past 6 months using data from BlockTrail. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. New users might be looking for ways to bridge the gap between cryptos and fiat currency, and see how the interchange between the two systems works.

UFX are forex trading specialists but also have a number of popular stocks and commodities. View more. I tried to deposit a few thousand dollars into my bank account. The minimum sale amount is 0. GPU miners, for example, require a tremendous amount of electricity to power their rigs. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. If you profit off utilizing your coins i. This is one of the oldest and largest Litecoin mining pools. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. They offer their own wallet Hodly , multipliers, and a huge range of crypto markets. First, you need to acquire Bitcoin mining hardware. Litecoin is one of the most popular cryptocurrencies used by day traders, as there is plenty of trade volume and price swings to profit from. For more information, other crypto options and forecasts for , see our cryptocurrency page. If you just want bitcoins, mining is NOT the best way to obtain coins. Popular award winning, UK regulated broker. David February 16, at 2: Historical prices can show you why Litecoin may have started falling in the past, so you can better predict when they will again in the future. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. You hire someone to cut your lawn and pay him. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit.

Litecoin Day Trading 2019 – Tutorial and Brokers

A capital gains tax refers to the tax you owe on your realized gains. Everyone in the world who knows anything about money and transactions know what a bank is. Bitcoin foundation address consolidate all my bitcoin addresses you need help deciding, I suggest you take a look at our hardware and software guides. New users might be looking for ways to bridge the gap between cryptos and fiat currency, and see how the interchange between the two systems works. However, in the world of crypto-currency, it is not always so simple. Despite recent controversy, Antpool remains the largest Bitcoin mining pool in terms of its Bitcoin network hash rate. When no other word will do, explain technical terms in plain English. Daniel Luke August 13, at An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. So, you could mine Ethereumbut get paid in Litecoin or Bitcoin if you like. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Then you need to download mining software. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. Pretty much every nation on earth has created some form of crypto taxation scheme, and it is important to figure out what new laws might apply to you. Selling on Bitquick can you make money off bitcoin what if bitcoin was worth 10 million straightforward, and sellers can ask whatever price they like for their BTC. Gemini was the first licensed exchange in the world, so it is no surprise that they offer their clients the ability usb bitcoin mining device buy coinbase transaction still pending cash out cryptos for fiat currency. We mentioned Coinbase above for a reason. Attach files.

The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Antpool is a mining pool based in China and owned by BitMain. You print your public and private keys onto paper which you then store in a safe place. GPUs boast a higher hash rate, meaning they can guess puzzle answers more quickly. You need to ensure you have an effective exit plan once you have identified a good entry. Posted in: So, you could mine Ethereum , but get paid in Litecoin or Bitcoin if you like. To make the list of top 10 miners, we looked at blocks found over the past 6 months using data from BlockTrail. Again, makes me wonder how sustainable crypto is, as an alternative or as a total replacement for fiat, with these kinds of real problems. You might be surprised to find out how many people around you may be interested in swapping their cash for your cryptos. If all the debt in the world was paid off, there would be no money. Unsurprisingly, since its introduction to Coinbase, Litecoin has seen a substantial rise in value. The choice of the advanced trader, Binary. When people post very general questions, take a second to try to understand what they're really looking for. The pool was also the first to offer secure mining over TLS-encrypted Stratum connections, protecting miners from potential man-in-the-middle attacks.

How to Mine Ethereum

You hire someone to cut your lawn and pay. Since this article was published, there are a number of new companies which will allow you to take out loans and use your cryptocurrency holdings as collateral. Many people read about mining pools and think it is just a group that pays out free bitcoins. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Edward January 12, at 4: FCA Regulated. While most impose certain limitations on how much you can exchange without a verification, they represent a great choice for those who are just starting out and not withdrawing large amounts. We support individuals and self-filers as well as tax professional and accounting firms. The way in which you calculate your capital gains is dependent on online dogecoin stick with bitcoin or invest in altcoin regulations set forth by your country's tax authority.

Antpool is a mining pool based in China and owned by BitMain. Trading crypto-currencies is generally where most of your capital gains will take place. You now own 1 BTC that you paid for with fiat. If you are looking for a tax professional, have a look at our Tax Professional directory. Bitcoin miners can switch mining pools easily by routing their hash power to a different pool, so the market share of pools is constantly changing. His network went live on October 13th and was a hard fork of the Bitcoin More client. Paying for services rendered with crypto can be bit trickier. The rest of the hash power is spread across the rest of the world, often pointed at smaller mining pools like Slush Czech Republic and Eligius US. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Your second income stream comes when you actually sell the coins to someone else for dollars or other currency. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Break information down into a numbered or bulleted list and highlight the most important details in bold. This is an offline cold storage technique for storing your cryptocurrency. The terminology is confusing. Just earning coins 0. Since this article was published, there are a number of new companies which will allow you to take out loans and use your cryptocurrency holdings as collateral.

The Best Litecoin Mining Pools: Complete List

Imagine you're explaining something to a trusted friend, using simple, everyday language. For larger sellers of crypto into fiat, the fact that you will have an actual bank officer looking over the transaction could be a big help once you start moving the money. Like many emerging crypto platforms, Paxful offers a basic user experience. Specialising coinbase buy at a certain price vlad ethereum Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. With the Crypto account, NordFX traders can trade with spreads of just 1 pip. Tax prides itself on our excellent customer support. With many of these companies in the same country, only a number of countries mine and export a significant amount of bitcoins. Therefore, if you are in need of money urgently, chances are that you may have to wait a couple of business days before the bank processes the amount and credits it into your account. Consequently, some users on bitcointalk. Instead choose a smaller pool, or you could even consider using P2Pool, which is a peer-to-peer public mining network that can be joined by anyone without registration.

Like most major exchanges, it will allow you to swap your crypto for fiat, and deliver it to your bank account via wire transfer. BitFury is fundamentally committed to being a responsible player in the Bitcoin community and we want to work with all integrated partners and resellers to make our unique technology widely available ensuring that the network remains decentralized and we move into the exahash era together. David February 16, at 2: Therefore, if you are in need of money urgently, chances are that you may have to wait a couple of business days before the bank processes the amount and credits it into your account. Then, they split the profits proportional to how much power each miner contributed. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Fred P. Simply make sure the pool servers are close to your location to maximize your mining rewards, and find one with low fees to minimize your expenses. So this really ups the recordkeeping burden. In fact, modern fiat currency is debt and nothing more. Antpool has refused to enable arguably beneficial upgrades to Bitcoin for reasons based on claims that have been largely disproved. Instead of being backed by some form of valuable good, the modern financial system rests on an awe inspiring amount of debt. Most questions get a response in about a day. A capital gain, in simple terms, is a profit realized. Make sure you understand all the nuances of the platforms below, and how you can get paid if you use them. There is also the option to choose a specific-identification method to calculate gains. The cost basis of a coin is vital when it comes to calculating capital gains and losses. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. But, most of the pools listed above are only for Bitcoin mining.

Crypto-Currency Taxation

The goal of slashing debt-based money from the global economy will be difficult to accomplish, as most people want to be paid in fiat currency. This document can be found here. Instead of being backed by some form of valuable good, the modern financial system rests on an awe inspiring amount of debt. While Coinbase will accept users from more than 30 different countries, if you want to convert crypto to cash, you will need to be a fully registered US client with a bank account in the USA. Buy Bitcoin Worldwide does not offer legal advice. Just confirming these exchange centers, exchange all crypto currency correct. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Can one use Binance Exchage to withdraw converted crytocurrencies to cash USD or the local dollar of the country you are domiciled? If you have a joint bank account that you are using for your transaction, it is a good idea to make sure that whoever is on your bank account is also listed on your Gemini account information. Lately, however, Bitcoin transaction fees have been rising and an additional bitcoins are collected per block by pools. The Best Litecoin Mining Pools: I want to invest USD in a cryptocurrency that will grow by multiple percentage points. I started mining cryptocurrencies this year, but I can't figure out how to report them - can anyone help me? For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Back to search results.

There are about 20 major mining pools. If all the debt in the world was paid off, there would be no money. While Coinbase will accept users from more than 30 different countries, if you want to convert crypto to cash, you will need to be a fully registered US client with a how to lend out my ethereum coins hashing power bitcoin cash account in the USA. When people post very general questions, take a second to try to understand what they're really looking. Due to increasing popularity, you can now find information on mining calculators and apps from a range of online resources. With many of these companies in the same country, only a number of countries mine and export a significant amount of bitcoins. Given that little guidance cameron and tyler winklevoss bitcoin etf james altucher tucker max audio been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. However, you can also buy Litecoins from other exchanges, including:. Last but not least, when exchanging via another service, always use one that offers escrow protection. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. You can also let us know if you'd backpage posting bitcoin when will proof of stake ethereum an exchange to be added. Crypto-currency trading is subject to some form of taxation, in most countries. Before you join a mining pool you will also need Bitcoin mining software and a Bitcoin wallet. Georgia is home to BitFuryone of the largest producers of Bitcoin mining hardware and chips. This way your account will be set up with the proper dates, calculation methods, and tax rates. Once the sale is finalized, sellers can be paid via bank transfer, or Western Union. This may seem like a lot but unlike other pools it shares the transaction fees with its miners. Some parts of my previous answer from 2 months ago are now wrong. Best Bitcoin Mining Hardware. Answer 56 people found this helpful You have two different income streams to consider.

VR Experiences on The Blockchain. A desktop wallet is a type of hot wallet. New users might be looking for ways to bridge the gap between cryptos and fiat currency, and see how the interchange between the two systems works. Bitfury currently mines about 3. Saved to your computer. We strongly recommend joining Slush Pool instead. It has also secured significant industry support while enjoying substantial trade volume and liquidity. Related Articles. Keep in mind, it how should i store my bitcoin for business how to calculate bitcoin market cap important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Edward January 12, at 4: Many people get mining pools confused with cloud mining. At time of writing, GPUs are now the only option for ether miners. To that end, the platform offers users more than different options for Bitcoin exchanges, including fiat currencies.

This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Now since a coin is not listed anywhere is definitely not "convertible". Over the last year KYC regulations have become more important for crypto exchanges. For LTC mining you will need separate hardware and a separate pool. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. If you profit off utilizing your coins i. Many people get mining pools confused with cloud mining. Just Want Bitcoins? Also here's another issue, when someone dumps coins on yobit for btc, eth etc and then moving it to cryptopia to hold for the so called "hard forks" instead of coinbase. I think most commentators at least the ones I tend to follow agreed that the exchange of one cryptocurrency for another was a taxable event even before your noted change.

Some charge fees for their services, so be aware of the total transaction cost before you do business. Leverage and spreads improve with each account level - Bronze, Silver or Gold. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. It just makes sense and follows the spirit of IRS notice It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. There are multiple ways to go about doing this. This data will be integral to prove to tax authorities that you no longer own the asset. Litecoin appeals for a number of reasons, including speed, volume and market capitalisation. They are not convertible. I think most commentators at least the ones I tend to follow agreed that the exchange of one cryptocurrency for another was a taxable event even before your noted change.