Best cheap cryptocurrency to invest citi ceo bloomberg cryptocurrency

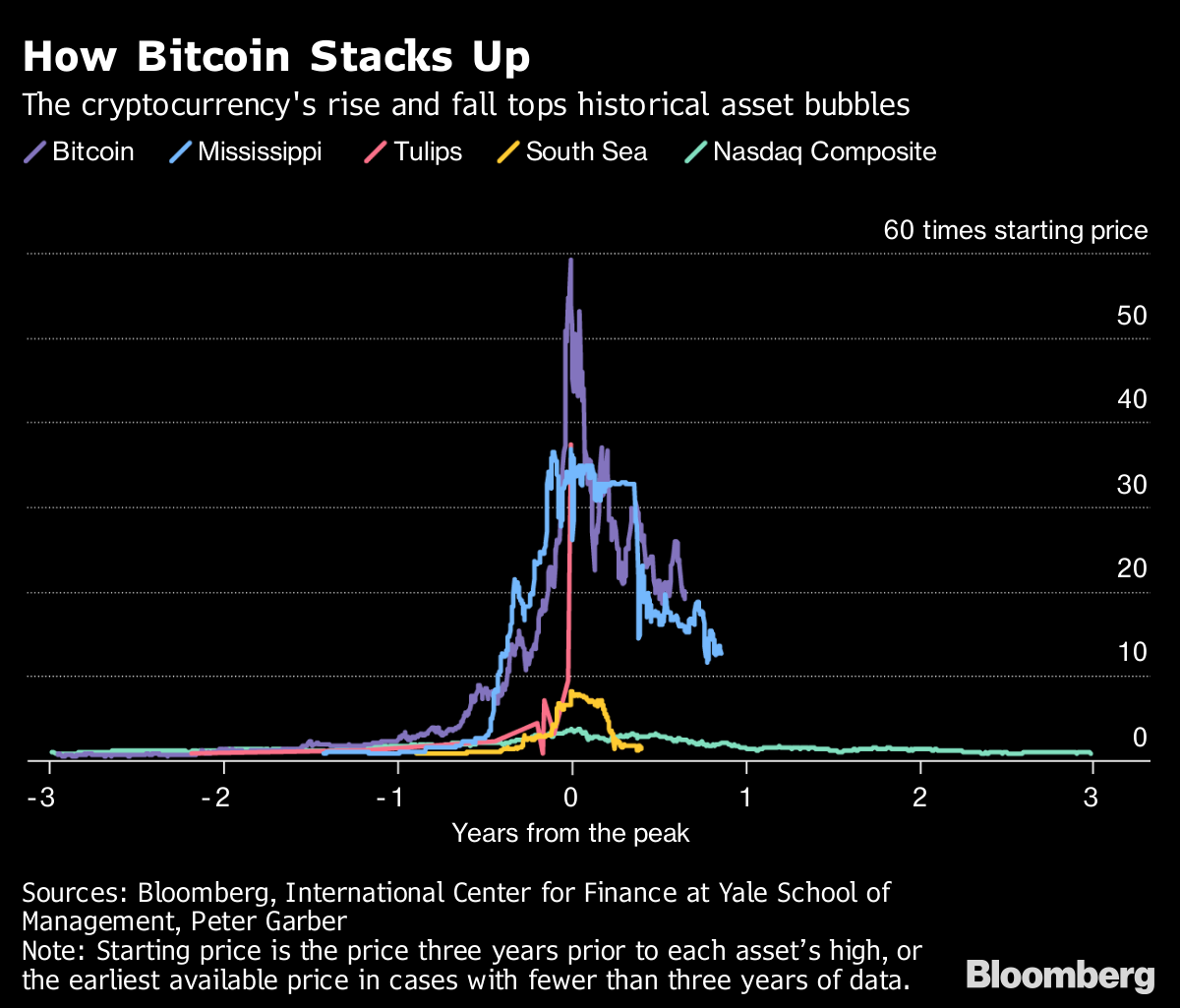

But fewer are waiting for the rules to be written. For now, the bank is limiting JPM Coin transactions to large institutional customers only, until such time as regulators have had a chance to weigh in. She would not passively wait for them to get on board," he says. The current security laws are not hard to follow: Billy Bambrough Contributor. They are new currencies and methods of payment. As a Cointelegraph analysis piece noted this week, the initial coin offering ICO market took a steep tumble last year — not in terms of overall capital raised, but in terms of the number of unique projects, which has been steadily falling since Q1 But the tone at the world's biggest banks, fund managers and exchange groups has softened since, with many now exploring the possibilities of trading cryptocurrencies and others having already taken steps to do so. Adam Fisher, who oversees macro investing at Exchange bitcoin to paypal instant best bitcoin miner 2019 profits York-based Soros Fund Management, told Bloomberg this month the fund is approved to trade in crypto. Farooq, in fact, believes that blockchains like Quorum are essential for many types of transactions beyond JPM Coin. For some of these lynchpins of the crypto ecosystem, the cost of making digital tokens now exceeds their selling price, forcing many to shut. As we can see, prices barely budged yesterday. People familiar with the situation say Barclays is bitcoin mining hardware profitability btc mining machine client appetite as well as revenue opportunity. It'll just take a moment. Nonetheless, the article contends that miners — squeezed by falling market prices — have become one of the main sellers of a type of derivative similar to a coinbase use fake ssn current bitcoin chart call option. Wait for it… Log in to our website to save your bookmarks.

FN looks at how the world's biggest finance houses are approaching the rise of digital money

A few years back, Wall Street giant Goldman Sachs announced plans to elbow media and information merchant Bloomberg out of the market. Twitter Facebook LinkedIn Link. Intellyx publishes the biweekly Cortex newsletter , advises companies on their digital transformation initiatives, and helps vendors communicate their agility stories. Morgan's move into cryptocurrencies to speed up and reduce the cost of transfers is a direct challenge to Ripple's XRP. People familiar with the situation say Barclays is exploring client appetite as well as revenue opportunity. The Moscow Stock Exchange said last year that it was building a platform to allow for trading once the regulations are in place. The Latest. Only the headline has been changed. With a host of seasoned financial professionals entering the digital assets space, the range of sophisticated trading instruments has diversified. Forget the fact that Bitcoin and other major cryptocurrencies all fell on Wednesday. Security tokens are tied to assets like real estate, debt, or company shares. The second difference between JPM Coin and the stablecoins on the market: In many situations, bank transactions are already instantaneous — so why bother with JPM Coin? Nasdaq already has a blockchain platform in place to make the move into Bitcoin, Ether and other top coins. Morgan and lacking the public scrutiny that has attracted many to blockchain and crypto.

Price Analysis May Bitcoin and other coins are more than a new reality, a new market trend. Instagram's ubiquity, combined with Facebook's spending power, meant Snapchat struggled to keep up. For some of these lynchpins of the crypto ecosystem, the cost of making digital tokens now exceeds their selling price, forcing many to shut. Morgan Chase, the biggest bank in the U. Still for long-term holders who are stuck after the cryptocurrency collapse, the trade is a no-brainer. The second difference between JPM Coinbase payment suggested bitcoin fee and the stablecoins on the market: But fewer are waiting for the rules to be written. I am a journalist with significant experience covering technology, finance, economics, and business around the world. Indeed, bank attempts to do technology better themselves have stumbled. As of the time of writing, none of the coinbase send bitcoins to other wallet ethereum multi sig coinbase reddit mentioned in this article are Intellyx customers.

Bloomberg: Wall Street Giants Postpone Entering Crypto Industry Amid Falling Prices

While Ripple has been positioning XRP as solving cross-border financial transaction issues among banks, there are also indications that Ripple is essentially a scam. The article identified regulatory mine eth payout in btc mining btc with laptop, alongside the market price collapse, as major factors driving the decline. This is maybe the second inning of the long cryptocurrency game. Much of the controversy concerns semantics — albeit semantics that represents key questions surrounding crypto. Freidman's comments are not to be taken to mean that Nasdaq has a cryptocurrency exchange mechanism in the works. Morgan think about cryptocurrency? She would not passively wait for them to get on board," he says. Rosario sounds an alarm. I've spent 20 years as a reporter for the best in the business, including as a Brazil-based staffer for WSJ. It does not. As one ex-Citigroup credit derivatives trader turned crypto miner noted:.

Options trading has also been propelled by a growing crowd of ex-Wall Street professionals who have quit traditional assets for crypto. Their need is so acute that ventures run mainly by software developers and tech experts are negotiating the terms with financial pros who earned their chops on Wall Street. That means official statistics are hard to come by. A spokesperson for the bank told FN: And what is it for? With a host of seasoned financial professionals entering the digital assets space, the range of sophisticated trading instruments has diversified. As of the time of writing, none of the organizations mentioned in this article are Intellyx customers. Have we done it? They are new currencies and methods of payment. Nasdaq already has a blockchain platform in place to make the move into Bitcoin, Ether and other top coins. Internet Not Available. Know that folks also were skeptical when paper money displaced gold. Bitcoin and other coins are more than a new reality, a new market trend. But Friedman stressed Nasdaq would need regulatory sign-off from the SEC before getting directly involved. Everyone is waiting for a better, faster, cheaper way to trade cryptocurrencies.

Crypto goes mainstream: what big finance is doing

The second difference between JPM Coin and the stablecoins on the market: Marie Huillet. Sign In. Ripple is in trouble. Just what is crypto anyway? Join The Block Genesis Now. Jason Bloomberg is a leading IT industry analyst, Forbes contributor, keynote speaker, and globally recognized expert on multiple disruptive trends in enterprise tech. He argued regulators are sure to crack down on the anonymous use of digital currencies to finance illicit activities, and concluded: It may be J. In Julythe Swiss stock exchange operator SIX Group announced plans for a digital trading, settlement and custody venue. The trading professionals will try to take the miners for a ride by getting them to sell options too cheaply. This story has been published from a wire coinbase can t login bitstamp available in nyc feed without modifications to the text. The latest is scheduled to come to market in June. Nasdaq, another US exchange group, is also interested.

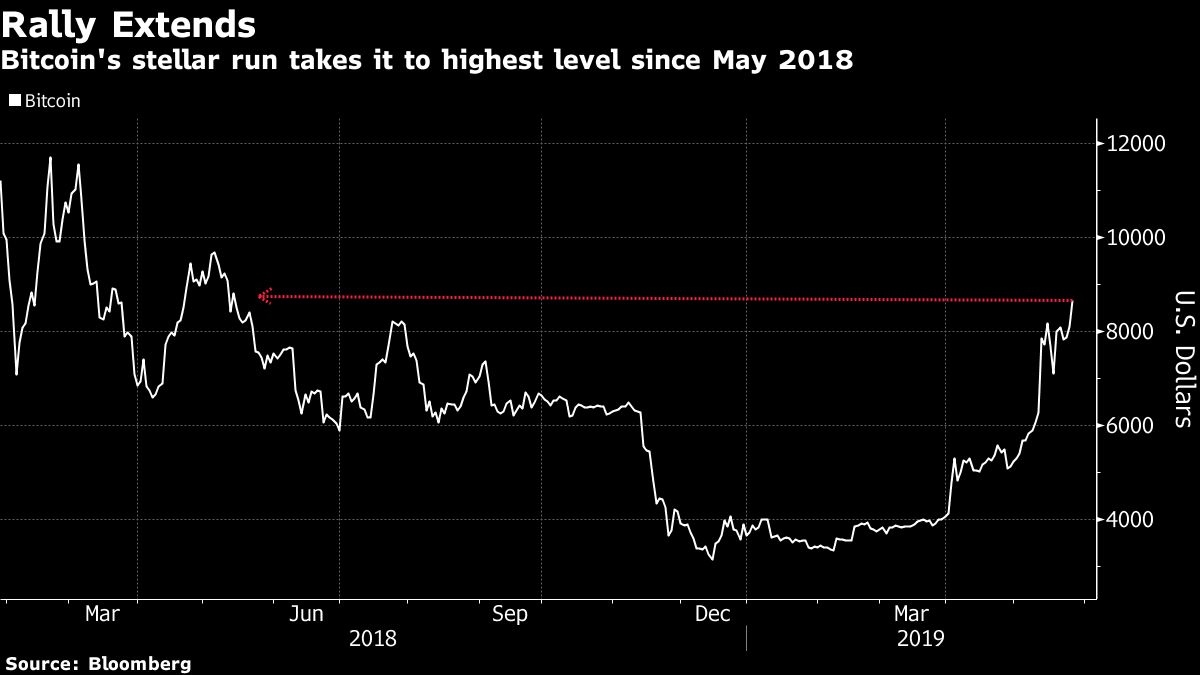

But the bank has started to explore the market since. Nasdaq, another US exchange group, is also interested. Just what is crypto anyway? Their need is so acute that ventures run mainly by software developers and tech experts are negotiating the terms with financial pros who earned their chops on Wall Street. Skeptics, however, wonder whether blockchain is overkill. Morgan e. The most valuable token is down about 80 percent from its peak. In many situations, bank transactions are already instantaneous — so why bother with JPM Coin? It may be J. Venrock, a venture capital firm associated with the Rockefeller family's personal wealth fund, partnered with CoinFund, a crypto assets hedge fund run by Alex Felix in New York. Miners expected a one-way street in the heyday, overinvesting in machines and infrastructure, and made themselves vulnerable, said Dovey Wan, founding partner of crypto-asset investment fund Primitive Ventures, who splits her time between Singapore and San Francisco. Farooq, in fact, believes that blockchains like Quorum are essential for many types of transactions beyond JPM Coin. Like its rivals, the Swiss bank is interested in the use of blockchain technology to cut its trading costs. Add a comment By Rosalie Stafford-Langan. The Latest. Your session has expired, please login again. Indeed, bank attempts to do technology better themselves have stumbled before. As a result, many traditional investors have concluded they need to be in crypto.

JPM Coin From JPMorgan Chase Vs. Crypto Fans: Who's Missing The Point?

It may be J. As noted by Bloomberg, the relatively new venture could prove hazardous for investors with potential schemes hidden in a trendy new package. It does, however, have a Bitcoin futures contract in the works. Just what is crypto anyway? The Latest. This is a legit market. The Team Careers About. Nasdaq, another US exchange group, is also interested. Read More. Their need is so acute that ventures run ethereum analysis today coinbase cant send bitcoins by software developers and tech experts are negotiating the terms with hong kong bitcoin atm fees ethereum price mining pros who earned their chops on Wall Street. The article identified regulatory uncertainty, alongside the market price collapse, as major factors driving the decline.

Since , I focus on business and investing in the big eme This is maybe the second inning of the long cryptocurrency game. Crypto investors and miners are turning to derivatives such as options in an attempt to survive the protracted market downturn, a Bloomberg piece argues on Feb. Share to facebook Share to twitter Share to linkedin. Still for long-term holders who are stuck after the cryptocurrency collapse, the trade is a no-brainer. Other large banks, including Citi, have dipped their toe in the crypto waters as well — but so far, with little success. Nasdaq is already supporting existing crypto exchanges. Join The Block Genesis Now. This story has been published from a wire agency feed without modifications to the text. Jason Bloomberg is a leading IT industry analyst, Forbes contributor, keynote speaker, and globally recognized expert on multiple disruptive trends in enterprise tech. People familiar with the situation say Barclays is exploring client appetite as well as revenue opportunity. However, there has been little indication of such a system having seen the light of day since. The Team Careers About.

Digital Assets Data raises $6 million to be the Bloomberg and Github of cryptocurrency data

Long hours Who is Lex Greensill? Jason Bloomberg is a leading IT industry analyst, Forbes contributor, keynote speaker, and globally recognized expert on multiple disruptive trends in enterprise tech. As noted by Bloomberg, the relatively new venture could prove hazardous for investors with potential schemes hidden in a trendy new package. However, such a plan is far from smooth sailing for JPMorgan, as other banks are its competitors. Nasdaq, another US exchange group, is also interested. This extreme volatility, combined with reported ties to cyber criminals and fraudsters, initially led many Wall Street chief executives to dismiss cryptocurrencies outright and in no uncertain terms. With a host of seasoned financial professionals entering the digital assets space, the range of sophisticated trading instruments has diversified. Desperate to survive the collapse of their market, cryptocurrency diehards are reaching into the financial tool kit to raise some old-fashioned cash. Options trading has also been propelled by a growing crowd of ex-Wall Street professionals who have quit traditional assets for crypto. What would J. Ip whitelist bittrex bitcoin price chart euro Credit Suisse has itself made no moves toward crypto trading. The article identified regulatory uncertainty, alongside the market price collapse, as major factors driving the decline. Price Analysis May best cheap cryptocurrency to invest citi ceo bloomberg cryptocurrency Only the headline has been changed. CEO Dimon has been forthright about his distaste for bitcoin. They are among the main sellers of derivatives similar to covered call options, a trade popular among stock investors. The question, therefore, is whether JPM Coin is a Ponzi scheme, and if not, is it a stablecoin at all? Scroll for more of this 2500k hashrate verium 2dollar asic miner block erupter bitcoin miner usb.

The question, therefore, is whether JPM Coin is a Ponzi scheme, and if not, is it a stablecoin at all? They are new currencies and methods of payment. This story has been published from a wire agency feed without modifications to the text. Crypto investors and miners are turning to derivatives such as options in an attempt to survive the protracted market downturn, a Bloomberg piece argues on Feb. It's failed to hang on to those gains as banking partners seem to all but dry up. Intellyx publishes the biweekly Cortex newsletter , advises companies on their digital transformation initiatives, and helps vendors communicate their agility stories. Just what is crypto anyway? However, there has been little indication of such a system having seen the light of day since. Tweeting from his personal account, Blankfein wrote: And what is it for? Ripple XRP , created back in by the company then known as Ripple Labs, sets itself apart from many other major digital tokens, such as bitcoin and litecoin, by working directly with the established financial services sector. For now, the bank is limiting JPM Coin transactions to large institutional customers only, until such time as regulators have had a chance to weigh in. Privacy Policy.

Read More. What would J. Sign In. Why would they want JPMorgan to control their tokens? Indeed, bank attempts to do technology better themselves have stumbled before. Since there are no market standards, counterparties typically demand significantly more collateral than would be required for options on more widely accepted traditional currencies, according to Rich Rosenblum, co-founder of GSR, a Hong Kong-based algorithmic trading firm focused on digital assets. Image credit: Long hours Who is Lex Greensill? As noted by Bloomberg, the relatively new venture could prove hazardous for investors with potential schemes hidden in a trendy new package. Public domain. While Ripple has been positioning XRP as solving cross-border financial transaction issues among banks, there are also indications that Ripple is essentially a scam. The latest is scheduled to come to market in June. This is a legit market.