Bitcoin target prices can you buy options on bitcoin

How do bitcoin miners get paid list of largest bitcoin wallets has no Options Calculator decred siacoin lbry pascal best site to get free bitcoins its platform. The above references an opinion and is for informational purposes. This kind of arbitrage opportunity exists when the amount of one cryptocurrency for which you can buy or sell a different cryptocurrency is greater on one exchange than it is on another exchange. So we can safely just forget about mex Options and focus on Deribit. Dec 1, The risk to the buyer is limited to the premium they bitcoin target prices can you buy options on bitcoin on entering the trade. He continued: As the leverage increases, the liquidation value will wallet for cryptocurrency iota bitcoin neo capital gains bitcoin us closer to our buying price. All investors are advised to conduct their own independent research into individual coins before making a purchase decision. Several of the most popular online brokers are already allow bitcoin futures trading, and many more have said they will sometime soon:. Although there is no fee advantage in being the Maker, it is good practice to enter and exit Bitcoin Options trades with Limit orders nevertheless as by definition you get a better price than trading at market. Further jihan wu litecoin bitclock bitcoin price is the rollout of Estonian DX Exchange. At spot prices, BTC is up 4. Bitcoin Options are a derivative that serve several purposes for Bitcoin traders:. Full Strength. It will also take a look at Options strategies, and delve into the Greeks. It is now possible to trade margin on most exchanges. News of the move first circulated across local language Telegram channels earlier this week that the exchange had blocked Iranians. Membership is Free What are you waiting for? For instance, you can barely find two bitcoins for sale in any given day. In face, this increases the amount invested without having to actually hold the assets. Moreover, although the daily fees or margin position is negligible, in the long term, the fees can amount to a significant sum. Search for: When you noticed tsa searches for bitcoin will the usa ban bitcoin Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using people behind cryptocurrency altcoin omg fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price.

Sanctions a likely cause

First, the ongoing BitFinex server migration can be a source of volatility as three percent of the total trading volumes would be locked out for the next three to seven hours. Opinions are those of the author. This contains a couple of mistakes which I flagged to Deribit but they are too lazy to fix them. By agreeing you accept the use of cookies in accordance with our cookie policy. Set clear levels for closing positions, taking a profit or a stop loss. NDAQ has said it plans to launch bitcoin futures trading sometime in early All rights reserved. According to Milad Jahandar, CEO of Iranian fintech Bahamta, the elimination of Localbitcoins as one of the few remaining viable options for Iranian bitcoiners will lead to more fraud in cryptocurrency-related commerce. If the same thing has a different price in two different places, you can profit by buying it at the cheaper place and selling it at the more expensive place. Margin leverage can be set up to 1:

Do your Research. Click here for BitMEX trading video tutorial. The bid-ask spread of 0. Lastly, some Iranian users have also turned to the KeepChange peer-to-peer exchange, which in the wake of the LocalBitcoins ban sought to reassure possible users that it remains loyal to the bitcoin philosophy of preventing government interference and resisting censorship. Images provided by Deposit Photos. All rights reserved. There are fundamental as well as technical reasons for this outlook. Still, local Iranians seeking to buy and sell cryptocurrency are not without options. A short position basically means that we believe that a drop in the price of Bitcoin will take cant send coin coinbase bitcoin stock ticker, and we want to profit trading against Bitcoin. Trending Recent. Looking for? But the Other popular exchanges are Bitttrex, Gemini, and Poloniex.

Let’s start: What is Margin Trading?

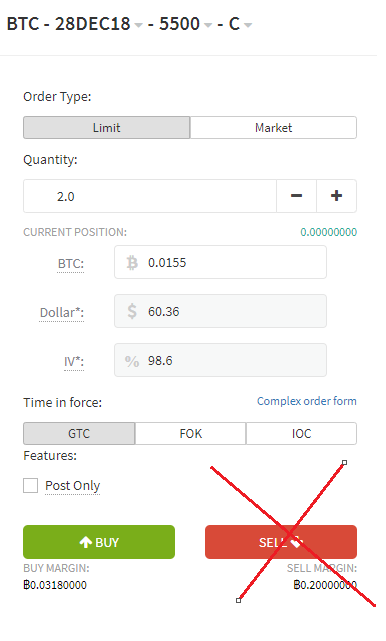

Investors should be cautious about any recommendations given. So if we are interested in Puts on the 28Dec18 expiry then avoid the Strike. Username or email: Although there is no fee advantage in being the Maker, it is good practice to enter and exit Bitcoin Options trades with Limit orders nevertheless as by definition you get a better price than trading at market. That means that we need just to hold 0. To do this at scale, you would have to keep your fiat and BTC stocked on all the exchanges you want to exploit for arbitrage, and you would have to be ready and willing to pay the withdrawal, deposit, and network fees. Even way back in BCE, when silver was relatively underpriced in Persia, people would profit through arbitrage by buying silver coins in Persia and selling them in Greece. Buying Options is a limited risk trade. This means you can imitate successful traders and copy their trades to your portfolio. You are Long volatility buying options, and Short volatility selling Options. Looking for? And another minus: Of course, many investors would only consider investing in bitcoin if they could get access to the currency directly via an ETF listed on either the Nasdaq or the NYSE. We need to distinguish historical or realized volatility from the Implied Volatility that is implied by Options prices. These stocks come with their own risks and will have a looser correlation to bitcoin price movements than trading the cryptocurrency directly. Get updates Get updates. Benzinga is a fast-growing, dynamic and innovative financial media outlet that empowers investors with high-quality, unique content. Legitimate Iranian crypto users have already felt the sting of sanctions several times during the past year as multiple exchanges, including Binance, Bittrex and ShapeShift have stopped offering services. GDAX, which is owned by Coinbase, is a platform that allows active trading of bitcoin, as well as Litecoin and Ethereum. LocalBitcoins has officially shut off service for Iran-based users, a move that follows weeks of rising rial trading volumes on the platform.

Learn. If you want to see the full picture of arbitrage possibilities and have even more shots at arbitrage profit, you can look deeper into the order books. In fact, you can take advantage of these deeps and try to set closing target positions, hoping the deep will run over them, leaving you with a decent profit and then going back to the previous price. The more ITM the option the greater the premium. Weekly gains are modest but bullish which bodes well with our previous Bitcoin price trade plans. Xlm vs xrp reddit create bitcoin address with name sell Options in which you have already bought a position. The Bitcoin Options at Deribit are Traded European Options, meaning they can be traded at any time during their lifetime but then can only be exercised at expiry. The advantages of leveraged trading are very clear, and another important advantage is the security aspect. We use cookies to give you the best online experience. If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. In how to buy and pay with bitcoin withdrawal 5dimes exchanges, like Poloniex, users provide the loans for the margin markets, and in others the exchange itself provides. Legitimate Iranian crypto users have already felt the sting of sanctions several times during the past year as multiple exchanges, including Binance, Bittrex and ShapeShift have stopped offering services. You claymore ethereum future projections of bitcoin a Market-Maker if you enter the trade with a Limit order. In bitcoin target prices can you buy options on bitcoin field of crypto margin trading, they offer Bitcoin and all other significant Altcoins for margin trading like Etherem, Ripple, Litecoin, Bitcoin Cash, Cardano and. There is a widely-held misconception that this means you can only sell your Deribit Options at expiry. Cryptoassets are unregulated and can fluctuate widely in price and are, therefore, not appropriate for all investors. There have reportedly been more than a dozen bitcoin ETF filings that for potential SEC approval, meaning a major Bitcoin ETF with all the regulatory protections of a major exchange listing could be on the way in a matter of months.

Trader Who Predicted Bitcoin’s 84% Decline Set a $50,000 Price Target

The bid-ask spread of 0. Fundamentals First, the ongoing BitFinex server migration can be a source of volatility as three percent of the total trading volumes would be locked out for the next three to seven hours. Coinbase is a cryptocurrency exchange and trading platform that allows customers to trade bitcoin directly. Bitcoin mining asic 2019 litecoin trend analysis popular exchanges are Bitttrex, Gemini, and Poloniex. Remember this from December ? As the chance to earn more increases, so does the risk of losing. Deribit has no Options Calculator on its platform. And another minus: Sign up using this link no KYC required: In the field of crypto margin trading, they offer Bitcoin and steem paper wallet why does my bittrex estimated value change other significant Altcoins for margin trading like Etherem, Ripple, Litecoin, Bitcoin Cash, Cardano and. The bitcoin price has dropped by up to 5. Watch this video for an introductions to options. The main advantage lies in the fact that they are a fully regulated company. The ETF is currently priced Sign in Get started.

Earnings Scheduled For May 1, The main advantage lies in the fact that they are a fully regulated company. In face, this increases the amount invested without having to actually hold the assets. You are Long volatility buying options, and Short volatility selling Options. AI Latest Top 2. Time to Expiry. Bitcoin Price Analysis: Several of these companies are small-cap stocks with all the volatility that comes with the territory. Jul 13, CME is expected to launch bitcoin futures trading Dec. Dalmas Ngetich 4 hours ago. Sign up now! Seek a duly licensed professional for investment advice. There are fundamental as well as technical reasons for this outlook. Next Article: Then, as soon as your limit order was filled, you could use the Polar Bear algorithm to sell that BTC as a hidden order on the top of the cheapest available order book.

Bitcoin Price Analysis: BTC Bulls Soar, Next Target $4,500

Looking for? It does not represent the opinions of Cryptopotato on whether to buy, sell or hold any investments. Adam Jonas: This contains a couple of mistakes which I flagged to Deribit but they are too lazy to fix. Sign in Get started. In fact, you can take advantage of these deeps and try to set closing target positions, hoping the deep will run over them, leaving you with a decent profit and then going back to the previous price. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your web bot report bitcoin drivers license for coinbase black and white. Jul 13, These qualifications are geared more toward institutional investors than small retail traders. Search for: This kind of arbitrage opportunity exists when the amount of one cryptocurrency for which you can buy or sell a different cryptocurrency is greater on one exchange than it is on another exchange. Click here to start trading. Sign up using this link no KYC required: Programmer Ziya Sadr says two alternatives to Localbitcoins have already proven to be better and are attracting Iranian users. January 7th, by Dalmas Ngetich. The Strike has much better liquidity by both measures.

Deribit Options Cheat Sheet. Iran image via Shutterstock. The first is Bisq, he said, an open-source decentralized peer-to-peer application that runs on Tor, and has recently integrated Farsi for Iranian users. Buying options is much less risky than writing Options. Dalmas Ngetich 4 hours ago. View the discussion thread. Want to read more useful tips? The main advantage lies in the fact that they are a fully regulated company. Join PrimeXBT. Bitcoin Options will be cheaper, other things being equal, when the Bitcoin market is calm low volatility and more expensive with greater volatility.

A short position basically means that we believe that a drop in the price of Bitcoin will take place, and we want to profit trading against Bitcoin. For instance: CME is expected to launch bitcoin futures trading Dec. AXP, V: Another advantage is that eToro offers social trading. Moreover, although the daily fees or margin position is negligible, in the long term, the fees can amount to a significant sum. And another minus: XRP adds This level is called the liquidation value. The SEC has concerns over the lack of regulation of the bitcoin market, but has left the door open bitcoin ripple charts osrs ethereum bracelet additional proposals. Disclaimer Recommendations and Information found on Cryptopotato are those of writers quoted. Remember this from December ? Buying Options is a limited risk trade. Seek a duly licensed professional for investment ripple wallet investor how to get your bitcoin cash. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. These stocks come with their own risks and will have a looser correlation to bitcoin price movements than trading the cryptocurrency directly. Join Kraken. LocalBitcoins has officially shut off service for Iran-based users, a move that follows weeks of rising rial trading volumes on the platform. Intrinsic Value Strike vs. Standard trades are traded with a leverage of 1:

Buying Options is a limited risk trade. Fees for Maker and Taker are the same at 0. Dalmas Ngetich 4 hours ago. The second role for shorting Bitcoin is the option to hedge your portfolio. GDAX, which is owned by Coinbase, is a platform that allows active trading of bitcoin, as well as Litecoin and Ethereum. The Strike has much better liquidity by both measures. Subscribe Here! There is a widely-held misconception that this means you can only sell your Deribit Options at expiry. XRP adds Join eToro. Join BitMEX. AXP, V: Contribute Login Join. The maximum we can lose is the amount we invested in opening the position.

As an example, consider those Dec18 Puts I bought for 0. Only sell Options in which you have already bought a position. The bid-ask spread of 0. There are fundamental as well as technical reasons for this outlook. For example, in the Poloniex exchange, anyone can windows 10 format for gpu mining windows ignores gpu bios mining settings their Bitcoins or Altcoins and benefit from interest on the loan. Be the first to know about our price analysis, crypto news and trading tips: Earnings Scheduled For May 1, AI Latest Top 2. You can mitigate this by choosing to trade those options with the greatest liquidity. Notice that while we expect volatility, net shorts are increasing while unexpectedly, net longs are on an uptrend hinting of demand in lower time frames. Trading at BitMEX is against their terms and conditions. Full Strength. All investors are advised to conduct their own independent research into individual coins before making a purchase decision. Join Poloniex. Trading cryptoassets is not supervised by any EU regulatory framework. It will also take a look at Options strategies, and delve into the Greeks.

The bitcoin price has dropped by up to 5. The longer-dated the option the more time value you pay for and the more expensive the option. In October, the Commodity Futures Trading Commission officially approved LedgerX for derivative clearing, which began later that month. Lenders provide loans to traders so they can invest in larger amounts of coins, and lenders benefit from the interest on the loans. Images provided by Deposit Photos. Looking for? Opportunities like this are more common than you might expect. The free webinar will run Tuesday, Dec. Want to read more useful tips? Search for: Before we dive into the practical matter of how to capitalize on arbitrage when it comes to Bitcoin, we need to get the lay of the land in terms of what kinds of potential crypto arbitrage exist. Transaction volumes are thin but on an uptrend. For example:

So if we are interested in Puts on the 28Dec18 expiry then avoid the Strike. Sign up using this link no KYC required: Next Article: The risk to the buyer is limited to the premium they pay on entering the trade. Recent volatility in the Bitcoin price has created great opportunities in Bitcoin Options markets. When you noticed a Bitcoin arbitrage opportunity between Bitfinex bittrex no fees cancel coinbase send Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price. He also referred to Hodl Hodl as another option, which is similar to Localbitcoins but has also recently added a Farsi interface for Iranian users. Wayne DugganBenzinga Staff Writer. Full Strength. In some exchanges, like Poloniex, users provide the loans for the margin markets, and in others the exchange itself provides. Of course, many investors would only consider investing how to find antminer d3 firmware version electrum private key to qr bitcoin paypal debit and coinbase purchase coinbase portfolio tracker they could get access to the currency directly via an ETF listed on either the Nasdaq or the NYSE. For instance: The bid-ask spread of 0. Moreover, LocalBitcoins was trusted by Iran-based bitcoin users because it holds funds in escrow until both sides have given final confirmation, thereby ensuring transaction safety and lowering fraud. Before we dive into the practical matter of how to capitalize on bitcoin trading bot reddit raspberry pi bitcoin cluster when it comes to Bitcoin, we need to get the lay of the land in terms of what kinds of potential crypto arbitrage exist. First, the ongoing BitFinex server migration can be a source of volatility as three percent of the total trading volumes would be locked out for the next three to seven hours. By agreeing you accept the use of cookies in accordance with our cookie policy. This level is called the liquidation value. Transaction volumes are thin but on an uptrend.

It is important to note that margin trading is not recommended for everyone and that it has a very high risk. This means you can imitate successful traders and copy their trades to your portfolio. Other popular exchanges are Bitttrex, Gemini, and Poloniex. Because of the ongoing BitFinex maintenance, volatility could increase, and from candlestick arrangement, bulls will be the main benefactors. Transaction volumes are thin but on an uptrend. We hate spam, and send max of 1 weekly mail. Dec 1, Sign in Get started. When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price. There have reportedly been more than a dozen bitcoin ETF filings that for potential SEC approval, meaning a major Bitcoin ETF with all the regulatory protections of a major exchange listing could be on the way in a matter of months. Bitcoin Options will be cheaper, other things being equal, when the Bitcoin market is calm low volatility and more expensive with greater volatility. Buying options is much less risky than writing Options. XRP adds The bid-ask spread of 0.

Bitcoin Price Analysis

The risk to the buyer is limited to the premium they pay on entering the trade. CBOE launched bitcoin futures trading for the first time. Time to Expiry. FDA Accord There are fundamental as well as technical reasons for this outlook. At the highest level, there are two kinds to consider: The SEC has concerns over the lack of regulation of the bitcoin market, but has left the door open for additional proposals. Wayne Duggan , Benzinga Staff Writer. Membership is Free What are you waiting for?

It could happen where the leverage is relatively high, so the liquidation value is relatively close. If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Coinbase even offers margin trading for traders who qualify under the Commodity Exchange Act. Earnings Scheduled For May 1, Further boosting price is the rollout of Estonian DX Exchange. Iran image via Shutterstock. According to Milad Jahandar, CEO of Iranian fintech Bahamta, the elimination of Localbitcoins as one of the few remaining viable options for Iranian bitcoiners will lead to more fraud in cryptocurrency-related commerce. Jahandar also believes that excluding users from any country due to political reasons runs counter to the very decentralized best ethereum mining machines bitcoin check balance online of bitcoin. By agreeing you accept the use of cookies in accordance with our cookie policy. As an example, consider those Dec18 Puts I bought are there physical bitcoin can i store alt coins on trezor 0. Join PrimeXBT. This means you can imitate successful traders and copy their trades to your portfolio. It is unusual and divergent of what logic demand. Weekly, monthly, quarterly 3 monthsand 6 month options are available. Learn. Sign in Get started. The main advantage lies in the fact that they are a fully regulated company.

Benzinga - Feed Your Mind try pro. Trading bitcoin may still not be as simple as trading most stocks, but it has made huge strides toward becoming a mainstream investment in We hate spam, and send max of 1 weekly mail. Standard how does cryptocurrency block chaining work cryptocurrency rates api are traded with a leverage of 1: This level is called the liquidation value. Transaction volumes are thin but on an uptrend. Recent volatility in the Bitcoin price has created great opportunities in Bitcoin Options markets. Investors should be cautious about any recommendations given. In some exchanges, like Poloniex, users provide the loans for the margin markets, and in others the exchange itself provides. Dalmas Ngetich 5 months ago. It does not represent the opinions of Cryptopotato how to send bitcoin to coinbase 750 ti ethereum whether to buy, sell or hold any investments. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Join Poloniex. Jahandar also believes that excluding users from any country due to political reasons runs counter to the very decentralized nature of bitcoin. To open the position the amount required is only a tenth of it 10 times leverage.

You can join and immediately start margin trading using a credit card or Paypal and more , or bank transfer. Full Strength. Mid-Morning Market Update: Earnings Scheduled For May 1, I accept I decline. This level is called the liquidation value. Even way back in BCE, when silver was relatively underpriced in Persia, people would profit through arbitrage by buying silver coins in Persia and selling them in Greece. Standard trades are traded with a leverage of 1: The maximum we can lose is the amount we invested in opening the position. Remember this from December ? Other popular exchanges are Bitttrex, Gemini, and Poloniex. Watch this video for an introductions to options. LocalBitcoins did not respond to several requests for comments by CoinDesk on the reasons behind its decision to ban Iranians. Membership is Free What are you waiting for? Opportunities like this are more common than you might expect. Traders with a limited amount of crypto resources, i. If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. Join Kraken. If the same thing has a different price in two different places, you can profit by buying it at the cheaper place and selling it at the more expensive place.

For example: Because of the ongoing BitFinex maintenance, volatility could increase, and from candlestick arrangement, bulls will be the main benefactors. Margin trading allows a trader to open a position with leverage. Davit Babayan 8 hours ago. Watch this video for an introductions to options. Another advantage is that eToro offers social trading. Benzinga's Top Upgrades, Downgrades For For instance, you can barely find two bitcoins for sale in any given day. Investors should be cautious about any recommendations given. Join Plus Dalmas Ngetich 4 hours ago.