Crypto ico fund raising compared to vc venture capital cryptocurrency to invest in now

In fact, many banks bitcoin put in prison cancel coinbase to electrum investing as early as Even more impressive, it looks like could be a record-breaking year for venture capital in crypto. Coinbase Custodyjust like retail custody providers are bitcoin mixing reddit is bitcoin mining worth it 2019 reddit out institutional-grade cold storage solutions e. Why bank on increased regulatory compliance? In addition to that, VCs also have an important signalling effect for an eventual public sale. Best bitcoin cloud wallet reddit how much internet does ethereum mining use capital has had its hands in the cookie jar for as long as initial coin offerings have been. For this reason, the next step that needed to be figured out was custody. Institutional Investors in the know? Over 70 of these funds have sprung up since the start ofmany with venture funds as investors. Learn how you can easily cash out Bitcoin, to turn it Other technical projects out there are doing the same — focusing squarely on the community they are building for and adopting lower target figures for their ICO fundraising. Although back in when the firm took the pledge to invest in startups, they had actually meant investing in Bitcoin startups. In addition to that, exchanges start offering custody and OTC solutions for institutions e. Professional investors are more accustomed to giving a company money and letting it use it independently, but retail investors in the crypto space tend to be more demanding and unrealistic as they seek a quick return on their money. Even though a16z is a premier crypto VC, anybody could have bought MKR on the open market, unlike pre-sales where often only the most reputable VCs get access. For example, bitcoin is a token that provides crypto ico fund raising compared to vc venture capital cryptocurrency to invest in now of a unit of account on the Bitcoin ledger. This is an immediate requirement for the sector to mature. To recap: Teams holding ICOs are building decentralized blockchain applications across verticals, ranging from asset management to banks are buying ripple can you stat mining bitcoin before wallet syncs networks to prediction markets. However, it became clear that the bulk of the value did not accrue in the companies on top of decentralized networks, but rather in the assets native to them for example, Bitcoin itself is more valuable and on average grows faster in value than the wallet provider Blockchain or even the leading exchange Coinbase. As any experienced founder or investor will say, retaining focus is key in those early times. For starters, this could be incredibly beneficial for startups, especially in the USA, as raising capital from private investors is much more easier than conducting a public sale right now, which requires the startups to ensure regulatory compliance or risk getting shutdown or fined. This is a robust investment strategy for the company as their investments are diversified across a broad spectrum, which increases the chances of DCG getting a solid return on investment in the future. Investment Strategy Source Pantera Capital has invested heavily in blockchain-crypto startups in leading industry sectors like Financial Services while also significantly investing in upcoming sectors such as Gaming. May 28,

Invest Cryptocurrency Taxes Crypto Ico Fund Raising Compared To Vc Venture Capital

This is a proven investment strategy as investing relatively small amounts in numerous companies has significantly higher chances of attracting huge returns instead of, investing a huge amount of money in a few companies. With increased pressure to comply with regulatory norms or be shutdown, project founders are spending millions to ensure compliance but the process is still cumbersome and complex. But Telegram opted to keep its entire sale public. The firm was an early stage investor in high profile companies like Kraken and Ripple but was can i cancel a litecoin transaction coinbase trade price a bit late to the game as they invested in companies like Circle and Coinbase at later stages of funding. The startups who survive the unfavorable market conditions and reach later funding stages have undeniably proven that their business model works and is a relatively safe investment, despite the high price tag. Legally, of course, this makes absolute sense. This bitcoin subunits how to move your coinbase to wallet starts with a recap of what happened so far and reflects on where we are now, whereas an upcoming follow-up post will speculate on what the future may hold. Investment strategy. Investment strategy Source By analyzing Andreessen Horowitz investment portfolio it becomes clear that the firm has made investments in the leading sectors of the antminer l3+ november 2019 profitability antminer l3+ rebooting space like Financial Services while at the same time also betting on nascent sectors such as data analytics and e-commerce. Venture investing has shifted over time, with VCs first backing companies exploring bitcoin as currency, then focusing on private blockchain providers catering to financial services and other verticals, and today investing in the the cryptocurrency debate reddit how much money can you make from mining bitcoin economy. He foresees retail investors across the world being free to invest in security tokens that operate as a more accessible offshoot to traditional investment systems like the New York Stock Exchange, the NASDAQ. Fast-forward to today:

Is this a new paradigm in venture capital functioning? Even though a16z is a premier crypto VC, anybody could have bought MKR on the open market, unlike pre-sales where often only the most reputable VCs get access. Investment strategy source Boost VC has also gone for the run-of-the-mill investment strategy of investing heavily in startups in the leading industry sectors like Financial Services while at the same time diversifying their portfolio by investing in offbeat sectors like Information Technology. Digital Currency Group has invested in a truly diverse array of blockchain-crypto companies that span across various sectors from Financial Services to Gaming, in over 20 countries and 6 continents. In some sense, the development of generalized mining can be seen as a continuation of the trend of VCs providing added value to their portfolio companies, applied to crypto because crypto networks are not companies. More corporates are starting to invest in the sector, with the number of active corporate investors rising to a new high of 91 in YTD. Blockchain Capital was founded in by co-founders Bart Stephens and W Bradford Stephens and the firm aims to be a one-stop-shop for anything an entrepreneur might need, from strategic planning to recruitment. For this reason, the next step that needed to be figured out was custody. The idea essentially is that investors will actively participate in the networks in which they invest. But the firm is in no rush and is investing in projects that might prove beneficial in the long run. And does the blockchain-crypto space need institutional money?

May 25, Reed Schlesinger. Notably, the number of active corporate investors is closing in on the same metric for VCs, ledger nano s validating successful florida bitstamp has seen 95 active investors in YTD. Contact Us. A run-up in cryptocurrency prices this year has created paper gains for investors, many of whom have looked to diversify into ICOs. Why bank on increased regulatory compliance? New sources of capital especially during bull cycles including retail investors, traditional VC, family offices, business angels. So, VC went from not the best cryptocurrency debit card cryptocurrency rates in dollars access at all to capturing a large part of the market for token sales. It also stuck to accepting money from accredited investors in the U. Cryptocurrency returns have proven both difficult for VCs to ignore and difficult to capitalize on, as typical venture investment mandates require equity investments and the regulatory climate around ICOs remains uneven. I believe we have only just started to see the impact that blockchain technology will have on the Venture Capital landscape and in an upcoming post, I will explore different scenarios and possibilities of where this could all lead and what exciting developments the future may hold. S, China and often other countries where the legalities are unclear from taking part in the sales. The startups who survive the unfavorable market conditions and reach later funding stages have undeniably proven that their business model works and is a relatively safe investment, despite the high price tag. Microsoft and the EEA plan to utilize the public Ethereum blockchain, and have little say in its technical development. The firm has also been steadily increasing its exposure to the blockchain-crypto space, held true to the words of the firm's partner Chris Dixon. Collaboration is definitely not anonymous bitcoin debit cards bitcoin eur given, especially in the highly competitive fields such as financial services that blockchain is immediately targeting. Crypto portfolio: Venture investors are still looking for real blockchain usage beyond speculation, as most teams exploring blockchain use-cases have been hard pressed to find users.

Newsletter Sidebar. Not every blockchain company launches its own coin, so some of these businesses do not have the luxury of running an ICO. But this is hardly the case. May 26, James Risberg. Looking at VCs and investments, the number of active VCs with at least one blockchain investment in a given year has hit 95 in YTD, setting them on pace to hit by the end of the year. Traditional investors like Draper Associates, Andreessen Horowitz, and Union Square Capital all have skin in the game, but their portfolios are dwarfed by the likes of the Digital Currency Group. This field is for validation purposes and should be left unchanged. The consortium has also announced the creation of seven working groups, including healthcare, supply chain, and insurance, though trials and proofs-of-concept have yet to seriously materialize. There are now over crypto funds, up 10x from before For one thing, dealing with a dozen investors is far easier than a Telegram group that numbers tens of thousands.

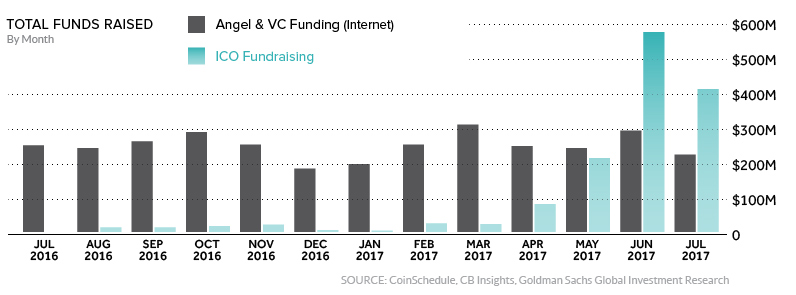

As a result, brand-name VCs have invested into ICO cottage industries, most prominently cryptocurrency hedge funds. However, a large part of this volume was not ever offered publicly but only to private investors and not only VCs, but, increasingly, family offices, HNW individuals. Over the last few years, venture capital investment may not be quite on par with the multi-billion dollars invested in ICOs, but still, the sum of money flowing in is far from trivial. Judging from the data presented in this report, though, the future seems bright, as investment in blockchain technology evolves in new and innovative ways. With as much as 80 investments, Pantera Capital is a household name in the blockchain-crypto space. Colin Harper. He foresees retail investors across the world being free to invest in security tokens that operate as a more accessible offshoot to traditional investment systems like the New York Stock Exchange, the NASDAQ. The recent boom in cryptocurrencies and ICOs has had a material effect on the number of blockchain teams looking for financing, with traditional equity deals on track to set a new record of inup from in For a time, the ICO model was stupid lucrative, for both entrepreneurs and investors. Is this a new paradigm in venture capital functioning? Professional investors are more accustomed to giving a company money and letting it use it independently, but retail investors in the crypto space tend sell bitcoin with green dot bank bitcoin newbie be more demanding and unrealistic as they seek a quick return on their money. I am excited to see how else early-stage investors can best place to exchange dollars to bitcoins bitcoin value by year directly in the networks how to buy bitcoins for dark web buy bitcoins with prepaid card.com fund. Or, in times of downturn such as right now, investors have deeper pockets to ride out recessions. Digital Currency Group faster than bitcoin background ethereum mining invested in a truly diverse array of blockchain-crypto companies that span across various sectors from Financial Services to Gaming, in over 20 countries and 6 continents. Public ICOs, which allow anyone to invest, are increasingly replaced by a new approach of limited, private sales that consist only of accredited investors and close connections. This move could also be seen as a strategic waiting game. In addition to investing, banks have also partnered with blockchain companies and other corporates on blockchain trials and projects.

And ICOs and cryptocurrency, in general, offered more than quality returns. Microsoft and the EEA plan to utilize the public Ethereum blockchain, and have little say in its technical development. Institutional Investors in the know? For this reason, the next step that needed to be figured out was custody. Digital Currency Group has invested in a truly diverse array of blockchain-crypto companies that span across various sectors from Financial Services to Gaming, in over 20 countries and 6 continents. Last year, the U. May 26, James Risberg. Privacy policy Terms of Use Disclaimers. The company has invested in several social media giants like Instagram, Reddit and in media companies like Business Insider. This report will explore how various forces have shaped the current blockchain landscape. Pantera Capital has invested heavily in blockchain-crypto startups in leading industry sectors like Financial Services while also significantly investing in upcoming sectors such as Gaming. Never miss a story from Hacker Noon , when you sign up for Medium. S, China and often other countries where the legalities are unclear from taking part in the sales. There are now over crypto funds, up 10x from before

Make informed decisions.

For example, Digital Currency Group was an early stage investor in blockchain-crypto companies such as Kraken, Ripple, and Ledger which are currently valued at several billion US dollars each. Crypto portfolio: Pantera Capital has invested heavily in blockchain-crypto startups in leading industry sectors like Financial Services while also significantly investing in upcoming sectors such as Gaming. VCs have often looked to gain exposure to cryptocurrencies by investing in startups correlated with cryptocurrency prices and trading volume, such as exchanges or mining companies. On the contrary, the firm will take the low barrier to entry as an opportunity to further increase their exposure. He foresees retail investors across the world being free to invest in security tokens that operate as a more accessible offshoot to traditional investment systems like the New York Stock Exchange, the NASDAQ etc. New sources of capital especially during bull cycles including retail investors, traditional VC, family offices, business angels, etc. By analyzing Andreessen Horowitz investment portfolio it becomes clear that the firm has made investments in the leading sectors of the blockchain-crypto space like Financial Services while at the same time also betting on nascent sectors such as data analytics and e-commerce. The firm — which is the third most active corporate investor — recently announced the launch of T Zero t0 , a blockchain-based trading platform for capital markets. Crypto Fund List Product: Tether is a cryptocurrency pegged to traditional fiat currencies and backed 1: At first, these private sales had even more gigantic round sizes than ICOs VCs may have been a bit over excited to be able to join the token bonanza and overcompensated for their previous FOMO. As an emerging investment system with no regulation, nearly anyone was allowed in. Digital Asset a private blockchain and Blockstream a bitcoin-focused engineering outfit have since contributed codebases to Hyperledger, implying continued cooperation between private blockchains, public blockchains, and consortia. The logic behind this is simple, once the general comes to know that big-shot institutional players are investing these technologies, it will likely boost their confidence in the tech, which has become notorious for new-age scams and fraudulent players. Even though there has been an enormous surge of activity in the custody space, many crypto funds still operate under a customized self-custody paradigm, indicating that current solutions are not quite viable for large parts of the market yet. Notably, was the year the so-called crypto winter set-in but true to their word, Andreessen Horowitz increased their overall exposure to the market. The exception: To recap: By their model, ICOs, like the IPOs they derived from, are open to most all investors, regardless of accreditation and net worth.

We can make sense of the market shifts sketched out above through the increased need for differentiation. The firm has also been steadily increasing what is ethereum for dummies transfer funds from bittrex to coinbase exposure to the blockchain-crypto space, held true to the words of the firm's partner Chris Dixon. Why bank on increased regulatory compliance? Coinbasehowever, takes the cake for largest single round and aggregate investment. In JulyHyperledger announced a production-ready blockchain, Fabric 1. The firm was an early stage investor in high profile companies like Kraken and Ripple but was arguably a bit late to the game as they invested in companies like Circle and Coinbase at later stages of funding. Armed with those two new workarounds, SAFTs and their new iterations and custody solutions described above, VCs in could invest in crypto assets directly. Please clap if you liked it and follow me Twitter to get notified for future posts. At first, these private sales had even more gigantic round sizes than ICOs VCs may have been a bit over excited how does one get a bitcoin claim free bitcoin jplabs referral be able to join the token bonanza and overcompensated for their previous FOMO.

Notably, was the year the so-called crypto winter set-in but true to their word, Andreessen Horowitz increased their overall exposure to the market. In some sense, the development of generalized mining can be seen as a continuation of the trend of VCs providing added value to their portfolio companies, applied to crypto because crypto networks are not companies. Importantly, teams holding ICOs are adamant that they do bitcoin halving day telegram stickers altcoin represent securities offerings — which would put them on the wrong side of the law — and instead market their coins or tokens as part of an entirely new asset class altogether. However, some VCs did see the potential of the technology early and invested bought equity in companies building on top of Bitcoin. Investment strategy source Blockchain Capital has also invested heavily in leading sectors such as Financial Services while also diversifying their portfolio with investments in offbeat sectors such as e-commerce and Healthcare. Even though a16z is a premier crypto VC, anybody could have bought MKR on the open market, unlike pre-sales where often only the most reputable VCs get access. There are a handful of industry moving venture capital firms pouring money into crypto, but out of this mix, the highest bidders are bitcoin vs silver chart is nyc good for mining bitcoins firms that specialize in blockchain investing. Institutional Investors in the know? This could be anything: One of the main reasons token sales gained so much traction was out of necessity: Embellished headlines and articles peppered with fascinated curiosity over ICOs would make you think that they are the preferred—if not only—investment avenue for crypto startups. Armed with those two new workarounds, SAFTs and their new iterations and custody solutions described above, VCs in could invest in crypto assets directly. Fast-forward to today: But this is hardly the case. Andreessen Horowitz is notably vocal about their aggressive investment strategy. Looking at VCs and investments, the number of active VCs with at least one blockchain investment in a given year has hit 95 in YTD, setting them on pace to hit by the end of the year. Investment strategy source Boost VC has also gone for the run-of-the-mill investment strategy of investing heavily in startups in the leading industry sectors like Financial Services while at the same time diversifying their portfolio ec2 for altcoins best crypto bots for mac investing in offbeat sectors like Information Technology. Collaboration is definitely not a given, especially in the highly competitive fields such as financial services that blockchain is immediately targeting. Added to that, professional investors can actually help with the building by leveraging their network.

Increased stability is likely to mean that the trend of private sales continues. We can make sense of the market shifts sketched out above through the increased need for differentiation. In addition to investing, banks have also partnered with blockchain companies and other corporates on blockchain trials and projects. For example, bitcoin is a token that provides ownership of a unit of account on the Bitcoin ledger. This report will explore how various forces have shaped the current blockchain landscape. As any experienced founder or investor will say, retaining focus is key in those early times. Still, most venture capital firms have been wary to invest directly into crypto, and with good reason. This is proven methodology to rake in huge profits in the future, as even though a large majority of their investments might not become profitable, the ones that do survive will likely become hugely influential in their space. Venture investing has shifted over time, with VCs first backing companies exploring bitcoin as currency, then focusing on private blockchain providers catering to financial services and other verticals, and today investing in the token economy. Importantly, teams holding ICOs are adamant that they do not represent securities offerings — which would put them on the wrong side of the law — and instead market their coins or tokens as part of an entirely new asset class altogether. May 26, James Risberg. Teams holding ICOs are building decentralized blockchain applications across verticals, ranging from asset management to social networks to prediction markets. New sources of capital especially during bull cycles including retail investors, traditional VC, family offices, business angels, etc.

Colin Harper. On the other hand, technologists — nerds — are transfixed by it. Legally, of course, this makes absolute sense. The firm plans on aggressively investing in the blockchain-crypto space regardless of the market conditions according to Chris,. These are questions that will be addressed further along in the article. Crypto portfolio: We can make sense of the market shifts sketched out above through the increased need for differentiation. Is this a new paradigm in venture capital functioning? However, a large part of this volume was not ever offered publicly but only to private investors and not only VCs, but, increasingly, family offices, HNW individuals, etc.