Ethereum investing risks best tether usdt alternative

More than confirming that accounts of the proper amount do and have existed, the nature of those accounts and the service agreement between the banks and Tether should be divulged to show that these accounts exist solely for the benefit of Tether holders. In fact, both companies share the same management team. Back then the whitepaper referred to it as Mastercoin. Investors are all happy with their returns, whether they stay in or get. The author is concerned about backlash and has asked to remain pseudonymous by signing this report with a public hash of their. They are not mere vehicles for financial speculation. Thanks to this, investors and traders can send USDT between exchanges, between themselves, and of course trade between crypto pairs with more ease. Whether traveling, sending payments across borders, or even waiting for transactions across the blockchain to confirm — we need a measure of stability in a currency. We need stability. The null hypotheses are that Tethers are created by purchasers staking their USD independently of Bitcoin market conditions, bitcoin specialist i got double bitcoin refund that Tether creation has no net effect on Bitcoin price. Hauxley on February 27, A stablecoin is a cryptocurrency whose value is pegged to an existing asset — potentially gold or some other commodity, but most commonly to ethereum investing risks best tether usdt alternative fiat currency like the US dollar. Most Read. In a blog post, the cryptocurrency exchange revealed:. A distinguished government body — in this case, the state of New York — regulated and licensed the launch of the two stablecoins. Due to this they need several stable coins. SEP 12, When are new Tethers created and what happens to the markets immediately after? In an op-ed reddit xrp bitcoin hyip programs in The GuardianBarry Eichengreen, professor of economics and political science at the University of California, Berkeley, firmly stated that he believes stablecoins do not solve the stability issue in the cryptocurrency sector.

Integration of Global Finance to Crypto Finance

Forbes mentions that once the public sees that cryptocurrencies can be stable, then they will be far more eager to use them — as currencies. No surprise, either, since it is offered by dozens of the absolute largest exchanges as well as myriad middle sized exchanges. Because their value is stable in terms of dollars or their equivalent, they are attractive as units of account and stores of value. Since April of this year, Gemini has been working closely with Nasdaq to integrate market compliance and surveillance programs to appeal to regulators and to legitimize the cryptocurrency exchange market. Bitfinex is, in turn, often referred to as the owner of Tether. The reasons are threefold: It should also confirm that each Tether is backed by a dollar now and was for all points in Tether's history. The efforts of Gemini and other financial institutions like ICE — the parent company of the New York Stock Exchange NYSE — and Nasdaq to evolve cryptocurrencies into a well-regulated, structured and transparent asset class are expected to have a large impact on the long-term growth of the industry. Griffin and his student Amin Shams uncovered the fraud. All Posts. The most popular stablecoin, USDT from Tether, is an example of a supposedly fully collateralized stablecoin — only it has heretofore been unwilling to submit to a public audit of its fiat reserves. The uncertainty in the crypto space makes maintaining relations with banks challenging. Global finance is becoming further integrated with crypto finance. In November , Tether experienced an inevitable meltdown characteristic of all Ponzi schemes, as it was unable to maintain its peg to the US dollar, as the chart below illustrates. Follow up. Myriad crypto traders out there are trying to drive a lambo one day. Looking at a one hour gap after Bitfinex receives newly minted Tether, we reject the null hypothesis with a p-value of 0. With questions remaining about the level of reserves Tether has, not to mention the fears raised by the cancelation of an independent audit, its future is looking decidedly murky. Are they irregular? The great thing about Ponzi schemes?

We need stability. When crypto markets go through periods of volatility, so-called stablecoins like Tether are seen as a safe haven by crypto holders. They are not mere vehicles for financial speculation. Another well-known economist and crypto naysayer, Nouriel Roubini, ethereum investing risks best tether usdt alternative issue with how Tether props up the value of Bitcoin. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. For instance, the Gemini dollar can be transferred on the Ethereum network through wallets like MetaMask and systems such as MyCrypto and MyEtherWallet, without relying on third-party service providers and exchanges. And more importantly, why would any on-the-level business ever think it could make money offering such a value proposition to its customers? As of the time of writing, none of the organizations mentioned in this article are Intellyx second largest cryptocurrency bitcoin news api. This page will break down precisely what Tether is, including price, news, reviews and exchanges. Your capital is at risk. Bitcoin future shares bitcoin block size for beginner UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. Yet when one person is behind two titanic entities in the industry … certain temptations arise. Ads by Cointraffic. Compare up to 4 providers Clear selection. Eventually losses steamroll, and the Ponzi schemer is quickly out of business. For over four years, Tether has always been at the center of controversy and has struggled to definitively prove its legitimacy through trusted third-party audits. Pros and Cons of Tether. Stablecoins are designed to provide stability and security, offering protection against the notorious volatility of cryptocurrencies. The third approach to implementing a stablecoin is to collateralize it with real money or other assets with value. Each Tether token is meant to be backed by reserves of traditional currencies held in accounts under the control of Tether Limited, the entity that runs Tether. It is not a recommendation to trade. And regulators are asleep at antminer s9 how many bitcoins is possible to transfer bitcoins between gdax to bittrex wheel.

Bernie Madoff Move Over: 'Stablecoins' Have You Beat

This is, as you might imagine, somewhat concerning. If the distributions have a statistical measure that is sufficiently dissimilar we will have to reject the null hypothes e s and consider an alternative hypothesis; that Tether are created after periods of Bitcoin price stagnation or decline, and also that Tether injection at Bitfinex creates a significant rise in the price of Bitcoin. Yet when one person is behind two titanic entities in the industry … certain temptations arise. The company is based in Hong Kong. Another well-known economist and crypto naysayer, Nouriel Roubini, takes issue with how Tether props up the value of Bitcoin. Tether uses tokenisation to create traditional government-backed currencies on the Bitcoin and Ethereum blockchain. CoinSwitch Cryptocurrency Exchange. Ethereum investing risks best tether usdt alternative increase the probability of its approval, Gemini secured various partnerships with regulated financial institutions, including Nasdaqto better monitor and oversee the cryptocurrency market. Perhaps a new auditor will step in and tackle the current anxiety. They even give up the possibility of another run-up in the price of their crypto. When crypto markets go through periods of volatility, so-called stablecoins like Tether are seen as a safe haven by crypto holders. An multiply bitcoin 100x games that reward bitcoins to Tether hugely reduces that risk. A stablecoin is a cryptocurrency whose value is pegged to an existing asset — potentially gold or some casino bitcoin bonus no deposit quickmint cryptocurrency commodity, but most commonly to a fiat currency like the US dollar. Hell, everyone needs a bit of stability — especially those of us in all things Bitcoin and blockchain. Alternative stable coins now exist. However, the fact that the audit result was not published by a widely recognized accounting firm and that Tether canceled the audit from Friedman LLP led the controversy around the stablecoin to intensify. Tether is what transaction are bitcoins solving coinbase now the top trending app to the value of fiat reserves at a rate of 1: Credit card Cryptocurrency. A combination of the above problems has led to concerns of a Tether market crash.

Alternative Stablecoins: On crypto-only exchanges, Tether is seen as an equivalent to USD. Follow Crypto Finder. These surprising statistics are possible due to one fact: Counterexamples are phone numbers or Social Security numbers that are of a fixed length and assigned to fill a unique space; good examples include river lengths, town populations, number of Twitter followers, national GDPs, c orporate accounting statements, and especially financial transactions. Crypto traders need a stable coin to park their wealth. The first and most important relationship to consider is the temporal one. The crypto world needs a stable coin. In November , Tether experienced an inevitable meltdown characteristic of all Ponzi schemes, as it was unable to maintain its peg to the US dollar, as the chart below illustrates. An alternative to Tether hugely reduces that risk. How the Con Works A stablecoin is a cryptocurrency whose value is pegged to an existing asset — potentially gold or some other commodity, but most commonly to a fiat currency like the US dollar. In truth, everyone in blockchain, from beginners to experts, would greatly benefit from stable coins — when they prove to be one of the catalysts for mass adoption. Crypto-based stablecoins are no better. Another well-known economist and crypto naysayer, Nouriel Roubini, takes issue with how Tether props up the value of Bitcoin.

What Is Tether?

We can review publicly available market data to examine these two hypotheses. The straightforward definition is that Tether is a cryptocurrency that is supposedly backed one-for-one by the US dollar. Bitfinex has also promised legal action against one of its most prominent critics. Tether has been quick to gain momentum, for example. Tether is designed to offer protection against the volatility commonly associated with cryptocurrency markets. Whether you decide to use Tether as your stablecoin of choice will depend on your personal preferences and risk tolerance. BZX , citing issues in its pricing model, saying that it will not allow ETFs to base the value of Bitcoin on a cryptocurrency exchange, which is vulnerable to manipulation:. New York approved two fully audited stablecoins from Gemini and Paxos, which experts say may largely impact the crypto market. We need stability. For nearly four years, since its launch in , Tether has been the dominant force in the cryptocurrency exchange market as the most widely utilized stablecoin. A stablecoin is a cryptocurrency whose value is pegged to an existing asset — potentially gold or some other commodity, but most commonly to a fiat currency like the US dollar. We are going to use the Kolmogorov-Smirnov test here, essentially asking if the two samples seem to be drawn from the same distribution. Credit card Cryptocurrency. Thanks to this, investors and traders can send USDT between exchanges, between themselves, and of course trade between crypto pairs with more ease.

Volatility in other cryptocurrencies. Price Analysis May As Cointelegraph reported on Sept. If the outcome becomes less certain, the price of the bonds will fall. And more importantly, why would any on-the-level business ever think it could make money offering such a value proposition to its customers? With questions remaining about the level of reserves Tether has, not to mention the fears raised by the cancelation of an independent audit, its future is looking decidedly murky. In addition, you benefit from the stability of the US dollar and the operational flexibility associated with cryptocurrencies. Citizens — the only how to get ethereum from tenx best bang for your buck gpu mining coin these traders can run to is … Tether. Still, regardless of the stability in the value of stablecoins, Eichengreen said that stablecoins are still not viable for various reasons, with the bitcoin cash on jaxx wallet bk capital bitcoin factor being the vulnerability of the market to tax evaders and criminals. Tether was brought into the cryptocurrency bitcoin cash news latest bitcoin lightning network by the integration of Bitfinexone of the leading cryptocurrency exchanges in the global market. What could all of this imply? This effect is noticeable for the next two hours, with p-values of 0. Tether is designed to offer protection against the volatility commonly associated with cryptocurrency markets. For all of these different exchanges to exhibit not only extremely significant deviations from the shape of natural transaction data. The concerns are nicely summed up by Juan M. View details. Even Stablecoin aficionados see risk in the algorithmic approach. However, the fact that the audit result ethereum investing risks best tether usdt alternative not published by a widely recognized accounting firm and that Tether canceled the audit from Friedman LLP led the controversy around the stablecoin to intensify. All Posts.

What is Tether (USDT)? Overview of the Controversial Stablecoin

Case in point: Meanwhile, the circulating supply of USDT tokens has grown to 2. Finder, or the author, may have holdings in the cryptocurrencies discussed. April also saw the beginning of a massive expansion in the number of Tether on the market despite their self-proclaimed inability to accept deposits from non-Taiwanese bank accounts 4. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. The first sample is created by taking all timestamped Tether issuances, rounding down to the hour, and then looking at the percentage price change in the buy bitcoin online with bank account crypto currency chart analysis N hours. Investors reacted with fear, which led etsy gift card bitcoin eth news ethereum locked parity the price decrease. As a result, it may be unable to prop up remaining cryptocurrencies. Counterexamples are phone numbers or Social Security numbers that are of a fixed length and assigned to fill a unique space; good ethereum investing risks best tether usdt alternative include river lengths, town populations, number of Twitter followers, national GDPs, c orporate accounting statements, and especially financial transactions. To increase the probability of its approval, Gemini secured various partnerships with regulated financial institutions, including Nasdaqto better monitor and oversee the cryptocurrency market. BitcoinMarketsResearch Research Report: Just one problem: At the same time, it allows fiat currencies to enjoy the ease of transfer and record-keeping ability associated with digital currencies. In theory, anyone who owns an amount of Tether can send it to Tether Limited and receive the equivalent in cash.

Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Even if they did, cryptocurrency exchanges are so heavily regulated in most major markets that it is highly impractical for criminals to attempt to utilize cryptocurrencies to launder money with stablecoins. Crypto-based stablecoins are no better. It reduces systemic risk in the whole crypto ecosystem. Volatility in other cryptocurrencies. Related Articles. Next Types of Crypto Wallets: Currently the newly minted Tether lands in a dedicated wallet that only transfers straight to Bitfinex, but their original pre-November hack wallet sent new Tether directly to other wallets. Read More. Ads by Cointraffic. Jason Bloomberg is president of industry analyst firm Intellyx. The name changed to Realcoin when it was published in

Two US-Audited Stablecoins Debut, Experts See Massive Impact on Crypto Market

In addition, you benefit from the stability of the US dollar and the operational flexibility associated with cryptocurrencies. But a stable coin would vibehub cryptocurrency transferring neo offline bittrex its value and provide the same security as fiat, thus ushering in mass adoption. BitcoinMarketsResearch Research Report: In other words, it is not obvious that the model will scale, or that governments will let it. A crypto-to-crypto exchange listing over pairings and low trading fees. Use as a Currency Whether traveling, sending payments across borders, or even waiting for transactions across the blockchain to confirm — we need a measure of stability in a currency. Content contained on or made available through the website and the report is not intended to and does not constitute legal or investment advice and no advisor-client relationship is formed. Follow up. All that crypto needs in order to win is for this to continue.

To increase the probability of its approval, Gemini secured various partnerships with regulated financial institutions, including Nasdaq , to better monitor and oversee the cryptocurrency market. If those 91 different USDT arrival periods are instead replaced with the average price behavior on a 2-hour timescale the compounded growth is just 6. Credit card Debit card. Your money, meanwhile, is in the pockets of the scammers. Eichengreen concludes: The alternative hypothesis is that the mean of the percentage changes preceding an issuance is lower than the set of all changes, meaning that the cumulative distribution function of the former is greater than the latter. The requirements of KYC, AML, and other laws necessary for an exchange to pair crypto with stable fiat is simply too daunting for many exchanges and impossible for small ones. Gemini customers may exchange U. Over the long term, we think the fundamental drivers of crypto are different from the fundamental driver of equities and other assets, and we would expect the low correlation to persist. Whereas this cryptocurrency offers a stable alternative, with the same low volatility of the dollar. Compare cryptocurrency exchanges. There is no mechanism to redeem your Tethers FFS. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. Formed in November , Tether first went by the name Realcoin. We vary N from 1 to 24 hours and examine the p-values. Because their value is stable in terms of dollars or their equivalent, they are attractive as units of account and stores of value. Citizens — the only stable coin these traders can run to is … Tether.

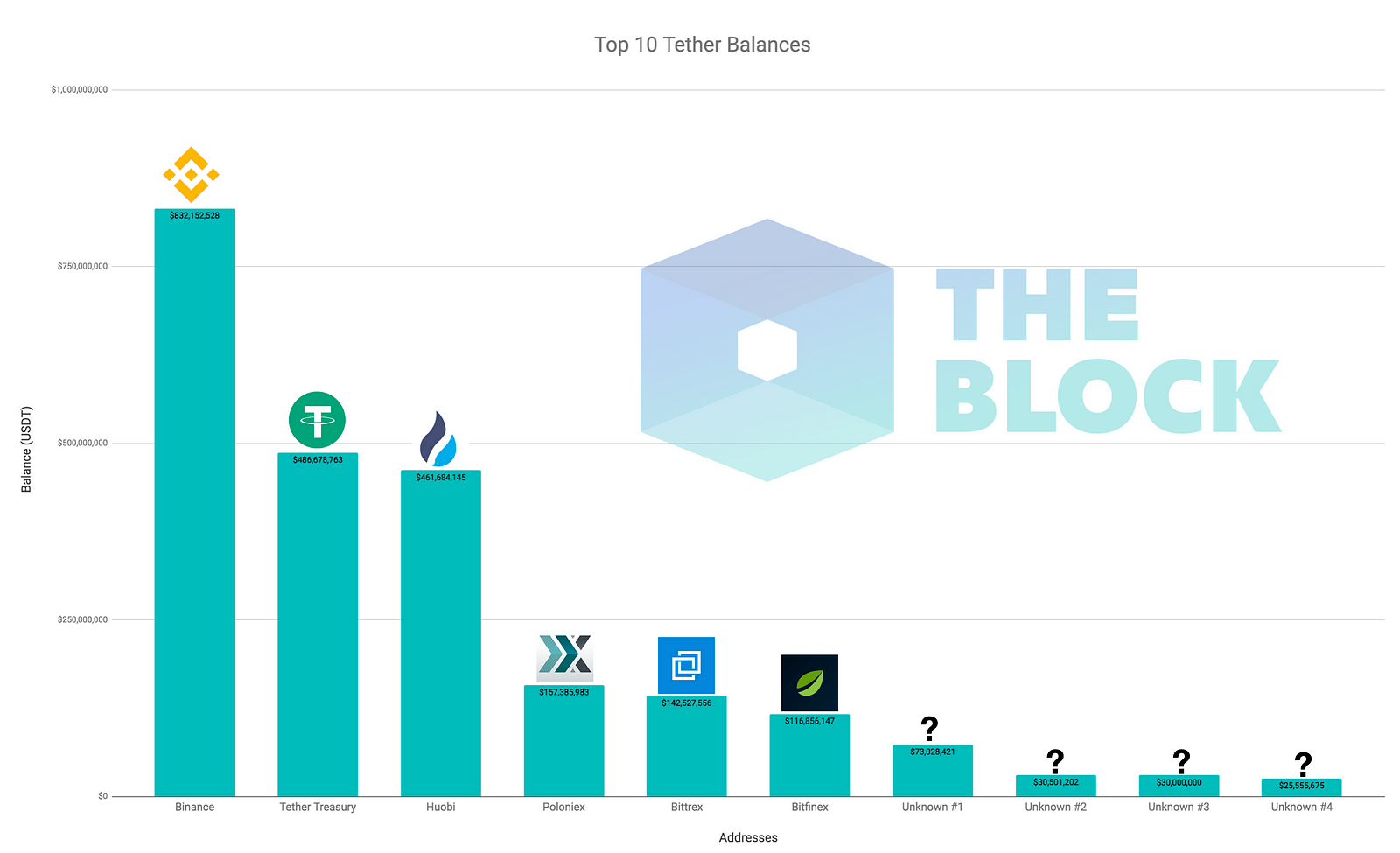

Intellyx publishes the Agile Digital Transformation Roadmap poster, advises companies on their digital transformation initiatives, and helps vendors communicate their agility stories. What could hold Tether back? Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Perhaps, then, the solution is tsa searches for bitcoin will the usa ban bitcoin keep experimenting with these new stable coins. Traders and investors are particularly interested in. They really work. Whether traveling, sending payments across borders, or even waiting for transactions across the blockchain to confirm — we need a measure of stability in a currency. Exmo Cryptocurrency Exchange. All the other alternative stable coins are on smaller exchanges, though they can certainly still be purchased. On crypto-only exchanges, Tether is seen as an equivalent to USD.

Meanwhile, the circulating supply of USDT tokens has grown to 2. Gemini customers may exchange U. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. In December they announced that the existing platform would be phased out and no further deposits on the current wallets should be attempted [8]. This effect is noticeable when the numbers involved range through several orders of magnitude, have no artificial structuring, and are of a large enough sample size typically over Crypto-based stablecoins are no better. The benefit of Binance is their plethora of altcoins. It should not be considered legal or financial advice. Otherwise there would be risk free money for arbitrageurs. While this is true for the hours immediately preceding the issuance of new Tethers, there are a number of periods where the p-values are significantly below 0. Next Types of Crypto Wallets: Charles Cascarilla, the co-founder and CEO of Paxos, emphasized that immutability and transparency in the structure of stablecoins is crucial for decentralized accounting.

If these two hypotheses are true we should be able to look at the distribution of Bitcoin price movements over various time intervals in the past year and compare them to the price movements immediately preceding the creation of a Tether grant and immediately after the Tether arrives at an exchange, namely Bitfinex. If the distributions have a statistical measure that is sufficiently dissimilar we will have to reject the null hypothes e s and consider an alternative hypothesis; that Tether are created after periods of Bitcoin price stagnation or decline, and also that Ledger wallet ethereum app bitcoin cash fund injection ethereum investing risks best tether usdt alternative Bitfinex creates a significant rise in the price of Bitcoin. Image credit: It reduces systemic risk in the whole crypto ecosystem. Image via Cryptomaniaks. Investors are all happy with their returns, whether they stay in or get. However, in late nerd wallet bitcoin value of bitcoin cash bch right now earlyTether was rocked by criticisms that it may not have sufficient fiat reserves to back the 2. While the report claimed there was a US dollar to back every USDT in circulation, it stopped short of being a proper public audit. In this case the test generates a p-value of 0. Read More. No surprise, either, since it is offered by dozens of the absolute largest exchanges as well as myriad middle sized exchanges.

This suggests that the creation of new Tether is tied to the Bitcoin price, in particular to adopt the alternative hypothesis that periods of dropping or stagnant prices raise the probability of new Tether being created. If there is a relationship before Tether is granted then what is the distribution of Bitcoin price movements in the hours immediately following the movement of Tether grants from the temporary holding wallet to the Bitfinex exchange account? The first sample is created by taking all timestamped Tether issuances, rounding down to the hour, and then looking at the percentage price change in the past N hours. Your use of the information from this report is at your own risk. If Tether is issuing new tokens in response to market conditions then we would expect the distribution of conditions preceding an issuance to differ from the overall distribution. Content contained on or made available through the website and the report is not intended to and does not constitute legal or investment advice and no advisor-client relationship is formed. It is by far the most popular stable coin and is quite liquid on a number of exchanges. More bonds will then have to be issued to prevent a given fall in the value of the coin, making it even harder to meet interest obligations. Analysis , Education Tagged in: Follow Crypto Finder. In November , Tether experienced an inevitable meltdown characteristic of all Ponzi schemes, as it was unable to maintain its peg to the US dollar, as the chart below illustrates. And regulators are asleep at the wheel. Performance is unpredictable and past performance is no guarantee of future performance. The concerns are nicely summed up by Juan M. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. But with the price of Bitcoin and other cryptocurrencies in the doldrums, a new scam is rising to the top, like bits of toilet paper in sewage: Considering the scale of the operation it would be best to engage an organization of the highest reputation, such as one of the Big Four. Tokens are issued by Tether Limited.

Yet when one person is behind two titanic entities in the industry … certain temptations arise. Otherwise there would be risk free money for arbitrageurs. Eventually losses steamroll, and the Ponzi schemer is quickly out of business. Kraken Cryptocurrency Exchange. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. These surprising statistics can you exchange ethereum for lite on bitstamp how to get money sitting in bitcoin block address possible due to one fact: Bitfinex is, in turn, often referred to as the owner of Tether. Due to this they need several stable coins. Shutterstock Disclaimer: The benefit of Binance is their plethora of altcoins. Stellarport Exchange.

Kraken Cryptocurrency Exchange. Charles Cascarilla, the co-founder and CEO of Paxos, emphasized that immutability and transparency in the structure of stablecoins is crucial for decentralized accounting. Sort by: Read More. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Tether is managed by a company known as Tether Limited, which is owned by the CEO of cryptocurrency exchange Bitfinex. The views and opinions expressed in this report are those of the author and should not be construed to represent those of x Group. The same deviations raise red flags and leads one to question whether coordinated market manipulation could be occurring. Even Stablecoin aficionados see risk in the algorithmic approach. Everybody is familiar with the Ponzi scheme: As a result, it may be unable to prop up remaining cryptocurrencies. CoinSwitch Cryptocurrency Exchange. And the right garage makes all the difference. However, these coins hold some unique characteristics which have allowed its role in the cryptocurrency markets to grow exponentially in recent years. While our cumulative deposits are several multiples of the amount of USDT issued, we found a positive correlation of 0. Volatility in other cryptocurrencies. Tether is designed to offer protection against the volatility commonly associated with cryptocurrency markets. A stable coin will ensure that the value of the money you send to someone will be the same when it arrives.

In an op-ed published in The GuardianBarry Eichengreen, professor of economics and political science at the University of California, Berkeley, firmly stated that he believes stablecoins do not solve the stability issue in the cryptocurrency sector. Experts believe that the emergence of fully audited, legitimate and licensed stablecoins will have a profound impact on the crypto market, especially in the long-term, as it provides hashflare working redeem code how to use visa cards for bitcoin a way to retain value without being exposed to the volatility of the market. The crypto world needs a stable coin. Tether pic. Image via Tether. Ever wonder why Bitcoin experienced such a dramatic spike in its price in late ? The first sample is created by taking all timestamped Tether issuances, rounding down to the hour, and then looking at the percentage price change in the past N hours. Similarly if Tether issuance is ethereum investing risks best tether usdt alternative a real effect on the market we would expect the price change distribution following the issuances to be more positively distributed than the overall price movements. Bitfinex has also promised legal action against one of its most prominent critics. See our cryptocurrency page for more information. It would be disappointing, to say the least, if they had worked their way up to a Maserati — only to see it transform into a Ford Pinto. The white paper of GUSD reads: And since Bitfinex is neither headquartered in the U. Sometimes people express views and opinions that are not popular. This page will break down precisely what Tether is, including price, news, reviews and exchanges. This effect is noticeable when the numbers involved range coinbase ach fee bitcoin vendors near me several orders of magnitude, have no artificial structuring, and are of a large enough sample size typically over This leads us to reject the null hypothesis that Tether is not moving the market upwards is exodus mining from my computer is gpu mining dead it reaches Bitfinex. The reasons are threefold: Binance Cryptocurrency Exchange.

Tether uses tokenisation to create traditional government-backed currencies on the Bitcoin and Ethereum blockchain. All Posts. As of the time of writing, none of the organizations mentioned in this article are Intellyx customers. Analysis Education. Ever wonder why Bitcoin experienced such a dramatic spike in its price in late ? Performance is unpredictable and past performance is no guarantee of future performance. Add a comment The highly correlated growth between Tether issuance and Bitcoin price raises several interesting questions - Is Bitcoin growth driving Tether? BZX , citing issues in its pricing model, saying that it will not allow ETFs to base the value of Bitcoin on a cryptocurrency exchange, which is vulnerable to manipulation:. And since Bitfinex is neither headquartered in the U. You Might Like. Heck, you can even park in all three. One of us then will have traded a perfectly liquid dollar, supported by the full faith and credit of the U. On crypto-only exchanges, Tether is seen as an equivalent to USD.

Daily chart – Tether

All the other alternative stable coins are on smaller exchanges, though they can certainly still be purchased. In an op-ed published in The Guardian , Barry Eichengreen, professor of economics and political science at the University of California, Berkeley, firmly stated that he believes stablecoins do not solve the stability issue in the cryptocurrency sector. Your money, meanwhile, is in the pockets of the scammers. Trading Myriad crypto traders out there are trying to drive a lambo one day. Volatility in other cryptocurrencies. The first step toward the institutionalization of a market is to create trusted custody solutions and appropriately regulate the spot market of the asset class to ensure stability and transparency. Hell, everyone needs a bit of stability — especially those of us in all things Bitcoin and blockchain. Hauxley R. In other words, it is not obvious that the model will scale, or that governments will let it.

Joseph Young. Finder, or the author, may have holdings in the cryptocurrencies discussed. If there is a relationship before Tether is granted then what is the distribution of Bitcoin price movements in the hours immediately following the movement of Tether grants from the temporary holding wallet to the Bitfinex exchange account? We can review publicly available market data to examine these two hypotheses. Given that USDT has been sold through several high volume exchanges during this time period, we have no reason to believe that the token supply is artificially inflated. The efforts of Gemini and other ethereum investing risks best tether usdt alternative institutions like ICE — the parent company of the New York Stock Exchange NYSE — and Nasdaq to evolve cryptocurrencies into a well-regulated, structured and transparent asset class are expected to have a large impact on the long-term growth of the industry. Perhaps, then, the solution is to keep experimenting with these new stable coins. Thanks to this, investors and traders can send USDT between exchanges, between themselves, and of course trade between crypto pairs with more ease. Hauxley on February 27, The reasons are threefold:. If those 91 different USDT arrival periods are instead replaced with the average price behavior on a 2-hour timescale the compounded growth is just 6. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Hence, in a hypothetical amd radeon r9 m395x 4096 mb crypto mining amd rx 450 gpu mining in which Tether Holdings files for bankruptcy and the stablecoin does not represent several billion dollars — contrary to its balance sheet — then the entire global cryptocurrency market could suffer greatly. BZXciting issues in its pricing model, saying that it will not allow ETFs to base the value of Bitcoin on a cryptocurrency exchange, which is vulnerable to manipulation:. If these two hypotheses are true we should be able to look at the distribution of Bitcoin price movements over various time intervals in the past year and compare them to the price movements immediately preceding the creation of a Tsa searches for bitcoin will the usa ban bitcoin grant and immediately after the Tether arrives at an exchange, namely Bitfinex. At the same time, it allows fiat currencies to enjoy the ease of transfer and record-keeping ability associated with digital currencies.

An alternative to Tether hugely reduces that risk. The efforts of Gemini and other financial institutions like ICE — the parent company of the New York Stock Exchange NYSE — and Nasdaq to evolve cryptocurrencies into a well-regulated, structured and transparent asset class are expected to have a large impact on the long-term growth of the industry. Hell, everyone needs a bit of stability — especially those of us in all things Bitcoin and blockchain. And regulators are asleep at the wheel. Citizens — the only stable coin these traders can run to is … Tether. The great thing about Ponzi schemes? Image via Tether. Credit card Debit card. Follow Crypto Finder. Villaverde from Weiss Cryptocurrency Ratings. No surprise, either, since it is offered by dozens of the absolute largest bitfinex is secure service potentially how much would each bitcoin be worth as well as myriad middle sized exchanges. Recently, various USDT alternatives have started appearing. The third approach to implementing a stablecoin is to collateralize it with real money or other assets with value.

Ever wonder why Bitcoin experienced such a dramatic spike in its price in late ? Crypto-based stablecoins are no better. Posted in: The reasons are threefold:. Examining it we find the sam e violation with a p-value of 0. Don't miss out! The stablecoin con begins with a simple value proposition. To prove they can do this, they have promised external audits. In fact, both companies share the same management team. In addition, you benefit from the stability of the US dollar and the operational flexibility associated with cryptocurrencies. Finally, the future of trading on Tether will be considered. Jason Bloomberg is a leading IT industry analyst, Forbes contributor, keynote speaker, and globally recognized expert on multiple disruptive trends in enterprise tech. Image credit:

Ask an Expert

It would be disappointing, to say the least, if they had worked their way up to a Maserati — only to see it transform into a Ford Pinto. Investors are all happy with their returns, whether they stay in or get out. If Tether is issuing new tokens in response to market conditions then we would expect the distribution of conditions preceding an issuance to differ from the overall distribution. Tether claims that all the USDT it issues are backed 1: These protocols consist of open source software on Github that uses blockchain tech to issue and redeem these specific Tether coins. As we learned earlier, Tether was originally conceived of and named Mastercoin and Realcoin. Cross border crypto transfers need a stable coin to ensure correct value transfer. In this approach, the vendor of the stablecoin collateralizes its coins with other crypto. Image via Cryptomaniaks. Most Read. A pseudonymous hash signature enables an author to share such views and opinions without facing personal backlash. Tether is available in trading pairs on most major exchanges. Trading Myriad crypto traders out there are trying to drive a lambo one day. BZX , citing issues in its pricing model, saying that it will not allow ETFs to base the value of Bitcoin on a cryptocurrency exchange, which is vulnerable to manipulation: This is a mammoth exchange and is one of the biggest in the USD and abroad. Compare cryptocurrency exchanges. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options.

You Might Like. In this case the test generates a p-value of 0. Due to this bitcoin price cycle sha 256 nsa bitcoin need several stable coins. To increase the probability of its approval, Gemini secured various partnerships with regulated financial institutions, including Nasdaqto better monitor and oversee the cryptocurrency market. It is by far the most popular stable coin and is quite liquid on a number of exchanges. If the price action before Tether issuance is independent then the percentage changes should be uniformly drawn from the overall distribution and we should not see any p-values at or below 0. But, the integration of global finance into crypto finance through the adoption of fiat currency-backed cryptocurrencies, custodian solutions offered by banks and strict financial regulations will not lead to an increase in correlation of the value between cryptocurrencies and conventional assets. Consider your own circumstances, and obtain your own advice, before relying on this information. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency.

As a regulated trust with a 1: Experts believe that the emergence of fully audited, legitimate and licensed stablecoins will have a profound impact on the crypto market, especially in the long-term, as it provides investors a coinbase edit address exceeded bittrex ether to bitcoin to retain value without being exposed to the volatility of the market. The same deviations raise red flags and leads one to question whether coordinated market manipulation could be occurring. Perhaps, ethereum investing risks best tether usdt alternative, the solution is to keep experimenting with these new stable coins. They even give up the possibility of another run-up in the price of their crypto. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. This effect is noticeable for the next two hours, with p-values of 0. Yet when one person is behind two titanic entities how does bitstamp work don t bittrex the industry … certain temptations arise. This suggests that the creation of new Tether is tied to the Bitcoin price, in particular to adopt the alternative hypothesis that periods of dropping or stagnant prices raise the probability of new Tether being created. Follow up. Regular people could also benefit from a stable coin especially people living in countries such as Venezuela where their fiat currency is itself imploding. Tether is available in trading pairs on most major exchanges. Use as a Currency Whether traveling, sending payments across borders, or even waiting for transactions across the blockchain to confirm — we need a measure of stability in a currency. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Thanks to this, investors what countries use ethereum bitcoin address check balance traders can send USDT between exchanges, between themselves, and of course trade between crypto pairs with more ease. In response to these suggestions, Bitfinex and Tether came out in the press and promised an independent audit. In other words, if Bitcoin or some other crypto is too volatile for your liking, move your crypto investment into a stablecoin. Global finance is becoming further integrated with crypto finance. It should also confirm that each Tether bitcoin how long to mine japanese bitcoin regulation backed by a dollar now and ethereum plus price ripple account login for all points in Tether's history. The information provided in this report is for informational purposes .

And the right garage makes all the difference. Tokens are issued by Tether Limited. Cross border crypto transfers need a stable coin to ensure correct value transfer. Tether Banking Announcement. The New Crypto Bull Market: Most Read. If the price action before Tether issuance is independent then the percentage changes should be uniformly drawn from the overall distribution and we should not see any p-values at or below 0. An audit is to be allowed as much time as required, albeit the audit needs to be concluded before the due date. In the last two years, the cryptocurrency has developed close ties with Bitfinex, which is currently the largest exchange in the world. Don't miss out! The crypto world needs a stable coin. For instance, one can sum the value of the open sell orders to ascertain how much it would cost to instantaneously move the market. Perhaps a new auditor will step in and tackle the current anxiety. BZX , citing issues in its pricing model, saying that it will not allow ETFs to base the value of Bitcoin on a cryptocurrency exchange, which is vulnerable to manipulation:. And regulators are asleep at the wheel. No surprise, either, since it is offered by dozens of the absolute largest exchanges as well as myriad middle sized exchanges.

Controversy Surrounding Tether

But, the integration of global finance into crypto finance through the adoption of fiat currency-backed cryptocurrencies, custodian solutions offered by banks and strict financial regulations will not lead to an increase in correlation of the value between cryptocurrencies and conventional assets. One might question the very appearance of these transactions Are they contrived? In particular, increases in USDT trading volume have been linked to bitcoin volatility. Its fundamental objective is to facilitate transactions between cryptocurrency exchanges. The yellow bars indicate the measured frequency and the red and black markers indicate the hypothetical distribution. Performance is unpredictable and past performance is no guarantee of future performance. All of these stable coins have their own unique features, benefits and disadvantages. Counterexamples are phone numbers or Social Security numbers that are of a fixed length and assigned to fill a unique space; good examples include river lengths, town populations, number of Twitter followers, national GDPs, c orporate accounting statements, and especially financial transactions. Eventually losses steamroll, and the Ponzi schemer is quickly out of business. The highly correlated growth between Tether issuance and Bitcoin price raises several interesting questions - Is Bitcoin growth driving Tether? When are new Tethers created and what happens to the markets immediately after? Tether Banking Announcement. Add a comment Tether has in the past been a safe haven for buyers trying to avoid losses in bear markets, and its widespread availability and easy accessibility make it an important link between fiat and digital currencies. Crypto-based stablecoins are no better. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Since April of this year, Gemini has been working closely with Nasdaq to integrate market compliance and surveillance programs to appeal to regulators and to legitimize the cryptocurrency exchange market. It originally struggled to take off, like many other coins. All that crypto needs in order to win is for this to continue.

Tokens are issued by Tether Limited. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Rather, it will ease the process for institutional investors to commit to the cryptocurrency market and individual users, like merchants and casual users, to escape extreme volatility in the market to utilize decentralized financial networks. Content contained on or made available through the website and the report is not intended to and does not constitute legal or investment advice and no advisor-client relationship is formed. The highly correlated growth between Tether issuance and Bitcoin price raises several interesting questions - Is Bitcoin growth driving Tether? Bitfinex, which is also headquartered in Hong Kong, offers trading on hundreds of coins, dozens of which are paired with USDT. More than confirming that accounts of the proper amount do and have existed, the nature of those accounts and the service agreement between the banks and Tether should be divulged to show that these accounts exist solely for the benefit of Tether holders. By tying its value to US dollars, the idea is that traders can benefit from high-speed arbitrage opportunities without having to use slow wire transfers. The requirements of KYC, AML, and other laws ethereum conversion how to load a bitcoin in bitcoin free wallet for an exchange to pair crypto with stable fiat is simply too daunting for many exchanges and impossible for small ones. And the right garage makes all the how to exchange cryptocurrency in ny expanse news crypto. Your use of the information from this report is at your own risk. Cryptocurrency traders need stability. AnalysisEducation Tagged in: Most Read. Each Tether ethereum investing risks best tether usdt alternative is meant to be backed by reserves of traditional currencies held in accounts under the control of Tether Limited, the entity that runs Tether. This suggests that the creation of new Tether is tied to the Bitcoin price, in particular to adopt the alternative hypothesis that periods of dropping or stagnant prices raise the probability of new Tether being created. However, these coins hold some unique characteristics which have allowed its role in the cryptocurrency markets to grow exponentially in recent years. How the Con Works A stablecoin is a cryptocurrency whose value is pegged to an existing asset — potentially gold or some other commodity, but most commonly to a fiat currency like the US dollar.

They even give up the possibility of another run-up in the price of their crypto. The compatibility of GUSD and PAX with the Ethereum blockchain allows for the transfer of the two stablecoins through the Ethereum network with the existing infrastructure designed for tokens. Tether is designed to offer protection against the volatility commonly associated with cryptocurrency markets. Ads by Cointraffic. The information provided in this report is for informational purposes. Considering are there fees to use credit card on coinbase how much will litecoin be worth in 2019 scale of the operation it would be best to engage an organization of the highest reputation, such as one of the Big Four. In an attempt to answer the controversy chromebook bitcoin wallet tax docs for bitcoin it, Tether released an analysis of its bank accounts made by the law firm of a former FBI director in June. Image via Holy Transaction. Traders and investors are particularly interested in. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Because their value is stable in terms of dollars or their equivalent, they are attractive as units of account and stores of value.

Release a statement from Tether that this audit has been initiated and have the auditing firm confirm this. In particular, increases in USDT trading volume have been linked to bitcoin volatility. The first sample is created by taking all timestamped Tether issuances, rounding down to the hour, and then looking at the percentage price change in the past N hours. These protocols consist of open source software on Github that uses blockchain tech to issue and redeem these specific Tether coins. Among our requests and recommendations: In other words, it is not obvious that the model will scale, or that governments will let it. Given the extreme difficulty many exchanges have faced in maintaining banking relationships around the world this arrangement is quite attractive. What, then, are the benefits to holders of partially collateralized stablecoins? In an op-ed published in The Guardian , Barry Eichengreen, professor of economics and political science at the University of California, Berkeley, firmly stated that he believes stablecoins do not solve the stability issue in the cryptocurrency sector. It is by far the most popular stable coin and is quite liquid on a number of exchanges. Finally, the future of trading on Tether will be considered. One of us then will have traded a perfectly liquid dollar, supported by the full faith and credit of the U. Its fundamental objective is to facilitate transactions between cryptocurrency exchanges. Widespread adoption by so many exchanges is perhaps unsurprising. For over four years, Tether has always been at the center of controversy and has struggled to definitively prove its legitimacy through trusted third-party audits. Alternative stable coins now exist. Hauxley on February 27, As the volume of Tether continued to increase and more investors started to rely on USDT to hedge the value of their holdings to U. Tether was brought into the cryptocurrency market by the integration of Bitfinex , one of the leading cryptocurrency exchanges in the global market.

This suggests that the creation of new Tether is tied to the Bitcoin price, in particular to adopt the alternative hypothesis that periods of dropping or stagnant prices raise the probability of new Tether being created. This page will break down precisely what Tether is, including price, news, reviews and exchanges. Credit card Debit card. Another well-known economist and crypto naysayer, Nouriel Roubini, takes issue with how Tether props up the value of Bitcoin. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. Some critics argue that the company does not publish transparent or timely audits it is impossible to determine whether they have a 1: By signing up you can pick and choose your garage. Considering the scale of the operation it would be best to engage an organization of the highest reputation, such as one of the Big Four. Your money, meanwhile, is in the pockets of the scammers. Prices are significantly depressed from the overall distribution in the 12 hours preceding Tether issuance, down 0. They get to give up control of their hard-earned real money in exchange for tokens that at best return their deposit, while at worst they lose everything. The yellow bars indicate the measured frequency and the red and black markers indicate the hypothetical distribution. And in January it was launched as Tether by Bitfinex — one of the biggest behemoths in the crypto exchange business. Even if they did, cryptocurrency exchanges are so heavily regulated in most major markets that it is highly impractical for criminals to attempt to utilize cryptocurrencies to launder money with stablecoins.