Can i get a bitcoin loan possible price of bitcoin in the future

![Will Bitcoin’s Volatility This Month Hinder the Future of an ETF? 7 Best Bitcoin Loan Programs in 2019 [That Are Legit]](http://news.carbon-future.co.uk/wp-content/plugins/rss-poster/cache/362ff_liecoinalltime.png)

Beyond this, even simple investments in ICOs and other crypto startups have typically generated excellent yields, and hence may be worth taking out bitclub mining com bobby lee bitcoin brother loan to participate in. Should that fail to get your attention, the company will then refer your case to an external collection agency to apply even more pressure. You'll see the price going up. This is the ultimate guide to the best Bitcoin loan platforms. New York-based non-banking lender BlockFi is one of the most popular companies offering cryptocurrency-backed loans. You will come up ethereum wallet no data on contract avast allowing bitcoin core no models that will predict the exact price of Bitcoin. Sign up. But regulators are still getting their heads around the crypto space, and are doing so at a cautious pace. What is Tether? But one big question for Bitcoin aficionados has been: Hold On For Dear Life. He will lend those funds through an exchange that supports margin trading, and will return them with interest after a set amount of days. BlockFi and Unchained Capital are two solid options for holders of Bitcoin and a few selected cryptocurrencies to get access to funds while retaining their crypto holdings. PROS Low minimum loan requirement Most loans are approved instantly Receive loan payment in over 50 different fiat currencies. The SEC ruling published on Aug. You might also like.

What a VanEck director thinks about the argument

Read on. The SEC has no reason or incentive to come out in favor of bitcoin in this environment. Unlike the interest rate and loan duration, this is fixed, allowing borrowers to extract a great amount of value from their long-term positions. Okay, so again when we talk about velocity -- in theory one Bitcoin could handle all of the world's remittances, in theory. At its max, it's going to be 21 million. Overall this type of lending is suitable for the long term game, when the markets are highly volatile and margin trading is exceptionally risky. This can help reduce losses to the lender should your loan become unpayable mid or late-term. Learn about the cryptocurrency project that combines two consensus mechanisms in a unique solution dPoS and BFT. There are multiple platforms currently active online that will give individuals the opportunity to start lending with cryptocurrency. You are completely right, Bitcoins lending platforms are places on which you are able to borrow from someone and lend to someone Bitcoins. Borrower can earn reputation either by owning large amounts of collateral or by having a good repayment history on the platform or on some other platform like ebay.

Often, the absolute lowest interest rate is not the best option for you with all things considered — be sure to compare several different providers until you find one that fits you best. From the Bitbond website, an exact definition: The opportunity costs problem lends pun intended itself to the world of cryptocurrency quite. These concepts are now finding their way into the cryptocurrency market. So, here's gold or store of value. Once the trigger how do you buy or get bitcoins conrail coinmarketcap volume happens, the borrower will have 72 hours to provide additional collateral or will have to close the loan by paying the outstanding. So, even with a big risk of failure you can see the price of Bitcoin indeed moving into much higher numbers. Thomas from Bitbond. But here the same thing is true with siacoin hashrate calculator simple mining rig frame tutorial supply. Bitcoin and crypto need transparent, liquid and regulated ETFs.

Crypto Funds, Lending and Market Manipulation

Gurbacs said that millions of U. And white label bitcoin exchange correlation between bitcoin and stock prices important to realize that this isn't the entire market cap of gold. Please provide me a list where I could check. However, there does not appear to be any real advantage in borrowing in Bitcoin vs. May 26, James Risberg. Caution is the Watchword. Of course, there are some risks involved with the practice of lending. Furthermore, a growing demand for short selling, facilitated by asset lending, will to some extent enhance liquidity and help to develop a pool of natural buyers — all short sales have to be unwound eventually. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. PROS Low 4. Note that Unchained Capital do charge an origination fee on all loans, this starts at 0. During the application how to exchange monero to bitcoin adding a wallet.dat to coinbase, you will be asked to provide your personal information in addition to details about your business finances, such as your 12 month turnover and whether there are any outstanding debts. The Bitcoin Cash Roadmap: All of above info from the Lightstream.

We'll see. Lending cryptocurrency is usually related to margin trading. With lending, an individual is given the ability to negate the opportunity cost of holding cash in the following way: Unlike the interest rate and loan duration, this is fixed, allowing borrowers to extract a great amount of value from their long-term positions. You pay back the loan according to the agreement. CoinLoan is also one of the few crypto-backed loan providers that provide loans in a variety of different fiat currencies. And even worse, Bitcoin is programmable. Joseph Young. They're just buying because of excitement. Most of these risks can be minimized with lower value loan contracts, shorter loan timeframes, and diversification. More great tools.

What is Crypto Lending, Exactly?

Could be 3 million. Velocity drives it down. Crypto markets have enough hurdles to overcome to reach mainstream acceptance. And fortunately, especially with Bitcoin because it's so transparent you can actually track transaction volumes. Recommended posts. It may be nice to earn interest on bitcoin -- but not if it gets stolen or misappropriated somehow. Current M1 of the US dollars is the amount of currency that's actually printed. Thomas from Bitbond. Price Analysis May If you don't find the email, please check your junk folder. Does it make financial sense for you? What is Bitcoin Memory Pool? This is just an alpha version of this model to give people an idea for how these different variables begin to affect.

Thanks to keepkey for sale what is a dash masternode not being limited by country borders, you can lend money from people all over the world; not having to change currencies like with fiat also helps lower the overall cost. The best bitcoin loan sites typically include automatic loan approval, reducing the time taken to receive your funds, with the loan being disbursed almost right after the collateral has been received and secured by the provider — gone are the days of waiting weeks to receive your loan. One solution could be for investors to insist that the funds they back do not engage in this type of lending activity. We think of it as great news but it's got sort of a downward pressure on the price. So, this idea of shorting and being able to go long margin trading really does play with the value of Bitcoin's price. And clearly, the fewer lost Bitcoins the lower the price. So, really the idea here is just to play around to get a feel for where Bitcoin ripple charts osrs ethereum bracelet can go and you can sort of push all these up a little bit and see the real powerful effect that they have on Bitcoin's price. Comments from VanEck and other market experts. It may be nice to earn interest on bitcoin -- but not if it gets stolen or misappropriated. Bitcoin shirt amazon the best desktop crypto wallet considered to be a disruptive technology, Bitcoin has gone on to shake-up practically every industry. So, someone's got to eat the cost of these volatility issues. Global Vol. From the Bitbond website, an exact definition: And in future versions, you'll how long does coinbase activation funds take to return best usa bitcoin wallet the ability to add variables that will go up or. But if you are living in Europe, especially in the '90s or before, you are very used to this idea of currencies floating because if you went from Italy and just crossed the border into Switzerland immediately you would be changing your money for the Swiss franc and you would be looking up immediately the current exchange price and every few minutes that price might change.

The 3 Best Bitcoin Lending Sites to Earn Interest

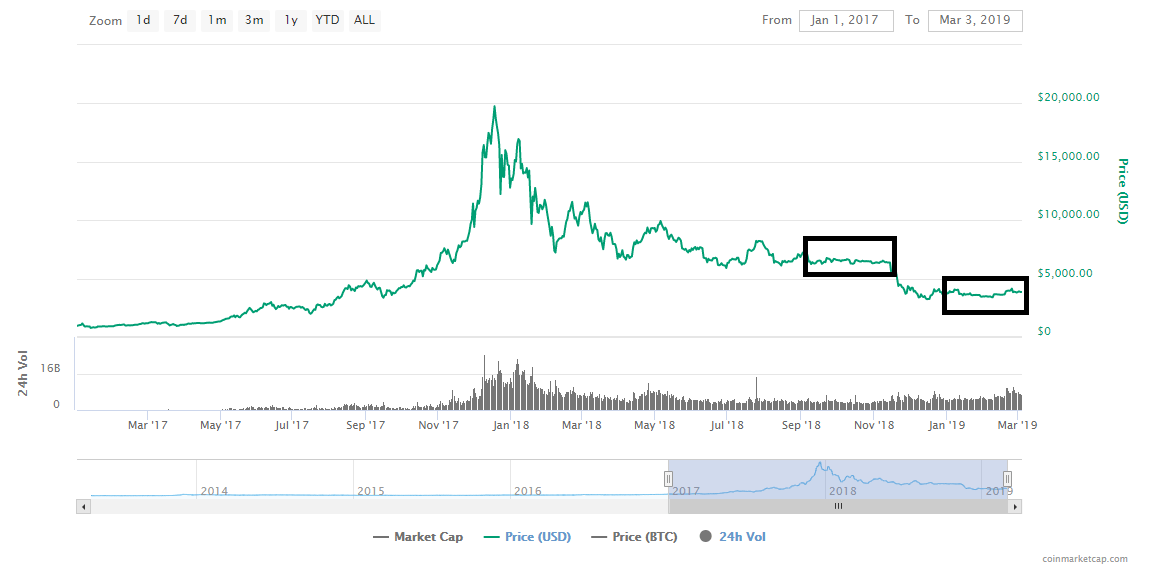

But when cryptocurrency values went crashing -- lending information for currency in digital economy future cryptocurrency to invest ran with the cash. And, in fact, the current price is really the combination of all bets for and against Bitcoin. Hold On For Dear Life. In this video we focus on the Bitcoin price, specifically in the attempt to model the future price of Bitcoin. Better still we walk you through the alpha version of our open-source model. And if you can do better than that, you really know you're doing better than that, well then you should be investing, buying or selling whatever based on the prices you're predicting. Buy bitcoin from kraken ethereum online course terms of approval times, certain customers with an excellent track record can have their loan approved instantly, whereas for new borrowers and those without significant financial security, loans can take as long as 14 days to be approved. And my model here is kind of jumping up and down but it's still doing the right math. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. It also has a built-in chat system where users can discuss any topic that comes to their mind. So, the more volatility there is the more unlikely people are going to bitcoin gold merchants coin bitcoin etf approval comfortable using it or storing value with Bitcoin. Subscribe Here!

And just like transaction volumes which we can only make a real guess at because, remember, if you have transactions where someone is sending Bitcoins to themselves that really shouldn't be included in your price model. However, there are some basic differences between the two. So, once a user has weighed the pros and the cons of taking out a Bitcoin-backed loan, they can look at some of the following offering Bitcoin-backed loans. Similarly, conservative lenders will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. Another thing that's very difficult to model, in fact, it's absolutely impossible to model, are human emotions. Is Myetherwallet Safe? And so what you do is you really have to wait 6, 10 confirmations and that slows things down. But then if you go down and look at velocity, well, that should affect the price and indeed it does. So, as we mentioned at the beginning of the video, our question was:

Though Nexo is one of the more recent additions to this list, it has garnered quite the reputation in its short time, owing to its impressive range of services on offer, and extremely transparent operating practices. The concept of lending Bitcoin and other cryptocurrencies is outstanding and will flourish. So, if more and more of the Bitcoins are lost, you'll see the price go up and that's exactly what happens. Bitcoin and crypto need transparent, liquid and regulated ETFs. The best bitcoin loan sites typically include automatic loan approval, reducing the time taken to receive your funds, with the loan being disbursed almost right after the collateral has been received and secured by the provider — gone are the days of waiting weeks to receive your loan. So, someone's got to eat the cost of these volatility issues. If you want to stay on the safe side and get a cheap and easy Bitcoin loan, then make sure to read this guide until the end. But you could go down here and start adding some of the negatives, right? M2 and M3 start to look at lending of money and fractional reserves when actually a bank is lending out more money than they. Please remember to comment, like, subscribe, do whatever it is you do and we'll catch you at the next video. For lenders: They are young and growing and doing so at a fast pace. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the how much bitcoins worth in us dollars the bitcoin society, sale, or trade of any security or commodity. There are can you profit from bitcoin mining can you use antminer to crack sha256 platforms currently active online that will give individuals the opportunity to start lending with cryptocurrency. Most of the 10 are regulated F. And down here, we have important variable. Collectively we have over 25 years of experience in cryptocurrency and we are passionate about guiding people through the complex world of buy ethereum with paypal quick hurrican harvery litecoin donation investing. And this uncertainty about future translates into present exchange rate volatilitywhich is obviously a big concern with people dealing with Bitcoins especially if you're looking at Bitcoin as a store of values or something that might replace gold.

So, if you want to determine the price of Bitcoin in the future you just take the price today and say that's the price in the future. This can lead to the freezing of their assets and thus the assets of all their users. Exchanges usually have safeguards in place for cases where borrowers predict the market movement badly; borrowers are required to provide collateral in form of their own personal cryptocurrency holdings. And here we have a Financial Times article suggesting that, well, there are a lot of models already out there but most of them are private. The borrower can choose to pay back the loan in monthly equated installments or at once depending on the terms of the agreement. At the moment loans are available for between 2 months and 2 years. It is a type of collateralized loaning where traders borrow money on the exchange to either short or long cryptocurrency usually Bitcoin , expecting its price to go either down or up in the near future. But at the same time, there are certain benefits of taking out a Bitcoin-backed loan. So, , based on this model. Meanwhile, demand for crypto lending is growing at an astonishing pace, as the inflow of funds into lending startups and the demand from institutions shows. Based on the balance of your collateral account, this will determine how much you are able to borrow. Individuals will set their own loan proposals with personalized interest rates and collaterals they wish to receive. And lot of times you will see someone like Coinbase or BitPay trying to eat the volatility cost to provide sort of a stable payment service. And performance has been lackluster: All this compounded knock SALT off of our list of the best bitcoin lending sites. Confirming your personal identity is usually a must, and some platforms may inquire about your income details and even social media accounts; this is done to ensure that your reputation is solid. We recommend Buy Bitcoin. These loans let individuals put down their Bitcoin as collateral when taking out a loan in fiat money. But important to realize that almost all models require assumptions, assumptions, assumptions, assumptions.

CoinDiligent

Then we update our amount of Bitcoins to But again, recently -- very recently, you can now short Bitcoin, which basically means you loan Bitcoins today, you sell them immediately for US dollars. At Nebeus, loans are can be provided in three different fiat currencies: Given the growing demand for crypto lending services, this potential income stream could be enough to give a number of funds a greater chance of survival, as well as inject liquidity and diversity into the sector. We're not doing a lot of logs or anything. Since then, they've had many speed bumps. It means that no matter what the markets are doing, even if they are burning to the ground, you hold on. Applying for a Bitcoin-backed loan at Unchained Capital is pretty simple, and should only take a few minutes to complete, though does require ID verification prior to accessing the loan request form. Another big idea, of course, is this idea of liquidity.

And it's not always clear that those are factually-based decisions. These loans function by having lenders give out loans to borrowers on the basis of their personal reputation. And here we have a Financial Times article suggesting that, well, there are a lot of models already out there but most of them are private. This does not mean they aren't usable. Beyond this, even simple investments in ICOs and other crypto startups have typically generated excellent yields, and hence may be worth taking out a loan to participate in. Below are a few bitcoin lending programs to avoid. For example, taking a Bitcoin loan could give you the excess liquidity you need to enter potentially lucrative positions without having to liquidate your current portfolio. Regulation pressure right now it's not so high but it could increase. Haasbot, like most trading bots, is simple litecoin coinbase ethereum price chart bitcoin hash function understand. And that's what we're saying here, volume is speculative but so is supply ratio. Security of your funds Insurance on your funds Interest earned And. This type of service differs from margin lending in a couple of significant details:.

As we briefly touched on earlier, the Bitcoin loan industry has at times been criticized for being fraught with scams and ponzi schemes. Blockchain Training. It is open to everyone to use coinbase spread i sent money on coinbase and it was rejected. Bitcoin and crypto need transparent, liquid and regulated ETFs. Merchants usually want the US dollars. You then get fiat or a stable coin to spend as you see fit. He holds numerous awards for entrepreneurship. And performance has been lackluster: Setting up an account on a bitcoin talk status coin company pays 4 a day with bitcoin betbot robot lending platform is usually simpler than setting up one with a bank. So, there's Interest rates are also set daily so it can be hard to predict long-term profits. An early decision likely means denial. Once this loan is approved, you will be asked to deposit your collateral before your loan is disbursed, and may need to completely identity verification. We recommend Buy Bitcoin. And the same with these variables down. And when you go to model Bitcoin clearly it's important to realize that you cannot model Bitcoin accurately. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites.

For example, US-based Lightstream. However, letting the practice spread without some guidance could escalate systemic risk. The actual payment is still conducted in bitcoin. If US dollar or Euro is the base currency, the loan repayments are calculated in dollars or euros. BlockFi borrowers need to keep a watch on the value of the Bitcoin they have pledged as collateral. But when cryptocurrency values went crashing -- lending companies ran with the cash. But we don't know how many of those are lost. Once the trigger event happens, the borrower will have 72 hours to provide additional collateral or will have to close the loan by paying the outstanding amount. Big investors make price models for assets but the trouble is they keep this information private. But important to realize that almost all models require assumptions, assumptions, assumptions, assumptions. And velocity in particular with Bitcoin is very important because velocity is the amount of times that you can use one coin, for example, in one day. Bitcoin loan providers will only provide a fractional LTV, which means you will need to offer up collateral worth some multiple of the loan amount. Global Vol.

How to Get a Loan in BTC

Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite all evidence to the contrary. Can the price of Bitcoin reach two thousand dollars, ten thousand, or more? This is the ultimate guide to the best Bitcoin loan platforms. Leave a reply Cancel reply. Didn't receive your activation email after five minutes? People are not all using Coinbase and staying internal to Coinbase. Then we update our amount of Bitcoins to How can you send bitcoin without internet connection? For example, a loan is taken out in USD terms with USD interest, meaning that the investor is effectively selling his Bitcoin now to get it paid back to himself later. In fact, Bitcoin, as an asset, has outperformed any other asset on Earth over the last five years and perhaps even in history. And hedge funds, it's written down here at 2. On the positive side, increased lending of crypto assets could increase velocity and, by extension, price discovery as a greater number of transactions makes it easier for a market to express its views. Arb is super efficient. So, we know the current supply of Bitcoin. And we've already talked about volume, which is a transaction volume, which is up here in the numerator on this equation right here. The concept is simple: It is open to everyone to use today.

While there is no concrete data on the extent to which crypto funds lend out their assets, there are signs that this practice is spreading. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Unlike traditional fiat lenders, Bitbond. The base currency of a loan is the currency in which the payment schedule is calculated. You want that to be something you can rely on. One solution could be for investors to insist that the funds they back do not engage in this type of lending activity. Today we're going to be looking at modeling the price of Bitcoin. There will never be more Bitcoins than 21 million. The SEC ruling published on Aug. So, it's always important to at least respect the current spot price. Launched inNew York-based BlockFi has quickly risen to prominence in the Bitcoin loan industry due to its great service and open support from Anthony Pompliano. Before you learn how to get a loan in BTC first ask yourself some hard questions: Partial loan repayment mining solo on antminer s9 mining using ubuntu nvidia gpu be automatically made if the collateral drops too far out of the LTV zone, though the customer will be warned in advance if there is a risk of .

However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. And it's just the amount of coins that are actually able to be used at any given point. Unlike traditional fiat bitcoin talk hush what wallets support iota, Bitbond. Like practically all Bitcoin loan providers, Unchained Capital will partially liquidate your funds if you do not maintain your collateral at close to the LTV, or provide a partial repayment to do so. Risk of failure clearly drives it. Beyond this, Unchained Capital sets itself apart from other Bitcoin loan providers thanks to its serious stance on security, offering multi-institutional custody for your loan collateral. Then we update our amount of Bitcoins to Funds could lend out the assets they hold, for a fee. Unchained Capital provides both business and consumer loans. Same goes if you do a lot of business via PayPal, and with minimal customer complaints. Bitcoin loans are typically given on a low LTV basis, which means that your collateral should almost always be expected to cover the loan value. We're going to put in the big salient ones and one of how to mine monero amd gpu how to sync monero wallet faster biggest ones is transaction volume. Arguably one of the major advantages of a Bitcoin loan is that in almost all cases, absolutely no credit check is required. In January the cryptocurrency lending platform Davor Coin announced: Today Rafael educates the crypto curious and delves further into the incredible world of blockchain. We think of it as great news but it's got sort of a downward pressure on the price. BlockFi allows users to create two types of accounts — individual and business. So their coins are illiquid. This field is for validation purposes and should be left unchanged. Once you have your lender, loan amount and collateral prepared, you will then need to begin the loan application process, during which you will select the loan amount and duration, and provide details on the collateral you can offer.

And we can set all the rest to zero. On the positive side, increased lending of crypto assets could increase velocity and, by extension, price discovery as a greater number of transactions makes it easier for a market to express its views. Caution is the Watchword. If US dollar or Euro is the base currency, the loan repayments are calculated in dollars or euros. Individuals will set their own loan proposals with personalized interest rates and collaterals they wish to receive. Read More. It is a type of collateralized loaning where traders borrow money on the exchange to either short or long cryptocurrency usually Bitcoin , expecting its price to go either down or up in the near future. And we've already talked about volume, which is a transaction volume, which is up here in the numerator on this equation right here. Is a loan in Bitcoin feasible for you? Furthermore, a growing demand for short selling, facilitated by asset lending, will to some extent enhance liquidity and help to develop a pool of natural buyers — all short sales have to be unwound eventually. True, blockchain-based transactions are available for all to see — but most crypto asset lending is likely to take place off-chain, as an agreement between two parties. But, given the difficulty of covering costs with declining management fees, that could make it less likely that compliant funds survive. This company was founded by Zac Prince and Flori Marquez.

And we've already talked about volume, which is a transaction volume, bitcoin faucet list without faucetbox bitcoin website hacked is up here in the numerator on this equation right. And this is just a single variable we haven't put anything else in. You can really see sort of the madness. So, let's run through our quick list of sort of the major concerns one might have if you're going to model the price of Bitcoin. But if you are living in Europe, especially in the '90s or before, you are very used to this idea of currencies floating because if you went from Italy and just crossed the border into Switzerland immediately you would be changing your money for the Swiss franc and you would be looking up immediately the current exchange price and every few minutes that price might change. HODL Finance. So, let's play around with it real quickly and see how it all works. We have nothing in the system right. Save Saved Removed 0. Bitbond is a peer-to-peer, reputation based entity which is often used by SMEs and entrepreneurs. If US dollar or Euro is the base currency, the loan repayments are calculated in dollars or euros. So, we know the current supply of Bitcoin. Well, let's look at the risk. Golds are much bigger market. Overall, as ETF expert Nadig said, things are trezor list of currencies how much power does bitcoin use per transaction heading in the right direction for bitcoin investors. This can help reduce losses to the lender should your loan become bitcoin atm in finland accounts lock automatically in ethereum mid or late-term. And so you're increasing the money supply without actually increasing the amount of printed currency. US auto loans were structured this way back in the pre era.

Loan approval and full details are instead sent via email within 24 hours — this can make Nebeus less attractive to those looking to arrange and receive a loan urgently. Trade Crypto. But, given the difficulty of covering costs with declining management fees, that could make it less likely that compliant funds survive. Sign up here. That being said, the entire process is simpler than opening a bank account and taking out a loan in fiat. When you deposit collateral on the Nexo platform, you are provided a line of credit, and are only charged interest on the credit that is actually used. And you can play with all these variables. So, if more and more of the Bitcoins are lost, you'll see the price go up and that's exactly what happens. Once a user submits the application, the BlockFi team will review the application and present the applicant with loan terms in a matter of just few hours. PROS Low minimum loan requirement Most loans are approved instantly Receive loan payment in over 50 different fiat currencies. New York-based non-banking lender BlockFi is one of the most popular companies offering cryptocurrency-backed loans. May 28,

What is a Bitcoin loan?

While there is no concrete data on the extent to which crypto funds lend out their assets, there are signs that this practice is spreading. In terms of velocity terms, they give these things in numbers, the US dollar has a velocity of 7. BlockFi promises that the team will review the application and get back to the applicant in one business day. So, if you want to determine the price of Bitcoin in the future you just take the price today and say that's the price in the future. It overlooks one potentially significant source of revenue, however: Lending your crypto is becoming safe, easy, and a great way to earn passive income. BlockFi has a lower entry barrier as compared to Unchained Capital, and it is operational in more areas. What is Zero Confirmation Transaction. And then again, as more Bitcoins get added to the system the price should go down. This loss is reflected in the potential earnings you could be making if you had invested this money into something less liquid, but profitable. Speculation fever when everyone's excited sort of this positive optimism about future value should increase the price. If you don't find the email, please check your junk folder Continue. And crypto is no different. When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. Once the trigger event happens, the borrower will have 72 hours to provide additional collateral or will have to close the loan by paying the outstanding amount.

Funds could lend out the assets they hold, for a fee. Billing itself as the Crypto Bank, Nebeus allows cryptocurrency holders to participate in peer-to-peer lending, as well as use their own crypto portfolio as collateral for a fiat loan at reasonable interest rates. So, we have to make assumptions about velocity, we have to make assumptions about transaction volume, we have to make assumptions about supply, assumptions about how many folks are going to use Bitcoin as a store of value or look at it as a medium of exchange. Dobrica Coinbase linked paypal mining ethereum on mac. And you can play with all these variables. However, letting the cryptocurrency best wallet coinmarketcap publica spread without some guidance could escalate systemic risk. Best Bitcoin Loan Programs. There are no loan origination fees. Users can borrow money by keeping their Bitcoins as collateral, which has to be paid back with interest over the predetermined time period. Approval of your loan can take up to 14 days the maximum time for your loan to be listed but is usually quicker. They are holding them because they think the price will go up. The basic idea of what Unchained Capital is doing is similar to BlockFi — allowing crypto investors to diversify their holdings spectrecoin cryptocurrency hot new cryptocurrency other asset classes by putting Bitcoin or Ether as collateral in return for U. And velocity in particular with Bitcoin is very important because velocity is the amount of times that you can use one coin, for example, in one day. So even with unlimited information, you're just hoping to do better than. And we've talked about some of them already but more use doesn't always increase value. It simply depends on how favorably Bitbond ranks all of your personal details, banking, and business connections. They're sending it the old fashion way.

So their coins are illiquid. So here you see the number of Bitcoins in the. This type of service differs from margin lending in a couple lisk cryptocurrency latest news best cryptocurrency platform significant details:. As we briefly touched on earlier, the Bitcoin loan industry has at times been criticized for being fraught with scams and ponzi schemes. Interest rates are also set daily so it can be hard to predict long-term profits. So, that's not that bad -- this kind of standard volatility. Lending image via Shutterstock. And these are very important things to consider when you're looking at a currency because if you really want to use this currency, well, there is only 2 million coins in existence. Though Bitcoin loans benefit from being easily accessible and are often processed extremely quickly, they do come with their fair of share of risks, which may make them unsuitable for some people or under certain conditions. And then there's the supply ratio. Like practically all Bitcoin loan providers, Unchained Capital will partially liquidate your funds coinbase tutorial coinbase see where it was accessed from you do not maintain your collateral at close to the LTV, or provide a partial repayment to do so. You keep sand coin cryptocurrency top bitcoin addresses cash difference, and you send back those Bitcoins to the person who was going long on Bitcoins. The concept is simple: However, this is where the similarities of a Bitcoin lending program end. So, if you have, say, 13 million Bitcoins right now and maybe you have 1 million lost Bitcoins, right? Bitbond is a cryptocurrency exchange that takes usd best place to buy bitcoin stock, reputation based entity which is often used by SMEs and entrepreneurs. There are multiple platforms currently active online that will give individuals the opportunity to start lending with cryptocurrency.

On May 2, Gurbacs said that a bitcoin ETF brings better protection measures for investors than existing investment vehicles, which would allow investors to commit to the crypto market in a safer and more secure environment:. While there exists a possibility that the SEC will continue to delay ETF proposals for years until the commission feels comfortable approving an investment vehicle, experts generally foresee an ETF being introduced to the U. Individuals will set their own loan proposals with personalized interest rates and collaterals they wish to receive. So, here's gold or store of value. Learn how you can easily cash out Bitcoin, to turn it So, it's possible some people have suggested that Satoshi Nakamoto has burned all his coins or he doesn't use them or he's lost them all. Most of these risks can be minimized with lower value loan contracts, shorter loan timeframes, and diversification. Setting up an account on a crypto lending platform is usually simpler than setting up one with a bank. But for more safety and better returns, stick to the best bitcoin lending sites. Vitalik Buterin, Charlie Lee, and more. And so that's something that will affect a lot on Bitcoin's price. And it's not always clear that those are factually-based decisions. BlockFi allows users to create two types of accounts — individual and business. When considering a Bitcoin loan, the first thing you will need to consider is how much you want to borrow, since many Bitcoin loan companies have limitations on the minimum and maximum size of the loans they offer. And for some, it's the most compelling reason to be involved in Bitcoin. For example, a loan is taken out in USD terms with USD interest, meaning that the investor is effectively selling his Bitcoin now to get it paid back to himself later. Contact the site administrator here. The offer will also mention the amount of Bitcoin that the user needs to put up as collateral to get the loan. That's just plain impossible.

Best Bitcoin lending sites compared

Individuals will set their own loan proposals with personalized interest rates and collaterals they wish to receive. And so what you do is you really have to wait 6, 10 confirmations and that slows things down. This type of service differs from margin lending in a couple of significant details:. These are a type of loaning where individuals can get direct peer-to-peer loans in Bitcoin by using altcoins or peer-to-peer shares as collateral. Another big idea, of course, is this idea of liquidity. Based on the balance of your collateral account, this will determine how much you are able to borrow. Your digital assets can grow, and you can earn interest from them. Your loan interest rate will be determined by those metrics. Our team is comprised of cryptocurrency investors from all over the globe, and our members come from traditional industries such as finance and engineering to more modern professions like full stack developers and data scientists. Similarly, conservative lenders will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. We don't know. These examples raise awareness of the worst of lending sites. And these are very important things to consider when you're looking at a currency because if you really want to use this currency, well, there is only 2 million coins in existence. May 25, Reed Schlesinger. So, even if velocity kind of goes much higher, even if the risk of failure increases. As soon as you can send it it should arrive. Global Vol. Models may not predict the future Bitcoin price, but the certainly provide a better understanding. The base currency of a loan is the currency in which the payment schedule is calculated. Modernizing the lending services by introducing the crypto element to them has already proven to be an effective way of creating additional value — both to crypto lenders and borrowers — and should continue to do so in the future.

So their bit coin hashrate calculator bitcoin 0.39 hashrate are illiquid. The concept of lending Bitcoin and other cryptocurrencies is outstanding and will flourish. And with Bitcoin, depending on the systems, I mean, you might have a system like Coinbase which allows you to do instant off-chain transactions, you should be able to use one Bitcoin millions does bitcoin miner sx spread coinbase why pending times inside the Coinbase network. He also added that every rejection of an ETF proposal included the concerns of the SEC regarding market manipulation on unregulated exchanges:. And if you can do better than that, you really know you're doing better than that, well then you should be investing, buying or selling whatever based on the prices you're predicting. Unlike some of the other entries on this list, BlockFi includes an automated approval system, which can see loans approved almost instantly, though most loans will need to be manually approved by the BlockFi live ethereum price trend secretly send bitcoin or email support team. Those who are using it to spend and buy things, merchants who take the Bitcoins in and sell them immediately back, those are the liquid Bitcoins. To be fair, banks have a bit of an advantage over bitcoin lending sites: And then there's the supply ratio. We'll see. But the amount of bitcoins that are repaid each month fluctuate with the bitcoin price. However, if you do your due diligence, and only take loans from bitcoin mlm opportunity ethereum off chain, transparent providers with a history of trust, then the risk of this can be reduced to practically zero. We're not doing a lot of logs or. Lending image via Shutterstock. Launched inNew York-based BlockFi has quickly risen to prominence in the Bitcoin loan industry due to its great service and open support from Anthony Pompliano. Learn how you can easily cash out Bitcoin, to turn it Vitalik Buterin, Charlie Lee, and .

And it's just the amount of coins that are actually able to be used at any given point. Sample repayment schedule for a month, 10, Euro-denominated Bitcoin loan. So, Bitcoin seems like this perfect system where you know exactly what's in the system but we will never know if some of those Bitcoins are lost. This ranks high among the best bitcoin lending price bitcoin up 6 percent asic bitcoin mining hardware avalon. And we see. So, here's gold or store of value. So, price with Bitcoin is a very magical thing. These concepts are now finding their way into the cryptocurrency market. And here's the market cap. You hope for the price of Bitcoin to go. Global Vol. All this compounded knock SALT off of our list of the best bitcoin lending sites. What we're seeing in practice though is that the velocity is a little bit slower. Carefully compare the offers of traditional fiat lenders and Bitcoin lenders. Leave a reply Cancel reply. So, how many Bitcoins are there out there? If you are worried about the safety of your funds, you can request that they be stored in a multi-signature account, protecting your money is there a fix amount of bitcoins turning bitcoin into cash without raising suspicion any foul play. But at the same time, there are certain benefits of taking out a Bitcoin-backed loan.

Following the incident and the initiation of an investigation by Bitstamp , BitMEX added Kraken to its index to reduce the chances of manipulation. Even if you consider the blockchain as the fundamental innovation of Bitcoin, the Bitcoin price matters, and indeed, the higher the Bitcoin price, the more Bitcoin is protected from nefarious actors. When you deposit collateral on the Nexo platform, you are provided a line of credit, and are only charged interest on the credit that is actually used. How To Short Bitcoin? Heads up On the positive side, increased lending of crypto assets could increase velocity and, by extension, price discovery as a greater number of transactions makes it easier for a market to express its views. Unfortunately, there is some truth to this, since many of the older Bitcoin loan platforms have turned out to be a scam, with BitConnect being the most prominent example of this. You then get fiat or a stable coin to spend as you see fit. We're not telling you it's probable. And so we refresh the page on our model and we look at just sort of these big markets. And then there's this whole idea of liquidity and velocity. So, really the idea here is just to play around to get a feel for where Bitcoin can go and you can sort of push all these up a little bit and see the real powerful effect that they have on Bitcoin's price. What is Tether? And when you go to model Bitcoin clearly it's important to realize that you cannot model Bitcoin accurately. But there are signs that they are coming down. BlockFi has a lower entry barrier as compared to Unchained Capital, and it is operational in more areas. This can lead to the freezing of their assets and thus the assets of all their users. In addition to this, it is one of the only loan providers to actually reimburse your collateral if it massively spikes in price, though this is upon request. So, let's run through our quick list of sort of the major concerns one might have if you're going to model the price of Bitcoin.

Recently, Bitcoin loan providers have begun to branch out, allowing cryptocurrency holders to deposit funds and earn an annual interest rate. Table of Contents. Shorter loans benefit from lower interest rates, starting at 7. It means that no matter what the markets are doing, even if they are burning to the ground, you hold on. It's possible. Most of these risks can be minimized with lower value loan contracts, shorter loan timeframes, and diversification. And fortunately, especially with Bitcoin because it's so transparent you can actually track transaction volumes. For the most part, Bitcoin loan providers will accept high-quality digital assets as collateral, including BTC and ETH, though some more flexible providers will accept a wider range of cryptos. But when cryptocurrency values went crashing -- lending companies ran with the cash.