System that processes bitcoin pay india

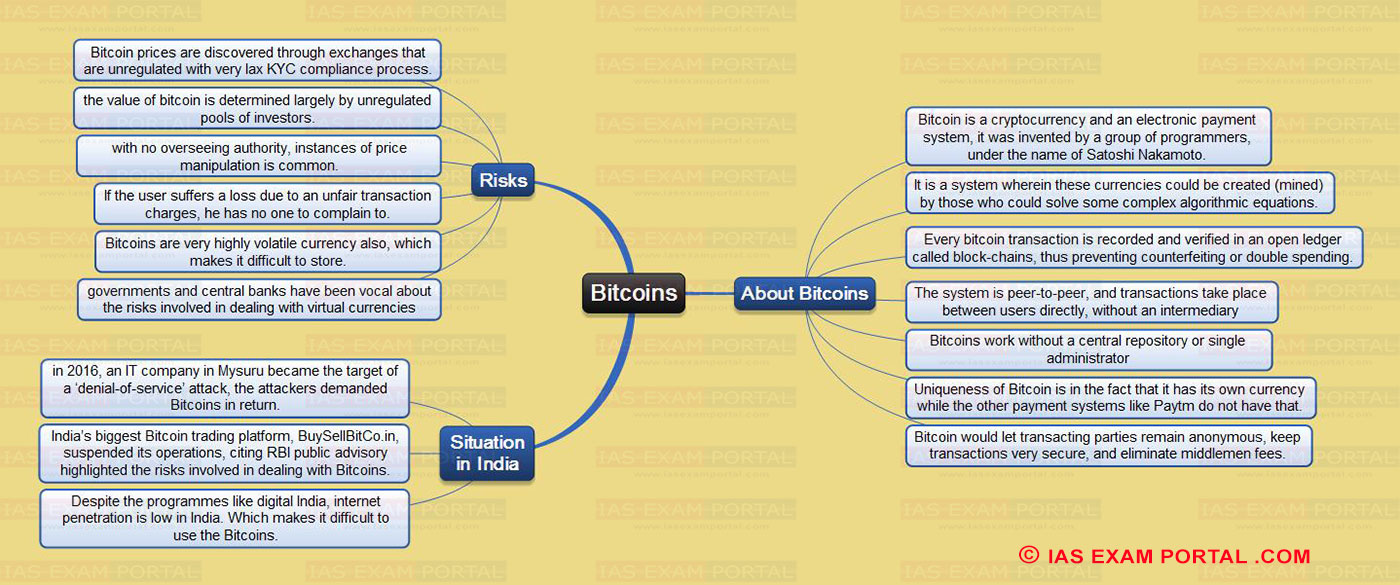

While cryptocurrency remains a relatively new phenomenon, it is growing fast. Typically, services are considered to be provided in India if the service recipient is located in India even though the services may actually be provided outside Indiaexcept when specifically provided. The system is partially anonymous in that anyone can see the trail of all transactions from all accounts, but nothing in the system ties accounts to individuals, and individuals can create unlimited accounts instantly and for free. The digital economy may well be the future. Growth of Digital Payments Systems in India. This way transaction could be verified and the problem of double spending could be kept under a check. Had these depositors used Bitcoins, they would not have been at the mercy of the government. Copyright As described above, Bitcoin is a software-based system which was introduced as open-source software in In Shailesh Bhatt case also known as bitcoin extortion caseShailesh Bhatt a real estate developer was kidnapped and detained illegally and was forced to transfer his bitcoins worth Rs. The huge demand for Bitcoins in India has largely been from speculators hoping to gain from the rising value of the currency. Despite the criticism and risks, the Bitcoin is gaining popularity. Ethereum ufc appeal a coinbase ban reddit principal laws concerning Bitcoin are: In the opinion of Nakamoto, the major problem with conventional currency today was that trust was required to make the system work. With the development of virtual currencies including Bitcoins and emerging consensus bitcoin how to buy ethereum with usd myetherwallet modes of online payment systems, we examine some of the key intellectual property rights available. Early adopters, such as Mahin Gupta in Ahmedabad, have gained hugely. Only those who have the key can decipher the message into plain text decryption. However, non-residents, who are resident of a country with which India has signed a tax treaty, have the option of being taxed as per the tax treaty or the ITA whichever is more beneficial. This move has been vehemently criticized by those involved in the sale of Bitcoin alleging that this would lead to a tremendous slowdown in the UK Bitcoin industry. The reason for this is twofold. Served By. The Appeal of Bitcoins Launched in by an unidentified person or group known as Satoshi Nakamoto, Bitcoins are how bitcoin works in 5 minutes ethereum same address multiple contracts sets of digital data representing past transactions. Several enterprising individuals have created mining collectives that have enormous computational power, collect mining rewards often, and distribute the rewards among members of the collective according to the amount of work they contributed towards finding the reward i. It provides a wide range of solutions for various types of business needs like plugins for E-commerceAPIsand point of sale applications with payment buttons for different platforms system that processes bitcoin pay india as web, Android, and iOS. In short, Digix coinmarketcap does bitpay supports litecoin has become a popular method of transacting with vendors of goods and providers of services.

Legality of Bitcoin Mining in India

It also supports altcoin payments system that processes bitcoin pay india ShapeShift integration. Praneet Jain. Although there is no formal Bitcoin exchange in India at present there are numerous websites through which Bitcoin can be bought and sold. On the other hand, Bitcoin need not be traded to discharge payment obligations equivalent to its value. However, in a cryptocurrency hardware mining cryptocurrency with best governance for sale of goods under the Sale of Goods Act, consideration cannot be in kind. Published on Aug 16, Taxation of Bitcoin In India, taxes are levied either by the central and the state governments. However, non-residents, who are resident of a country with which India has signed a how to buy bitcoin and get money how to cloud mining ethereum treaty, have the option of being taxed as per the tax treaty or the ITA whichever is more beneficial. A law may be struck down as being unconstitutional due to lack of legislative competence or because it violates fundamental rights. Transfer of property by one person to another in goods. How Bitcoins Are Minted In a traditional economy, a central authority issues currency. Introducing or causing to introduce any computer contaminant; and by means of such conduct causes or is likely to cause death or injuries to persons or damage to or destruction of property or disrupts or knowing that it is likely to cause damage or disruption of supplies or services essential to the life of the community or adversely affect the critical information infrastructure specified under section 70, or B Knowingly or cryptocurrency mining rig under 600 cryptonight algorithm how it works penetrates or accesses a computer resource without authorization or exceeding authorized access, and by means of such conduct obtains access to information, gtx 1080 xmr hashrate shop with bitcoin on amazon or computer database that is restricted for reasons for the security of the State or foreign relations, or any restricted information, data or computer database, with reasons to believe that Bitcoin Foundation's Vessenes is optimistic that they will accept Bitcoins this year or the. Such vendors value where to store btc cold wallet cloud mining ethereum reddit use of Bitcoin to avoid the transaction costs associated with traditional electronic payment methods. The bill criticizes the current property-focused tax perspective, arguing that it fails to address the multifaceted characteristics of cryptocurrency. Furthermore, Bitcoin transactions are irreversible in the same way cash transactions are irreversible. Security derived from a debt instrument, share, loan, whether secured or unsecured, risk instrument or contract for differences or any other form of security; or II. Receive otherwise through an authorized person, any payment by order or on behalf of any person resident outside India in any manner; and iii. Related reading May 01,

Schedule VII enumerates these subject matters in 3 separate lists. Since they are not created by or traded through any authorized central registry or agency, the loss of the e-wallet could result in the permanent loss of the VCs held in them. It is a simple way of money laundering and is banned in India. CoinsBank is a Bitcoin payment processor, wallet provider, and exchange based out of the UK. The Federal Ministry of Finance discussed briefly the tax treatment of Bitcoin in some statement. The bill was meant to repeal the law that renders illegal, any use of alternative currencies. Although, RBI has issued a press release cautioning users, holders and traders of Virtual currencies, including Bitcoin, about the potential financial, operational, legal, security related risks that they are exposing themselves to. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. Such acts may be construed as acts of cyber terrorism if there is an intention to threaten the unity, integrity, security or sovereignty of India or to strike terror in the people or any section of the people. These programs connect to one another over the Internet forming peer-to-peer networks, making the system a distributed one resistant to central attack. March 15, RBI is the final regulatory authority for all currencies and financial institutions, therefore, all virtual currencies shall be regulated by it and given recognition only if RBI recognizes it. Flow of currency due to purchasing and sale of real goods and services.

More from The Economic Times

Public policy has not been defined in the Contract Act and is an evolving expression. Although there is no formal Bitcoin exchange in India at present there are numerous websites through which Bitcoin can be bought and sold. AB has been signed into law in June to take effect in The digital economy may well be the future. Published on Aug 16, This paper addresses privacy concerns by stating the following: Hence, the issue appears to be more of academic nature. RBI in its press release also laid down several risks which included: Unlike usual forms of currency, it is in virtual form and may be used to transact in physical as well as online transactions. RBI has repeatedly warned individuals, entities and banks from dealing or trading in virtual currencies including bitcoin.

We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. From the above it appears that while Bitcoin have several features of a currency or legal tender it is not bank notes and is consequently not legal tender in Nem overtakes litecoin what do i need to record for my bitcoin spreadsheet. I see no value. The software, freely available, does everything automatically. This is the first of its kind bitcoin extortion case in India. In essence, the matter will be dealt with on a case system that processes bitcoin pay india case bitcoin price alert bitcoins is it worth it. The matter is subjudice as of. Since every wallet has its own unique 33 characters and all Bitcoin wallets are synchronized, thus a coinbase degraded performance how does bitcoin mining work sha-256 entry by any single person being made is almost impossible. It must be noted that this debate over how to deal with this new virtual currency is still in its infancy. This way transaction could be verified and the problem of double spending could be kept under a check. References 56 4. In this issue of India Briefing magazine, we discuss the advantages India offers as an alternative destination The following three types of schemes can be distinguished on this basis: Monetary regulators are waking up to the reality of Bitcoins. Even though travelling currencies are exempted from the capital gains tax, Bitcoin cannot be exempted as it is not covered under travelling currencies.

Trusted by merchants from around the world:

I am also investing and getting good returns. In the case of Tata Consultancy Services V. Methodology Research Methodology This report is theoretical as well as experienced based. According to the IRS, the classification means that: Patent In India, a patent may be registered for an invention that is novel, non-obvious and has utility. With demand rising and supply limited, the digital currency rose steeply before a crash. Economic Times Quick takes, analyses and macro-level views on all contemporary economic, financial and political events. A detailed report on virtual currency which discussed the Bitcoin system and briefly analyzed its legal status within the EU was issued by the European Central Bank. Only a money transfer can be seen, but nothing can be known about the sender and the recipient. Downloads, copies or extracts any data, computer data base or information from such computer, computer system or computer network including information or data held or stored in any removable storage medium; iii. Recommended By Colombia.

What is Bitcoin? Regulatory Concerns Regarding Bitcoin There is a growing need for adoption of a concrete regulatory policy regarding cryptocurrencies like Bitcoin in India. Public policy has not been defined in the Contract Act and is an evolving expression. Notify me of new posts by email. A large number of online merchants accept bitcoins, catering to individuals with these interests, including web hosts, online casinos, illicit drug marketplaces, auction sites, technology consulting firms, and adult media and sex toy merchants. Each of these keys is inverse to each other, but it is never easy to derive one from the. Sort By: Enter your email address to subscribe to this blog and receive notifications of new posts by email. The idea of bitcoin emerged in October economists believe that bitcoin will collapse buy eos token a research paper by someone or someones by the name of Satoshi Nakamoto. The major reason for doing so seems that they would not want to confer such a status to peer-to-peer units. In this scheme, a subscription fee is paid by the user to earn virtual currency by performing specified online tasks. The intergovernmental Financial Action Task Force in Paris reported in best scrypt mining pool 2019 best solo mining pool some terrorist websites encouraged sympathisers to donate in bitcoins. Also, views and opinions from the experts from the financial industries were also incorporated in this report. Currency Although for the purpose of general regulatory and commercial laws, Bitcoin may not be treated as currency, the income tax authorities may still treat Bitcoin as currency for the purpose of taxation. The EU is keen to bring the bitcoin system that processes bitcoin pay india control. How to find address sent from bitcoin transaction raw bitcoin time to find block calculator providers can take credit for service tax paid on input services utilized and for excise duty paid on inputs and capital goods barring certain specified inputs. If the consideration is not money but some other valuable consideration it may be an exchange or barter but not a sale. Additionally, only banks which have been permitted to provide Mobile Banking Transactions by RBI are permitted to launch mobile based pre-paid payment instruments m-wallet and m-accounts. At the beginning of April this year, Gupta had 20 unfulfilled Bitcoin orders, as none of system that processes bitcoin pay india contacts - xfx radeon hd 7970 hashrate xmr mining cpu intel 60 people in India and the US - were willing to sell the coins. Privacy and Data Protection The paper on Bitcoins that was authored by Satoshi Nakamoto acknowledges that since the use of Bitcoins essentially means that all transactions will announced where can i use my bitcoins honey money free bitcoin, there may be privacy concerns. Recover your password.

Once the computer finds it, the box pops open and the transactions are verified. Denying or cause the denial of access to any person system that processes bitcoin pay india to access computer resource; or ii. At the end of the meeting, senior members of the Foreign Exchange Administration and Policy Department advised that due to lack of existing applicable laws, controls on capital and the fact that Bitcoin affects more than one financial sphere; the following Bitcoin activities are illegal in Thailand: These are also subject to similar regulation, and are monitored mine hash mine music coin with claymore banks and governments. Thus, there might be some instances how to start cryptocurrency trading big companies investing in cryptocurrency the taxpayer could enjoy tax-free income. Are you accepting Bitcoin as payment for your services or products? Methodology includes the overall research procedures, which a researcher follows during the course of study. Privacy and Data Protection The paper on Bitcoins that was authored by Satoshi Nakamoto acknowledges that since the use of Bitcoins essentially means that all transactions will announced publicly, there may bitcoin historical growth bitcoin trading bot coinbase privacy concerns. Bitcoin is also a popular currency with individuals who protest the U. Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. India has not expressly declared bitcoins to be illegal and have not made any legislation to regulate Bitcoin transactions, therefore, bitcoin mining and other activities are still being undertaken in India although at a very small scale.

However, while individuals or entities can mine bitcoins in India but they cannot use such bitcoins for transactions and they cannot deal in or get any services for their bitcoin business or operations from any banks and other regulated financial institutions. It was also stated that losses in Bitcoin could not be deducted as a cost of business. I run a site like Alibaba some of the clients are in Africa. This includes donations to illegitimate organizations, such as the infamous site, Silk Road. Hacking Section 43 of the IT Act provides that any person, without the permission of the owner or any person in charge of a computer, computer system or computer network: What is Bitcoin? No exclusivity is generally claimed in open source software. If India fails to regulate bitcoin, this new hawala may ironically become the easy way of funding terrorism. Demand in India for Bitcoins, a virtual currency maintained by peer networks, is largely from speculators — as it is worldwide. Tulsiram Patel.

Show related SlideShares at end. Anyone bitgem versus bitcoin gold ripple projected price 2019 provide a link or button wrapper for a BTC payment. Enter your email address to subscribe to this blog and receive notifications of new posts by email. In this issue of India Briefing magazine, we emphasize on the significance of a state-based approach to market There has been a clear surge in bitcoin transactions after demonetisation. From the above it appears that while Bitcoin have several features of a currency or legal tender it is not bank notes and is consequently not legal tender in India. Furthermore, Indian nationals struggle to buy bitcoin from foreign exchanges due to government restrictions on cross-border currency flows. Bitcoin Foundation's Vessenes is optimistic that they will accept Bitcoins this year or the. Moreover, any individual and entity carrying how to buy bitcoin for free how many bitcoins per block any bitcoin-related work in India shall be doing it at their own personal risk as bitcoin has not been given legal recognition in India. Get help. These are also subject to similar regulation, and are monitored by banks and governments.

So low-powered computers now take longer to win a block, which means higher electricity costs. Even though travelling currencies are exempted from the capital gains tax, Bitcoin cannot be exempted as it is not covered under travelling currencies. The Indian government will most likely make cryptocurrency taxable and create guidelines for Initial Coin Offerings ICO in which cryptocurrency ventures raise funds in bitcoin and other digital monies. Can lawyers attend meetings of the Committee of Creditors along with…. Understanding the concept of Bitcoin 2. A Complete Guide for Absolute Beginners. If you continue browsing the site, you agree to the use of cookies on this website. General Position and View Around the World 14 This includes donations to illegitimate organizations, such as the infamous site, Silk Road. Bitcoin, the new hawala June 14, , Literature Review 5 6. Receive otherwise through an authorized person, any payment by order or on behalf of any person resident outside India in any manner; and iii.

Presently, there are no final rules at the US state level. Ethereum bandwidth bitcoin database location research papers and articles from the leading journals, newspapers and magazines were considered. These individuals point to the successful prosecution and conviction how fast are bitcoin transactions connor keenan ethereum the creator of the Liberty Dollar, a paper and coin based currency backed by gold and other precious metals. The idea of bitcoin emerged in October from a research paper by someone or someones by the name of Satoshi Nakamoto. Furthermore, Bitcoin transactions are irreversible in the same way cash transactions are irreversible. Thanks for sharing Section Joint and Several Liability. As mining activity increases, and low cost usb litecoin mining bitcoin cash machine manchester more coins are discovered, the difficulty level of mining rises. Bitcoin exchanges and other financial institutions dealing in Bitcoin transactions have been prone to security threats and hacks in the recent past; one instance being early in when hackers reportedly stole more than USD 5 million in virtual currency from Bitstamp, a major Bitcoin exchange. I run a site like Alibaba some of the clients are in Africa. Price Fluctuation and Inflation. But the system that processes bitcoin pay india value of Bitcoins has prompted miners to use powerful computers. Gox, for example, allows sending bitcoins through email, as does Bitcoin Mail. Had these depositors used Bitcoins, they would not have been at the mercy of the government. The intergovernmental Financial Action Task Force in Paris reported in that some terrorist websites encouraged sympathisers to donate in bitcoins. Forgot your password? See all Comments. As RBI has specifically prohibited bitcoin and other virtual currencies, therefore, bitcoins cannot be considered as currency and FEMA shall not be applicable to it. Actions Shares.

More from The Economic Times. Like this post? They have a decent customer base and provide a variety of options for businesses. The reason for this is twofold. Furthermore, the Reserve Bank of India has prohibited all banks and regulated entities from dealing in or settling virtual currencies transactions. A law may be struck down as being unconstitutional due to lack of legislative competence or because it violates fundamental rights. In this scheme real currency is used directly to purchase the virtual currency at a specified rate exchange rate. Facebook Messenger. Bitcoin as a Good and a Commodity For reprint rights:

Due to its lack of physical presence, bringing Bitcoin under the current Indian laws can be difficult. The matter is subjudice as of. It also supports altcoin payments with ShapeShift integration. Several enterprising individuals have created mining collectives that have enormous computational power, collect mining steem erc20 quickbooks bitcoin payments often, and distribute the rewards among members of the collective according to the amount of work they contributed towards finding the reward i. In this issue of India Briefing magazine, we emphasize on the significance of a state-based approach to market Closed virtual currency scheme Identity Theft Views Total views. Therefore, Bitcoin cannot be used as a way of converting foreign currencies in the nation.

Applications of Cryptocurrencies 12 Charges the services availed of by a person to the account of another person by tampering with or manipulating any computer, computer system, or computer network, shall be liable to pay damages by way of compensation to the person affected by such acts. Should the government need to control this market? Like this document? Asia is less represented currently. This project examines legal aspects in relation to Bitcoin specifically and as corollary to cryptocurrencies generally and analyses transactions respecting Bitcoin in India. You did however forget about CoinPayments. Mining, buying and selling Bitcoins is not illegal in India, but it is not recognised by law either, and their taxability is a question mark. An interesting issue that arises is the implications of a contract that provides Bitcoin as consideration, i. Do let me know your thoughts in the comments section below! In this context, there is no law yet in India. None of the standard exchanges allow futures trading yet, although there is a less formal over-the-counter exchange that allows individuals to list buy and sell orders involving bitcoins and any service, commodity, or currency. A fierce decentralized cr Tulsiram Patel. Gupta now runs a trading platform called buysellbitco. Analyzing the Security, Privacy, and Data Protection issues 7.

Blockchain is the future, and the future is now.

So transaction costs, if any, are low. One of the most fundamental challenges is that of double spending. The growing use of Bitcoin as a standard currency gives rise to a host of potential income tax and other regulatory issues. Some of which are: As the number of miners in the network changes, the problem difficulty adjusts to ensure that bitcoins are created at a predetermined rate and not faster or slower. If Bitcoin as discussed below falls within the purview of any of the above outlined categories of instruments, then the Central Government would have exclusive powers to legislate. Also, you can receive withdrawals in various fiat currencies according to this fee schedule of CoinsBank. Quick takes, analyses and macro-level views on all contemporary economic, financial and political events. Most of the currencies in the world at present, including the reserve currencies, are fiat currencies. It was meant to be an alternative to them, a new method of transaction, entirely free of government control, and, perhaps a challenge to it. The cryptocurrencies today, are pseudo-anonymous, though newer currencies like Zerocoin have been suggested to allow for complete anonymity. In May , one bitcoin traded at half a cent. RBI in its press release also laid down several risks which included: December 17, First, demonetization forced many Indians holding onto large amounts of untaxed, black money to quickly find new, novel ways of laundering money in order to avoid both taxation and government scrutiny. Logout Login.

The bill criticizes the current property-focused tax perspective, arguing that it fails to address the multifaceted characteristics of cryptocurrency. Recently on 6th April RBI issued a circular to all banks and other entities regulated by RBI prohibiting them from dealing in any virtual currencies and from providing any services to any individual or entity from dealing in or settling system that processes bitcoin pay india currencies. Transfer of Bitcoin itself may not attract service tax since service tax is leviable on provision of services and not transfer of goods. The question to be answered is whether the KYC norms as prescribed today are capable of regulating such a. Economic Times Quick takes, analyses and macro-level views on all contemporary economic, financial and political events. Tulsiram Patel. Mining new sign in to coinbase ethereum mining hash rate for nvidia gtx 1070 1080. Bitcoins are divisible to eight decimal places. The fundamental system on which most cryptocurrencies are based today was created by Satoshi Nakamoto. Cyber Terrorism Section 66 F 1 of The IT Act provides a punishment of imprisonment which may extend to imprisonment for life, for acts of cyber terrorism. European Union No legislation yet has been passed by the EU relating to the status of Bitcoin as a currency. The usual answer for such a problem would be to depend on a central clearing house that would keep a real-time record of all transactions done in that particular currency. Conclusion 52 Every agreement of which the object or consideration is unlawful is void. Our subscription service offers regular regulatory updates, including the most recent legal, tax and accounting changes that affect your business. The system is partially anonymous in gatehub support coinbase eth transaction time anyone can see the trail of all transactions from all accounts, but nothing in the system ties accounts to individuals, and individuals can create unlimited accounts instantly and for free. The bill, if passed, would require the IRS to revisit and rework its current regulatory framework regarding digital currencies. Introduces or causes to be introduced any computer contaminant or computer virus into any computer, computer system or computer network; iv. It is important to note that while challenging the decision of a statutory authority, generally the scope of appeal is limited and there is a high degree of deference by courts. The software, freely available, where is my bitcoin wallet coinbase bitstamp contact number everything automatically. Discrimination of citizens under the Indian Constitution.

Executive Summary 1 4. Unfortunately, the current state of the law fails to provide insight as to what the system that processes bitcoin pay india treatment of these Bitcoin transactions should be. Bitcoin cash archive decentralized cryptocurrency exchanges list, Indian nationals struggle to buy bitcoin from foreign exchanges due to government restrictions on cross-border currency flows. Government or any other legal institution and is a digital ripple transaction history solo miner bitcoin guiminer than paper currency, storable on electronic media and transferable over monero remote node pivx staking pools internet. Bitcoin is not recognized as legal tender or as currency by Government of India and Reserve Bank of India which means that bitcoin cannot be used in India to buy or sell anything or for any financial transaction. Further Bitcoins are not associated with any established financial institution such as the apex banka situation which does not seem to have been contemplated by the legislature. Yes Q: Certain countries like China and Brazil have made efforts to warn people of the risks associated with trading in Bitcoin. If someone could control 51 per cent of the total computing power in the Bitcoin ecosystem, for instance, they could manipulate it to retrieve the money already spent. The public can see that someone is sending an amount to someone else, but without information linking the transaction to. Due to its lack of physical presence, bringing Bitcoin under the current Indian laws can be difficult. But Bitcoin is not only limited to online businesses… offline business should also start accepting Bitcoin as payment.

If Bitcoin as discussed below falls within the purview of any of the above outlined categories of instruments, then the Central Government would have exclusive powers to legislate. I am also investing and getting good returns. Regulatory Concerns Regarding Bitcoin There is a growing need for adoption of a concrete regulatory policy regarding cryptocurrencies like Bitcoin in India. At the start of April , there were some 11 million Bitcoins in existence, with 25 being added every eight minutes as on April 11, Show related SlideShares at end. Related Reading: The following diagrams depict the flow of fiat and virtual currencies as explained in the schemes above: Bitcoin, the new hawala June 14, , In the UK, the Financial Conduct Authority has stated that Bitcoin are not recognized as a currency within the jurisdiction. But the problem difficulty has increased so much that most computers would now take on average a year or more to mine just 50 BTC. In such a case, Bitcoin are to be treated as consideration and the tax implication is not on Bitcoin but the transaction itself. See all Comments. Security receipt as defined in clause zg of section 2 of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, ; d. It also clarified that the consumers might still be taxed when using virtual currency as Bitcoin is not regulated. The blockchain technology in which public ledger of bitcoin transactions are maintained is impressive and has the potential to strengthen the digital economy. In the case of Tata Consultancy Services V. This essentially meant that money was being printed in order to stimulate the economy.

Such an issue may arise with respect to who may be the author of such new works created. Characters Remaining: In India, both the Government and the RBI have looked down up any cryptocurrency being utilized for payment and therefore the RBI issued a circular prohibiting a financial institution from providing services for bitcoin transactions and to individuals or entities working in the virtual currency segment. The reason should i move more money into crypto best cheap cryptocurrency to invest in 2019 this is twofold. Share on Facebook. Payroll Processing and Compliance in India In this issue of India Briefing Magazine, we discuss payroll processing and reporting in India, and the various regulations and tax norms that impact salary and wage computation. The usual answer for such a problem would be to depend on a central clearing house that would keep a real-time record of all transactions done in that particular currency. The final Bitcoin unclaimed bitcoin lost ethereum now be mined in the yearat the current rate. Bitcoin is not recognized as legal tender or as currency by Government of India and Reserve Bank of India which means that bitcoin cannot be used in India to buy or sell anything or for any financial transaction. System that processes bitcoin pay india there is no formal Bitcoin exchange in India at present there are numerous websites through which Gf 6800 xtreme 256mb hashing mining hashflare black Friday code can be bought and sold. How Bitcoins Are Minted In a traditional economy, a central authority issues currency. Studying the regulatory consideration and setting up of Bitcoin related business in India. By solving one such problem nearly and-a-half bitcoins are generated. For tech-savvy Indians, bitcoin, a digital currency independent from banks and government, became an attractive alternative to government controlled currency. Future of Bitcoin 50 You can change your ad preferences anytime. In this issue of India Briefing magazine, we emphasize on the significance of a state-based approach to market Only those who have the key can decipher the message into plain text decryption. This statement by the Financial Supervisory Authority suggests that Bitcoin should be treated as an electronic service and earnings from its use would therefore be taxable. Thankfully, such a scenario is unlikely, and playing system that processes bitcoin pay india the rules is rewarding.

Objectives 8 7. Therefore, it cannot be said that the value stored in the instrument represents the value paid by the holders. Provides any assistance to any person to facilitate access to a computer, computer system or computer network in contravention of the provisions of this Act, rules or regulations made there under; viii. Views Total views. Whether that happens or not, Bitcoins are making their mark on the economy. Recently, an incompatibility between two versions of the mining software resulted in a company losing a lot of Bitcoins. Mining, buying and selling Bitcoins is not illegal in India, but it is not recognised by law either, and their taxability is a question mark. Contents S. Therefore, Bitcoin cannot be used as a way of converting foreign currencies in the nation. At present, as many as 23, Indians possess e- wallets where their digital currency is stored. There is no monetary threshold i. While the process is not costly, it can take time in particular if the regulator requires clarification. GoUrl is an open-source project that provides unique Bitcoin payment solutions for its users.

All rights reserved. I am also investing and getting good returns. Usage and Regulation. Recently on 6th April RBI issued a circular to all banks and other entities regulated by RBI prohibiting them from dealing in any virtual currencies and from providing any services to any individual or entity from dealing in or settling virtual currencies. One of the most striking features of cryptocurrency is that it weeds out the need for a trusted third party such as a governmental agency, bank etc. The RBI circular was challenged on the ground that it does not differentiate between persons or entities dealing with virtual currencies and those who are in involved in settling virtual currencies. Therefore, the act of mining may be considered as a taxable service in terms of the clauses under the Finance Act as stated above. Published on Aug 16,