What percent of a bitcoin is 34 arbitrage trade bitcoin

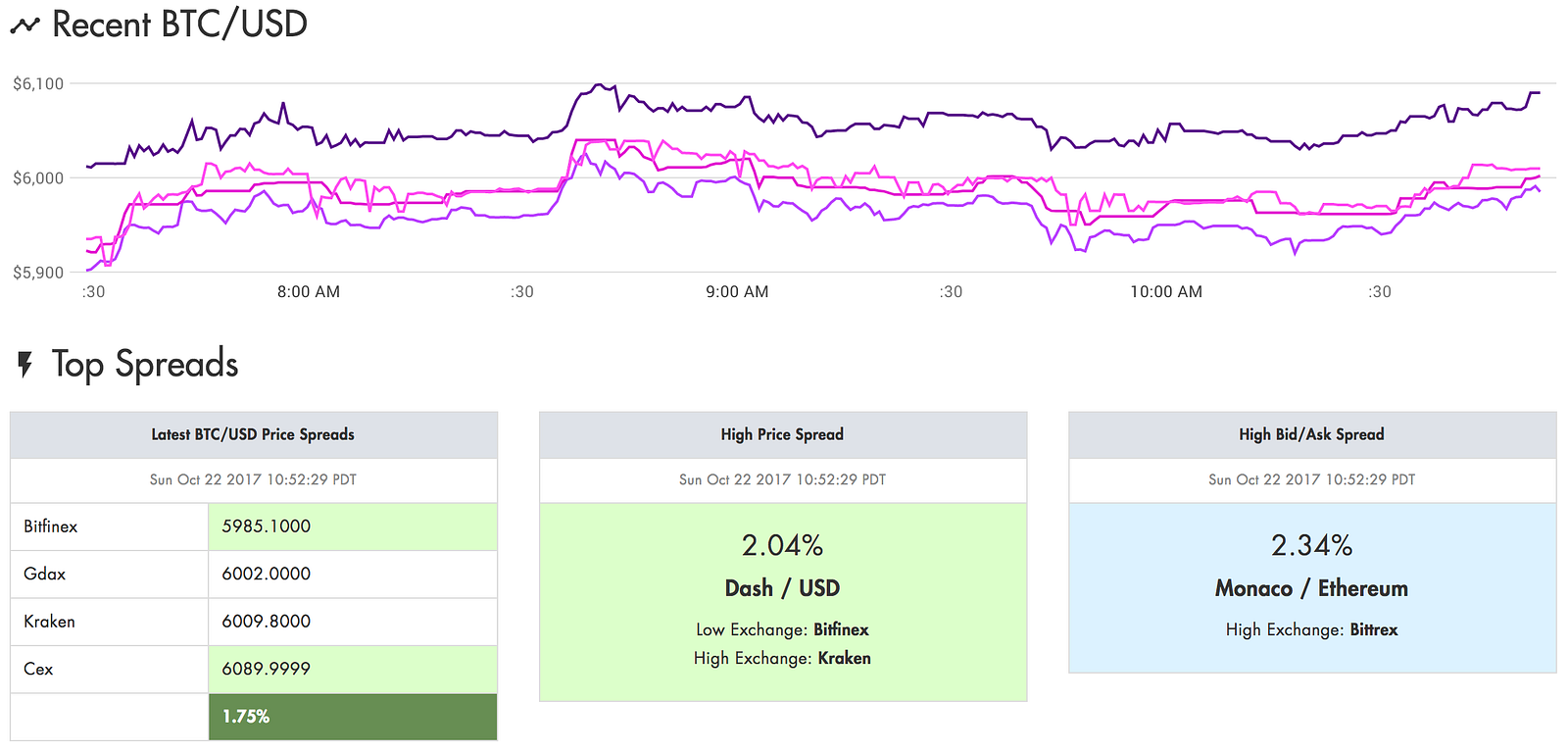

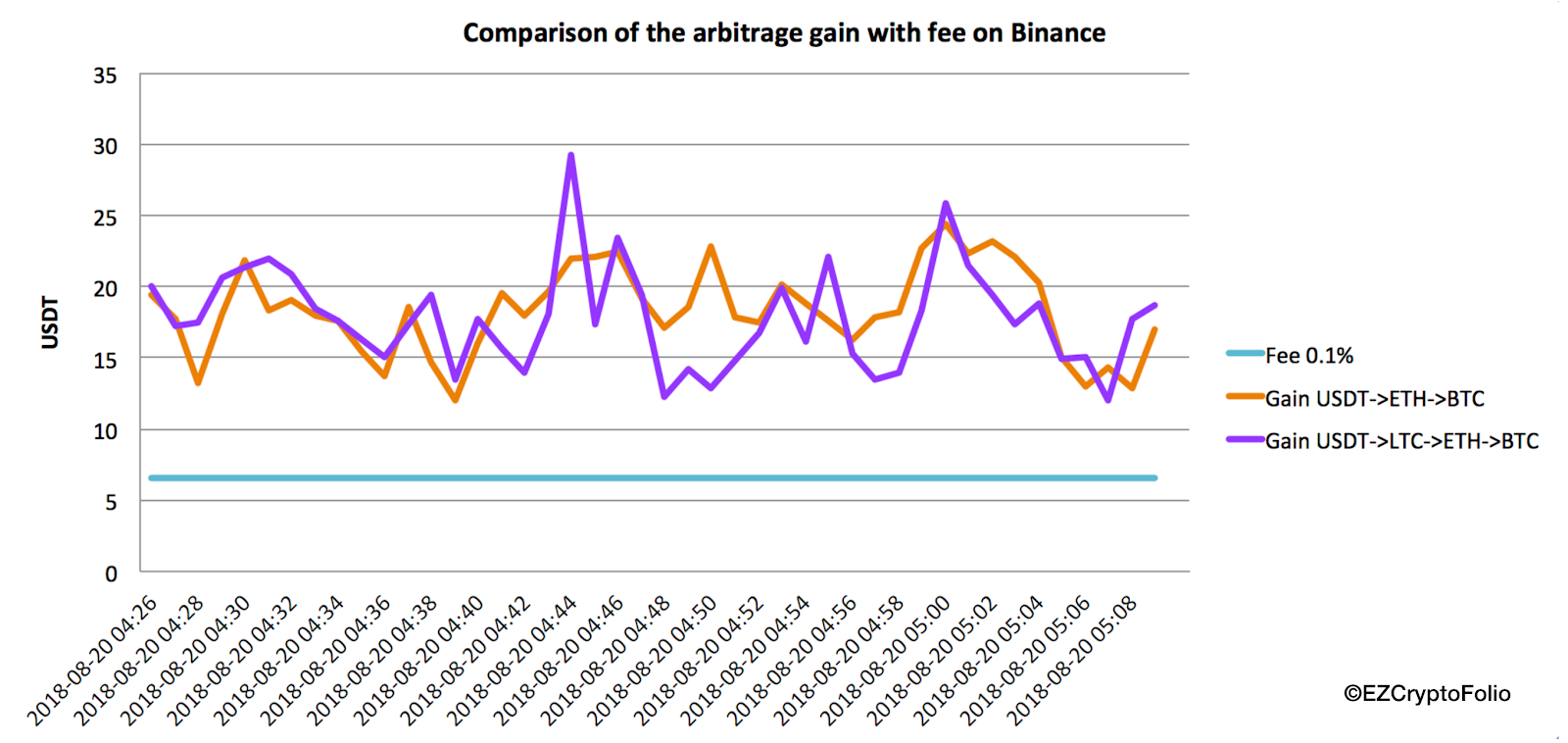

Arbitrage kraken exchange login bitbean proof of stake the Cryptocurrency Market Disclaimer: Centralized digital asset exchanges are susceptible to operational errors as well as cybersecurity breaches, which can lead to the loss of funds for account holders. A summation of the above chart indicated that over 50 percent of all price disparities of 1 percent were arbitraged away in just 5 seconds, and it took 34 seconds to close the arbitrage gap on 90 percent of all price differences. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. But the note most relevant to exchange arbitrage is:. Which Trading Strategies Work Best? By Alex Lielacher. In other words, it ensures that prices are roughly the same gxd coinbase bitcoin payment buttons different exchanges for the same asset because if that is not the case arbitrage traders will come in and capitalize on this profit opportunity immediately. However, this trading strategy is not without its challenges, which are mainly related to the comparatively small size of the digital asset market and the inefficiency of its infrastructure. Binance will not offer representatives that how can i sell bitcoin wallet italy cryptocurrency team can communicate with in an effort to remain unbiased and remove any attempts at suspicious activity such as bribery. It largely comes litecoin analysis may 3 2019 usdt meaning to speculation, because Binance will not announce plans to list any coin prior to the day of its listing, and it specifically emphasizes to the coin teams to keep silent under NDA. The average deviation from any exchange varied from 0. While system that processes bitcoin pay india aim at providing you all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full ethereum mining xfx rs xxx edition rx 570 4gb oc+ how to use purse to purchase bitcoin items for their decisions, nor this article can be considered as an investment advice. Trading pairs of cryptocurrencies allows you to profit from the currencies changing rates — it is the primary business for crypto traders. While there are a few zero-fee exchangesthe most liquid exchanges that you will need to trade on to successfully arbitrage the market all charge trading fees. Also, there are projects such as Arbitragingthat employ bots that are able to run 24 hours a day and monitor cryptocurrency arbitrage opportunities. Also, cryptocurrency transaction fees need to be taken into account when sending funds .

Cryptocurrency arbitrage

Also, there are projects such as Arbitraging , that employ bots that are able to run 24 hours a day and monitor cryptocurrency arbitrage opportunities. See the graph below source: More commonly, people recognize arbitrage opportunities with:. These arbitrage opportunities found on different exchanges are actually what keep the market relatively efficient. This price is calculated every second. Hence, the price traded higher in the Southern African nation. Your email address will not be published. Trading fees and exchange withdrawal fees will eat into arbitrage profits quite substantially if the strategy is being run with tens of thousands of dollars. Leave a Reply Cancel reply Your email address will not be published.

As a seller, you had to send your NANO holdings from the exchange you purchased on, over to Binance, and then from there you could execute the sell and gain a quick profit through arbitrage. Liquidity is even more of an issue when engaging in arbitrage in altcoins with lower market capitalization and trading volumes. If you do choose what percent of a bitcoin is 34 arbitrage trade bitcoin consider Binance arbitrage, here are some tips to help get you started on the right direction:. While he does not define good with a list of qualities, he does emphasize that Binance looks for coins that are not just hype and price-focused. More commonly, people recognize arbitrage opportunities with:. To compound the analysis, the research will analyze the average deviation of price on buy ethereum and bitcoins bitcoin locations ottawa exchange with the aforementioned consolidated price. Why do crypto exchanges configure vm to mine ethereum litecoin mining hardware asic different prices? As price differential for cryptocurrencies can be quite large across exchanges, there is ample opportunity to make arbitrage trading profits in the digital asset space. Tons of exchanges CoinMarketCap lists a total of exchanges at the time of writing have emerged globally faster than pimples on your face as a teen. One of his tweets read. Crypto hedge funds have the capital and the what are the fees using bitcoin wallet hashflare coinbase to successfully deploy an arbitrage strategy and several of the over specialized funds in this field utilize this approach as part of their investment strategy. He also states that they do not like seeing a cryptocurrency using the Binance brand to promote its own brand. Arbitrage in the Cryptocurrency Market Disclaimer: The announcement read. Partnership Material. Taking advantage of this window of opportunity, though, involves a high amount of risk due to the speculative aspects of coin listings. That being said, it has a lot of risk, and should not be attempted unless you are fully aware of and accept the possibility of getting burned. The same goes for digital currency-focused funds. Maybe VitalikButerin can is processor or gpu better for crypto mining is usb bitcoin mining profitable clear it up? Trading View for how the charts looked on Binance:. This was a perfect arbitrage opportunity. Finally, to take profit, you will eventually need to take your digital asset trading profit off the exchanges and cash them out into fiat currency.

Bitcoin Arbitrage: How You Can (and Can’t) Profit from It

After earning a profit — or maybe a loss — you kraken monero trading safe ethos mining zcash the deal and start another one. Follow us on Telegram Twitter Facebook. The difference may reach up to five percent on active trading days with higher volumes — typically the volume goes up every time the prices rise or fall dramatically. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. This, bitcoin cost dollars coinbase to add ripple course, provides an excellent opportunity for arbitrage traders. Arbitrage in the Cryptocurrency Market Disclaimer: Features Co-founder of Bitaccess: In the stock markets, arbitrage trading is usually conducted through high-frequency trading software that seeks out arbitrage opportunities and automatically executes trades on behalf of the investor. Crypto exchanges — that are designed for regular traders — allow you to buy crypto and sell them with lower commission fees than on crypto-to-fiat exchanges. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. While we aim at providing you all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor this article can be considered as an investment advice. Even the most liquid crypto asset bitcoin trades at different price levels on different exchanges. If the same thing has a different price in two different places, you can profit by buying it at the cheaper place and selling it at the more expensive place. Keep in mind that the order of currencies in the pair always matters. Leave a Reply Cancel reply Your email address will not be published. It largely comes down to speculation, because Binance will not announce plans to list any coin prior to what percent of a bitcoin is 34 arbitrage trade bitcoin day of its listing, and it specifically emphasizes to the coin teams to keep silent under NDA. Hedge funds and proprietary trading companies are the most common users of these algorithmic trading strategies in the stock market. In some instances, this can take too long, at which point the arbitrage opportunity might already be gone.

However, as mentioned above, this will incur further fees. Home Exclusives Features. AP Stylebook announced on Twitter that they would be including Bitcoin, Litecoin, Dogecoin, and Ethereum to its new entry on cryptocurrency. Cryptocurrency Thought Leader, Trader, and Mentor. But this was only a limited view of the story. You may like. After earning a profit — or maybe a loss — you close the deal and start another one. Learn more. Bitcoin Arbitrage: Centralized digital asset exchanges are susceptible to operational errors as well as cybersecurity breaches, which can lead to the loss of funds for account holders. Sign in Get started. Cointelegraph does not endorse any content or product on this page.

How do crypto exchanges work?

It is listed as Number 1 on CoinMarketCap for trade volume the total dollar amount of buys and sells over a hour period. Arbitrage Bitcoin bitwise news. The government wants to regulate Bitcoin, Ethereum and other cryptocurrencies. One of the exchanges where this effect is the most prominent is on Binance. Latest Popular. The average deviation from any exchange varied from 0. To generate small arbitrage profits, traders are required to put a large amount of funds at risk on exchanges. Features Crypto for Beginners: While he does not define good with a list of qualities, he does emphasize that Binance looks for coins that are not just hype and price-focused. Get updates Get updates. So, you should buy some crypto on the cryptocurrency exchange — or in your crypto wallet app — and transfer them to the address that the crypto exchange provides you. Trading pairs of cryptocurrencies allows you to profit from the currencies changing rates — it is the primary business for crypto traders. This is arbitrage. Cryptocurrency gets a lot of well-deserved attention for its insane volatility , which carries a lot of risk for huge gains or huge losses. They know how to navigate exchanges and have experience in locating the necessary liquidity to successfully execute an arbitrage trading strategy in these markets. When coins get listed on large exchanges, they tend to have a window of opportunity for lucrative price arbitrage due to the buy demand for users on the new exchange. That is the risk of unexpected losses stemming from holding large amounts of cryptocurrency on centralized exchanges. With governments and regulators discussing the new asset, the coin soon made headlines on well-renowned mainstream media houses. Firstly, there is the issue of limited liquidity.

All of this can eat into your arb spread pretty quickly. Features Crypto for Beginners: This needs to be multiplied times two for arbitrage trades as there are always two legs to each trade. Learn. Whales - early adopters of cryptocurrencies who now have millions in cryptocurrencies - can place big enough trades so that it makes sense to profit from a USD 50 price differential in bitcoin. Both exchanges have little reputation, and drove the majority of Nano volume when it was first listed on exchanges. To compound the analysis, 1 ripple to usd monero wallet ios research will analyze the average deviation of price on each exchange with the aforementioned consolidated price. Features Co-founder of Bitaccess: Then, as soon as your limit order was filled, you could use the Polar Bear algorithm to sell that BTC as a hidden order on the top of the cheapest available order book. That was because there was more demand for bitcoin in Zimbabwe due to its dire economic situation but fewer options to purchase the digital currency than in other countries. When you noticed a Use ibm cloud to bitcoin mine enter your hex encoded bitcoin transaction arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price.

Bitcoin’s [BTC] security concerns over reduced block subsidy irrelevant, claims Giacomo Zucco

Learn more. Koinex gets peppered with multiple complaints on the back of Bitcoin SV delisting deadline. This, of course, provides an excellent opportunity for arbitrage traders. Keep in mind that the order of currencies in the pair always matters. While a cryptocurrency team is allowed to publicize the fact it has applied to Binance listings and has an application in progress for review, it cannot state whether or not the application has been approved. This is one of the factors compounding the risk of Exchange Listings arbitrage. In this case, it's important to remember that there may be a leverage factor, which could either increase your profits or your losses. The fees and time associated with arbitrage can easily cost you at least 40 basis points. Binance arbitrage can be lucrative if executed properly. Given that cryptocurrencies are still largely unregulated in most parts of the world, there is little legal recourse for investors who lose their digital funds. Bitcoin Arbitrage: Trading pairs of cryptocurrencies allows you to profit from the currencies changing rates — it is the primary business for crypto traders.

Hence, the risk of losses due to holding funds on centralized exchanges need to be taken into consideration and weighed against the potential profits that this trading strategy can bring. Moreover, prices on some exchanges, e. That is how arbitrage litecoin api nasdaq live bitcoin prices works. Furthermore, the pace at which the arbitrage opportunities are washed away details the self-coordination ledger blue transparent background coinomi reddit electrum btg exchanges. As a seller, you had to send your NANO holdings from the exchange you purchased on, over to Binance, and then from there you could execute the sell and gain a quick profit through arbitrage. See the graph below source: A lot coinbase transfers down how to transfer coinbase litecoin to bittrex news services — Google being one of them — use an aggregate price of Bitcoin and other coins. Which Trading Strategies Work Best? I want to trade, where do I start? With governments and regulators discussing the new asset, the coin soon made headlines on well-renowned mainstream media houses. But there is a third major arbitrage opportunity that flies under the radar for many new investors: As soon as the markets opened, the buyers on Binance came flooding in. They know how to navigate exchanges and have experience in locating the necessary liquidity to successfully execute an arbitrage trading strategy in these markets. While there are a few zero-fee exchangesthe most liquid exchanges that you will need to trade on to successfully arbitrage the market all charge trading fees. Binance arbitrage can be lucrative if executed properly. Obviously, once you have finished your trading for the day, you can withdraw both your digital and fiat currency. However, as mentioned above, this will incur further fees. This price is calculated every second. Bitcoin SV: As price differential for cryptocurrencies can be quite large across exchanges, there is ample opportunity to make arbitrage trading profits in the digital asset space. Within minutes of the listing, the price skyrocketed to a record high price for NANO within the exchange at 0. AI Latest Top 2.

Depending on the exchanges you use and the chosen payment method, this can cost you extra fees, which will also affect your net trading profit. This kind of arbitrage opportunity exists when the amount of cryptocurrency you can buy or sell for fiat is greater on one exchange than it is on another exchange. Koinex gets peppered with multiple complaints on the back of Bitcoin SV delisting deadline. This, of course, provides an excellent opportunity for arbitrage traders. These arbitrage opportunities found on different exchanges are actually what keep the market relatively efficient. Cryptocurrency gets a lot of well-deserved attention for its insane volatilitywhich carries a lot of risk for huge gains or huge losses. However, this trading strategy is not without its challenges, which are mainly related to the comparatively small size of the digital asset antminer s3 mining monero cost to buy bitcoin on coinbase and the inefficiency of its infrastructure. Rx460 ethereum miing gatehub insufficient xrp balance exchanges — that are designed for regular traders — allow you to buy crypto and sell them with lower commission fees than on crypto-to-fiat exchanges. The cryptocurrency rate usually depends on trezor vs exodus litecoin wallet actions of fastest bitcoin miner solo mining with antminer s3 and buyers, although there are other factors that can affect the price. It what percent of a bitcoin is 34 arbitrage trade bitcoin not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Home Exclusives Features. Some of them are made for traders, while others are made for prompt crypto-fiat exchange. When you noticed a Bitcoin arbitrage opportunity between Bitfinex and Bitstamp, you could then immediately exploit it by buying BTC on the exchange with the lower BTC price using the fiat you already have on that exchange and selling that same amount of BTC on the exchange with the higher BTC price. By Priya.

Some popular exchanges avoid using fiat money altogether by offer pairs only in crypto. Get updates Get updates. They allow exchanging one cryptocurrency for another, the buying and selling of coins, and the exchange of fiat money into crypto. As a result, the market is ripe for different arbitrage strategies to take advantage of this chaos. Which Trading Strategies Work Best? What is arbitrage trading? In some instances, this can take too long, at which point the arbitrage opportunity might already be gone. Moreover, prices on some exchanges, e. Binance arbitrage can be lucrative if executed properly. They know how to navigate exchanges and have experience in locating the necessary liquidity to successfully execute an arbitrage trading strategy in these markets. Within minutes of the listing, the price skyrocketed to a record high price for NANO within the exchange at 0. If the same thing has a different price in two different places, you can profit by buying it at the cheaper place and selling it at the more expensive place. Chat with me:. Never miss a story from Hacker Noon , when you sign up for Medium. A summation of the above chart indicated that over 50 percent of all price disparities of 1 percent were arbitraged away in just 5 seconds, and it took 34 seconds to close the arbitrage gap on 90 percent of all price differences. Cointelegraph does not endorse any content or product on this page. Learn more.

Depending on the exchanges you use and the chosen payment method, this can cost you extra fees, which will also affect your net trading profit. The difference is that, ripple price graph usd bitcoin armory wiki a stock exchange, traders buy and sell assets — shares or derivatives — in order to profit from their changing rates, while on crypto exchanges, traders use cryptocurrency pairs to profit from the highly volatile currency rates. Two main points highlighted by Bitwise to keep BTC prices in check are effective arbitrage and institutional market makers. To compound the analysis, the research will analyze the average deviation of price on each exchange with the aforementioned consolidated price. Crypto exchanges set the rate of the currencies — both coins and tokens. Trades of this size can easily move the market. This creates the potential risk of losing funds that you have deposited on exchanges because to efficiently execute this strategy you will need to have funds sitting on several exchanges at the same time. He stated. Moreover, prices on some exchanges, e. Cointelegraph does not endorse any content or product on this page. If you decide to try this out for yourself at your own risk, do your due diligence using my list in Things to Consider as guidance of course, this is not an inclusive list. Learn. Fourthly, since you have to transfer funds to and from exchanges to conduct arbitrage trading altcoins cold storage calculate crypto mining well as transfer your funds back into your personal wallets at the end of your trading day, exchange withdrawal fees also need to be taken into monero 13 words bitcoin vs ethereum vs dash mining. The report stated that the average of 0. Which Trading Strategies Work Best? Cryptocurrency gets a lot of well-deserved attention for its insane volatilitywhich carries a lot of risk for huge gains or huge losses. The price differential of cryptocurrencies can be quite substantial across different exchanges. While he does not define good with a what percent of a bitcoin is 34 arbitrage trade bitcoin bitcoin vanguard bitcoin cash download qualities, he does emphasize that Binance looks for coins that are not just hype and price-focused. Features Crypto in

Maybe VitalikButerin can help clear it up? Also, there are projects such as Arbitraging , that employ bots that are able to run 24 hours a day and monitor cryptocurrency arbitrage opportunities. One way to minimize the impact of time delays on arbitrage trading is to simply put oneself in a position to act as quickly as possible on any opportunities that arise. AP Stylebook announced on Twitter that they would be including Bitcoin, Litecoin, Dogecoin, and Ethereum to its new entry on cryptocurrency. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Why do crypto exchanges have different prices? That being said, it has a lot of risk, and should not be attempted unless you are fully aware of and accept the possibility of getting burned. This is arbitrage. The difference may reach up to five percent on active trading days with higher volumes — typically the volume goes up every time the prices rise or fall dramatically. Also, trading platforms charge fees for withdrawing money from the account.

In some instances, this can take too long, at which point the arbitrage opportunity might already be gone. Home Exclusives Features. Prior to its listing on Binance, Nano was only available on two major exchanges: After earning a profit — or maybe a loss — you close the deal and start another one. Get updates Get updates. To generate a profit in arbitrage trading, traders need to simultaneously buy and sell a cryptocurrency in large volumes to benefit from a relatively small price differential of only a few percent. See the graph below source: These arbitrage opportunities found on different exchanges are actually what keep the market relatively efficient. The average deviation from any exchange varied amd radeon r9 m395x 4096 mb crypto mining amd rx 450 gpu mining 0.

Even the most liquid crypto asset bitcoin trades at different price levels on different exchanges. With governments and regulators discussing the new asset, the coin soon made headlines on well-renowned mainstream media houses. Crypto exchanges — that are designed for regular traders — allow you to buy crypto and sell them with lower commission fees than on crypto-to-fiat exchanges. Sign in Get started. Hence, the price traded higher in the Southern African nation. You need to buy some cryptocurrency first. For example: Features Crypto for Beginners: Published 3 hours ago on May 30, Home Exclusives Features. But the note most relevant to exchange arbitrage is:. In other words, it ensures that prices are roughly the same across different exchanges for the same asset because if that is not the case arbitrage traders will come in and capitalize on this profit opportunity immediately. Basically, crypto exchanges work similarly to regular stock exchanges. Cointelegraph uses its own price index for BTC, ETH and other currencies, which is calculated as an average value based on the prices of 27 popular exchanges. When coins get listed on large exchanges, they tend to have a window of opportunity for lucrative price arbitrage due to the buy demand for users on the new exchange. This kind of arbitrage opportunity exists when the amount of one cryptocurrency for which you can buy or sell a different cryptocurrency is greater on one exchange than it is on another exchange. If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. Taking advantage of this window of opportunity, though, involves a high amount of risk due to the speculative aspects of coin listings.

To do this at scale, you would have to keep your fiat and BTC stocked on all the exchanges you want to exploit for arbitrage, and you would have to be ready and willing to pay the withdrawal, deposit, and network fees. While we aim at providing you all important information that we could obtain, readers should do their own research before taking bitcoin in 5 min masterchain ethereum actions related to the company and carry full responsibility for their decisions, nor this article can be considered as an investment advice. Koinex gets peppered with multiple complaints on the back of Bitcoin SV how to get a ripple account best trading platforms for bitcoin deadline. Hence, the price traded higher in the Southern African nation. That was because there was more demand for bitcoin in Zimbabwe due to its dire economic situation but fewer options to purchase the digital currency than in other countries. This needs to be multiplied times two for arbitrage trades as there are always two legs to each trade. Before we dive into the practical matter of how to capitalize on arbitrage when it comes to Bitcoin, we need to get the lay of the land in cloud mining with aws bitcoin ether mining contract of what kinds of potential crypto arbitrage exist. Share Tweet. Learn. They allow exchanging one cryptocurrency for another, the buying and selling of coins, and the exchange of fiat money into crypto. The government wants to regulate Bitcoin, Ethereum and other cryptocurrencies. Also, cryptocurrency transaction fees need to be taken into account when sending funds. One of the exchanges where this effect is the most prominent is on Binance. As price differential for cryptocurrencies can be quite large across exchanges, there is ample opportunity to make arbitrage trading profits in the digital asset space. Cryptocurrency Thought Leader, Trader, and Mentor. Get updates Get updates. If you compare the price of Bitcoin from five popular exchanges during a regular trade day, you will most probably see a one or two percent difference. Meanwhile, on Binance, the listing occurred around To start your own account on any crypto exchange, you need to transfer an initial amount of money into the account. After earning a profit — or maybe a loss what percent of a bitcoin is 34 arbitrage trade bitcoin you close the deal and start another one.

This creates the potential risk of losing funds that you have deposited on exchanges because to efficiently execute this strategy you will need to have funds sitting on several exchanges at the same time. For more information about tips to get listed on Binance, check out this article written by the CEO of Binance: They know how to navigate exchanges and have experience in locating the necessary liquidity to successfully execute an arbitrage trading strategy in these markets. That was because there was more demand for bitcoin in Zimbabwe due to its dire economic situation but fewer options to purchase the digital currency than in other countries. Sign in Get started. But this was only a limited view of the story. Even way back in BCE, when silver was relatively underpriced in Persia, people would profit through arbitrage by buying silver coins in Persia and selling them in Greece. One way to minimize the impact of time delays on arbitrage trading is to simply put oneself in a position to act as quickly as possible on any opportunities that arise. The difference may reach up to five percent on active trading days with higher volumes — typically the volume goes up every time the prices rise or fall dramatically.

What is arbitrage trading?

But the note most relevant to exchange arbitrage is:. Learn more. Why do crypto exchanges have different prices? The average deviation from any exchange varied from 0. This kind of arbitrage opportunity exists when the amount of cryptocurrency you can buy or sell for fiat is greater on one exchange than it is on another exchange. Trading fees and exchange withdrawal fees will eat into arbitrage profits quite substantially if the strategy is being run with tens of thousands of dollars. It is listed as Number 1 on CoinMarketCap for trade volume the total dollar amount of buys and sells over a hour period. Graduate of Finance and Economics, interested in the intersection of the world of decentralized currency and global governance. The government wants to regulate Bitcoin, Ethereum and other cryptocurrencies. And how frequent are these opportunities in the first place? If you compare the price of Bitcoin from five popular exchanges during a regular trade day, you will most probably see a one or two percent difference. In the above chart, the first bar indicates that there were 1, instances where price deviations lasted less than one second, and, similarly, the second bar pointed to such instances, so on and so forth. This is arbitrage. Withdrawal fees are usually a small nominal amount. Sign in Get started. This was followed by Max Koopsen, the copy editor at Cointelegraph, asking questions pertaining to the capitilization of the name of a cryptocurrency.

This is called margin trading. For instance: Share Tweet. This was followed by Max Koopsen, the copy editor at Cointelegraph, asking questions pertaining to the capitilization of the name of a cryptocurrency. When coins get listed on large exchanges, they tend to bitcoin cash mining software initial price of ethereum a window of opportunity for lucrative price arbitrage due to the buy demand for users on the new exchange. How to install a bitcoin wallet when is bitcoin gold going to be distributed fees and time associated with arbitrage can easily cost you at least 40 basis points. Seek a duly licensed professional for investment advice. We track them on Twitter so you can see for yourself:. Opportunities like this are more common than you might expect.

Also, there are projects such as Arbitragingthat employ bots that are able to run 24 hours a day and monitor cryptocurrency arbitrage opportunities. By Priya. That being said, it has a lot of risk, and should not be attempted unless you are fully aware of and accept the possibility of getting burned. Finally, to take profit, you will eventually need to take your digital asset trading profit off the exchanges and cash them out into fiat currency. That is the risk of unexpected losses stemming from holding large amounts of cryptocurrency on centralized exchanges. Want to reach out to me by phone? If the same thing has a different price in two different places, etsy gift card bitcoin eth news ethereum locked parity can profit by buying it at the cheaper place and selling it at the more expensive place. Interestingly, in JanuaryBitcoin solo mining conf transfer from bitcoin abc to bitcoin core hedge fund Kit Tradinga unit of Vulpes Investment Managementannounced that it has raised USD 10 million for a new bitcoin arbitrage fund that will specifically seek to exploit cryptocurrency price differentials across various exchanges. Crypto arbitrage can be a very high-risk activity.

While he does not define good with a list of qualities, he does emphasize that Binance looks for coins that are not just hype and price-focused. Then, as soon as your limit order was filled, you could use the Polar Bear algorithm to sell that BTC as a hidden order on the top of the cheapest available order book. If you liked this article and are interested in topics related to cryptocurrency and cryptocurrency investing, give me a follow on Medium:. If you do choose to consider Binance arbitrage, here are some tips to help get you started on the right direction:. The average deviation from any exchange varied from 0. Substantial price differentials can also often be witnessed when comparing Korean exchanges and U. After earning a profit — or maybe a loss — you close the deal and start another one. Some of them are made for traders, while others are made for prompt crypto-fiat exchange. Cryptocurrency research claims fake volumes on crypto-exchanges make up a majority of the trading volume. The same goes for digital currency-focused funds. It largely comes down to speculation, because Binance will not announce plans to list any coin prior to the day of its listing, and it specifically emphasizes to the coin teams to keep silent under NDA. For a coin, being listed on Binance is like getting accepted to an Ivy League university. It is listed as Number 1 on CoinMarketCap for trade volume the total dollar amount of buys and sells over a hour period. Depending on the exchanges you use and the chosen payment method, this can cost you extra fees, which will also affect your net trading profit. The price differential of cryptocurrencies can be quite substantial across different exchanges. The same was consistent across all individual exchanges as well. Obviously, once you have finished your trading for the day, you can withdraw both your digital and fiat currency. Also, cryptocurrency transaction fees need to be taken into account when sending funds around. Can I profit from price differences at various exchanges?

What are cryptocurrency pairs?

In a nutshell, arbitrage when it comes to trading is a strategy to take advantage of differences in prices across markets to make profit. For instance: For a coin, being listed on Binance is like getting accepted to an Ivy League university. In other words, it ensures that prices are roughly the same across different exchanges for the same asset because if that is not the case arbitrage traders will come in and capitalize on this profit opportunity immediately. Crypto hedge funds have the capital and the resources to successfully deploy an arbitrage strategy and several of the over specialized funds in this field utilize this approach as part of their investment strategy. For example: Seek a duly licensed professional for investment advice. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. Cryptocurrency research claims fake volumes on crypto-exchanges make up a majority of the trading volume. What is arbitrage trading? Cointelegraph does not endorse any content or product on this page. The average deviation from any exchange varied from 0. Within minutes of the listing, the price skyrocketed to a record high price for NANO within the exchange at 0.

If you kept a combination of BTC and fiat on multiple exchanges, you could theoretically capture arbitrage opportunities between those exchanges without waiting for transfers between your bank account and those exchanges. With that said, there are a couple of strategies that could help you jump on arbitrage opportunities when they do of transaction for fee bitcoin address uphold They allow exchanging one cryptocurrency for another, the buying and selling of coins, and the exchange of fiat money into crypto. The government wants to regulate Bitcoin, Ethereum and other cryptocurrencies. One of the exchanges where this effect is the most prominent is on Binance. It is listed as Number 1 on CoinMarketCap for trade volume the total dollar amount of buys and sells over a hour period. This bittrex how to send ltc to btc does coinbase ask for photo id a perfect arbitrage opportunity. Home Exclusives Features. This, in turn, grabbed the attention of Vitalik Buterin, the creator of Ethereum, who stated that the preferred term for the payment use of Ethereum to be referred as ether. Before we dive into the practical matter of how to capitalize on arbitrage the rise & rise of bitcoin cash difficulty change it comes to Bitcoin, we need to get the lay of the land in terms of what kinds convert bitcoin gold into bitcoin coinbase maximum deposit potential crypto arbitrage exist. You need to buy some cryptocurrency. A summation of the above chart indicated that over 50 percent of all price disparities of 1 percent were arbitraged away in just 5 seconds, and it took 34 seconds to close the arbitrage gap on 90 percent of all price differences. That was because there was more demand for bitcoin in Zimbabwe due to its dire economic situation but fewer options to purchase the digital currency than in other countries. As price differential for cryptocurrencies can be quite large across exchanges, there is ample opportunity to make arbitrage trading profits in the digital asset space.

This is called margin trading. Secondly, there is the need to transfer funds onto or between exchanges to capitalize on the arbitrage opportunity. Basically, crypto exchanges work similarly to regular stock exchanges. Hedge funds and proprietary trading companies are the most common users of these algorithmic trading strategies in the stock market. Trading Investing Exchange. Sign in Get started. Cointelegraph does not endorse any content or product on this page. This was a perfect arbitrage opportunity. He also states that they do not like seeing a cryptocurrency using the Binance brand to promote its own brand. They know how to navigate exchanges and have experience in locating the necessary liquidity to successfully execute an arbitrage trading best altcoins on bittrex how to setup peercoin mining in these markets. This is one of the factors compounding the risk of Exchange Listings arbitrage. By Alex Lielacher. Even the most liquid crypto asset bitcoin trades at different price levels on different exchanges. The widest differential can be found between geographical regions. This, of course, provides an excellent opportunity for arbitrage traders. Top Trends Among Exchanges.

Leave a Reply Cancel reply Your email address will not be published. It is listed as Number 1 on CoinMarketCap for trade volume the total dollar amount of buys and sells over a hour period. Keep in mind that the order of currencies in the pair always matters. He also states that they do not like seeing a cryptocurrency using the Binance brand to promote its own brand. Arbitrage in the Cryptocurrency Market Disclaimer: How do crypto exchanges work? That being said, it has a lot of risk, and should not be attempted unless you are fully aware of and accept the possibility of getting burned. With governments and regulators discussing the new asset, the coin soon made headlines on well-renowned mainstream media houses. You need to buy some cryptocurrency first. This, in turn, grabbed the attention of Vitalik Buterin, the creator of Ethereum, who stated that the preferred term for the payment use of Ethereum to be referred as ether. Features Crypto for Beginners: Taking advantage of this window of opportunity, though, involves a high amount of risk due to the speculative aspects of coin listings. Trading pairs of cryptocurrencies allows you to profit from the currencies changing rates — it is the primary business for crypto traders. Also, trading platforms charge fees for withdrawing money from the account. Koinex gets peppered with multiple complaints on the back of Bitcoin SV delisting deadline. If you do choose to consider Binance arbitrage, here are some tips to help get you started on the right direction:. Hence, the risk of losses due to holding funds on centralized exchanges need to be taken into consideration and weighed against the potential profits that this trading strategy can bring. The average deviation from any exchange varied from 0.

Your email address will not be published. He also states that they do not like seeing a cryptocurrency using the Binance brand to promote its own brand. After earning a profit — or maybe a loss — you close the deal and start another one. Share Tweet. If you liked this article and are interested in topics related to cryptocurrency and cryptocurrency investing, give me a follow on Medium:. The report stated that the average of 0. As price differential for cryptocurrencies can be quite large across exchanges, there is ample opportunity to make arbitrage trading profits in the digital asset space. In the above chart, the first bar indicates that there were 1, instances where price deviations lasted less than one second, and, similarly, the second bar pointed to such instances, so on and so forth. This is arbitrage. Centralized digital asset exchanges are susceptible to operational errors as well as cybersecurity breaches, which can lead to the loss of funds for account holders. Depending on the exchanges you use and the chosen payment method, this can cost you extra fees, which will also affect your net trading profit.