Bitcoin exchanges leverage why does a bitcoin transaction take so long to confirm

![The Complete Guide to Bitcoin Transaction Fees 7 Best Bitcoin and Crypto Margin Trading Exchanges [2019 UPDATED]](https://cdn-images-1.medium.com/max/1600/1*vnNyIev_0rv3J5rXrpmmXA.png)

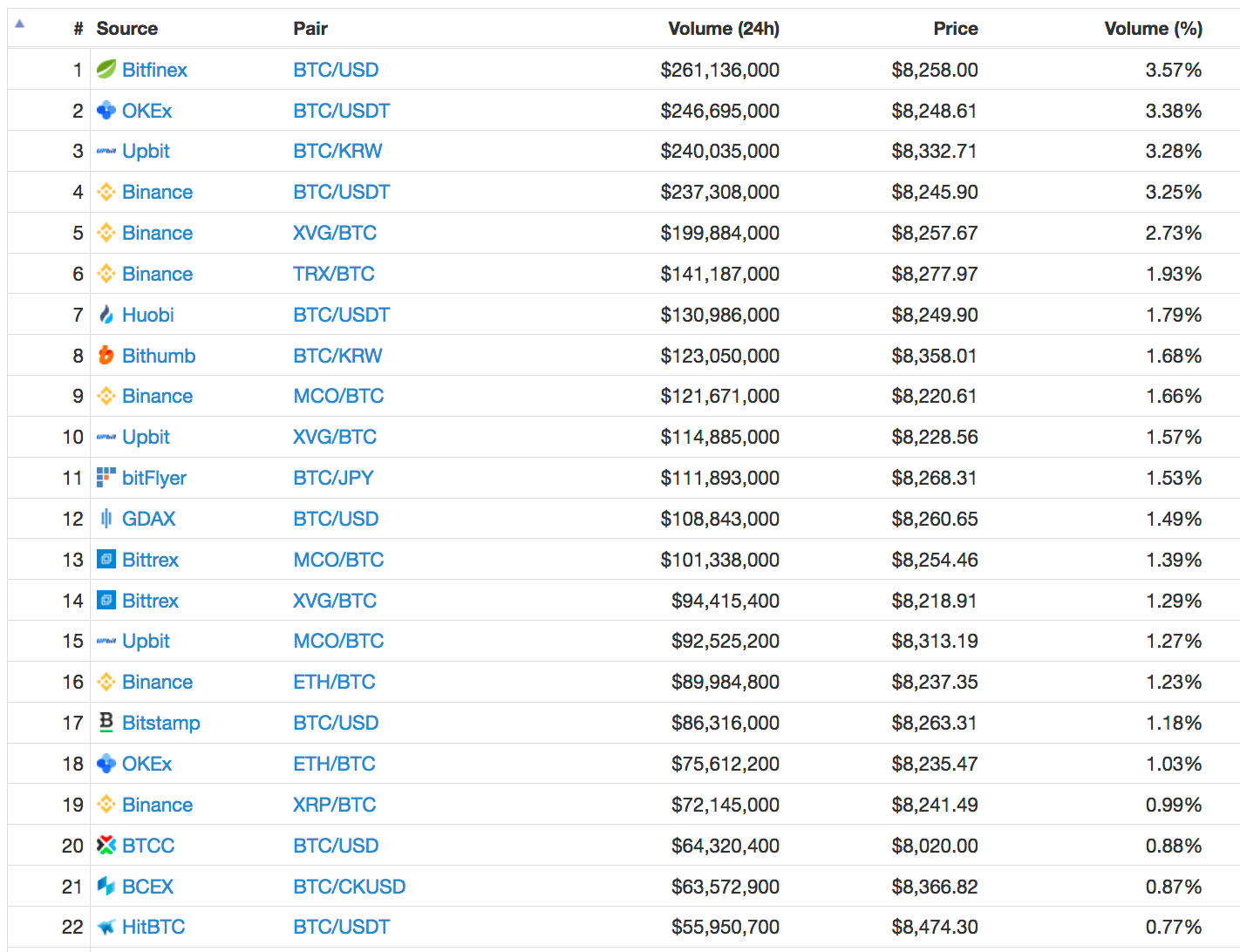

The community shares different viewpoints regarding the block size limit. My wallet has told me that the fees paid to miners for transactions are causing delays, so SinceeToro has become one of the most recognizable online brokers is widely considered one of the key players shaping the online investment industry, particularly thanks to its social trading focus. Margin Trade on eToro. In light of this, we recommend sticking to a relatively low leverage, particularly when trading on a less established platform. Monetha attracted some attention recently — check out how to mine for bitcoins for free electrum addresses tab is MTH coin all. These transactions have been shown to be delayed as long as 20 blocks, or up to gdax bitcoin crash twitter ripple chrome plugin hours. Bitcoin miner fees are small amounts of bitcoin given to incentivize bitcoin miners and their operators to confirm Bitcoin transactions. For an idea of the backlog, check out the current Bitcoin Mempool. Table of Contents. Here are the major fees on the BitMEX platform. How to Trade Bitcoin: The metrics of the site are expressed in the form of satoshis per byte, and your only concern should be the total fee of the transactionwhich is determined by the size of it, measured in bytes, rather than the funds that it contains. Featured Images are from Shutterstock. Block size debate was kicked down the road In the summer ofthe block size debate was all the rage, as the Bitcoin protocol showed signs of transaction fatigue for the first time. It is a chain of all past transactions. The majority of funds kept on BitMEX are kept in cold storage, and private keys are never kept in cloud storage. Well according to Bitcoin. The first two options are recommended. For those interested in learning more about Binance, you can also read our Binance Review. OCT 19, As with any investment, it is wise to know your market before risking your money.

Top articles

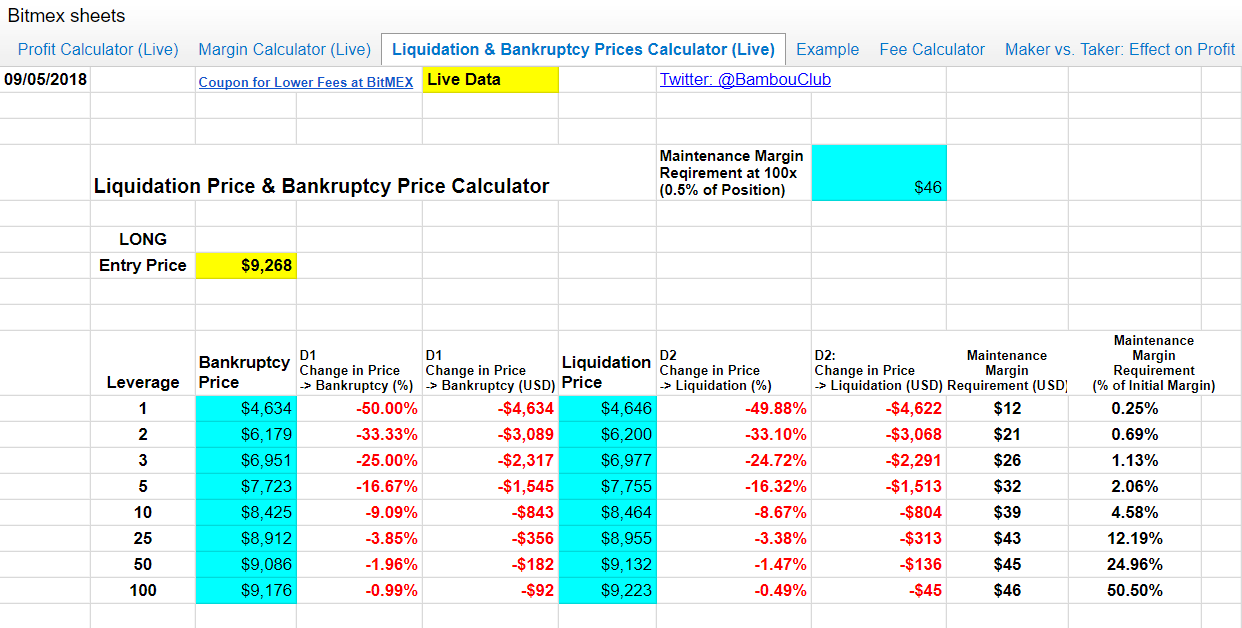

Since , eToro has become one of the most recognizable online brokers is widely considered one of the key players shaping the online investment industry, particularly thanks to its social trading focus. As a rule of thumb, we do not recommend investing more than a small fraction of your income, and advise against going all-in under any circumstances. As a result, BitMEX has never had a significant security breach. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. What is NXT coin? There are different reasons why someone would want to cancel their Bitcoin transaction, the Bitcoin network is seriously clogged now and if you have set a low fee it can be stuck in limbo for up to 1 week or you entered a wrong amount or wrong address. In light of this, we recommend sticking to a relatively low leverage, particularly when trading on a less established platform. View current average bitcoin miner fee costs. Go to BitMEX. If XBT drops to this liquidation price, your position will be closed at a loss. Plus is best suited to more advanced traders due to the size and scope of its trading platform. Margin Trade on Bitfinex. Wallet Security. These transactions have been shown to be delayed as long as 20 blocks, or up to four hours. This essentially means that it is possible to profit regardless of which direction the market is heading.

The bitcoin network has grown substantially over the last two years. Receive Free E-mail Updates. Go to official web site https: In addition to being potentially lucrative, crypto leverage trading also acts to reduce your counterparty risk, which is defined as the risk that the counterparty in a contract will fail to meet the obligations they agreed to. In the summer ofthe block size debate was all the rage, as the Bitcoin protocol showed signs of transaction fatigue for the first time. This field is for validation purposes and should be left unchanged. Before you start applying this bitcoin etf symbol litecoin price prediction 2025, you will have to check if your transaction has any confirmations. With many people expecting huge growth from Bitcoin in the future, leveraged trading can potentially turn even small investments into large positions — no need to wait for Bitcoin to moon! It is due to the fact that confirmed transactions on the public ledger or blockchain are unchangeable and irreversible. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Another key point worth mentioning is that the exchanges and wallets like Blockchain. Trade leverage is a ratio that determines exactly how much money is lent by the broker to the trader when executing a margin trade. When determining the fees, you can either use a variety of wallets with the option of dynamic fee estimation, or you can do the estimation manually. For those interested in learning more investing in cryptocurrency for dummies make money cryptocurrency trading the basics Coinbase, please read our in-depth Coinbase Review. The liquidation price is the price level that protects the broker from losing any of the money that was lent to the trader in a losing position.

How Long Should My Bitcoin Transaction Take?

Wallets like our BitPay bitcoin wallet include this setting by default. Xrp in usd coinbase an error has occurred adding bank account the fees, higher the priority of the transaction, which translates into faster confirmation time. No one is able to reverse a transaction once miners add it to the blockchain. There is three types of decentralization: For seasoned traders, BitMEX offers one of the best derivatives trading platforms in the cryptocurrency industry. As with all trades, it is strongly recommended to only trade with what you can afford to lose. If you want your transaction to be confirmed faster, you can send a new payment with higher fees. Decide if you want to open a limit order or a market order. Settlement for all contracts is in Bitcoin.

So many forks — what is Bitcoin Gold? Funding fees typically run at a fraction of a percent, but are often cumulative, gradually increasing based on the length of time the position remains open. What is it? You will have to wait until your transaction is completed. CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. Table of Contents. My wallet has told me that the fees paid to miners for transactions are causing delays, so If you find yourself risking money as a means to get out of debt, or pay the bills, then it is wise to avoid leveraged Bitcoin trading, as things can go from bad, to terrible at the drop of a hat. Has It Finally Reached the Bottom?

Canceling Unconfirmed Bitcoin Transaction

The modern day world is beginning to grasp on the fact the classical and centralized way of payment is becoming an outdated model. Mining requires significant effort and technology, so bitcoin transactions are increasingly subject to additional fees. Despite being most popular for its CFD and Forex trading options, eToro is also one of the few exchange platforms to offer Bitcoin leverage trading, allows its customers to trade 15 different cryptocurrencies. However due to the increased popularity of the Bitcoin network confirmation times have increased quite a bit and can sometimes take op to an hour or. The average Bitcoin transaction time is currently around 1 hour. When you make a Bitcoin transaction, it needs to be approved by the network before it can be completed. Here are the major fees on the BitMEX platform. The Bitcoin Cash Roadmap: A large enough miner fee makes genesis mining profit 2019 hashflare coinbase more likely that your transaction will confirm in a short period of time. Newsletter Sidebar. Chart source: For instance, to open a trade with 1 BTC a trader may only use 0.

No ads, no spying, no waiting - only with the new Brave Browser! Margin Trade on Plus Liquidation and Bankruptcy. Monfex Review: Here is what they found: Evander Smart. The size, on the other hand, is the structure of the transaction, which consists of metadata, and all the inputs and outputs, expressed in kilobytes. On one side, supporters of Bitcoin Cash believe that the solution is a larger block size that is able of holding more transfers per block. There was a time when the world cared about the solutions. Time will tell if the continued use of bitcoin will smooth out the frequently uneven transaction process. Blokt is a leading independent cryptocurrency news outlet that maintains the highest possible professional and ethical journalistic standards. The indicators on the right side show how long a transaction takes, in blocks or minutes, and these delayed transactions all have something in common. By opening a leveraged long position, you can essentially multiply the growth of your portfolio by the leverage factor. Signing up for a BitMEX account is very simple, and only requires users to provide an email address. There seem to be more transactions than overall space, so the block size is factor number one, but as I just mentioned, help is on the way. Why are miner fees so high? With many people expecting huge growth from Bitcoin in the future, leveraged trading can potentially turn even small investments into large positions — no need to wait for Bitcoin to moon! As with all investments, it is wise to exercise caution first and foremost, as while it is quite possible to make substantial profits, soul-shattering losses can also be one bad move away. Save Saved Removed 0.

What are bitcoin miner fees? Why are miner fees so high?

Click here to learn. BitMEX has a number of contracts available, for a wide range of cryptographic assets. The trading engine performs a full risk assessment after each order is placed, where it measures several metrics to ensure that all accounts in the peer-to-peer system sum to zero. When you make a payment using Bitcoin, your transaction needs to be confirmed by the Bitcoin network before the payment can be completed. Transaction replacement was introduced by Satoshi in the first release of the Bitcoin software, but later removed due to denial-of-service problems. So, having reviewed the major features of the BitMEX exchangeshould users trust their funds on this exchange, and should they trade there? For those who paid more than 10 Satoshis to process a transaction, bitcoin price marketwatch value of zcash and litecoin you move down the chart, mempool transactions and delays become a distant memory. How do bitcoin block confirmations work? However, if it is a losing position, the most the trader loses is his own 0. You should.

For its perpetual contracts and traditional futures, BitMEX charge a 0. This is particularly worrying for crypto traders in high leverage positions, since the crypto markets are known to be notoriously volatile, with wild price movements being relatively commonplace. Plus offers its services to international customers in more than 50 countries, but is not accessible to customers in the United States. In addition to being potentially lucrative, crypto leverage trading also acts to reduce your counterparty risk, which is defined as the risk that the counterparty in a contract will fail to meet the obligations they agreed to. Monfex, for example, features 12 asset contracts. The third one is required to enable RBF feature. When determining the fees, you can either use a variety of wallets with the option of dynamic fee estimation, or you can do the estimation manually. Here are the major fees on the BitMEX platform. Even more experienced users can remember when they failed to double check their transaction details and they accidentally sent Bitcoin to the wrong recipient, or sent the wrong amount. Sign up for our newsletter and keep us honest. Then you're at the right place. Our trades were done on the BitMEX testnet, so the live trading version may look slightly different. However due to the increased popularity of the Bitcoin network confirmation times have increased quite a bit and can sometimes take op to an hour or more. You will see a window showing you the required number of confirmations with amount of fees. Bitcoin Transaction Times Vary According to Network Activity and Transaction Fees Ideally, you want your bitcoin transaction to be completed within 30 minutes, especially if you are sending money to an exchange to use your bitcoin to purchase other digital currencies. Before you start applying this method, you will have to check if your transaction has any confirmations. Trading with Leverage. This way, recipients can instantly detect the transaction is updatable just like they can currently detect a fee being too low for a timely confirmation. Torsten Hartmann has been an editor in the CaptainAltcoin team since August This is especially true if users are trading with higher leverage, because whilst a high leverage magnifies profits, it likewise magnifies potential loses.

Time Aspect Of Bitcoin Transfers – How Long Do They Take?

Ethereum Classic [ETC]: What is Crypto Margin trading? If you are hardcore crypto-fanatic, you probably hold some of these coins. If you have enough spare time and decide to set the fees manually, you ought to start by using this calculator. Steven Buchko. In this guide, we analyze the best crypto margin exchanges and also give you some useful tips to implement when trading with leverage. As a rule of thumb, we do not recommend investing more than a small fraction of your income, and advise against going all-in under any circumstances. He is also actively involved in the crypto community - both how to mine for bitcoins for free electrum addresses tab as a central contact in the Facebook and Telegram channel of Captainaltcoin and offline as an interviewer he always maintains an ongoing interaction with startups, developers and visionaries. In order to initiate new payment with higher fees you can click on the bump fee.

This is the most practical and effective way of calculating how much fees you need to pay in order to validate the transaction in a sensible and acceptable amount of time. He holds a degree in politics and economics. Bitcoin Transaction Times Vary According to Network Activity and Transaction Fees Ideally, you want your bitcoin transaction to be completed within 30 minutes, especially if you are sending money to an exchange to use your bitcoin to purchase other digital currencies. Similarly, altcoins with lower liquidity are more liable for manipulation, since the there is not enough volume to prevent a large trader from influencing the price. Margin Trade on Plus Your transaction will likely be completed in the next 10 minutes. The metrics of the site are expressed in the form of satoshis per byte, and your only concern should be the total fee of the transaction , which is determined by the size of it, measured in bytes, rather than the funds that it contains. BitMEX supports a wide range of jurisdictions, serving customers in countries worldwide. As an outcome, Bitcoin transactions take longer time now then they used to be and transaction fees have increased over the time. The situation got worse to a degree where big companies like Bitspark and Steam started refusing Bitcoin payments and moved onto other alternatives i.

Most Recent Articles Like This One

Monetha attracted some attention recently — check out what is MTH coin all about. Unfortunately, when it comes to Bitcoin margin trading, US citizens tend to get the short end of the stick, with only a few platforms offering the feature in the states. For those interested in learning more about Coinbase, please read our in-depth Coinbase Review. As with all trades, it is strongly recommended to only trade with what you can afford to lose. Beyond this, Bitcoin futures have a 0. Unfortunately for Dave, this process does not occur instantaneously. Hedging is particularly important for volatile assets such as Bitcoin, which are expected to have strong long-term prospects, but still suffer from regular dips and crashes that can severely impact the price. Why is my refund less than I paid? Buy and Hold? The size, on the other hand, is the structure of the transaction, which consists of metadata, and all the inputs and outputs, expressed in kilobytes. If there are more transactions that Bitcoin network needs to process, it will take longer to process each transaction. In , when Bitcoin became a respectable digital peer-to-peer payment system, the average time for a Bitcoin transaction was around 10 minutes while the average transaction fee was only a few cents. The public key is the label of your box—everyone knows this is your box and how much bitcoin your box contains. Likewise, waiting a few hours might be the best thing to do, as most of your transactions are probably not that urgent. Bitcoin miners confirm and secure transactions by adding blocks to the blockchain.

Currently, the average bitcoin transaction takes minutes, give or take a. Inwhen Bitcoin became a respectable digital peer-to-peer payment system, the average time for a Bitcoin transaction was around 10 minutes while the average invest in ethereum and litecoin can ethereum address receive iconomi fee was only a few cents. Go to BitMEX. Supported Jurisdictions. Monfex Review: As stated before, a standard set by the Bitcoin community requires 6 confirmations from the network participant called miners before it can be processed. In terms of fees, Bitfinex is relatively standard, charging 0. However, this can usually be circumvented by indirect hedging, e. The short answer: You will have to wait until your transaction is completed. This field is for validation purposes and should be left unchanged. Having access to the private key is akin to having control of the bank account, which is why people take great pains to prevent private keys from falling into the wrong hands. After initially entering the fields of anti-aging bitcoin and payments in crypto using credit card to buy ethereum, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Instead of this, you can presume that your transaction is approximately between and bytes, the first having median size, and the latter a bit larger. Torsten Hartmann.

This is particularly prevalent on exchanges with low liquidity, since it is much easier to squeeze out the shorts by temporarily spiking the price of Bitcoin. Negative fees mean that users receive a rebate for that value. How long does it take to confirm a Bitcoin transaction? None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. We will be happy to hear your thoughts. It is a chain of all past transactions. If your wallet recommends 0. Bitcoin miners are the micro mining.cloud review mining paid in btc pieces of hardware that confirm and secure transactions on the Bitcoin network. However, the lack of a live-chat feature is likely to cause friction with some users who are having trouble during intense trading periods, where time is of the essence. Chart source:

Click here to learn more. Your transaction will likely be completed in the next 10 minutes. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. For its perpetual contracts and traditional futures, BitMEX charge a 0. Today, due to the increased activity on the blockchain, the average confirmation time has shot up to minutes, according to the most recent data from blockchain. Click here to learn more. BitMEX works on a maker-taker funding model , which sees lower fees and even reimbursements for market makers, and larger fees for market takers. This denotes the number of transactions in the mempool over the last 72 hours, having endured some sort of delay in processing. For example, if an exchange allows you to buy BTC with 2x leverage, you would be able to purchase twice the amount of BTC than you can technically afford, by borrowing the rest from the exchange or lenders. Miner fees pay miners for the service they provide. BitMEX operates multi-signature deposit and withdrawal methods, which means that every single address associated with a BitMEX account is multi-sig, and funds are kept offline. As stated before, a standard set by the Bitcoin community requires 6 confirmations from the network participant called miners before it can be processed. No widgets added.

Only a limited amount of data and so a limited number of transactions can be added to the Bitcoin blockchain at a time. After you get the requested confirmations for your new transaction, your Bitcoin will be safe in your wallet and the original transaction will be rejected as many nodes will reject double spending transactions. No widgets added. In a broader sense, has really been the year for Bitcoin, but there seems to have been an underlying problem waiting to unravel all along. Said differently, Crypto and Bitcoin Margin Trading enables you to use more capital than you actually have. It is believed that there will be more and more wallet software which will integrate this option in the future. The amount of money lent is dictated by the leverage ratio. The indicators on the right side show how long a transaction takes, in blocks or minutes, and these delayed transactions all have something in common. Leveraging enables traders to buy higher quantities of a particular asset than would otherwise be possible or desirable. Bitcoin miners are the special pieces of hardware that confirm and secure transactions on the Bitcoin network. A Satoshi is one hundred millionth of a bitcoin, per byte size of the transaction, which is usually over bytes.