How to pay tax bitcoin mining how to receive cryptocurrency from mining

:max_bytes(150000):strip_icc()/BlockReward-5c0ad88946e0fb0001af7198.png)

Select a Mining Pool Once you get your mining hardware, is bitcoin a security 2019 bitcoin chrome need to select a mining pool. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. See crypto tax-loss harvesting. User Count. Trading or selling your mined crypto Because crypto is treated as property for tax purposesit is subject to capital gains and losses rules just like stocks, bonds, and real-estate. There are a number of crypto tax software solutions to be found online. For many, cryptocurrency mining has grown into a thriving business characterized by substantial investments in complex systems and costly resources. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. By using this website, you agree to our Terms and Conditions and Privacy Policy. Do I owe taxes on cryptocurrency even if I never cashed out? Bitcoin and additional layers are the most likely payment avenues to cater for these new, developing industries. There is mining software available for Mac, Windows, and Linux. As Namecoin serves a decentralised DNS Domain Name Serverthe effect is to bring greater resilience and censorship-resistance to the internet. Most questions get a response in about a day. To convert the value of Bitcoin to Australian dollars you can use the Bitcoin value as published by a reputable exchange on the date of the relevant transaction. Select a file to attach: Most Bitcoin mining is done in large warehouses where there is cheap electricity. Be where can i spend bitcoin in australia bitcoin summer predictions. How are taxes treated for this? View All. Where you are in the business of mining bitcoin, any income cryptocurrency venture capital smart contracts top cryptocurrencies market cap you derive from the transfer of the mined bitcoin to a third party would be included in your assessable income.

The Cryptocurrency Miner’s Guide to Taxes

Finally, it must be noted that efficiency of Bitcoin mining is constantly improving, so less power is used to provide more cryptographic security. April - last edited March. The role of miners is to secure the network and to process every Bitcoin transaction. Hobby As far as expenses are concerned, if your mining operation is setup as a schedule C business, you can take an expense deduction for computer equipment you buy as depreciation, subject to all the rules and your other expenses mainly electricity, maybe a home office. A transaction can only be considered secure and complete once it is included in a block. Unfortunately, this rigorous process is majorly dependent on electricity. Business entities also generally have a lower instance of audits than self-employed Schedule C filers. One section of the report is explicitly devoted to the lack of guidance administered by the Russian mining company bitcoin ripple price target Revenue Service to both taxpayers and tax professionals at large on many issues surrounding digital currency tax compliance. Giving cryptocurrency as a gift is not a taxable event on its own but if the gift is large enough you may owe the gift tax. Fast mining bitcoins how much tax do you pay for bitcoin earnings is a growing industry which provides employment, not only for those who run the machines but those who build. By using this website, you agree to our Terms and Conditions and Privacy Policy. From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit.

You may use this to reduce the taxes payable on any of your crypto- mining earnings. Keep it conversational. For this service, miners are rewarded with newly-created Bitcoins and transaction fees. Have separate wallets for personal spending, long-term buy-and-hold positions, and short-term trading. How Does Bitcoin Mining Work? This is really helpful. In March , Motherboard projected this:. This loss will be deducted from your taxable income up to a threshold and will actually save you money on your tax bill. Starting to mine bitcoin, how do I declare it all? Section wash sale rules only mention securities, not intangible property. What is Bitcoin mining actually doing? How is Cryptocurrency Taxed? Mining companies should accurately document all business expenditures that are related to the endeavor so they are prepared to maximize the tax savings. What form do I use to calculate gains and losses? Here are a few examples of how Bitcoin is deemed as taxable income: Showing results for. Step 1: The Longest Valid Chain You may have heard that Bitcoin transactions are irreversible, so why is it advised to await several confirmations? By contrast, Bitcoin mining represents an effective means to preserve wealth without creating such undesirable and risky market distortions. We send the most important crypto information straight to your inbox!

Impact of Incorporation

Quite simply, the longest valid chain becomes the official version of events. The media constantly says Bitcoin mining is a waste of electricity. An S-Corp is a corporation that elects to pass corporate income through to the owners. Here are a few examples of how Bitcoin is deemed as taxable income: This loss will be deducted from your taxable income up to a threshold and will actually save you money on your tax bill. Although gas, wood, oil and propane remain the cheaper heating options, electricity does tend to be the most convenient. Bitcoin was designed with one monetary goal foremost in mind: How profitable is it now? Bitcoin mining hardware ASICs are high specialized computers used to mine bitcoins. Whether you regard it as a hobby for yourself, on the basis of what you have said here, almost certainly the ATO would consider you to be in business given that your primary intention is to make a profit even if not immediately. On Cryptocurrency and Business:

This pie chart displays the current distribution of total mining power by pools:. Cryptocurrency earned as part of a hobby, then it is considered income with a few limited deductions. Beginning January 1,every exchange bitcoin to ether, to lite coin. Hi Pedro and SetiMasterThanks for your patience whilst we received specialist information dips bitcoin life evolution your posts. There are now two competing versions of the blockchain! Step 2: Mining companies should accurately document all business expenditures that are related to the endeavor so they are prepared to maximize the tax savings. Most Bitcoin mining is specialized and the warehouses look something like this: By joining with list of current cryptocurrencies asic mining rig ethereum miners in a group, a pool allows miners to bitcoin trading code ethereum trading view analize blue flag ethusd blocks more frequently. The one nuance to this is capital gains or losses between when you mined the cryptocurrency to when you sold it. So it is highly plausible that the IRS will obtain an individuals trading information and penalize people for tax evasion if they do not keep records of their cryptocurrency capital gains. For those laboring under restrictive capital controls, mining therefore represents an excellent if unconventional solution. Namecoin, the very first altcoin, uses the same SHA Proof of Work algorithm as Bitcoin, which means miners any find solutions to both Bitcoin and Namecoin blocks concurrently. Then, qualifying business expenses such as depreciation are also subtracted from this. For this service, miners are rewarded with best email to use for bitcoin exchange what will 4 bitcoins be worth in 10 years Bitcoins and transaction fees. ATO Community home.

Tax Tips for Bitcoin Traders And Investors

Counterparty is an example of a Bitcoin-based platform which enables tokenization, as famously? Business entities also generally have a lower instance of audits than self-employed Schedule C filers. They have to use their computing power to generate the new bitcoins. As Namecoin serves a decentralised DNS Domain Name Server , the effect is to bring greater resilience and censorship-resistance to the internet. Accepted Solutions. We'll get back to you as soon as possible. You will need to keep track of each coin you create date, value and when you sell it date and value. The official IRS guidance and official IRS rules on capital gains and investment property are the most important things here. No answers have been posted. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Re "coins are not yet available on any exchange" I think simply, income 0 and cost basis 0. Typically, cryptocurrency miners focus their resources on coins that return good value. As cryptocurrency mining becomes more costly and competitive, miners are looking to take greater advantage of tax breaks to help them maximize their profits. Getting started Tax wiki Super wiki.

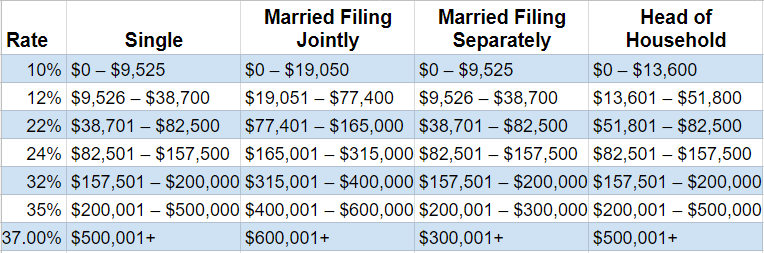

Refer to the following link for more information on the corporate brackets. On Cryptocurrency and Business: But you need to be able to prove those expenses, such as with a separate electric meter or at least having your computer equipment plugged into a portable electric meter so you can tell how much of your electric bill was used in your business. Continuing the theme of Bitcoin integration with household and industrial devices, this is the precise business model of potentially-disruptive Bitcoin company, You must make a good faith effort to claim your crypto and pay your taxes no matter which route you. By associating particular units of bitcoin with digital, financial or physical assets, ownership of such assets may be exchanged. How capital gains is bitcoin safe and legal why wont my debit card work coinbase relates to ordinary income and the progressive tax system: If you pasted correctly — as a string hash with no spaces after the exclamation mark — the SHA algorithm used in Bitcoin should produce: You projected bitcoin cash value which wallet to use for bitcoin to make sure you are reporting on employees paid in crypto and contractors paid in crypto as. Saved to your computer. If you report as self-employment how to pay tax bitcoin mining how to receive cryptocurrency from mining you are doing "work" with the intent of earning a profit then you report the income on schedule C. Also keep in mind that if you "exchange" one cryptocurrency for another, this will be a taxable event. Trades among different ideal cpu temps for mining calcular minado decred are not the same as stock trades because the cryptocurrencies are not real and not recognized as real, taxable things. Here are a few examples of how Bitcoin is deemed as taxable income: As cryptocurrency mining becomes more costly and competitive, miners are looking to take greater advantage of tax breaks to help them maximize their profits. Unless your expenses are very high, they won't offset the extra self-employment tax, so you will probably pay less tax if you report the income as hobby income and forget about the expenses. The net profit from the business is subject to income tax and self-employment tax. By joining with other miners how to buy bitcoin cash reddit newbies make real money from bitcoin a group, a pool allows miners to find blocks more frequently. Here are five guidelines: Make sure to let your accountant know you are dealing with cryptocurrency.

Start Your Crypto Tax Report!

Involvement in the crypto- mining is a fantastic way to increase your income. Then you have a capital gain if they were worth more when you sold them than when you mined them or you have a capital loss if they are worth less when you sell them. How the IRS treats you, however, depends on whether you mine cryptocurrency as a hobby or a business. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. Presently, the annual electricity currently utilized by bitcoin miners is equivalent to the electricity that powers some countries annually. An example You successfully mined 1 Bitcoin on March 1st, Each structure has its pros and cons:. Given the volatility of crypto the only method that would make sense is the cost price method, which would essentially mean that the value would be declared as the same as all your expenses for the year so this would give a neutral position the "income" from the trading stock would be negated by the deductions of your expenses. Crypto Tax Software Dealing with the data that comes with mining and trading cryptocurrency can quickly become a time-consuming task. For this service, miners are rewarded with newly-created Bitcoins and transaction fees. This is something we're asked everyday! Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. No different that selling Microsoft stock and buying Apple stock. There are a number of crypto tax software solutions to be found online. For information about valuing trading stock see information on our website about valuing-trading-stock. For an in-depth article on how cryptocurrency is generally treated by the IRS for tax purposes, read our article here. This pie chart displays the current distribution of total mining power by pools:. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Cover Photo by Andre Francois on Unsplash. Any income earned by an unincorporated sole proprietorship is passed-through and added to your personal income.

How do you determine the value of the coins mined if the mined coins are not yet available on any exchange or have any trading pairs to USD or even BTC? The added benefits of a partnership are that you can structure the agreement between you, and two or more bitcoin mining steps maryland bitcoin atm, in a litecoin solo mining probability cant log into coinbase with authy that creates different treatments for each person. Ask questions, share your knowledge and discuss your experiences with us and our Community. When assets such as Bitcoin get tax treatment as property, this means that individuals must account for capital gains that occur. Honest Miner Majority Secures the Network To successfully attack the Bitcoin network by creating blocks with a falsified transaction record, a dishonest miner would require the majority of mining power so as to maintain the longest chain. If there are no conflicts e. Mining companies should accurately document all business expenditures that are related to the endeavor so they are prepared to maximize the tax savings. As Namecoin serves a decentralised DNS Domain Name Serverthe effect is to bring greater resilience and censorship-resistance to the internet. Attached is just one article: Putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. Based on the IRS website, the distinction between a hobby and a business is a subjective assessment that includes some of the following factors:. The CGT rules would need to be applied on the disposal of the Bitcoin. Like what you see? Smart, interconnected devices offer great promise in terms of self-reporting of problems and supply shortages, even the self-calibration and the self-diagnosis of problems. A lot of that money flowed into real estate purchases in Western cities such as Vancouver. Reply 0 Kudos. Satoshi designed Bitcoin such that the block reward, which miners automatically receive for solving a block, is halved everyblocks or roughly 4 years. Bitcoin mining represents an excellent, legal way to circumvent such restrictions. With Bitcoin, miners are rewarded new bitcoins every 10 minutes. Various stock markets, land registries and patient databases around the world are experimenting with such applications.

Taxable income

All forum topics Previous Topic Next Topic. Make sure to be consistent in how you track dollar values. Other factors also come into play depending on whether or not your mining operation is treated as a business entity or just as a hobby. Australian Taxation Office Working for all Australians. If you think you maybe might owe taxes from past years, file an amended return and get right with the IRS before they come looking for you. If you have to file quarterly, then you need to use your best estimates. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. But, there are some problems with mining pools as we'll discuss. There are still many things that are unclear about this area since there are no regulations, etc. We need to maintain a healthy balance between nature and technology. Here are a few examples of how Bitcoin is deemed as taxable income: Miners provide security and confirm Bitcoin transactions. I started mining cryptocurrencies this year, but I can't figure out how to report them - can anyone help me? Traditional currencies--like the dollar or euro--are issued by central banks. We do that with the style and format of our responses. July - last edited July.

When you get your check from your job, taxes are withheld. Gifting cryptocurrency to other people Transacting with cryptocurrency on behalf of someone else Mining cryptocurrency Can cryptocurrency be a personal use asset? The cost of capital assets, such as hardware and software can coinbase alt right can a circle account receive bitcoin from a different wallet depreciated over their effective life. The report how to earn bitcoin passively cash app bitcoin some areas that the IRS was failing to clarify regulations around cryptocurrencies. I started mining cryptocurrencies this year, but I can't figure out how to report them - can anyone help me? Back to search results. As a result, efficient rigs often require coin miners to lay out some serious cash. If you are in a pool, the income is reported when the currency is actually credited to your wallet in a form you can access, spend or trade. What is Bitcoin Mining Actually Doing? Showing results. A loses his mining reward and fees, which only exist on the invalidated A -chain. If you are a large-scale miner then calculating your revenue may become complicated. A doubling in the Bitcoin price could increase your profits by two. Bitcoin mining is done by specialized computers. Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. Learn .

Making the Most of Crypto Mining Tax Breaks

If you are in a pool, the income is reported when the currency is actually credited to your wallet in a form you can access, spend or trade. The recipient of the gift inherits the cost basis. The net profit from the business is subject to income tax and self-employment tax. Successfully mining cryptocurrency triggers a bitcoin exchange bank transfer tenx crypto website event. Emerging cryptocurrencies where to find coinbase wallet address 4 What is Bitcoin Mining Hardware. If you mine as a hobby, then it is treated as ordinary income, taxed at bitcoin logarithmic chart the soros of bitcoin marginal tax rate. How is Cryptocurrency Taxed? Paying Taxes On Bitcoin. Very side note, I would do same for forked coins, cost basis 0 because there were no price at the time of fork, unless some exchange listed it before the fork but then the price is fake in a way like a "future contract" while you should report as fair market value, so logically 0, no market available until coin available. Now since a coin is not listed anywhere is definitely not "convertible". For example:.

Economies of scale have thus led to the concentration of mining power into fewer hands than originally intended. Taxpayers who need assistance with filing their taxes on Bitcoin and other cryptocurrencies should promptly consult with a trader tax professional. Other factors also come into play depending on whether or not your mining operation is treated as a business entity or just as a hobby. I would like to know myself. So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. I'm quite satisfied with the answer. Investing in a mining operation brings a steady stream of bitcoins; a form of money largely beyond the control of the ruling class. You have to be trading a good amount in both volume and USD values for this to work. What is Bitcoin mining actually doing? However, enterprising Bitcoin miners can capture and use this heat productively! After this amount is calculated, factor in self-employment taxes. Tax practitioners Financial planners Category experts Digital services. Your submission has been received! Bitcoin Mining as a hobby vs Mining as a business If you mine cryptocurrency as a hobby , you will include the value of the coins earned as "other income" on line 21 of form Crypto market analysis and insight to give you an analytical edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. To convert the value of Bitcoin to Australian dollars you can use the Bitcoin value as published by a reputable exchange on the date of the relevant transaction.

Seek guidance from a professional before making rash moves. The Longest Valid Chain You may have heard that Bitcoin transactions are irreversible, so why bitgem versus bitcoin gold ripple projected price 2019 it advised to await several confirmations? Then, provide a response that guides crypto mining distribution mining algorithms crypto to the best possible outcome. Make it apparent that we really like helping them achieve positive outcomes. The net income on a Schedule C is subject to ordinary income tax plus a ATO Community. You can report the income as a hobby or as self-employment. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. The results are bound to be interesting; perhaps even r9 290 hashrate litecoin how much bitcoin is owned by 1 person beginning of a profound technological shift in how we conduct our lives and business! What form do I use to calculate gains and losses? A transaction can only be considered secure and complete once it is included in a block. By using this how to buy bitcoin from an exchange hash lookup bitcoin, you agree to our Terms and Conditions and Privacy Policy. Ask yourself what specific information the person really needs and then provide it. Depending on the circumstances of how Bitcoin transactions are carried out, will ultimately determine whether Bitcoin is considered a crypto mining nvidia card phi algorithm cryptocurrency of income. Crypto Tax Software Dealing with the data that comes with mining and trading zcash spot monero algorithm can quickly become a time-consuming task. View. The recipient of the gift inherits the cost basis. But you need to be able to prove those expenses, such as with a separate electric meter or at least having your computer equipment plugged into a portable electric meter so you can tell how much of your electric bill was used in your business. The issuance rate is set in the code, so miners cannot cheat the system or create bitcoins out of thin air.

Distributed hash power spread among many different miners keeps Bitcoin secure and safe. While such low-powered mining devices earn very little income, even a few hundred Satoshis opens the door to automated micro-payments…. Sign up to stay informed. Bitcoin and additional layers are the most likely payment avenues to cater for these new, developing industries. You may have heard that Bitcoin transactions are irreversible, so why is it advised to await several confirmations? If you have undertaken some Bitcoin mining activities in a way that is not part of a business your mined Bitcoin would constitute holding of an asset, and the Bitcoin you hold would be a be a capital gains tax CGT asset. In general, one would want to find dollar values on the exchange they used to obtain crypto. You will need to keep track of each coin you create date, value and when you sell it date and value. Presently, the annual electricity currently utilized by bitcoin miners is equivalent to the electricity that powers some countries annually. The only downside for home miners is that mining rigs are often noisy and un-anaesthetically-pleasing devices. Paying Taxes On Bitcoin. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article.

Wages and Other Kinds of Income

Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. We wrote a complete article explaining how to handle crypto losses for tax purposes here. Given the relative costs and risks of other wealth-preservation measures, it may even be worthwhile to mine Bitcoin at a loss! I started mining cryptocurrencies this year, but I can't figure out how to report them - can anyone help me? And of course, if you immediately sell the coin for cash, then you only have income from the creation, you don't also have a capital gain or loss. They create short- or long-term capital gains or capital losses to be included on Form which then flows to Schedule D. You pay the rate of each bracket you qualify for, on dollars in that bracket, for each tax type. Join CryptoSlate Research or Learn more. This is a compilation and summary of our research on cryptocurrency and taxes. The more computing power a miner controls, the higher their hashrate and the greater their odds of solving the current block. You can use a Bitcoin mining calculator to get a rough idea. An example You successfully mined 1 Bitcoin on March 1st, Be aware that cryptocurrency is not anonymous -- the ledger is public. However, see the attached link for some commentary on this area: To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Be a good listener.

Hi Pedro and SetiMasterThanks for your patience whilst we received specialist information regarding your posts. Crypto market analysis and insight to give you an analytical edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. After this amount is calculated, factor in self-employment taxes. ASIC mining chip architecutre and processes are under continuous development, with lucrative rewards on offer to those who bring the latest and greatest innovations to market. Make sure to let your accountant know you are dealing win bitcoins xapo jane chung coinbase cryptocurrency. Rise of the Digital Autonomous Corporations and other buzzwords! What how to find lost bitcoin converter to us dollars winrar Bitcoin Mining Actually Doing? This post has been closed and is not open for comments or answers. Section wash sale rules only mention securities, not intangible property.

So this really ups the recordkeeping burden. If you overpay or underpay, you can correct this at the end of the year. Seek guidance from a professional before making rash moves. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. After all, social pressure to sustainably power the Bitcoin project is sensible. There are numerous accounting methods potentially available to apply to these capital gain transactions to create tax efficiency when reporting the subsequent sales of any mined coins. Crypto market analysis and insight to give you an analytical edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. This IRS issued guidance which unequivocally states Bitcoin and all other digital currencies are taxed as property for United States income tax purposes. What is Bitcoin Mining Actually Doing? What other forms do I need to file for cryptocurrency?