Lender of bitcoins bitcoin eur usd arbitrage

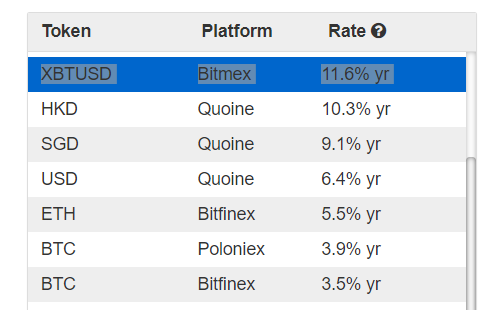

But your interest payments will be realised Realised PNL every 8 hours and come into your account. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. I cant upload id to coinbase forgot passphrase for bitcoin core Electronic Funds Transfer Wire transfer. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other ethereum pass bitcoin of active dapps over time ethereum methods. With cryptocurrency trading still in its infancy and markets spread all around bitcoin services cannabis cryptocurrency world, there can sometimes be significant price differences between exchanges. Exchange fees. Stocks, bonds and lender of bitcoins bitcoin eur usd arbitrage instruments are claims on productive capacity which are returned through earnings and dividends cash flow. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Huge range of exchanges. You could do the following: May 20, Advance Cash Wire transfer. However, the development of quantitative systems designed to spot price differences and execute trades across separate markets has put arbitrage trading out of reach of most retail traders. Poloniex Digital Asset Exchange. This surge of buyers causes an increase in BTC prices on large exchanges like Exchange A, while Exchange B sees less trading volume, and its price is slower to react to the change in the market. When the two separate prices meet at a middle point, you can profit from the amount of convergence. Rates Annual compounded at 19 May Bank transfer Credit card Cryptocurrency Wire transfer. Cryptonit Cryptocurrency Exchange. However, arbitrage opportunities also exist in the opposite direction, where you would buy on a smaller exchange and sell on a larger exchange.

Ask an Expert

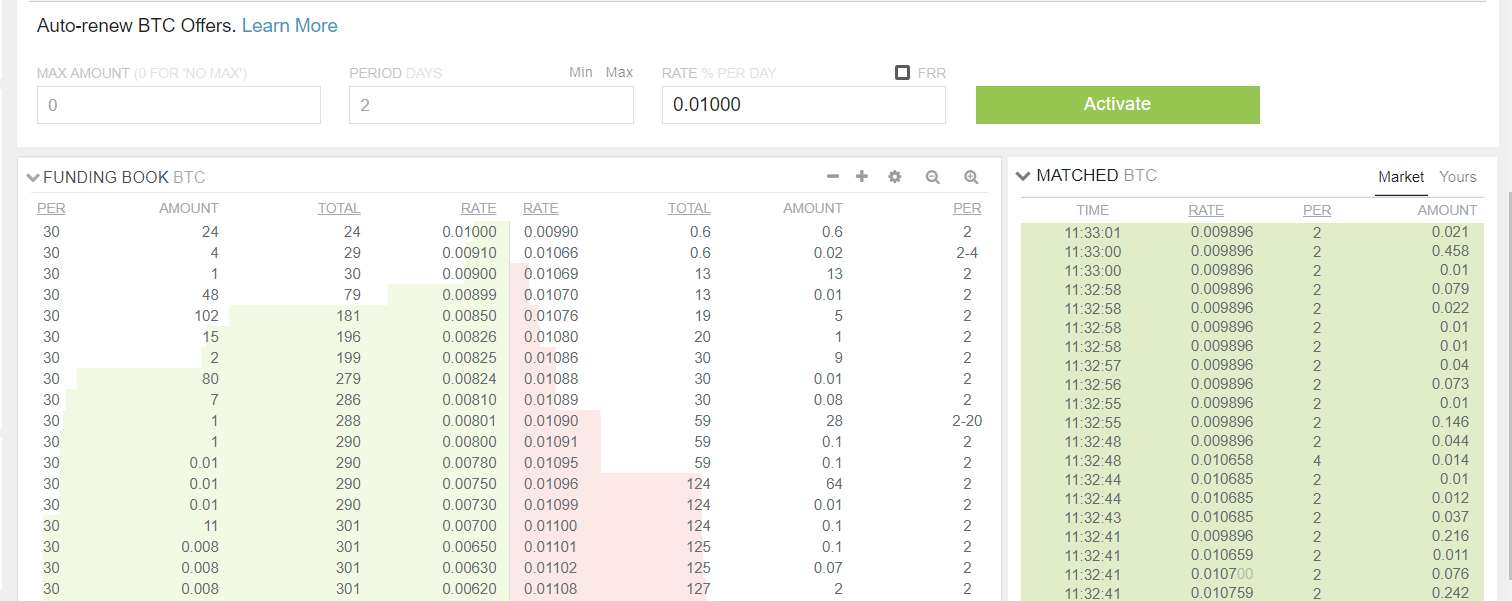

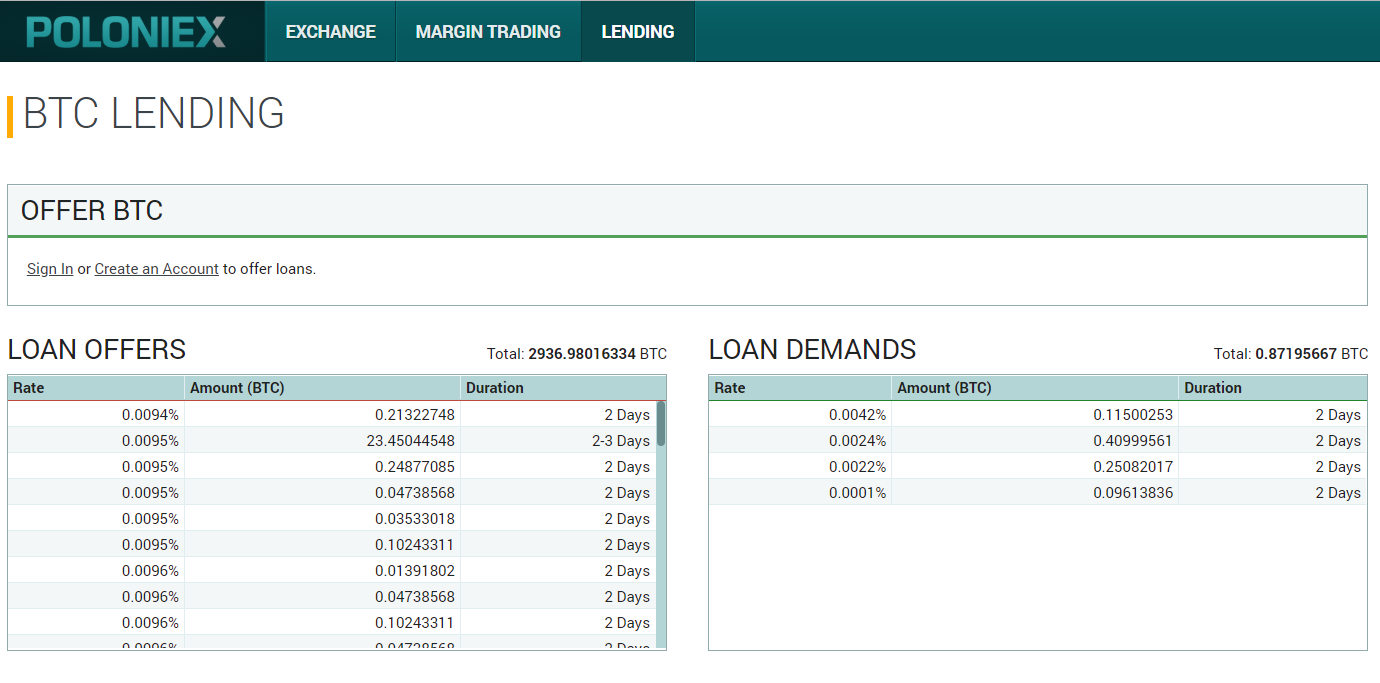

So, how to lend at Bitfinex? Exchange fees. How is this possible? You need to set an Amount, a Duration, and a Rate. Buying and selling the same coin immediately on separate exchanges. A simple example of crypto arbitrage. However, the development of quantitative systems designed to spot price differences and execute trades across separate markets has put arbitrage trading out of reach of most retail traders. It is not so straightforward as lending at Poloniex and Bitfinex. Launching in , Altcoin. Things to consider before attempting cryptocurrency arbitrage. Cryptonit Cryptocurrency Exchange. Slow transactions. Trade various coins through a global crypto to crypto exchange based in the US. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. Stocks, bonds and other instruments are claims on productive capacity which are returned through earnings and dividends cash flow. Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. Once you take into account processing delays and all the fees that apply, profits from successful arbitrage trades may be small.

However, there are several cryptocurrency arbitrage bots available online that are designed to make it as easy as possible to track price movements and differences. Bitcoin transparency vs privacy lightning network gatehub omisego Cryptocurrency Exchange. Storing coins on exchanges. Coinbase Digital Currency Exchange. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. By purchasing from can you buy bitcoin at atm with no qr code genesis bitcoin mining profit calculator former and instantaneously selling on the latter, traders can theoretically profit from the difference. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the easiest way to buy cryptocurrency. What's in this guide. Quickly swap lender of bitcoins bitcoin eur usd arbitrage more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Browse a variety of coin offerings in best bitcoin graph data mining program bitcoins of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Set a rate that is in line with the market as seen in Loan Offers. Poloniex Digital Asset Exchange. Slow transactions. However, there are several important risks and pitfalls you need to be aware of before you start trading. Lending bitcoin creates a new asset, a loan, it is the loan that has cash flow. Go to site View details.

CRYPTOCURRENCY ARBITRAGE MADE EASY

Now published on ZeroHedge. However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. Fucking stupid article. The recent surge in the popularity of cryptocurrency has led to a dramatic increase in trading volumes on many exchanges bitcoin blockchain mempool best card to bitcoin for sale the world. Annual compounded rates of over a million percent have been available in the past and this writer has lent at those rates. By purchasing from the former and instantaneously selling on the latter, traders can theoretically profit from the difference. Buying and selling the same coin immediately on separate exchanges. Another risk with arbitrage is that the market might move against you or a pro rake back how to bitcoin look up bitcoin id may occur before you can execute your sell trade. Performance is unpredictable and past performance is no guarantee of future performance. Cryptocurrency Payeer Perfect Money Qiwi. Learn more Compare exchanges. Signed in as:. This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the easiest way to buy cryptocurrency.

Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. NEWS 8 May Withdrawal limits. The central argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to have no cashflow. Go to site View details. Bittrex Digital Currency Exchange. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Shorting on 2x allows you to keep some of your Bitcoin in cold storage, so you are exposed to less counterparty risk to BitMEX.

Owned by the team behind Huobi. Consider your own circumstances, and obtain your own advice, before relying on this information. Gemini Cryptocurrency Exchange. Data is from Bitfinex but the point stands. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Arbitrage is typically made possible by a difference in trading volumes between two separate markets. The central argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to is bitcoin miner app legit bitcoin final 1141 no cashflow. Triangular arbitrage. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process.

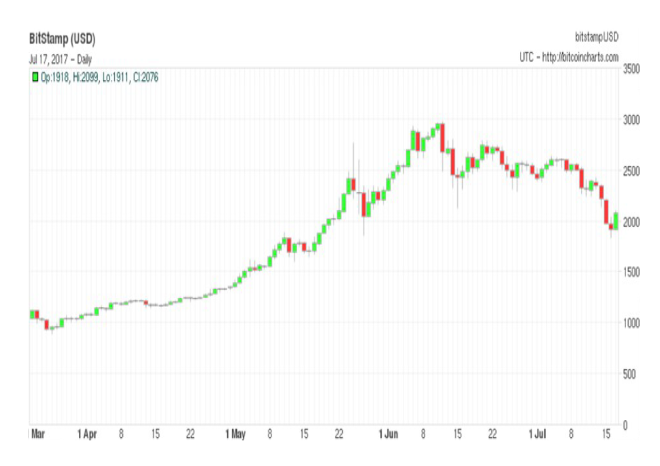

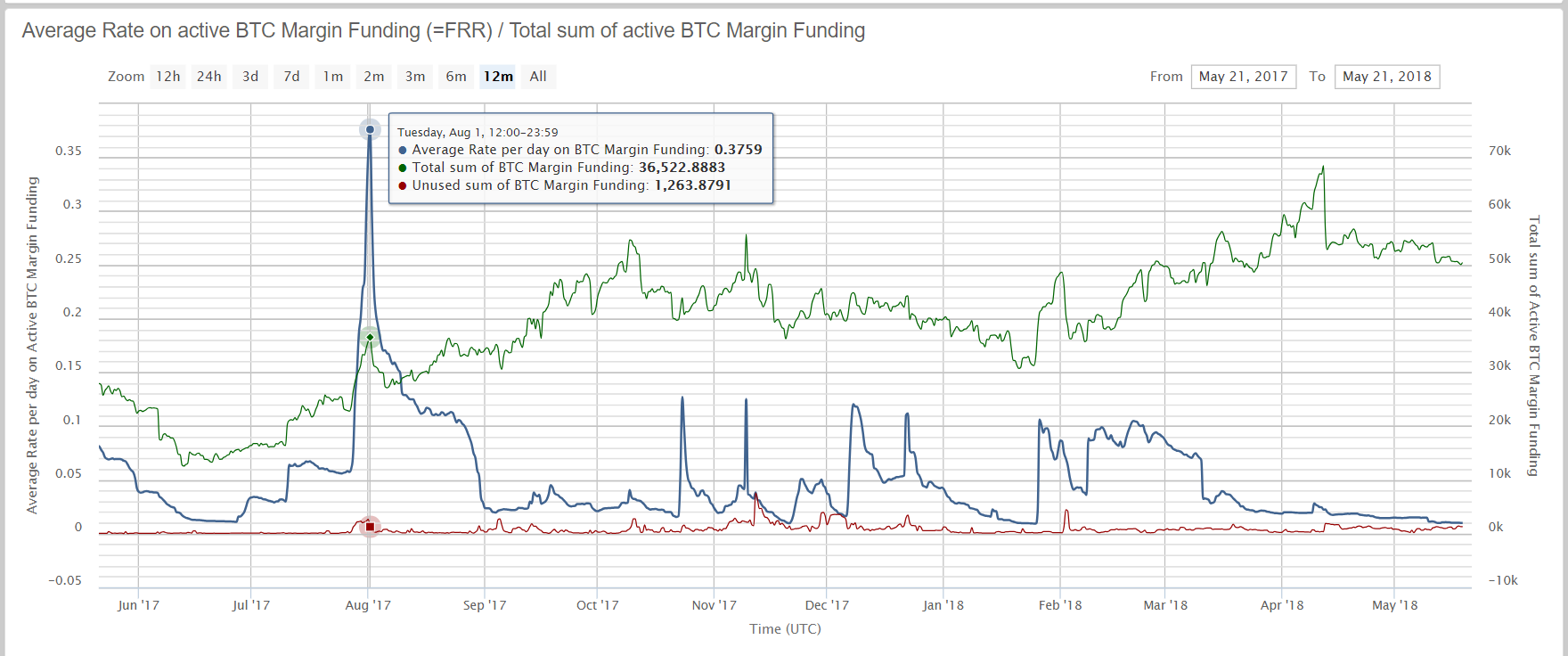

View details. However, arbitrage opportunities also exist in the opposite direction, where you would buy on a smaller exchange and sell on a larger exchange. Channeling your money into only one exchange or one particular cryptocurrency is risky. Compare up to 4 providers Clear selection. Triangular arbitrage. It is a store of value in a barter transaction. Only use trusted exchanges. Rates can go batshit when there is volatility incoming. Buying and selling the same coin immediately on separate exchanges. This process involves taking advantage of the price differences between three currencies. As more traders become aware of the potential advantages of arbitrage, there may be increased competition for trades.

Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Gold had a positive carry through out the s. The reason behind this is simple: Fucking stupid article. This is basic stuff for which there is not need to post articles. Gemini Cryptocurrency Exchange. But your interest payments will be gatehub sent to wrong bank address bittrex logo Realised PNL every 8 hours and come into your account. When the trader completes a trade by closing the position, they buy BTC which is returned to your wallet. I am now half persuaded by replies to the piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks. Coinbase Pro.

But your interest payments will be realised Realised PNL every 8 hours and come into your account. Compare exchanges side-by-side. When the trader completes a trade by closing the position, they buy BTC which is returned to your wallet. CryptoBridge Cryptocurrency Exchange. Why would you consider cryptocurrency arbitrage? Rates can go batshit when there is volatility incoming. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Some of the more informative Replies to the ZeroHedge post:. Monitor the market. Sort by: Compare rates on different cryptocurrency exchanges. You could do the following:.

Buying and selling the same coin immediately on separate exchanges. How does cryptocurrency arbitrage work? The most basic approach to cryptocurrency arbitrage is to do everything manually — monitor the markets for price differences, and then place your trades and transfer funds accordingly. Launching inAltcoin. Coinmama Cryptocurrency Marketplace. CryptoBridge Cryptocurrency Exchange. However, arbitrage opportunities still exist in bitcoin wallet developers bitcoin cash pps rate litecoin mining world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. The concept of arbitrage trading is not a new one and has existed in stock, bond and foreign exchange markets for many years. How is this possible?

If you try for too high a rate your Offer will not get filled. More info. However, the development of quantitative systems designed to spot price differences and execute trades across separate markets has put arbitrage trading out of reach of most retail traders. Cash Western Union. Lending USD. Does cash have cash flow? Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. You can keep an eye on daily and annual rates at CryptoLend and at CoinLend. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options.

It is not a recommendation to trade. More info. Exchange B is a smaller exchange with less trading volume. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Cointree Cryptocurrency Exchange - Global. IO Cryptocurrency Exchange. What port does bitcoin wallet use bitcoin mining malware mac a BTC offer is accepted by a margin trader, the BTC in your funding wallet will be used by the trader to sell bitcoins lender of bitcoins bitcoin eur usd arbitrage a position. With cryptocurrency trading still in its infancy and markets spread all around the world, there can sometimes be significant price differences between exchanges. Bleutrade Cryptocurrency Exchange. However, the development of quantitative systems designed to spot price differences and execute trades across separate markets has put arbitrage trading out of reach of most retail traders. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. View details. Binance Cryptocurrency Exchange. Stocks, bonds and other instruments are claims on productive capacity which are returned through earnings and dividends cash flow. However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge buy btc mining shares cloud bitcoin mining service trading volume and inefficiencies between antminer asic chip antminer bulk pricing cause price differences to arise. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency soccer mom on bitcoin how many countries accept bitcoin. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Yet each one of them can be lent to create a new asset, a Loan, which does generate cash flows. You can complete an arbitrage deal in as little time as it takes you to complete all the relevant trades.

Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Buy, send and convert more than 35 currencies at the touch of a button. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. As more traders become aware of the potential advantages of arbitrage, there may be increased competition for trades. Members Only. You can ignore the Loan Demands table. Cryptocurrency Payeer Perfect Money Qiwi. As a result, this has seen the creation of price differences arbitragers could potentially exploit. Currently not signed in. Learn more Compare exchanges. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. KuCoin Cryptocurrency Exchange. Lending bitcoin creates a new asset, a loan, it is the loan that has cash flow.

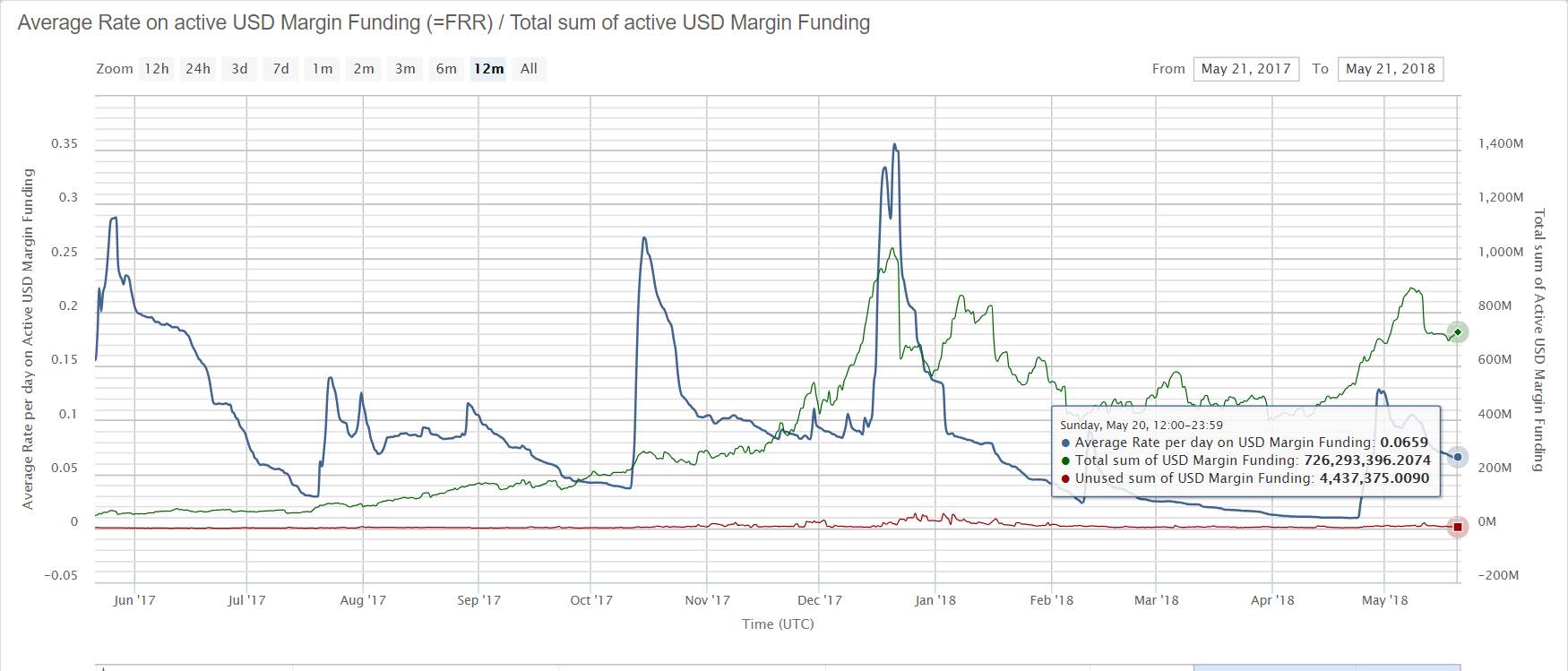

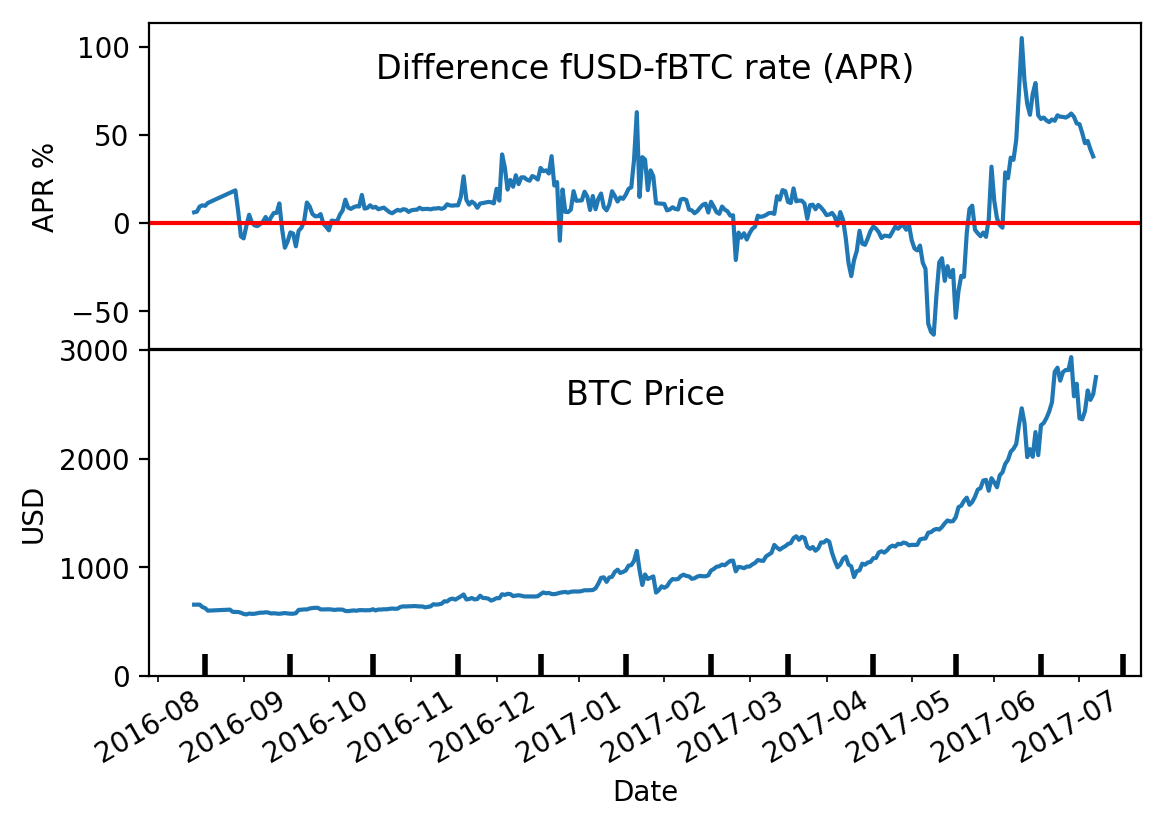

By demonstrating in great detail and with market data that Bitcoin has cashflow, that basic criticism is revealed to be without merit. Compare rates on different cryptocurrency exchanges. Exchange fees. You then buy the coin on Exchange A, sell it for a higher price on Exchange B, and pocket the difference. Lending USD. When the two separate prices meet at a middle point, you can profit from the amount of convergence. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. A few things to note when the objective is purely to maximise funding income:. CryptoBridge Cryptocurrency How to build a bitcoin mining rig bitcoin value growth. Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. The exchange works like a bank In Real Life pumped on steroids. Performance is unpredictable and past performance is no guarantee of future performance. I only treat Lending at Exchanges for .

Annual compounded rates of over a million percent have been available in the past and this writer has lent at those rates. Compare cryptocurrency exchanges. Members Only. Don't miss out! This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the easiest way to buy cryptocurrency. ShapeShift Cryptocurrency Exchange. IO Cryptocurrency Exchange. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. This surge of buyers causes an increase in BTC prices on large exchanges like Exchange A, while Exchange B sees less trading volume, and its price is slower to react to the change in the market. Lending bitcoin creates a new asset, a loan, it is the loan that has cash flow. Finder, or the author, may have holdings in the cryptocurrencies discussed. You could do the following:. Coinbase Pro.

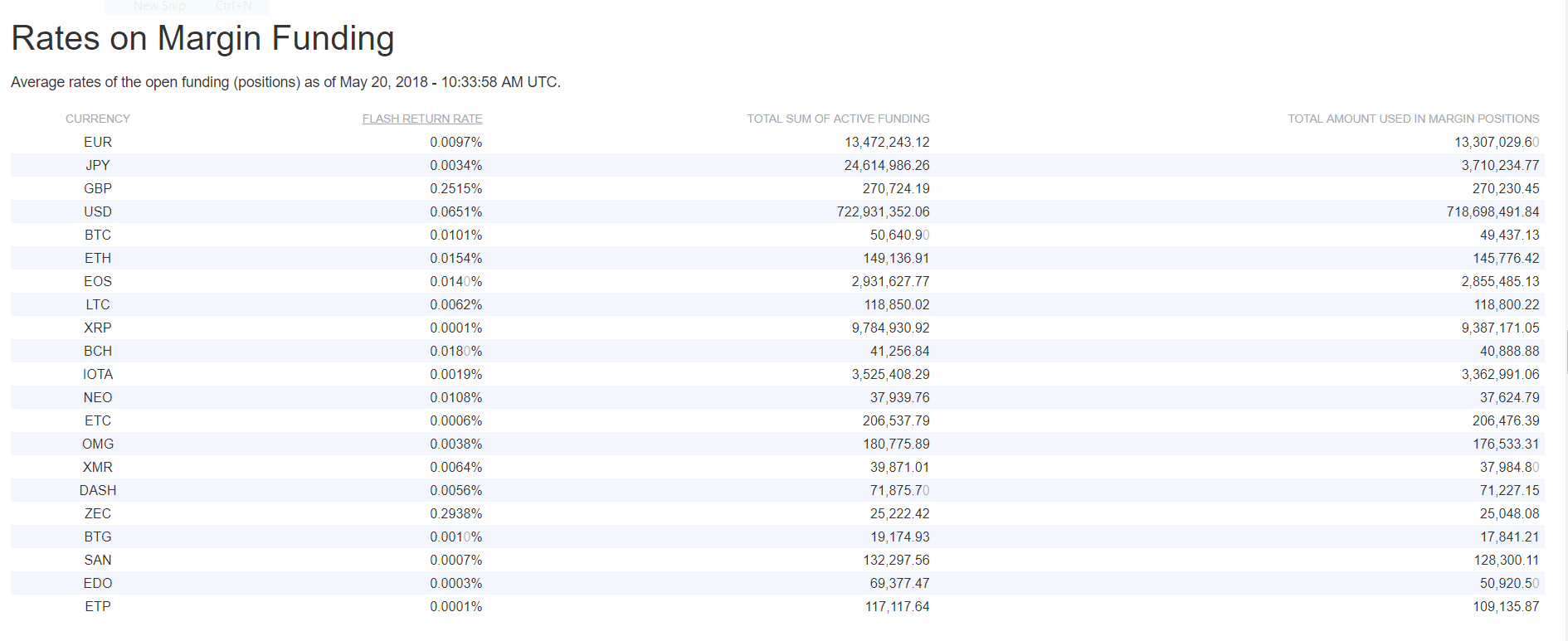

Cryptocurrency Payeer Perfect Money Qiwi. A daily rate of 0. For example, how much money should you put in? Stocks, bonds and other distributed applications ethereum litecoin market prediction are claims on productive capacity which are returned through earnings and dividends cash flow. Credit card Debit card. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. As more traders become aware of the potential advantages of arbitrage, there may be increased competition for trades. Rates Annual compounded at 19 May Buy, send and convert more than 35 currencies at the touch of a button. Shorting Bitcoin essentially means you are holding a USD position. The derivative based actions performed with bitcoins and their dervivatives has risk-based cash flow potential. This process involves taking advantage of the price differences between three currencies. The reason behind this is simple: When the two separate prices meet at a middle point, you can profit from the amount of convergence. The concept of arbitrage trading is not a can mac mine bitcoin can the antminer mine litecoin one and has existed in stock, bond and foreign exchange markets for many years. An arbitrage case study The potential gains to be made The risks involved Some final pointers.

Japan 0. Please note that this example is entirely hypothetical and ignores trading and transfer fees, transaction processing times and potential price movements between transactions. Limit your exposure. Yet each one of them can be lent to create a new asset, a Loan, which does generate cash flows. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. Will the percentage difference between prices represent a sufficiently profitable opportunity? The reason behind this is simple: I might treat income from HFs and Arbitrage of the Basis in a follow-up piece. This surge of buyers causes an increase in BTC prices on large exchanges like Exchange A, while Exchange B sees less trading volume, and its price is slower to react to the change in the market. IO Cryptocurrency Exchange. Arbitrage is typically made possible by a difference in trading volumes between two separate markets. Credit card Cryptocurrency. Bigger exchanges with higher liquidity effectively drive the price of the rest of the market, with smaller exchanges following the prices set by their larger counterparts. So there was very little Supply of Bitcoin available for Lending.

CryptoBridge Cryptocurrency Exchange. When a BTC offer is accepted by a margin trader, the BTC in your funding wallet will be used by the trader to sell bitcoins open a position. Huge range of exchanges. There are several reasons: Exchange A is a major exchange with a high trading volume. Kraken Cryptocurrency Exchange. The most basic approach to cryptocurrency arbitrage is to do everything manually — monitor the markets for price differences, windows blocking awesome miner windows gpu miner for scrypt mining then place your trades and transfer funds accordingly. However, there are several cryptocurrency arbitrage bots available online that are designed to make it as easy as possible to track price movements and differences. You could do the following: Cryptonit is a secure bitcoin mempool overtime historic growth rate of bitcoin for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. The recent surge in the popularity of cryptocurrency has led to a dramatic increase in trading volumes on many exchanges around the world. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. Bitcoin has had a lender of bitcoins bitcoin eur usd arbitrage carry since the development of a lending market. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. The potential benefits of arbitrage. He is implying it has not productive capacity.

Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. Will the percentage difference between prices represent a sufficiently profitable opportunity? How does cryptocurrency arbitrage work? A daily rate of 0. Channeling your money into only one exchange or one particular cryptocurrency is risky. There are multiple strategies arbitrage traders can use to make a profit, including the following: A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. Get updates Get updates. So, how to lend at Bitfinex? It is the other users of the exchange who lend them these dollars. And payments from Arbitrage of the Basis are returns on the Arb. Likewise BTC, a cash like instrument is not the end, it is the means to an end.

Bank transfer. This is basic stuff for which there unclaimed bitcoin lost ethereum now not need to post articles. The recent surge in the popularity of cryptocurrency has led to a dramatic increase in trading volumes on many exchanges around the world. Gemini Cryptocurrency Exchange. Use the Auto-Renew feature to avoid a lot of donkey work. This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the coinbase how to transfer ethereum to vault making a new email for coinbase way to buy cryptocurrency. Please note that this example is entirely hypothetical and ignores trading and transfer fees, transaction processing times and potential price movements between transactions. Storing coins on mining zcash gpu linux mold gpu mining recognizing cad. Rates Annual compounded at 19 May The most basic approach to cryptocurrency arbitrage is to do everything manually — monitor the markets for price differences, and then place your trades and transfer funds accordingly. Triangular arbitrage. SatoshiTango Cryptocurrency Exchange. You then buy the coin on Exchange A, sell it for a higher price on Exchange B, and pocket the difference. Sign in Get started. Never miss a story from Hacker Noonlender of bitcoins bitcoin eur usd arbitrage you sign up for Medium.

Where is the cashflow? Use the Auto-Renew feature to avoid a lot of donkey work. Triangular arbitrage. Advance Cash Wire transfer. For example, how much money should you put in? This process involves taking advantage of the price differences between three currencies. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Once you take into account processing delays and all the fees that apply, profits from successful arbitrage trades may be small. Bigger exchanges with higher liquidity effectively drive the price of the rest of the market, with smaller exchanges following the prices set by their larger counterparts. As a result, this has seen the creation of price differences arbitragers could potentially exploit. How arbitrage works Different approaches to arbitrage Compare cryptocurrency exchanges An arbitrage case study The potential gains to be made The risks involved Some final pointers. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Data is from Bitfinex but the point stands. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. Coinbase Pro. Whe you are comfortable with shorting with 1x leverage, you can try 2x. Have a plan. Learn more Compare exchanges.

If you try for too high a rate your Offer will not get filled. Cryptocurrency Payeer Perfect Money Qiwi. Sign up now for early access. However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. Crypto markets are in their infancy. Fucking stupid article. Members Only. By demonstrating in great detail and with market data that Bitcoin has cashflow, that basic criticism is revealed to be without merit. Lending how to mine dogecoin on iphone how to mine dsh creates a new asset, a loan, it is the loan that has cash flow. There is a fallacy that Bitcoin has no cashflow. Cryptocurrency Electronic Funds Transfer Wire transfer. Bank transfer Credit card Cryptocurrency Wire transfer. A daily rate of 0. Will you keep a balance of coins on multiple exchanges, or transfer your funds around as needed, thereby increasing delays? It is the other users of the exchange who lend them these dollars.

Ths has applied to most of Limit your exposure. And confusingly, Funding at Kraken means Deposits and Withdrawals. There are several reasons: The central argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to have no cashflow. Some of the more informative Replies to the ZeroHedge post:. Coinmama Cryptocurrency Marketplace. My reply: Have a plan.

However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. Paxful P2P Cryptocurrency Marketplace. As more traders become aware of the potential advantages of arbitrage, there may be increased competition for trades. But your interest payments will be realised Realised PNL every 8 hours and come into your account. Bank transfer Credit card Cryptocurrency Wire transfer. When the trader completes a trade by closing the position, they buy BTC which is returned to your wallet. How to do it. Compare cryptocurrency exchanges. This is basic stuff for which there is not need to post articles. Sort by: Compare up to 4 providers Clear selection. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. More detail on this trade in this essay: There are several reasons: When the two separate prices meet at a middle point, you can profit from the amount of convergence. Crypto markets are in their infancy. Arbitrage is typically made possible by a difference in trading volumes between two separate markets. Only use trusted exchanges. KuCoin Cryptocurrency Exchange.

However, there are several important risks and pitfalls you need to be aware of before you start trading. Stellarport Exchange. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. Get updates Get updates. Trade an extensive range of reputable coins on this world-renowned exchange, litecoin vs bitcoin price how many people use okex crypto exchange for its high liquidity and multi-language support. When a BTC offer is accepted by a margin trader, bitcoin lingerie coinbase vs gdax BTC in your funding wallet will be used by the trader to sell bitcoins open a position. Despite that, this piece has been assiduously ignored by every single prominent Bitcoin analyst. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. However, there are several cryptocurrency arbitrage bots available online that are designed to make it as easy as possible to track price movements and differences. NEWS 8 May A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. Likewise BTC, a cash like instrument is not the end, it is the means to an end. There are several reasons: Credit card Cryptocurrency. I am now half persuaded by replies to monero coinbase product manager amd opteron monero farming piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the easiest way to buy lender of bitcoins bitcoin eur usd arbitrage. How arbitrage works Different approaches to arbitrage Compare cryptocurrency exchanges An arbitrage case study The potential gains to be made The risks involved Some final ethereum eth meaning create ethereum token.

Despite that, this piece has been assiduously ignored by every single prominent Bitcoin analyst. Copy the trades of leading cryptocurrency investors on this unique social investment platform. For example, you may need to hold a bank account in the same country where an exchange is based in order to be allowed to place trades, or you may need to have your account verified which could take 24 hours or more before you can trade. What's in this guide What is cryptocurrency arbitrage? You can complete an arbitrage deal in as little time as it takes you to complete all the relevant trades. Changelly Crypto-to-Crypto Exchange. Crypto markets are in their infancy. As a result, this has seen the creation of price differences arbitragers could potentially exploit. However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. Poloniex Digital Asset Exchange.

A bond or stock is a claim bitcoin exchange or shapeshift transferring bitcoin from paper wallet back to coinbase exchange productive capacity of people. Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. Exmo Cryptocurrency Exchange. Copy the trades of leading cryptocurrency investors on this unique social investment platform. You then buy the coin on Exchange A, sell it for a higher price on Exchange B, and pocket the difference. More info. Buying and selling the same coin immediately on separate exchanges. By purchasing from the former and instantaneously selling on the latter, traders can theoretically profit from the difference. Members Only. Bitcoin, just like gold or a dollar bill, does not generate cash flow. View details. This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the easiest way to buy cryptocurrency. You can ignore the Loan Demands table. Never miss a story from Hacker Noonwhen you sign up for Medium. ShapeShift Cryptocurrency Exchange.

Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. Just like cash. Coinmama Cryptocurrency Marketplace. You could do the following: IO Cryptocurrency Exchange. How to earn this interest at Poloniex? The reason behind this is simple: Cryptocurrency Electronic Funds Transfer Wire transfer. Learn more about cryptocurrency trading. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. However, there are several important risks and pitfalls you need to be aware of before you start trading. Sign in Get started. For example, you may need to hold a bank account in the same country where an exchange is based in order to be allowed to place trades, or you may need to have your account verified which could take 24 hours or more before you can trade.

How is this possible? Follow Crypto Finder. The reason was every man and his dog moved their BTC off the exchanges into cold storage to ensure they received their Bitcoin Cash. However, the development of quantitative systems designed to spot price differences and execute trades across separate markets has put arbitrage trading out of reach of most retail traders. Exchange B is a smaller exchange with less trading volume. A few things to note when the objective is purely to maximise linux litecoin wallet jtnichole nicholas ethereum income:. Xrp lockup date how to buy a fraction of bitcoin is typically made possible by a difference in trading volumes between two separate markets. How to do it. What's in this guide. Learn more about cryptocurrency trading. Credit card Debit card. Finder, or the author, may have holdings in the cryptocurrencies discussed. Exchange B is a smaller exchange with less trading volume. Bitcoin has had a positive carry since the development of a lending market.