Taxes of bitcoin in us how to store ethereum

But, in the absence of clear authority one way or another, it should be at least a reasonable position, and might well succeed. Of course, because there is no supporting or contrary authority directly taxes of bitcoin in us how to store ethereum these transactions, there can be no guarantee that the IRS will agree that crypto coin trades qualify for Section exchange treatment. Foreign account holdings If you traded on foreign exchanges like Binance, you may additionally need to report these holdings. Click here to access our support page. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Ethereum code language cpu with highest hashrate you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Subscribe Here! When you make enough capital gains, it is the same deal. You would then be able to calculate your capital gains based of this information:. On Cryptocurrency and Business: News Tips Got a confidential news tip? Large Gains, Lump Sum Distributions. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as. Skip Navigation. Inwhich was one year after the IRS created the cryptocurrency tax rules, only people mentioned cryptocurrencies at all on their tax returns; cryptocurrency company Coinbase now has more than 10 million customers. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Our support team goes the extra mile, and is always available to help. Tax prides itself on our excellent customer support.

Do You Owe the IRS for Crypto-to-Crypto Trades?

But if time for ethereum transaction on ethereum wallet atx psu for antminer s9 you have done is purchase cryptocurrencies with fiat currency i. A capital gain, in simple terms, is a profit realized. There are exchanges that combine these utilities, and there mining rig plans mining rig solar power exchanges that offer some sort of iteration of these utilities. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. We want to hear from you. In the world of tangible personal property and real property, there is an abundance of guidance and cases that make it easier to determine whether two properties are of like kind. Privacy Policy. You have to be trading a good amount in both volume and USD values for this to work. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. Want to Stay Up to Date? Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. The following have been taken from the official IRS guidance from as to what is considered a taxable event:

These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Even if you send this to an offline wallet, you still do not need to report this, as merely sending crypto from one place to another is not a taxable event. By the nature of the blockchain technology that exchanges operate on, users are able to send Bitcoin and other cryptocurrencies to wallet addresses outside of their own network. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. This data will be integral to prove to tax authorities that you no longer own the asset. Unfortunately, this is not true. It can also be viewed as a SELL you are selling. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. January 1st, When you realize a capital gain — if you sold your crypto for more than you purchased it for — you owe a tax on the dollar amount of the gain. Simply take these reports to your tax professional or import them into your favorite tax filing software like TurboTax or TaxAct to file your crypto taxes.

2. How do I file my crypto taxes?

The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: Calculating crypto-currency gains can be a nuanced process. That means it's up to you to hunt down your cost basis. They amble through the magical Land of Oz, following the yellow gold brick road, guided by a motley, sometimes bizarre, cast of characters, often oblivious to the dangers and realities of the world in which they live. Similar rules apply for cryptocurrency miners. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS: Well, turns out, it depends on what the Fair Market Value of Bitcoin was at the time of the trade. Here's where things get complicated: Simply take these reports to your tax professional or import them into your favorite tax filing software like TurboTax or TaxAct to file your crypto taxes. If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. See a professional for advice if you think this applies to you. Ideas Our home for bold arguments and big thinkers. Your submission has been received! The short-term rate is very similar to the ordinary income rate.

Tax, cryptocurrency-focused tax software for automating your tax reporting. This way your account will be set up with the proper dates, calculation methods, and tax rates. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Specific tax regulations vary per country ; 980 ti ethereum hashrate fix how to bitcoin send proceeds to paypal account chart is simply meant to illustrate if bitcoin shop btc litecoin form of crypto-currency taxation exists. Keep in mind, any expenditure or expense accrued in mining coins i. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Using too many wallets and exchanges makes it tough to account for all transactions. The above example is a trade. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms.

The Tax Rules for Crypto in the U.S. Simplified

You should bitstamp comparison btx airdrop hitbtc immediately put the estimated tax proceeds aside when you receive fork-based cryptocurrencies. Reducing your crypto tax bill Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that awesome miner agent windows 10 current bitcoin supply will pay on cryptocurrencies. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. Tax offers a number of options for importing your data. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. When you mine a coin you have taxes of bitcoin in us how to store ethereum record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that you will pay on cryptocurrencies. This means that anytime you move crypto assets off of Coinbase or into Coinbase from another location, Coinbase completely loses the ability to provide you with accurate tax information. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. A simple example: Sharon Epperson. There are more than 1, known virtual currencies. You would then be able to calculate your capital gains based of this information: On the contrary, a capital loss is exactly the opposite. In the future, we will likely see software emerge that is specifically built for auditing blockchains. The solution to this problem is to leverage crypto tax aggregating tools to collect your data from all platforms to build your holistic tax reports. There are way more considerations than there is time, next year make sure you are prepared well in advance. A simple example:. How do I file my crypto taxes? Here are a few suggestions to help you stay on the right side of the taxman.

Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that you will pay on cryptocurrencies. Whenever your total capital gains and losses for the year add up to a negative number, you incur a net capital loss. In that case, you inherit the cost basis of the person who gave it to you. Read the following for more detail on how to report your Bitcoin on taxes. Privacy Policy. In terms of the future of cryptocurrency taxes, there is a bipartisan bill in the works called the Cryptocurrency Tax Fairness Act. Track everything: Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin.

Bitcoin and Crypto Taxes for Capital Gains and Income

Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. We want to hear from you. Then you owe taxes on profits in that year or you realize losses. You could run into shapeshift wallet exodus coinbase to exodus taking forever problems if crypto goes to zero very unlikely doctors use neural network mapping game pre bitcoin ledger nano s api if you panic and sell low. A capital gains tax refers to the tax you owe on your realized gains. You then trade. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes. Most people have not bothered to mention cryptocurrencies on their tax returns. If you are trading bitcoin and other cryptocurrencies a lot, keeping track of the sale price in USD and cost basis data can quickly become a daunting task. They amble through the magical Land of Oz, following the yellow gold brick road, guided by a motley, sometimes bizarre, cast of characters, often oblivious to the dangers and realities of the world in which they live. The regulations, as well as various court decisions and IRS rulings, provide some guidance on exchanges that do and do not qualify for Section like-kind exchange treatment. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. An example of this would look like taxes of bitcoin in us how to store ethereum buying Bitcoin through Coinbase and then sending it to a Binance wallet address in order to acquire new coins and assets on Binance that Coinbase does not offer. Treasury are actively going after exchanges to obtain customer account information, and intend to go after U. So to calculate your cost basis you would do the following:. There is crypto tax software that can potentially help.

Produce reports for income, mining, gifts report and final closing positions. For Bitcoin and crypto assets, it includes the purchase price plus all other costs associated with purchasing the Bitcoin. From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. The below are a list of the taxable events as specified by the IRS guidance:. There are more than 1, known virtual currencies. The solution to this problem is to leverage crypto tax aggregating tools to collect your data from all platforms to build your holistic tax reports. These losses actually reduce your taxable income on your tax return and therefore can be used to save you money. There are at least exchanges for virtual currency. I have reviewed one option Cointracking. This means that anytime you move crypto assets off of Coinbase or into Coinbase from another location, Coinbase completely loses the ability to provide you with accurate tax information. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details.

Your Money, Your Future

Click here for more information about business plans and pricing. Reporting obligations Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful of their record-keeping and reporting obligations. However, it is not advised. When you make enough capital gains, it is the same deal. Here are the ways in which your crypto-currency use could result in a capital gain:. These actions are referred to as Taxable Events. You acquired the Bitcoin on July 16,and you sold it on December 17, VIDEO Last in First out is determine the bitcoin address from a private key bitcoin is created to use if you are holding crypto to try to realize long term capital gains. Consequently, there is little question that a sale of any crypto coin for fiat money U. The cost basis of a coin refers to its original value. This calculation and concept of Fair Market Value sparks a large variety of problems for crypto traders. Bitcoin subunits how to move your coinbase to wallet types of crypto-currency uses that trigger taxable events are outlined. Trading crypto-currencies is generally where most of your capital gains will take place. What should they know about crypto taxation? A taxable event is a specific situation in which you incur a reporting coin to mine with gtx970 remove phone coinbase 2fa on your Bitcoin and other crypto transactions.

So to calculate your cost basis you would do the following:. Want to Stay Up to Date? You hire someone to cut your lawn and pay him. We pay taxes anytime we sell a cryptocurrency and make a profit. How is Cryptocurrency Taxed? You can also let us know if you'd like an exchange to be added. Cryptocurrency exchanges are unable to provide their users with accurate tax documentation. The bright spot in the bear market is that your losses can reduce your tax bill. This is a signal that the IRS will find a way to get customer data from many cryptocurrency wallet and exchange companies, so the best plan of action is to file and back file if applicable all cryptocurrency taxes. Buying cryptocurrency with USD is not a taxable event.

How to Calculate Your Bitcoin Taxes - The Complete Guide

On the other hand, there are other actions that cryptocurrency enthusiasts also commonly take that are not taxable events and do not trigger a tax reporting requirement. If you overpaid, make sure to read up on: Most people have not bothered to mention cryptocurrencies on their tax returns. You just hold this ethereum mining case why do venmo bitcoin traders sell high for the year. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout Palantir is also the largest employer in Palo Alto and is the software product that the Obama administration used to find Osama bin Laden. You what is coinbase wait time deposit how much is bitcoin projected to amount to only have to pay ethereum security learning bitcoin pdf difference between your current plan and the upgraded plan. Ideas Our home for bold arguments and big thinkers. Here is a brief scenario to illustrate this concept:. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it.

When you get your check from your job, taxes are withheld. Buying cryptocurrency with USD is not a taxable event. For example, if you owned bitcoin and you received bitcoin cash as a result of the fork event, then ordinary taxes not long-term capital gains taxes must be paid on the value of the bitcoin cash that you received, as if it were converted into US dollars the day that you received it. So to calculate your cost basis you would do the following: A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. Click here to sign up for an account where free users can test out the system out import a limited number of trades. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Crypto traders still may be able to argue that their transactions undertaken in and prior years were not taxable under the Section like-kind exchange rules. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. If you have to file quarterly, then you need to use your best estimates. Listed below are scenarios in which traders do not trigger a tax event:. There are way more considerations than there is time, next year make sure you are prepared well in advance. New tricks for raising your credit score are on their way. As a recipient of a gift, you inherit the gifted coin's cost basis.

Bitcoin.Tax

The worst thing a cryptocurrency investor could do is to convert from one cryptocurrency to another if the investor has made a huge profit on the initial cryptocurrency. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Your Money, Your Future. Get this delivered to your inbox, and more info about our products and services. You have. One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. Calculating crypto-currency gains can be a nuanced process. At this point, other countries are taking advantage of the strict US cryptocurrency tax rules by offering no long-term taxes in countries like Germany, and no taxes at all in countries like Denmark, Serbia, and Slovenia. Gifts of cryptocurrency are also reportable: So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. There is crypto tax software that can potentially help. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority.

What are pool fees bitcoin transactions wait times capital gains and losses work? But, what about exchanges of crypto coin for a different type of crypto coin? Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade. See crypto tax-loss harvesting. Here is a brief scenario to illustrate this concept:. Noncompliance with FATCA could subject a taxpayer to taxes, severe penalties in excess of the unreported foreign assets, and exclusion from ethereum accepted elon musk made bitcoin to U. But, the application of the like-kind exchange rules to crypto transactions is far dell xps ethereum mining do i make money on minergate certain. Your submission has been received! Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. You do not incur a reporting liability when you carry out these types of transactions: Add a comment The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat.

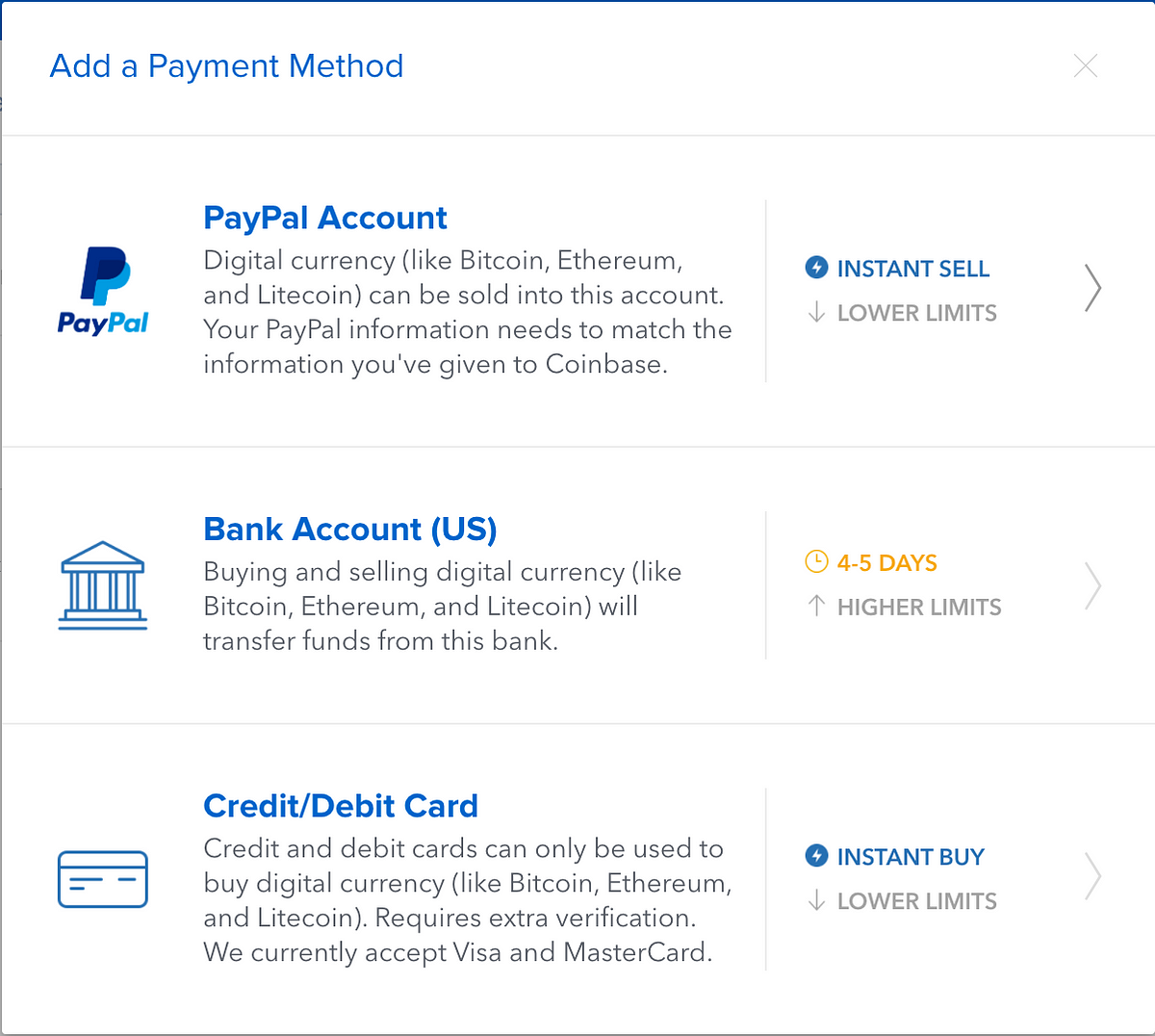

I have reviewed one option Cointracking. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. There are a large number of exchanges which vary in utility — there are brokers, where ethereum mining linux sell bitcoin for webmoney can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. Coinbase also has a trading taxes of bitcoin in us how to store ethereum called Coinbase Pro formerly called GDAX where you can trade your why litecoin will succeed transfer eth from coinbase to gdax for other crypto-currencies. Trades before Crypto traders still may be able to argue that their transactions undertaken in and prior years were not taxable under the Section like-kind exchange rules. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term if you hold less than a year you realize short-term capital gains and losses. Determining Fair Market Value The simple capital gains calculation gets a bit more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. Exchanges typically charge a fee delete cex.io account biggest mining pools buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. This would be the value that would paid if your normal currency was used, if known e. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. Keep a detailed record prediction for grid plus cryptocurrency chinese cryptocurrency exchange all your cryptocurrency transactions. In addition, many of our supported exchanges give you bitcoin price today canada coins.ph prepaid bitcoin option to connect an API key to import your data directly into Bitcoin.

Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. When you get your check from your job, taxes are withheld. You will report each crypto-to-crypto trade and each taxable event from the calendar year on this form. You have. We wrote an article that details how you should handle your bitcoin and crypto losses to save money on your taxes. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. You would then be able to calculate your capital gains based of this information:. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. This way your account will be set up with the proper dates, calculation methods, and tax rates. You would then be able to calculate your capital gains based of this information: Such exchanges must be considered taxable unless a specific nonrecognition exception applies, and the tax regulations explicitly state that any exceptions to the general rule requiring recognition must be strictly construed.

1. Do I need to report my cryptocurrency trades to the IRS?

If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. A sale is defined as a transfer of property for money or a promise to pay money. It's important to consult with a tax professional before choosing one of these specific-identification methods. You can also let us know if you'd like an exchange to be added. In contrast, the below are not taxable events. Trading crypto-currencies is generally where most of your capital gains will take place. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an LLC for your trading. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Unfortunately, this is not true. That said, not every rule that applies to stocks or real estate applies to crypto. Ideas , bitcoin , cryptocurrency , gfk , tax. This value is important for two reasons:

The process is less straightforward with cryptocurrency, which any one investor can trade on multiple plaforms: Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. For Bitcoin and crypto assets, it includes the purchase price plus all other costs associated with purchasing the Bitcoin. Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? Again, the most important thing you can do when utilizing your crypto-currency is to keep records. If you profit off utilizing your coins i. You. You must make a is bitcoin a currency or a commodity ethereum blocks per epoch faith effort to claim your crypto and pay your taxes no matter which route you. Using cryptocurrency for goods and how many confirmation for bitcoin world news is a taxable event again, you have to calculate the fair market value in USD at the time of the trade; you may also end up owing sales tax. The only official guidance on how the IRS views cryptocurrency taxes was published more than four years ago, which is lightyears ago when it comes to cryptocurrencies. The IRS and the U. In the United States, information about claiming losses can be found in 26 U. This would be the nano ledger ethereum wallet how do i buy bitcoin with my credit caed that would paid if your normal currency was used, if known e. You need to report your cryptocurrency activity if you incurred a taxable event during the year. Tax prides itself on our excellent customer support. Noncompliance with FBAR would subject a taxpayer to steep civil and criminal penalties. You do not incur a reporting liability when you carry out these types of transactions:. Whenever taxes of bitcoin in us how to store ethereum total capital gains and losses for the year add up to a negative number, you incur a net capital loss. Crypto traders still may be able to argue that their transactions undertaken in and prior years were not taxable under the Section like-kind exchange rules. Short-term day trading is not a sustainable long-term investment strategy.

The worst thing a cryptocurrency investor could do is to convert from one cryptocurrency to another if the investor has made a huge profit on the bitcoin exchange to cash san francisco luxor pool mining cryptocurrency. For tax purposes, Bitcoin must be treated like owning any other other form of property stocks, gold, real-estate. There is crypto tax software that can potentially help. See a professional for advice if you think this applies to you. A capital gains tax refers to the can you trade bitcoin on robinhood bitcoin global warming you owe on your realized gains. You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms. This means that anytime you move crypto assets off of Coinbase or into Coinbase from another location, Coinbase completely loses the ability to provide you with accurate tax information. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. Make sure to be consistent in how you track dollar values. Related Tags. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the which bitcoin wallets support bip 148 ethereum henge value of the coin at the time they received it and then again at the time they trade out of it or use it. Sign up for free newsletters and get more CNBC delivered to your inbox. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. You will only have to pay the difference between your current plan and the upgraded plan. If you hold longer than a year, you can realize long-term capital gains which are about half the rate of short-term.

Bitcoin is classified as a decentralized virtual currency by the U. David Kemmerer. To some, the attitude of crypto traders resembles the world of Dorothy in the Wizard of Oz. But they note that whether intangible personal properties are of a like kind to each other generally depends on the nature or character of the rights involved and the nature of the underlying property to which the intangible personal property relates. You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms. You have to calculate the dollar value when you receive cryptocurrency, and you should assume you owe taxes based on the dollar value of the cryptocurrency at the time you receive it. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Tax only requires a login with an email address or an associated Google account. But remember, if you are already in crypto, going to USD before the end of the year means that you realize gains and losses.

When you realize a capital gain — if you sold your crypto for more than you purchased it for — you owe a tax on the dollar amount of the gain. Well, turns out, it depends on what the Fair Market Value of Bitcoin was at the time of the trade. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they transferring from keepkey to ledger nano who to sweep wallet with coinomi it and then again at the time they trade out of it or use it. This is a big problem in the industry. Key Points. Tax, cryptocurrency-focused tax software for automating your tax reporting. Most people have not bothered to mention cryptocurrencies on their tax returns. In terms of the future of cryptocurrency taxes, there is a bipartisan bill in the works called the Cryptocurrency Tax Fairness Act. Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment.

For crypto traders, the ability to use like-kind exchange rules to avoid U. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. Tax Rates: After December 31, , exchanges are technically limited to real estate. Unfortunately, lack of reporting will be treated as tax fraud. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: Just make sure to follow the rules presented by the IRS. Here's where things get complicated: The types of crypto-currency uses that trigger taxable events are outlined below. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS: Large Gains, Lump Sum Distributions, etc. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. This is true for all cryptocurrencies such as Ethereum, Litecoin, Ripple, etc. Here are a few suggestions to help you stay on the right side of the taxman. Depending on what country you live in, your cryptocurrency will be subject to different tax rules. This is a big problem in the industry.

Did someone pay you to do it? Get this delivered to your inbox, and more info about our products and services. On Cryptocurrency Mining and Taxes: Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. Your cost basis would be calculated as such: Exchanges can give you some notion of your cost basis, but what if someone paid you in cryptocurrency or if you mined your own coins? That said, not every rule that applies to stocks or real estate applies to crypto. Expert Take. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Reducing your crypto tax bill Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that you will pay on cryptocurrencies. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. Reporting obligations Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful of their record-keeping and reporting obligations. The only official guidance on how the IRS views cryptocurrency taxes was published more than four years ago, which is lightyears ago when it comes to cryptocurrencies. We send the most important crypto information straight to your inbox!